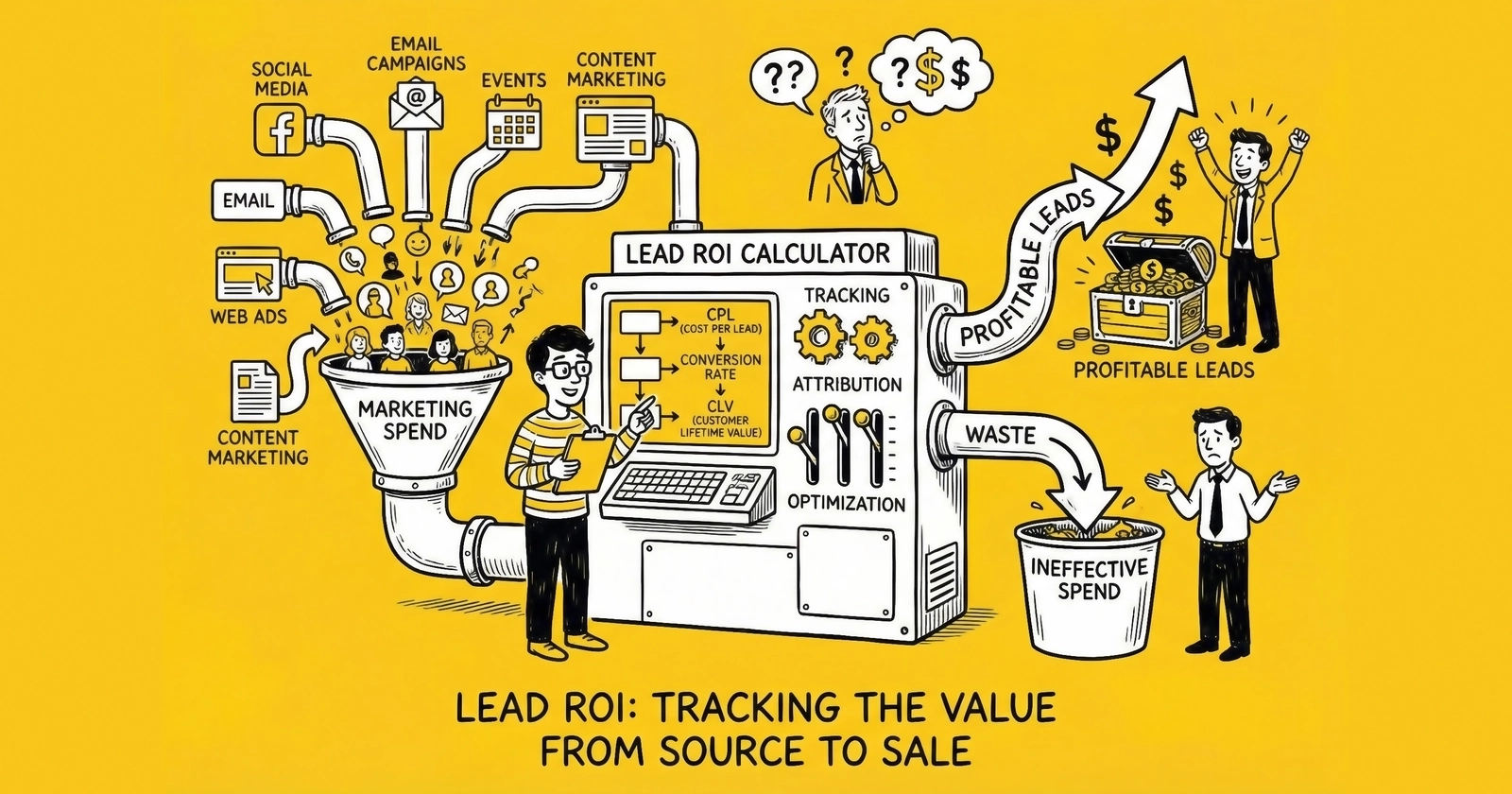

The measurement framework that separates operators building sustainable margins from those optimizing their way into bankruptcy. Learn to calculate true lead generation returns, identify hidden cost drains, and systematically improve performance across every campaign.

Why Most Lead ROI Calculations Fail

Every month, lead generation operators across the industry celebrate campaigns that are quietly losing money. The dashboard shows a 3:1 return on ad spend. Cost per lead came in under target. The campaign report gets forwarded to stakeholders with an optimistic summary.

Then reality arrives. Cash flow tightens. Buyer relationships strain. Returns pile up. The operator who thought they were scaling a winner discovers they’ve been scaling a loss.

This disconnect between reported ROI and actual profitability is the measurement problem that destroys more lead generation businesses than competitive pressure, regulatory changes, or market downturns combined. According to Forrester research, data-driven businesses grow more than 30% year-over-year on average – but only when they’re measuring the right things. Companies using advanced attribution and measurement achieve 15-30% improvement in marketing efficiency, not because they spend less, but because they finally understand what actually works.

