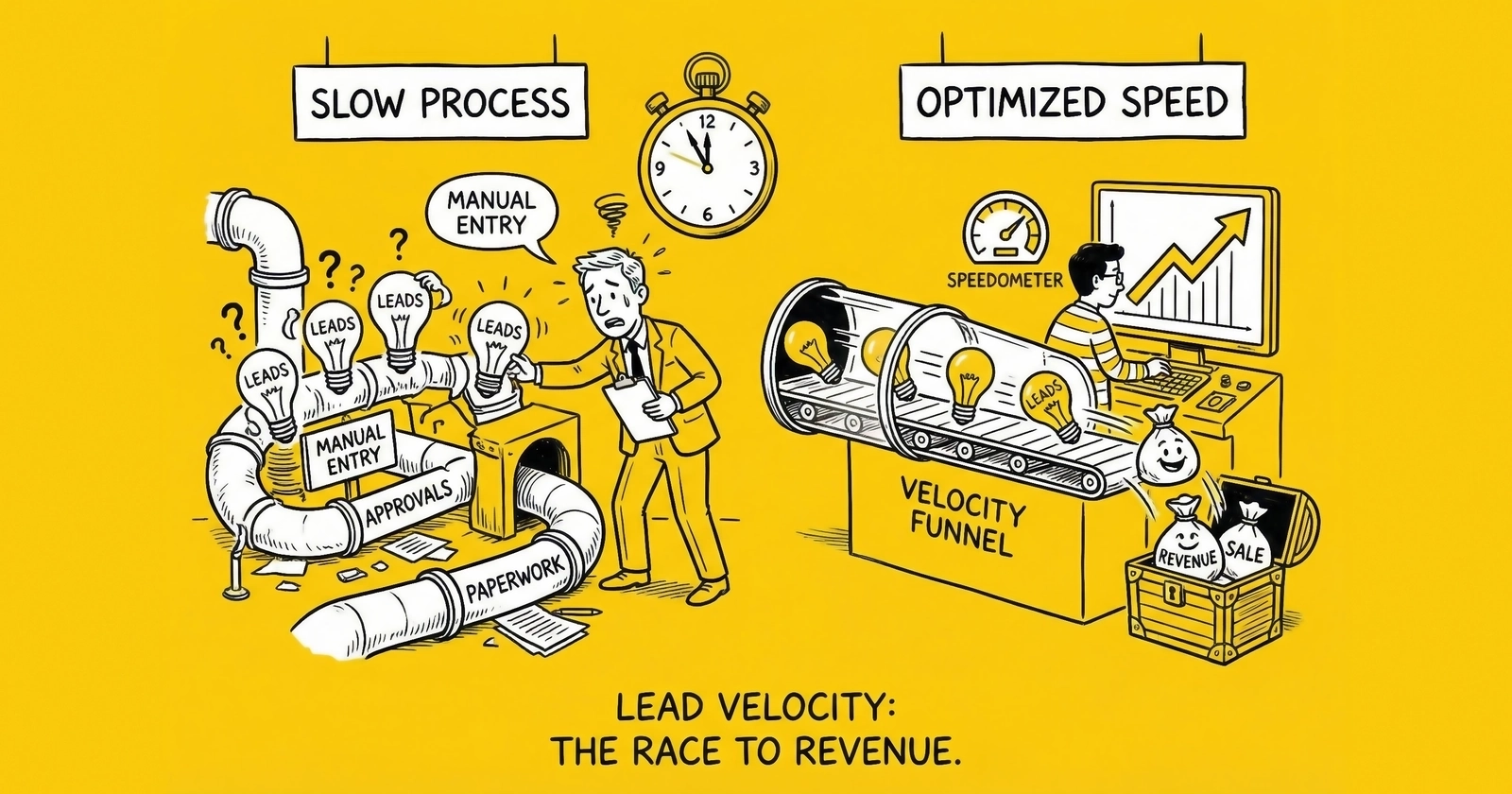

Those who understand lead velocity build sustainable competitive advantages. Those who treat speed as an afterthought watch their competitors capture customers who should have been theirs. This guide provides the complete framework for measuring and optimizing every speed metric that determines success.

Why Velocity Metrics Define Lead Generation Success

Lead generation is fundamentally a race against time. Consumer intent decays exponentially from the moment a form is submitted. Competitors are bidding on the same traffic. Sales teams have finite capacity. Every metric that matters in this business connects to velocity in some form.

The research is unambiguous: leads contacted within one minute convert at 391% higher rates. Leads contacted within five minutes are 21 times more likely to qualify than those contacted at 30 minutes. And 78% of customers ultimately purchase from whichever company responds first.

These are not marginal improvements. They are order-of-magnitude differences that separate profitable operations from money-losing ones.

Yet the average business takes 42-47 hours to respond to an inbound lead. 63% of leads never receive any response at all. This gap between what works and what happens represents the largest operational opportunity in lead generation.

Lead velocity metrics quantify this opportunity. They provide the framework for identifying bottlenecks, measuring improvement, and building systems that sustain speed at scale. Without these metrics, optimization is guesswork. With them, you can systematically close the gap between your current performance and industry-leading standards.

This article provides the complete framework for measuring speed to sale, covering every velocity metric from first contact through closed deal, the benchmarks that define competitive performance, the automation technologies that enable sub-minute response, and the attribution systems that prove what works.

The Four Categories of Lead Velocity Metrics

Lead velocity encompasses four distinct categories of speed measurement. Each category captures different aspects of the lead-to-customer journey and requires different optimization approaches.

Category 1: Speed to Contact Metrics

Speed to contact measures the time between lead capture and first engagement attempt. This is the foundational velocity metric because contact must occur before any other conversion activity can begin.

Time to First Attempt (TTFA)

Time to First Attempt measures the elapsed time from lead submission to first outreach attempt. This is your primary speed metric and should be tracked in minutes, not hours.

For real-time leads, target TTFA under 60 seconds. Elite operations achieve median TTFA under 30 seconds. The five-minute mark represents the minimum acceptable standard for competitive operations. Beyond five minutes, qualification probability drops by 80%.

Calculate TTFA by subtracting the lead creation timestamp from the first activity timestamp (call, SMS, or email). Track both median and 90th percentile to identify long-tail delays that averages obscure.

Time to First Conversation

Time to First Conversation measures elapsed time from lead submission to actual two-way engagement with a salesperson. TTFA captures attempts; this metric captures connections.

The gap between TTFA and Time to First Conversation reveals contact efficiency. If TTFA is 60 seconds but Time to First Conversation averages 4 hours, you have a contact rate problem, not a speed problem. Diagnosis requires both metrics.

Industry benchmarks show that leads contacted (actually reached, not just attempted) within five minutes convert at 8-10x the rate of leads contacted within 30 minutes. The specific numbers vary by vertical, but the pattern holds universally.

Contact Rate by Response Time Cohort

Contact rate by response time cohort demonstrates the decay curve in your own data. Track contact rates segmented by response time buckets: under 1 minute, 1-5 minutes, 5-15 minutes, 15-60 minutes, 1-4 hours, 4-24 hours, and 24+ hours.

Typical patterns show:

| Response Time | Expected Contact Rate |

|---|---|

| Under 1 minute | 70-85% |

| 1-5 minutes | 55-70% |

| 5-15 minutes | 40-55% |

| 15-60 minutes | 30-45% |

| 1-4 hours | 20-35% |

| 4-24 hours | 15-25% |

| 24+ hours | 10-20% |

Your specific rates depend on vertical, lead quality, and calling infrastructure. What matters is the pattern: every minute of delay reduces contact probability by measurable percentages.

First-Minute Response Rate

First-minute response rate is the percentage of leads receiving first contact attempt within 60 seconds. This is the gold standard for speed-to-lead excellence.

Elite operations achieve 80-90% first-minute response rates during staffed hours. Competitive operations target 70-80%. Below 50% indicates systematic speed problems requiring infrastructure investment.

Track this metric separately for business hours and after-hours to identify coverage gaps.

Category 2: Pipeline Velocity Metrics

Pipeline velocity metrics measure how quickly leads progress through your sales process after initial contact. Speed to contact gets you in the door; pipeline velocity determines how quickly you close.

Sales Cycle Length

Sales cycle length measures elapsed time from first contact to closed deal. Track both average and median, as averages are skewed by outliers.

Industry benchmarks vary dramatically by vertical:

| Vertical | Typical Sales Cycle |

|---|---|

| Auto Insurance | Same day to 3 days |

| Home Services | Same day to 7 days |

| Solar | 14-45 days |

| Mortgage | 30-60 days |

| B2B SaaS | 30-90 days |

| Enterprise Software | 90-180+ days |

Compare your sales cycle to vertical benchmarks. Cycles significantly longer than industry norms indicate process inefficiencies, qualification problems, or competitive disadvantages.