The issue isn’t that operators don’t measure. It’s that they measure incomplete metrics that systematically overstate performance. Standard ROI calculations capture perhaps half the costs involved in generating leads. The rest – platform fees, labor allocation, compliance infrastructure, return processing, float costs – disappear into general expenses, never attributed to the campaigns that consumed them.

This guide provides the complete framework for calculating true lead generation ROI. You’ll learn every cost category most practitioners forget to include. You’ll understand how to build lead-level profitability analysis that reveals which sources actually make money versus which ones just appear profitable in dashboards. You’ll develop optimization frameworks that turn accurate measurement into continuous improvement. And you’ll walk away with benchmarks by vertical that tell you whether your performance is healthy or merely looks that way.

The math required isn’t advanced. The discipline to apply it consistently is what separates operators who build lasting businesses from those who burn through capital wondering what went wrong.

The Complete Lead ROI Formula

Understanding True Cost Per Lead

The standard CPL calculation everyone learns is deceptively simple:

Basic CPL = Total Marketing Spend / Total Leads Generated

If you spend $10,000 on Google Ads and generate 200 leads, your CPL is $50. Clean. Simple. And missing at least 40% of the actual costs involved.

True cost per lead (True CPL) requires accounting for every expense that exists because you’re generating leads. If that expense wouldn’t occur without lead generation activity, it belongs in the denominator of your CPL calculation.

Here is the formula your business actually needs:

True CPL = (Media Spend + Creative Costs + Agency Fees + Testing Spend + Platform Fees + Technology Costs + Compliance Costs + Labor Allocation + Float Cost) / Net Leads Delivered

Notice the denominator says “Net Leads Delivered,” not “Leads Generated.” That distinction matters enormously. If you generate 1,000 leads and 150 get returned by buyers, your costs divide across 850 deliverable leads, not 1,000. This single adjustment typically adds 8-20% to true CPL.

The Complete True ROI Formula

Revenue calculation requires similar rigor:

True Net Revenue = Gross Lead Sales - Returns - Refunds - Bad Debt

True Total Cost = Media Spend + Creative Production + Agency Fees + Testing Costs + Platform Fees + Per-Lead Technology Fees + Allocated Labor + Compliance Costs (direct and indirect) + Return Processing Labor + Float Cost

True ROI = (True Net Revenue - True Total Cost) / True Total Cost x 100

An operation reporting 200-300% ROI using basic calculations typically shows 60-120% ROI when all costs are properly attributed. Still profitable in many cases – but requiring very different strategic decisions about scaling, pricing, and margin management.

Hidden Cost Categories Explained

Let me break down each cost category with realistic ranges based on current market conditions.

Traffic Acquisition Costs

Your media invoice is just the beginning. Media spend represents the dashboard baseline, but rarely the complete picture of what traffic actually costs.

Creative production adds substantial hidden expense. Landing page development, video production, and display ad design should be amortized across campaign lifetime, typically adding $0.50-3.00 per lead depending on production quality and volume. If you use agencies for media buying, campaign management, or creative services, their fees belong in your CPL calculation. Standard agency fees run 10-20% of media spend.

Testing and learning spend deserves particular attention. Before finding winners, you fund losers. Budget 15-25% of successful campaign spend for the testing that identified those winners. Platform access fees add another layer – some networks charge setup fees, minimum commitments, or technology access premiums that disappear into general expenses if not tracked.

At $100,000 monthly media spend with 15% agency fees, 20% testing allocation, and $1,500 monthly creative amortization, your actual traffic acquisition cost is $136,500 – 36.5% higher than what appears on the media invoice.

Technology and Platform Fees

Every lead touches software that costs money. Lead distribution platforms like boberdoo, LeadsPedia, and Phonexa charge $0.10-0.50 per lead plus $450-5,000 monthly base fees depending on features and scale. CRM and sales tools add user licenses and per-record costs of $0.25-2.50 per lead based on your configuration.

Validation services for phone verification, email authentication, and address standardization run $0.05-0.25 per lead. Analytics and reporting platforms vary dramatically – Google Analytics is free while enterprise BI tools like Looker or Tableau carry significant costs that should be allocated across lead volume.

A medium-scale operation processing 50,000 leads monthly might spend $8,000-15,000 on technology. That’s $0.16-0.30 per lead that never appears in dashboard CPL calculations.

Compliance and Consent Documentation

This category grows fastest and receives the least attention in most ROI calculations. TrustedForm certificates run $0.15-0.50 per lead for consent documentation. Jornaya TCPA Guardian charges similar rates for contact verification and compliance tracking. The validation stack – phone verification, litigator scrubbing, and suppression list checks – adds another $0.10-0.25 per lead.

Beyond per-lead costs, compliance requires ongoing legal infrastructure. TCPA compliance counsel runs $3,000-10,000 annually for most operations. Smart practitioners reserve 1-3% of revenue for potential TCPA exposure, recognizing that settlements average $6.6 million and prevention costs far less than litigation.

At 100,000 monthly leads with $0.35 per-lead compliance costs plus $6,000 annual legal fees, you’re spending $420,000 annually on compliance – costs that destroy margin if not tracked.