Stage Conversion Velocity

Stage conversion velocity measures how quickly leads progress between pipeline stages. If leads stall at specific stages, pipeline velocity degrades regardless of other speed metrics.

Define your pipeline stages (lead, qualified, proposal, negotiation, closed) and track:

- Average time in each stage

- Percentage progressing to next stage within target timeframe

- Stage-specific dropout rates

Common velocity bottlenecks include:

- Delayed proposal delivery after qualification

- Extended contract negotiation cycles

- Slow approval processes for pricing exceptions

- Documentation delays for compliance requirements

Identifying stage-specific bottlenecks enables targeted improvement rather than generic speed mandates.

Lead Velocity Rate (LVR)

Lead Velocity Rate tracks month-over-month growth in lead volume entering your pipeline. Calculate as:

LVR = (Leads This Month - Leads Last Month) / Leads Last Month x 100

An LVR of 15% monthly indicates healthy growth. Negative LVR for two consecutive months signals a problem requiring intervention.

LVR matters because it predicts future revenue more reliably than current revenue itself. Current closed deals reflect leads generated 30-90 days ago. LVR reflects what is happening now and what revenue will look like in 30-90 days.

Deal Velocity

Deal velocity measures average revenue generated per unit of time. Calculate as:

Deal Velocity = (Number of Deals x Average Deal Value) / Sales Cycle Length

Higher deal velocity means more revenue per unit of time invested. You can improve deal velocity by increasing close rate, increasing deal value, or reducing sales cycle length. Most operations have the greatest improvement potential in sales cycle reduction.

Category 3: Response Quality Metrics

Speed without quality produces fast failure. Response quality metrics ensure velocity improvements do not come at the expense of conversion effectiveness.

First-Call Resolution Rate

First-call resolution rate measures the percentage of leads where the desired outcome (quote, appointment, sale) occurs on the first call. Higher first-call resolution reduces total cycle time by eliminating follow-up requirements.

Benchmark first-call resolution varies by sales complexity:

| Transaction Type | Target First-Call Resolution |

|---|---|

| Transactional (simple quote) | 60-80% |

| Consultative (appointment set) | 40-60% |

| Complex (multi-step qualification) | 20-40% |

Low first-call resolution despite adequate preparation indicates sales process or rep skill issues.

Speed-to-Quote

Speed-to-quote measures elapsed time from first conversation to quote or proposal delivery. In many verticals, quote delivery speed is as important as initial contact speed.

Research from various industries shows that quotes delivered within 24 hours convert at significantly higher rates than quotes delivered in 48+ hours. The consumer who receives a quote while still actively shopping has not yet moved on to other vendors.

Track speed-to-quote separately from speed-to-contact. Different bottlenecks require different solutions.

Callback Completion Rate

For leads requiring callbacks, callback completion rate measures the percentage of scheduled callbacks that occur on time. Missed or delayed callbacks reset the sales cycle and often lose the opportunity entirely.

Target 95%+ callback completion rate. Below 90% indicates scheduling system failures or rep accountability issues.

Category 4: Competitive Position Metrics

Competitive position metrics measure your speed relative to competitors. Absolute speed matters, but relative speed determines outcomes in shared lead environments.

Caller Position Tracking

Caller position tracking identifies where you fall in the sequence of vendors contacting shared leads. First position captures 78% of value. Fifth position captures scraps.

Track caller position by asking leads “Have you spoken with other companies about this?” during initial calls. Document first, second, third, or later position and correlate with conversion rates.

If you are consistently in third position or later, your speed infrastructure is not competitive. The investment required to improve speed will pay for itself through improved win rates.

Speed-to-Lead Variance

Speed-to-lead variance measures consistency of response times, not just average speed. A median TTFA of 2 minutes with 90th percentile at 45 minutes means 10% of leads receive dramatically inferior treatment.

Calculate standard deviation and coefficient of variation for response times. Lower variance indicates more reliable speed performance.

High variance often indicates process or staffing problems: specific shifts with inadequate coverage, certain lead sources with delayed routing, or individual reps with slower response patterns.

Building a Speed-to-Contact Infrastructure

Achieving consistent sub-minute response requires technology infrastructure designed for speed. Manual processes cannot scale to this performance level.

Real-Time Lead Delivery Systems

The first requirement is instantaneous lead delivery. Any delay in lead transmission compounds downstream delays.