Labor Allocation

Someone runs those campaigns. Someone monitors quality. Someone handles buyer relationships. Their time has real cost.

Campaign management requires media buyers, creative strategists, and optimization specialists. Allocate 30-50% of their fully-loaded salary to lead generation operations. Quality assurance – lead review, source monitoring, and buyer feedback processing – often requires 1-2 full-time roles at scale.

Buyer relationship management consumes more time than most practitioners anticipate. Account management, dispute resolution, and contract negotiation demand 2-4 hours daily at minimum. Compliance monitoring adds consent audits, documentation reviews, and regulatory tracking to the labor requirement.

For most operations, labor represents 15-25% of total operating costs. Ignoring labor allocation inflates ROI calculations by 20-40%.

Return and Refund Reserves

Industry return rates vary dramatically by vertical.

| Vertical | Expected Return Rate | High-Quality Sources | Concerning Sources |

|---|---|---|---|

| Auto Insurance | 8-15% | 5-8% | 20%+ |

| Medicare | 12-20% | 8-12% | 25%+ |

| Mortgage | 10-18% | 6-10% | 22%+ |

| Solar | 15-25% | 10-15% | 30%+ |

| Legal | 20-35% | 15-20% | 40%+ |

| Home Services | 12-20% | 8-12% | 25%+ |

Returns carry compounding costs. The refund itself returns revenue to buyers. Processing each return requires investigation, documentation, and credit issuance – typically 15-30 minutes of labor per return. Buyer relationship damage from high returns reduces future revenue opportunities.

A 15% return rate on $75 leads with $25 hourly labor cost for 15-minute processing adds $11.25 direct cost plus $6.25 processing cost = $17.50 per returned lead, or $2.63 across all leads generated.

Float Cost (Working Capital)

The timing gap between paying suppliers and receiving buyer payments requires capital. That capital has cost.

Monthly Float Cost = Average Receivables Outstanding x (Annual Cost of Capital / 12)

Standard industry timing:

- Day 0: Lead generated and sold

- Day 7-15: Publisher/traffic source payment due

- Day 30-45: Buyer payment received

- Day 60: Buffer for disputes and collection delays

At $500,000 monthly media spend with 35-day average float and 12% cost of capital, float adds $4,800 monthly to operating costs. That’s nearly $0.10 per lead on 50,000 monthly volume.

Worked Example: Step-by-Step ROI Calculation

Theory only becomes useful when applied to real numbers. Let me walk through a complete True ROI calculation for an auto insurance lead operation.

Scenario Setup

- Monthly media spend: $80,000

- Average CPC: $4.66 (current Google Ads insurance benchmark)

- Landing page conversion rate: 5.5%

- Leads generated: 943 leads

- Dashboard CPL: $84.84

- Lead sale price (exclusive): $95

- Return rate: 11%

Dashboard perspective: $80,000 generates 943 leads at $84.84 CPL, selling at $95 = $9,576 gross margin. Looks healthy.

Step 1: Calculate True Net Revenue

Gross Lead Sales: 943 leads x $95 = $89,585

Returns (11%): 104 leads returned = $9,880 refunded

Bad debt (2% of remaining): $1,594 uncollectable

True Net Revenue: $89,585 - $9,880 - $1,594 = $78,111

Already we’ve lost $11,474 from the gross revenue figure that dashboard metrics ignore.

Step 2: Calculate All True Costs

Media Spend: $80,000

Creative Production (amortized):

- Landing page development: $12,000 / 12 months = $1,000

- Video production: $8,000 / 12 months = $667

- Display ads: $3,000 / 12 months = $250

- Subtotal: $1,917

Agency Fees (12% of media): $9,600

Testing Spend (18% of media for failed tests): $14,400

Platform and Technology:

- Lead distribution platform: $1,500 base + $0.20/lead = $1,689

- CRM allocation (5 users): $650

- Dialer system: $850

- Analytics tools: $400

- Subtotal: $3,589

Compliance Costs:

- TrustedForm ($0.30 x 943 leads): $283

- Validation stack ($0.12 x 943 leads): $113

- Jornaya ($0.18 x 943 leads): $170

- Legal counsel (amortized): $600

- TCPA insurance (amortized): $750

- Subtotal: $1,916

Labor Allocation:

- Campaign manager (45% allocation of $95,000): $3,563

- Operations coordinator: $4,000

- Buyer relations (30% allocation): $1,875

- Compliance monitoring (20% allocation): $1,250

- Subtotal: $10,688

Return Processing:

- 104 returns x 20 minutes x $28/hour loaded labor = $970

Float Cost:

- Capital deployed: $80,000

- Float period: 32 days

- Annual rate: 11%

- Monthly cost: $770

Step 3: Sum All Costs

| Cost Category | Monthly Amount |

|---|---|

| Media Spend | $80,000 |

| Creative Production | $1,917 |

| Agency Fees | $9,600 |

| Testing Spend | $14,400 |

| Platform/Technology | $3,589 |

| Compliance Costs | $1,916 |

| Labor Allocation | $10,688 |

| Return Processing | $970 |

| Float Cost | $770 |

| Total True Costs | $123,850 |

Step 4: Calculate True ROI and True CPL

True CPL: $123,850 / (943 - 104 returned) = $147.57 per deliverable lead

Dashboard CPL: $84.84

True CPL Premium: 74% higher than dashboard reported

True ROI: ($78,111 - $123,850) / $123,850 x 100 = -36.9%

Dashboard suggestion: Profitable campaign worth scaling Reality: Losing $45,739 monthly

Step 5: Identify Intervention Points

The example demonstrates how easily “profitable” campaigns destroy capital. Here’s the optimization path:

Conversion rate improvement from 5.5% to 7.5%:

- New leads generated: 1,286 (from 943)

- New dashboard CPL: $62.21 (from $84.84)

- Impact: +$29,315 revenue, fixed costs spread further

Return rate reduction from 11% to 7%:

- Returns: 90 (from 104)

- Savings: $5,700 in refunds + reduced processing

- Impact: +$6,500 monthly

Sale price increase from $95 to $108 (justified by quality improvements):

- Revenue increase: $12,220 monthly

Agency fee negotiation from 12% to 8%:

- Savings: $3,200 monthly

Combined optimization impact: These four improvements transform -$45,739 loss into +$5,396 profit – a $51,000+ monthly swing.

Lead-Level P&L Analysis: Finding Where Margin Lives

Campaign-level ROI tells part of the story. Lead-level profit and loss analysis reveals the full picture – which specific sources, audiences, and placements actually make money versus which destroy margin while appearing productive.

Building Lead-Level Revenue Tracking

Every lead needs complete revenue attribution:

Gross revenue: What the buyer paid for this specific lead. In auction environments, this varies by lead. In fixed-price models, it’s consistent by lead type.

Net revenue: Gross revenue minus any refunds, credits, or adjustments issued for this specific lead. A lead sold in March but returned in April needs revenue adjustment in the lead-level record.

Extended revenue (for shared leads): If sold to multiple buyers, capture total revenue across all transactions. A shared lead sold to four buyers at $25 each generates $100 total revenue – but if one buyer returns, net revenue drops to $75.

Allocating Costs to Individual Leads

Direct costs allocate easily. The media cost for the click that generated this lead, per-lead validation fees charged for this record, consent certification cost for this consumer, and commission paid to the affiliate who delivered it – all attach directly to individual lead records without allocation decisions.

Indirect costs require allocation methodologies. Platform fees should be spread proportionally across leads processed. Labor should be allocated by time spent on each source or campaign type. Compliance overhead distributes by volume, and creative costs amortize across impressions served.

Document your allocation methodology and apply it consistently. The specific allocation formula matters less than consistent application that enables source-to-source comparison.

Source-Level Profitability Analysis

Aggregate lead-level data by source to reveal your most and least valuable traffic origins:

| Source | Volume | Gross Margin | Net Margin | Return Rate | True ROI |

|---|---|---|---|---|---|

| Google Brand | 2,800 | $56,000 | $42,000 | 4% | 178% |

| Google Non-Brand | 9,200 | $138,000 | $64,400 | 16% | 58% |

| Facebook LAL | 5,400 | $81,000 | $48,600 | 9% | 96% |

| Affiliate A | 4,100 | $41,000 | $12,300 | 24% | 18% |

| Affiliate B | 1,500 | $30,000 | $22,500 | 6% | 192% |

| Native Display | 3,200 | $32,000 | $9,600 | 21% | 22% |

Analysis reveals distinct strategic implications for each source. Google Brand delivers low volume but exceptional margins – protect this source and monitor for competitive encroachment. Google Non-Brand provides high volume with moderate margins, making it the primary scale opportunity. Facebook LAL offers a strong balance of volume and margin and deserves systematic expansion.

The affiliate picture is more nuanced. Affiliate A shows the worst margins despite decent volume – the economics warrant either renegotiation or termination. Affiliate B demonstrates exceptional quality at lower volume, justifying prioritized relationship expansion to unlock additional capacity. Native Display suffers from poor margins and high returns, warranting an immediate pause for quality remediation before resuming spend.

Without lead-level P&L, you see only aggregate performance. Operators scaling “successful” campaigns often scale unprofitable sources hiding within profitable averages.

Margin Contribution Analysis

Calculate each source’s contribution to total margin, not just its own performance:

Margin Contribution = (Source Net Margin / Total Net Margin) x 100

In the example above, Google Non-Brand contributes 32% of total margin ($64,400 / $199,400), followed by Facebook LAL at 24%, Google Brand at 21%, Affiliate B at 11%, Affiliate A at 6%, and Native Display at 5%.

Budget allocation should roughly follow margin contribution for established sources. Affiliate A producing 6% of margin while consuming 16% of volume requires intervention – either improve economics or reallocate that budget to Affiliate B and Facebook LAL.