API-Based Delivery

Leads should flow via real-time API posts, not email or batch files. API delivery happens in milliseconds. Email notification can take minutes. Batch processing can take hours. Proper lead distribution platforms handle this routing automatically.

Configure your lead sources for webhook or API push notifications. The lead should create a record in your CRM or dialer simultaneously with the consumer clicking submit. If leads pass through intermediate systems before reaching your sales tools, audit the latency at each hop.

Direct CRM Integration

Leads should create records directly in your CRM or sales platform without intermediate steps. Every manual import or data transformation adds delay.

Modern CRMs accept inbound webhooks that create records instantly. Configure lead sources to post directly to these endpoints. Eliminate any batch processing, file imports, or manual steps.

Delivery Monitoring

Implement monitoring that alerts immediately when lead delivery fails or lags. A broken integration discovered hours later represents hours of lost leads.

Set alerting thresholds based on expected volume. If you normally receive 50 leads per hour and zero arrive for 30 minutes, something is wrong. Immediate notification enables immediate remediation.

Intelligent Routing Engines

Once leads arrive, they must reach the right person instantly. Intelligent routing eliminates the delays of manual assignment.

Skills-Based Routing

Match leads to reps based on geography, vertical expertise, language, or product knowledge. Proper matching improves both speed and conversion. A Spanish-speaking lead routed to a Spanish-speaking rep converts faster than one requiring interpreter services.

Availability-Aware Routing

Route leads only to reps who are currently available. Sending leads to reps in meetings, on calls, or at lunch delays contact. Real-time presence integration ensures leads reach available reps instantly.

Round-Robin with Timeout

Implement round-robin distribution with automatic reassignment if the primary recipient does not respond within a defined window. Typical timeout: 60-90 seconds. If Rep A does not initiate contact within 90 seconds, the lead automatically routes to Rep B.

This prevents leads from languishing when individual reps are temporarily unavailable.

Capacity-Based Distribution

Track rep capacity in real-time. When a rep is handling maximum concurrent leads, route new leads to others with capacity. Overloading individual reps creates queues that destroy response time.

Multi-Channel Engagement Platforms

Speed to lead is not just about phone calls. Modern engagement requires coordinated multi-channel outreach.

Power Dialers and Predictive Dialers

Auto-dialers eliminate dialing delay entirely. When a lead arrives, the system automatically initiates the call and connects the agent only when the consumer answers.

Power dialers (one call at a time per rep) provide controlled speed. Predictive dialers (multiple concurrent calls) provide maximum speed at the cost of potential dropped calls. Choose based on your compliance requirements and contact rate priorities.

SMS Automation

Automated text messages can reach leads in seconds, often before a phone call connects. A text saying “Hi [Name], this is [Rep] from [Company] calling about your [product] request. Is now a good time?” can increase answer rates by 20-30%.

SMS establishes first contact even if the phone call goes to voicemail. Many consumers prefer text communication, especially younger demographics.

Email Triggers

Instant email confirmation establishes contact even when phone calls go to voicemail. Personalized emails with clear next steps maintain momentum while waiting for live connection.

The combination of immediate SMS plus immediate email plus phone call creates multi-channel presence within the first minute.

AI and Automation for 24/7 Coverage

AI-powered systems can engage leads instantly even when human reps are unavailable.

Conversational AI

Chatbots and voice AI can answer immediately, qualify intent, gather additional information, and maintain engagement during the seconds before a human connects. For after-hours leads, AI can complete qualification and schedule callbacks for business hours.

Intelligent Scheduling

When immediate conversation is not possible, instant scheduling prevents lead decay. Automated scheduling links in first-response texts and emails let leads book their own callback at a convenient time. Calendar availability checking ensures only valid time slots are offered.

Voicemail Drop

When calls go to voicemail, pre-recorded messages can be dropped instantly. This ensures consistent messaging while freeing the rep to move to the next lead immediately.

Pipeline Velocity Optimization

Contact speed gets you in the door. Pipeline velocity determines how quickly you close. Optimizing pipeline velocity requires analyzing where time is lost after initial contact.

Mapping Your Sales Process Timeline

Before optimizing, document your current state. For a sample of 50 recent closed deals, record timestamps for:

- Lead submission

- First contact attempt

- First conversation

- Qualification completion

- Quote/proposal delivery

- Quote acceptance or objection

- Negotiation completion

- Contract signature

- Deal close

Calculate elapsed time between each stage. Identify which transitions consume the most time.

Most operations discover that 80% of cycle time concentrates in one or two transitions. Target those transitions for improvement rather than attempting to accelerate everything simultaneously.

Common Pipeline Velocity Bottlenecks

Quote Delivery Delays

Sales reps who take 3-5 days to deliver quotes after qualification create unnecessary cycle time. The consumer who was ready to buy on Monday has cooled off or engaged competitors by Friday.

Solutions: Automated quote generation, pre-approved pricing templates, same-day quote delivery SLAs.

Document Collection

Gathering required documentation (proof of income, property documents, business information) extends cycles when responsibility is unclear or follow-up is inconsistent.

Solutions: Upfront documentation requests during qualification, customer portals for self-service uploads, automated reminders for missing items.

Internal Approvals

Deals requiring manager approval for pricing exceptions or custom terms stall when approval processes are slow.

Solutions: Pre-authorized pricing ranges for frontline reps, escalation SLAs for approval requests, after-hours approval delegation.

Contract Negotiation

Extended back-and-forth on contract terms consumes days or weeks.

Solutions: Simplified contract templates, pre-approved negotiation parameters, e-signature acceleration.

Velocity-Based Sales Management

Traditional sales management focuses on outcome metrics: closed deals, revenue, close rate. Velocity-based sales management adds time dimension to every metric.

Velocity Dashboards

Create dashboards showing:

- Average time in each pipeline stage (current vs. target)

- Deals exceeding stage time thresholds

- Rep-level velocity comparisons

- Velocity trends over time

Make velocity visible to the sales team. What gets measured gets managed.

Stage-Time Alerts

Configure alerts when deals exceed stage time thresholds. A deal stuck in “proposal sent” for 7 days needs intervention. Waiting for the weekly pipeline review means lost opportunity.

Automated alerts enable managers to coach in real-time rather than discovering stalled deals retrospectively.

Velocity-Based Compensation

Consider adding velocity components to sales compensation. A rep who closes at the same rate but in half the time is twice as valuable. Incentive structures should reflect this reality.

Options include: bonuses for same-day closes, accelerators for deals closing under benchmark cycle time, velocity-based rankings affecting territory or lead allocation.

The Impact of Automation on Speed Metrics

Automation technologies have transformed what is possible in lead velocity. Understanding automation impact helps prioritize technology investments.

Quantifying Automation ROI

Automation investments should be evaluated on velocity improvement, not just cost reduction.

Dialer Automation Impact

Power dialers typically reduce time-to-first-attempt by 2-5 minutes compared to manual dialing. For an operation handling 500 leads per day, that represents 16-41 hours of aggregate response time improvement daily.

At 391% higher conversion for one-minute response, even partial speed improvement translates to meaningful revenue lift.

CRM Automation Impact

Automated lead routing and assignment typically reduce assignment latency from 5-30 minutes (manual) to under 1 second (automated). This improvement alone can move operations from “below average” to “strong” in industry benchmarks.

SMS Automation Impact

Automated first-response SMS reaches leads in 2-3 seconds. This establishes contact before competitors’ phone calls even connect. For shared leads, automated SMS can provide first-responder advantage regardless of phone answer timing.

AI Engagement Impact

AI voice agents and chatbots can engage leads within 1-2 seconds of submission, 24/7. This eliminates after-hours delays entirely and provides immediate engagement during peak hours when human reps are at capacity.

Operations implementing AI first-response report 40-60% improvement in after-hours conversion and 15-25% improvement in business-hours contact rates.

Automation Implementation Priorities

Not all automation delivers equal impact. Prioritize based on your current bottlenecks.

If TTFA exceeds 5 minutes: Implement real-time lead routing and auto-dialer integration. This is foundational infrastructure.

If contact rate is below 50%: Add SMS automation for immediate first contact and implement intelligent retry scheduling.

If after-hours leads underperform: Implement AI first-response and automated scheduling for business-hours callback.

If pipeline velocity lags: Focus on quote automation and document collection workflows rather than contact speed.

If consistency is the problem: Implement timeout-based reassignment and availability-aware routing to eliminate variance.

Attribution and Proving Velocity Impact

Velocity improvements require investment. Proving impact justifies continued investment and guides optimization priorities.

Correlation Analysis

The simplest proof of velocity impact is correlation between response time and conversion rate within your own data.