Attribution Models for Lead Generation

Understanding which marketing activities deserve credit for conversions determines how you allocate budget. Different attribution models embed different assumptions, and no model is objectively correct – the best choice depends on your business reality.

First-Touch Attribution

First-touch attribution gives 100% credit to the initial marketing interaction that introduced the consumer to your brand.

Logic: Without that first touch, nothing else happens. Brand introduction creates the opportunity everything else builds upon.

This model works well when measuring brand awareness and demand generation effectiveness, when sales cycles are short (under 7 days), when business growth depends on expanding reach, and when you need to understand top-of-funnel performance.

First-touch struggles when customer journeys span weeks or months, when retargeting and nurture play significant conversion roles, or when optimizing for efficiency rather than just reach. In practice, first-touch typically overvalues awareness channels (social, display, content) and undervalues conversion channels (search, retargeting).

Last-Touch Attribution

Last-touch attribution assigns 100% credit to the final interaction before conversion.

Logic: Whatever happened last was the decisive factor. The consumer had opportunities to convert earlier but didn’t.

This model works well when decision processes are impulse-driven, when optimizing for immediate conversions, when budget constraints require prioritizing proven closers, and when sales cycles are short with simple transactions.

Last-touch struggles when multiple touchpoints genuinely contribute to decisions, when brand building and awareness matter, or when you need to understand full funnel dynamics.

The danger: Last-touch often credits channels that capture existing demand rather than create it. Brand search campaigns harvesting consumers you’d have reached anyway appear spectacular while adding minimal incremental value.

Multi-Touch Attribution

Multi-touch attribution distributes credit across all touchpoints in the customer journey, with several common approaches offering different tradeoffs.

Linear attribution splits credit equally across all touches. Five touchpoints means each receives 20% credit. Simple to understand but treats a fleeting impression the same as an engaged click.

Time-decay attribution weights recent touchpoints more heavily. The conversion-proximate touch might receive 40% credit, with diminishing weights backward through the journey. This acknowledges recency while recognizing earlier contributions.

Position-based (U-shaped) attribution emphasizes first and last touches – typically 40% each – with the remaining 20% spread across middle interactions. This honors both introduction and closing while acknowledging nurture efforts.

W-shaped attribution adds weight to the lead creation moment, distributing perhaps 30% to first touch, 30% to lead creation, 30% to conversion, and 10% across other touchpoints. This works well when the transition from anonymous visitor to identified lead represents a meaningful milestone.

All multi-touch models require tracking infrastructure connecting touchpoints across sessions, devices, and channels – increasingly difficult as privacy restrictions expand.

Data-Driven Attribution

Algorithmic attribution uses machine learning to assign credit based on actual conversion patterns in your data, rather than applying predetermined rules.

Google’s data-driven attribution analyzes conversion paths to identify which interactions most influence outcomes. Credit flows to touchpoints that statistically increase conversion probability.

Implementing data-driven attribution requires sufficient conversion volume (600+ monthly conversions minimum), consistent tracking infrastructure across touchpoints, historical data spanning multiple months, and technical resources for implementation and interpretation. These prerequisites limit adoption to mature, high-volume operations.

When it works, algorithmic attribution reveals counterintuitive patterns. That creative appearing weak in last-touch analysis might be an essential assist player. That expensive upper-funnel channel might drive conversions credited elsewhere.

For most lead generation operations, algorithmic attribution serves better as a diagnostic tool than real-time optimization mechanism. Use it quarterly to validate assumptions, not daily to shift budgets.

Incrementality Testing

The limitations of all attribution models drive growing interest in incrementality testing – measuring what actually changes when you turn marketing on or off.

Geo experiments compare regions where you advertise versus similar regions where you don’t, isolating the true lift from marketing activity. Holdout tests randomly exclude portions of your audience from campaigns to measure the difference in conversion behavior. Platform lift studies from Meta Conversion Lift and Google Conversion Lift handle randomization within their ecosystems with rigorous methodology. Time-based toggles pause campaigns for defined periods and measure the impact on conversion volume.

A 2025 industry report showed 52% of brands and agencies now use incrementality testing, up significantly from prior years. Companies implementing proper incrementality measurement achieve 10-20% improvements in marketing efficiency.

Incrementality testing reveals uncomfortable truths. That retargeting campaign showing 800% ROAS in platform reporting might show 20% incremental lift when properly tested – because most of those conversions would have happened anyway.

Optimization Frameworks That Drive Results

Measurement exists to drive action. The ROI calculation framework provides insight. Optimization frameworks convert insight into performance improvement.

The Conversion Rate Priority

For most lead generation operations, conversion rate improvement delivers more economic impact than any other optimization lever. Consider the math:

At $4.66 CPC and 5% conversion rate: CPL = $93.20 At $4.66 CPC and 7% conversion rate: CPL = $66.57 Improvement: $26.63 per lead saved

On 10,000 monthly leads, that 2-percentage-point conversion improvement creates $266,300 annual profit impact. Compare to alternatives:

- Reducing CPC by 10% (from $4.66 to $4.19): $9,400 annual savings

- Improving return rate by 3 points: $37,500 annual savings

- Negotiating 5% higher sale price: $60,000 annual revenue gain

Conversion rate optimization provides 2-7x the impact of other common interventions. Priority should follow accordingly.