Building the Analysis

Extract data for 1,000+ leads including:

- Lead creation timestamp

- First contact attempt timestamp

- Conversion outcome (converted / not converted)

- Revenue (for converted leads)

Calculate TTFA for each lead. Bucket leads into response time cohorts. Calculate conversion rate and average revenue for each cohort.

The resulting analysis typically shows clear patterns:

| Response Time | Conversion Rate | Avg Revenue |

|---|---|---|

| Under 1 min | 18.2% | $1,247 |

| 1-5 min | 14.7% | $1,189 |

| 5-15 min | 11.3% | $1,156 |

| 15-60 min | 8.1% | $1,098 |

| 1-4 hours | 5.4% | $1,034 |

| 4-24 hours | 3.2% | $987 |

| 24+ hours | 1.8% | $892 |

This data proves velocity impact in your specific operation and quantifies the revenue opportunity from improvement.

A/B Testing Speed Improvements

For rigorous proof, implement controlled experiments.

Test Design

Randomly assign leads to “standard” and “accelerated” treatment groups. The standard group follows current processes. The accelerated group receives the new speed technology or process.

Track conversion rates and revenue for both groups over 4-8 weeks.

Interpreting Results

Calculate lift as: (Accelerated Conversion - Standard Conversion) / Standard Conversion

For a 12% standard conversion rate and 15% accelerated conversion rate: Lift = (15% - 12%) / 12% = 25%

Calculate statistical significance to ensure observed differences are not random variation. For most lead volumes, 2-4 weeks of data provides sufficient sample size for confidence.

Building the Business Case

Translate velocity metrics into financial impact for budget justification.

Revenue Impact Calculation

Step 1: Quantify current velocity (median TTFA, conversion rate by cohort) Step 2: Project improved velocity from proposed investment Step 3: Calculate conversion rate improvement based on cohort data Step 4: Multiply by lead volume and average deal value

Example:

- Current: 2,000 leads/month, 8-minute median TTFA, 9% conversion, $800 avg deal

- Projected: 2,000 leads/month, 90-second median TTFA, 13% conversion, $800 avg deal

- Revenue lift: (2,000 x 13% x $800) - (2,000 x 9% x $800) = $64,000/month

ROI Calculation

Compare monthly revenue lift to monthly cost of the speed investment.

If the automation platform costs $5,000/month and delivers $64,000/month in revenue lift, ROI = 1,180%.

Most velocity investments pay for themselves within 30-60 days when properly implemented.

Vertical-Specific Velocity Benchmarks

Velocity expectations vary dramatically by vertical. Benchmarks should reflect your specific market.

Insurance Lead Velocity

Auto insurance represents the most competitive speed environment in lead generation.

| Metric | Industry Avg | Competitive | Elite |

|---|---|---|---|

| Time to First Attempt | 4.2 hours | <5 min | <60 sec |

| Contact Rate | 45-55% | 55-65% | 65-75% |

| Same-Day Close Rate | 15-20% | 25-35% | 40-50% |

| Sales Cycle | 1-7 days | Same day-3 days | Same day |

Speed-to-contact matters more in auto insurance than almost any other vertical. Large carriers like Progressive and GEICO maintain sub-30-second response times through massive call center infrastructure. Understanding auto insurance lead generation dynamics explains this competitive intensity. Independent agents who cannot match this speed should consider exclusive leads to reduce competition exposure.

Mortgage Lead Velocity

Mortgage exhibits the most extreme speed-to-contact effects in the industry.

| Metric | Industry Avg | Competitive | Elite |

|---|---|---|---|

| Time to First Attempt | 38 hours | <5 min | <60 sec |

| Contact Rate | 30-40% | 40-50% | 50-60% |

| Application Rate | 15-25% | 25-35% | 35-45% |

| Sales Cycle | 45-60 days | 30-45 days | 25-35 days |

Industry research shows leads contacted within five minutes show 100x better outcomes than those contacted after 30 minutes. The first loan officer to engage often locks in the relationship.

Solar Lead Velocity

Solar combines urgency with longer consideration cycles.

| Metric | Industry Avg | Competitive | Elite |

|---|---|---|---|

| Time to First Attempt | 12 hours | <15 min | <5 min |

| Contact Rate | 40-50% | 55-65% | 65-75% |

| Appointment Set Rate | 20-30% | 35-45% | 50-60% |

| Sales Cycle | 30-60 days | 21-35 days | 14-25 days |

Geographic factors significantly affect solar velocity. States with favorable net metering policies show higher urgency. California leads post-NEM 3.0 require faster engagement as consumers weigh diminishing returns.

Legal Lead Velocity

Legal lead velocity varies dramatically by practice area.

| Practice Area | Target TTFA | Typical Cycle |

|---|---|---|

| Personal Injury | <5 min | 1-3 days to sign |

| DUI/Criminal | <15 min | Same day-2 days |

| Family Law | <1 hour | 3-14 days |

| Estate Planning | <4 hours | 7-30 days |

Personal injury and criminal defense demand the fastest response due to case urgency and competitive intensity. Estate planning and general civil matters allow longer response windows. The legal lead qualification process reflects these timing requirements.

B2B Lead Velocity

B2B velocity varies by deal complexity and buyer type.

| Segment | Target TTFA | Typical Cycle |

|---|---|---|

| SMB (<50 employees) | <5 min | 14-45 days |

| Mid-Market (50-500) | <1 hour | 30-90 days |

| Enterprise (500+) | <4 hours | 60-180+ days |

B2B velocity also depends on lead source. Form fills from the company website require faster response than marketing-generated leads from content downloads.

Implementing a Velocity Measurement Program

Moving from ad-hoc speed tracking to systematic velocity measurement requires structured implementation.

Phase 1: Baseline Establishment (Weeks 1-2)

Data Collection

Extract the last 90 days of lead data including all timestamps, outcomes, and attribution. If timestamps are not currently captured, implement tracking before proceeding.

Metric Calculation

Calculate current state for all velocity metrics: TTFA, Time to First Conversation, contact rate by cohort, sales cycle length, stage conversion velocity.

Benchmark Comparison

Compare current metrics to industry benchmarks. Identify gaps between current performance and competitive standards.

Bottleneck Identification

Analyze where time is lost. Is the problem in lead delivery, routing, dialing, qualification, quoting, or closing? Prioritize the largest bottlenecks.

Phase 2: Infrastructure Implementation (Weeks 3-8)

Technology Investment

Based on bottleneck analysis, implement required technology. This might include dialer automation, CRM workflow configuration, SMS platforms, or AI engagement tools.

Process Redesign

Modify operational processes to eliminate identified bottlenecks. Update staffing models, routing rules, and escalation procedures.

Team Training

Train sales teams on new tools and processes. Communicate velocity expectations and how performance will be measured.

Phase 3: Measurement Activation (Weeks 9-12)

Dashboard Development

Build real-time dashboards displaying all velocity metrics. Make dashboards visible to sales teams, managers, and leadership.

Alert Configuration

Implement alerts for velocity exceptions: leads exceeding response time thresholds, deals stuck in stages, declining velocity trends.

Reporting Cadence

Establish regular velocity reporting: daily metrics for frontline managers, weekly summaries for sales leadership, monthly trends for executives.

Phase 4: Continuous Optimization (Ongoing)

Weekly Reviews

Review velocity metrics weekly. Identify patterns, investigate anomalies, and implement improvements.

Monthly Optimization

Each month, select one velocity metric for focused improvement. Run experiments, measure impact, and standardize winning changes.

Quarterly Assessment

Quarterly, reassess against industry benchmarks. As you improve, targets should increase. What was “competitive” last quarter should be “table stakes” next quarter.

Frequently Asked Questions

What is the most important lead velocity metric to track?

Time to First Attempt (TTFA) is the foundational velocity metric because contact must occur before any other conversion activity. Research consistently shows leads contacted within one minute convert at 391% higher rates. If you can only track one metric, track TTFA.

What is a good benchmark for speed-to-contact in lead generation?

Elite operations achieve median Time to First Attempt under 60 seconds and 90th percentile under 5 minutes. Competitive operations achieve median under 5 minutes and 90th percentile under 15 minutes. The industry average of 42-47 hours represents massive economic waste. For most verticals, sub-5-minute response should be your minimum standard.

How do I improve lead response time with limited resources?

Start with automation rather than staffing. Automated SMS can reach leads in seconds regardless of rep availability. CRM workflow automation eliminates routing delays. Power dialers remove manual dialing time. These technologies typically cost less than additional staffing while delivering greater impact.

What is Lead Velocity Rate and why does it matter?

Lead Velocity Rate (LVR) tracks month-over-month growth in qualified leads entering your pipeline. Calculate as (This Month Volume - Last Month Volume) / Last Month Volume. LVR matters because it predicts future revenue more reliably than current closed deals. An LVR of 15% monthly indicates healthy growth; negative LVR for two consecutive months signals problems.