High-Impact Conversion Optimization Tactics

Multi-step forms consistently outperform single-page equivalents, with studies showing 86% higher conversion rates when forms break complex requests into manageable stages. Mobile optimization is non-negotiable – over 60% of lead form submissions now occur on mobile devices, making responsive design a baseline requirement rather than an enhancement.

Page load speed directly impacts conversion, with each second of load time reducing conversion 7-10%. Trust signals including privacy assurances, certification badges, and social proof reduce friction for hesitant consumers. Clear value proposition – articulating exactly what the consumer receives and when – provides the foundation for all other conversion elements.

Source Optimization Framework

Apply this decision framework to each traffic source monthly:

| True ROI | Return Rate | Volume | Action |

|---|---|---|---|

| >100% | <10% | Growing | Scale investment |

| >100% | <10% | Flat | Test expansion |

| 60-100% | <15% | Any | Optimize |

| 60-100% | 15-20% | Any | Quality intervention |

| <60% | <10% | Any | Renegotiate pricing |

| <60% | >15% | Any | Pause immediately |

| Any | >20% | Any | Terminate |

Sources with sustainable economics deserve investment. Sources with fixable problems deserve intervention. Sources with structural issues deserve termination regardless of volume contribution.

Budget Reallocation Principles

Conservative approach: Shift 10-15% of budget from lowest performers to highest performers each optimization cycle. This limits downside risk while capturing improvement.

Aggressive approach: Pause underperformers entirely and double down on winners. This maximizes short-term performance but risks missing scale opportunities in emerging sources.

Best practice combines both approaches. Established sources with 90+ day performance history qualify for aggressive reallocation based on clear economic signals. Emerging sources remain in testing mode with protected budgets until sufficient data accumulates, typically requiring 1,000+ leads and 60+ days before definitive conclusions. Seasonal adjustment overrides standard reallocation when historical patterns indicate temporary shifts rather than fundamental performance changes.

Reallocation frequency depends on data velocity. High-volume operations generating thousands of daily leads can rebalance weekly. Lower-volume operations need monthly cycles for statistically meaningful decisions.

Dashboard Design for Decision-Making

Effective dashboards surface the right metrics for the right audiences at the right frequency.

Executive Dashboards

Executive dashboards answer one question: Is the business healthy? Surface True ROI trend over the last 6 months, revenue versus target with variance explanation, net margin by major source category, quality composite score combining return rate, contact rate, and conversion, and cash runway indicator.

Keep executive views to 5-7 metrics maximum with clear trend indicators. Traffic light visualization (green/yellow/red) surfaces issues immediately without requiring detailed analysis.

Operational Dashboards

Operational dashboards enable daily management by providing source-level performance data including volume, CPL, return rate, and margin. Real-time campaign pacing versus targets shows whether spending aligns with plan. Validation pass rates and failure reasons identify quality issues early. Buyer acceptance rates and rejection patterns highlight relationship risks. Anomaly alerts surface threshold breaches requiring immediate attention.

Operational dashboards need granularity and near-real-time updates. Operators should identify problems within hours, not days.

Source-Level Views

Source-level views reveal optimization opportunities through True CPL by source including return impact, conversion rate trends over time, hour-of-day and day-of-week patterns, and quality metrics by sub-source or campaign.

Include drill-through capability so analysts can move from summary to underlying drivers without switching tools.

ROI Benchmarks by Vertical

Understanding what “good” looks like requires vertical-specific context. These benchmarks reflect realistic operational performance, not conference presentations or vendor marketing.

Insurance Leads

| Metric | Range | Target |

|---|---|---|

| Dashboard CPL (Google) | $45-100 | $60-80 |

| True CPL (all-in) | $75-150 | $90-115 |

| Return Rate | 8-15% | <10% |

| Contact Rate | 45-55% | >50% |

| Conversion (to bound policy) | 8-12% | >10% |

| True ROI | 50-120% | >75% |

Market dynamics: Auto insurance remains relatively stable. Medicare shows pronounced seasonality with AEP (October 15 - December 7) volumes 2-3x normal and CPLs doubling. Health insurance follows similar AEP patterns.

Mortgage Leads

| Metric | Range | Target |

|---|---|---|

| Dashboard CPL | $50-150 | $75-110 |

| True CPL | $85-220 | $110-160 |

| Return Rate | 10-18% | <12% |

| Contact Rate | 30-40% | >35% |

| Conversion (to funded loan) | 1-2% | >1.5% |

| True ROI | 35-90% | >55% |

Rate sensitivity: Mortgage lead economics shift dramatically with Federal Reserve decisions. When rates rise, refinance volume drops 40-60%. Purchase volume remains more stable but still affected by housing market conditions.

Solar Leads

| Metric | Range | Target |

|---|---|---|

| Dashboard CPL | $75-200 | $100-150 |

| True CPL | $110-290 | $150-210 |

| Return Rate | 15-25% | <18% |

| Contact Rate | 20-35% | >28% |

| Conversion (to installation) | 4-8% | >6% |

| True ROI | 25-85% | >45% |

Geographic variation: Solar lead value varies 8.5x from California ($1,929 customer acquisition cost) to North Dakota ($225). State-level targeting and policy awareness are essential for margin management.

Legal Leads

| Metric | Range | Target |

|---|---|---|

| Dashboard CPL | $200-500 | $250-400 |

| True CPL | $280-720 | $350-520 |

| Return Rate | 20-35% | <25% |

| Contact Rate | 15-25% | >20% |

| Conversion (to signed retainer) | 2-4% | >3% |

| True ROI | 20-75% | >35% |

Case type variation: Personal injury CPLs run $200-400. Mass tort leads can exceed $1,000-2,000. General legal services operate at $50-150. Different case types require different economic models entirely.

Home Services Leads

| Metric | Range | Target |

|---|---|---|

| Dashboard CPL | $30-100 | $45-75 |

| True CPL | $50-145 | $70-100 |

| Return Rate | 12-20% | <15% |

| Contact Rate | 40-55% | >45% |

| Conversion (to completed job) | 10-20% | >15% |

| True ROI | 55-140% | >85% |

Seasonality: HVAC peaks during extreme temperature months. Roofing follows storm patterns and spring/summer installation seasons. Landscaping concentrates in spring and fall. Budget allocation should follow these natural patterns.

Frequently Asked Questions

What is the most accurate way to calculate lead generation ROI?

True ROI requires calculating net revenue (gross sales minus returns, refunds, and bad debt) divided by total costs (media spend plus creative, agency, testing, platform, technology, compliance, labor, return processing, and float costs). The formula is: True ROI = (True Net Revenue - True Total Cost) / True Total Cost x 100. Most practitioners understate costs by 30-50%, making their reported ROI significantly higher than actual performance. An operation showing 200% ROI on basic calculations typically runs 70-120% on true ROI once all costs are properly attributed.

What costs should I include when calculating cost per lead?

A complete CPL calculation includes ten cost categories: media spend, creative production (amortized), agency fees, testing and learning spend, platform fees (distribution systems), technology costs (CRM, validation, analytics), compliance costs (consent documentation, legal counsel, litigation reserves), labor allocation (campaign management, operations, buyer relations), return processing labor, and float cost (working capital carrying cost). At medium scale, these hidden costs typically add $15-45 per lead beyond what dashboard metrics show.

How do return rates affect lead ROI calculations?

Return rates have compounding impact on ROI. A 15% return rate means 15% of leads generated return zero revenue while carrying full acquisition cost. Additionally, each return requires processing labor (typically 15-30 minutes per return). The effective cost impact of returns follows this formula: Return Cost Impact = (Return Rate x Lead Sale Price) + (Returns x Processing Labor Cost). A source with 5% returns versus one with 20% returns can differ by 25-35% in true CPL, making return rate tracking by source essential for margin management.

What is a good LTV to CAC ratio for lead generation?

Standard benchmarks vary by buyer type. Direct carriers and lenders typically require 3:1 LTV to CAC ratios for sustainable acquisition. Agents and brokers often work with 2:1 to 3:1 ratios but need faster payback periods. Call centers and aggregators require 4:1 to 5:1 ratios to account for operational overhead. Understanding buyer economics helps predict sustainable lead prices – if your buyers’ LTV to CAC falls below 2:1, they will eventually reduce spend or exit the market.

How do I calculate the working capital (float) cost in lead generation?

Float cost calculation: Monthly Float Cost = Average Receivables Outstanding x (Annual Cost of Capital / 12). Standard industry timing runs 30-45 days from lead sale to buyer payment while publisher payments are due in 7-15 days. This creates a timing gap requiring working capital. The 60-day float rule explains how to manage this effectively. At $500,000 monthly volume with 35-day average float and 12% cost of capital, monthly float cost is approximately $4,800. The 60-day working capital rule means you need roughly 60 days of operating expenses in reserve to operate safely.

What attribution model should I use for lead generation campaigns?

No single attribution model is universally correct – the best choice depends on your sales cycle and channel mix. Last-touch attribution works for short sales cycles but overstates conversion channels. First-touch works for brand awareness measurement but understates efficiency. Multi-touch attribution (linear, time-decay, position-based) provides balanced views for complex journeys. Data-driven attribution requires 600+ monthly conversions but reveals counterintuitive patterns. Incrementality testing, where 52% of brands now participate, provides the most accurate view of true channel contribution by measuring what changes when marketing turns on or off.

How often should I recalculate true ROI for my lead campaigns?

Apply a layered measurement cadence: complete True ROI calculation monthly, component monitoring weekly, and strategic review quarterly. True ROI shifts gradually, so monthly calculation catches trend changes. Weekly monitoring of return rates, validation failures, contact rates, and speed-to-contact catches emerging problems before they compound. Quarterly strategic reviews enable budget reallocation decisions based on sufficient data. For high-volume operations (10,000+ leads monthly), source-level analysis can support weekly optimization. Lower-volume operations need monthly data accumulation for statistically meaningful decisions.