How does pipeline velocity differ from speed-to-contact?

Speed-to-contact measures time from lead capture to first engagement. Pipeline velocity measures how quickly leads progress through your sales process after initial contact. Both matter. Fast contact with slow pipeline velocity still produces long sales cycles. Optimizing only contact speed while ignoring pipeline velocity leaves money on the table.

What technology is required for sub-minute lead response?

Sub-minute response requires: real-time lead delivery via API (not email or batch), intelligent routing that assigns leads instantly, power dialers that initiate calls automatically, SMS automation for immediate text engagement, and real-time dashboards for monitoring. Most operations can implement this stack for $2,000-5,000 per month depending on scale.

How do I calculate the ROI of speed improvement investments?

Extract conversion rates by response time cohort from your historical data. Project how your conversion rate would improve at faster response times. Multiply the conversion lift by lead volume and average deal value to calculate monthly revenue improvement. Compare to monthly investment cost. Most velocity investments achieve positive ROI within 30-60 days.

What causes high variance in response times?

High variance typically indicates: staffing gaps during specific shifts, certain lead sources with delayed routing, individual reps with slower response patterns, or system failures that create temporary backlogs. Analyze response time by hour of day, lead source, assigned rep, and date to identify root causes.

How important is after-hours lead response?

Leads arriving outside business hours often have extended response delays, sometimes 12+ hours until the next business day. During this time, competitors with 24/7 coverage capture first-responder advantage. After-hours leads typically represent 20-40% of total volume. Operations without after-hours coverage are systematically disadvantaged on this substantial portion of their leads.

How do I prove velocity improvements to leadership?

Build correlation analysis showing the relationship between response time and conversion rate in your specific data. Then run controlled A/B tests with new velocity technology, measuring conversion lift between standard and accelerated groups. Translate results to revenue impact and ROI. Most leadership responds well to “This $5,000/month investment generates $50,000/month in additional revenue.”

Key Takeaways

-

Lead velocity encompasses four metric categories: speed-to-contact, pipeline velocity, response quality, and competitive position. Each requires different measurement approaches and optimization strategies.

-

The five-minute rule is empirically validated: Leads contacted within one minute convert at 391% higher rates. Leads contacted within five minutes are 21x more likely to qualify than those contacted at 30 minutes. Beyond five minutes, qualification probability drops by 80%.

-

The industry average of 42-47 hours response time represents massive opportunity: 63% of leads never receive any response at all. Simply responding puts you ahead of two-thirds of competitors. Responding quickly puts you in the elite minority that captures disproportionate value.

-

Automation technologies enable sub-minute response at scale: Real-time lead delivery, intelligent routing, power dialers, and SMS automation are table-stakes infrastructure for competitive operations. Manual processes cannot achieve consistent speed.

-

Pipeline velocity matters as much as contact speed: Fast initial contact with slow quote delivery, extended negotiations, or prolonged approvals still produces long sales cycles. Optimize the entire journey, not just the first contact.

-

Velocity metrics require systematic measurement: Build dashboards displaying real-time TTFA, contact rates by cohort, sales cycle length, and stage conversion velocity. What gets measured gets managed.

-

Vertical benchmarks set appropriate targets: Auto insurance requires sub-minute response; estate planning allows hours. Solar has 30-60 day cycles; DUI defense closes same-day. Know your vertical standards and build toward them.

-

Correlation analysis and A/B testing prove velocity impact: Extract conversion rates by response time cohort from your data to demonstrate the decay curve. Run controlled experiments to quantify improvement from new investments. Translate to revenue for budget justification.

-

After-hours coverage eliminates systematic disadvantage: 20-40% of leads arrive outside business hours. Without coverage, these leads receive response times of 12+ hours while competitors with 24/7 operations capture first-responder advantage.

-

Velocity improvement compounds over time: Each increment of speed improvement captures additional value from every lead. Operations that invest in velocity build sustainable competitive advantages that widen over time as competitors fall further behind.

This guide draws on industry research including studies from Velocify (391% conversion improvement), Lead Response Management Study (21x qualification rate), Lead Connect Survey (78% first-responder advantage), InsideSales.com (63% no-response rate), and operational benchmarks from insurance, mortgage, solar, and legal lead markets. Response time benchmarks reflect 2024-2025 market conditions. Validate current performance against your specific vertical and lead sources.