What return rate should trigger pausing a traffic source?

Establish tiered thresholds based on vertical norms. For most verticals: 10-15% returns triggers increased monitoring and quality filter review. 15-20% returns requires volume reduction and direct source communication. Above 20% returns sustained for 2+ weeks warrants immediate pause. Track returns on 7-day and 30-day rolling windows – a single bad day should not trigger termination, but sustained poor quality requires swift action. A source running 25% returns destroys margin regardless of volume contribution and damages buyer relationships that take months to repair.

How does conversion rate improvement compare to other optimization levers?

Conversion rate improvement typically delivers 2-7x the economic impact of other common optimizations. A 2-percentage-point improvement (5% to 7% conversion) on $4.66 CPC reduces CPL by $26.63 per lead. On 10,000 monthly leads, that creates $266,300 annual profit impact. Compare to CPC reduction of 10% (approximately $9,400 annual savings), return rate improvement of 3 points (approximately $37,500 annual savings), or 5% price increase (approximately $60,000 annual revenue). Prioritize conversion rate optimization through multi-step forms, mobile optimization, page speed improvement, and clear value propositions before other interventions.

How do I account for compliance costs in lead generation ROI?

Compliance costs include both direct and indirect expenses. Direct costs include consent documentation (TrustedForm, Jornaya at $0.15-0.50 per lead), validation services ($0.05-0.25 per lead), and legal counsel ($3,000-10,000 annually). Indirect costs include TCPA litigation reserves (1-3% of revenue) and the opportunity cost of conservative consent language that may reduce conversion rates. At 100,000 annual leads with $0.40 per-lead compliance costs and $6,000 legal fees, total compliance expense runs $46,000 annually. TCPA settlements average $6.6 million, making comprehensive compliance investment essential regardless of ROI impact.

What benchmarks indicate healthy lead generation economics by vertical?

Healthy True ROI targets vary by vertical: Insurance leads should target 75%+ True ROI with under 10% return rates. Mortgage targets 55%+ True ROI with under 12% returns. Solar requires 45%+ True ROI with under 18% returns due to higher complexity. Legal operates at 35%+ True ROI with under 25% returns given longer sales cycles. Home services should achieve 85%+ True ROI with under 15% returns due to simpler transactions. True CPL should run 50-80% higher than dashboard CPL in well-managed operations – if True CPL exceeds double dashboard CPL, structural cost problems require immediate attention.

Key Takeaways

-

Dashboard ROI understates true costs by 30-60% in typical operations. Every metric your ad platform reports excludes at least 10 cost categories that erode margin before cash reaches your bank account. An operation showing 250% dashboard ROI typically runs 80-120% True ROI after complete cost attribution.

-

The complete True CPL formula includes 10 cost categories. Media spend, creative production, agency fees, testing costs, platform fees, technology fees, labor allocation, compliance costs, return processing, and float cost. Missing any category means your ROI calculation is fiction that guides decisions toward failure.

-

Return rates are the fastest margin destroyer. A 12% return rate on $100 leads adds $14-18 to True CPL when processing labor is included. Track returns by source with 7-day rolling windows. Pause sources exceeding 20% returns for more than two weeks regardless of their volume contribution.

-

Conversion rate optimization delivers 2-7x the impact of other interventions. A 2-percentage-point improvement (5% to 7%) can create $260,000+ annual profit impact on 10,000 monthly leads. Prioritize multi-step forms, mobile optimization, and page speed before CPC reduction or price negotiation.

-

Lead-level P&L analysis reveals hidden profit and loss. Aggregate campaign metrics hide that certain sources generate profit while others destroy it. Build lead-level revenue and cost tracking to identify which specific traffic origins deserve investment versus termination.

-

Attribution model choice determines budget allocation accuracy. Last-touch credits channels capturing demand rather than creating it. Multi-touch provides balance but requires infrastructure. Incrementality testing, now used by 52% of brands, reveals true channel contribution. Companies using advanced attribution achieve 15-30% efficiency improvements.

-

Float requires real capital that has real cost. The 60-day working capital rule is not optional. At $500,000 monthly spend with 35-day float and 12% cost of capital, float adds $4,800 monthly to operating costs. Undercapitalized operators fail from timing gaps, not unprofitable campaigns.

-

Vertical benchmarks vary dramatically. Solar True CPL runs $150-210 with 45%+ ROI targets. Insurance targets $90-115 True CPL with 75%+ ROI. Legal operates at $350-520 True CPL with 35%+ ROI. Know your vertical’s economics before entering or scaling investment.

Statistics and benchmarks based on 2024-2025 industry data from Forrester, WordStream, and vertical-specific research. Platform pricing and regulatory information current as of late 2025. Validate benchmarks against your specific vertical, geography, and buyer relationships before making material investment decisions.