The language of lead generation determines whether you negotiate from strength or sign contracts you don’t understand.

A vendor proposes a lead contract at $45 per lead with an expected 12% conversion rate. The math seems straightforward until the contract arrives, and the definition of “conversion” reveals a fundamentally different meaning than anticipated. The vendor counts lead-to-contact as conversion. The buyer expected lead-to-customer. The 12% suddenly represents a very different economic reality, and a deal that seemed profitable becomes questionable.

This scenario plays out daily across the lead generation industry. Terminology that appears universal carries different meanings in different contexts, and the consequences of misunderstanding extend far beyond semantic confusion. Contract disputes, failed partnerships, and business failures often trace back to terminology disconnects that went unexamined until too late.

The problem intensifies as the industry matures. New entrants learn vocabulary through osmosis, inheriting imprecise definitions from whomever taught them. Veterans assume shared understanding that does not exist. Contracts written without explicit definitions create liability exposure that manifests only when disputes arise. The cumulative effect is an industry that often talks past itself, where apparent agreement masks fundamental misalignment.

This guide exists to establish common ground. Not because there is one universally correct definition for every term – reasonable practitioners disagree on certain boundaries – but because precision about what terms mean in specific contexts prevents the misunderstandings that cost real money.

Walk into any lead generation conference and you’ll hear veterans discussing lead decay rates, prospect qualification, and customer acquisition costs. The vocabulary sounds interchangeable to newcomers, but every term carries specific operational meaning. Mix them up in a contract, and you’ve just agreed to terms that favor the other party.

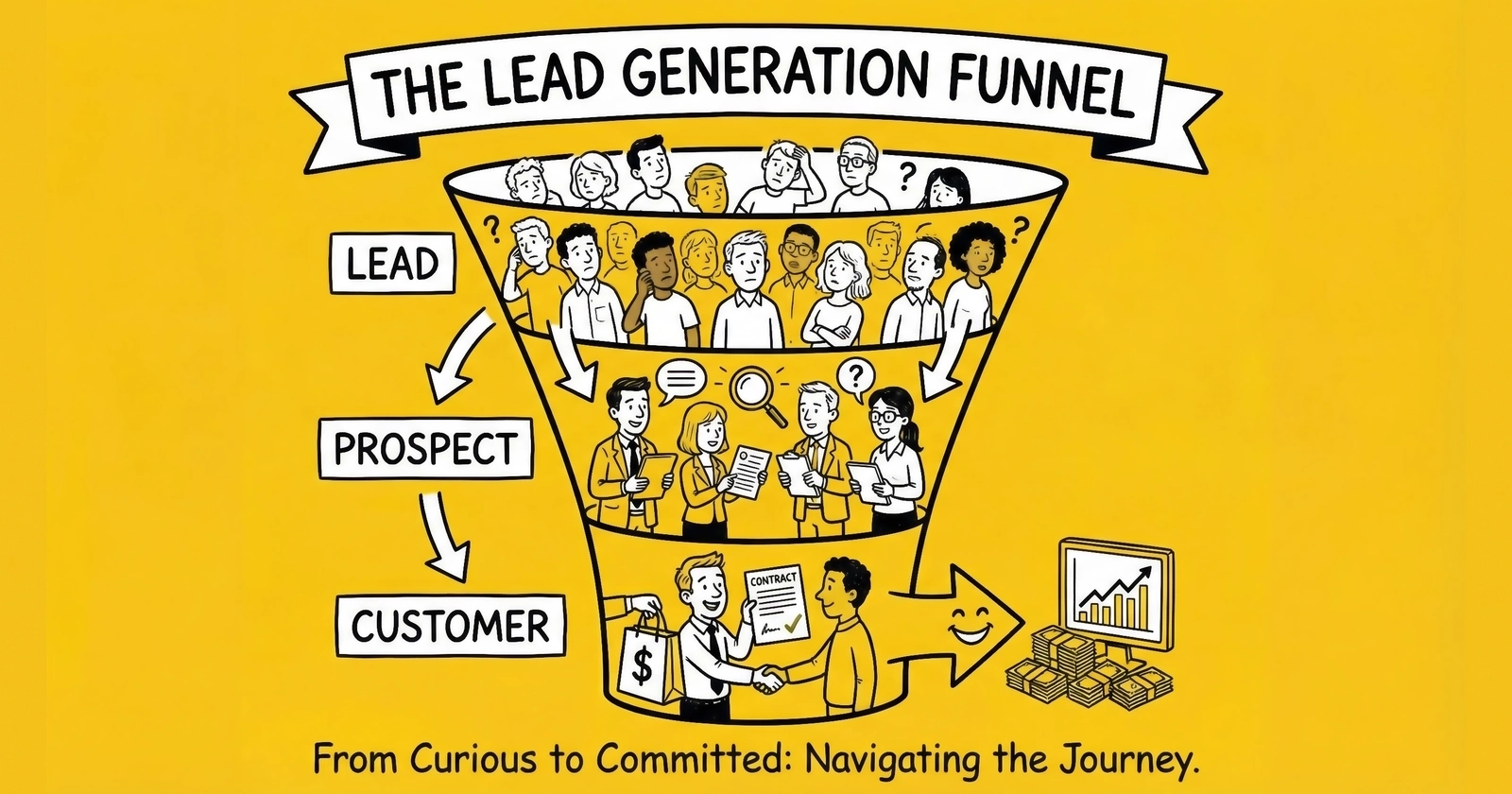

A lead is not a prospect. A prospect is not a customer. And confusing these terms costs businesses millions in misaligned expectations, mispriced transactions, and failed conversions. This isn’t semantic pedantry. This is the operational language that determines how much you pay, what you receive, and whether your sales funnel actually works.

This guide establishes precise definitions for lead, prospect, and customer. More importantly, it explains why these distinctions matter for pricing, performance metrics, and strategic decision-making across every major vertical in the lead generation industry.

What Is a Lead?

A lead is consumer intent captured with permission, contact data, and timing. It represents someone who has expressed interest in a product or service and provided a way to contact them. The key word is “expressed.” A lead isn’t a name scraped from a directory or a phone number purchased from a list broker. A lead is created when a consumer takes action.

The Four Essential Elements of a Lead

Every valid lead contains four components. Missing any one of these transforms a lead from an asset into a liability.

Intent. The consumer demonstrated interest in a specific product or service. They searched for “auto insurance quotes,” clicked an ad, and landed on a comparison page. Or they visited a solar company’s website after seeing a neighbor’s installation. Intent is the raw material that gives leads value and distinguishes them from random contact information.

Without intent, you have a cold list. Cold lists have fundamentally different economics, typically converting at 5-10% the rate of intent-driven leads. The distinction matters because buyers pay for intent, not for data.

Permission. The consumer explicitly agreed to be contacted about their inquiry. Under the Telephone Consumer Protection Act (TCPA), contacting consumers without proper consent exposes your business to statutory damages of $500-$1,500 per unauthorized contact. No cap on total exposure. Average TCPA settlements exceed $6.6 million.

Permission isn’t optional or negotiable. It’s the legal foundation that allows the lead to be contacted at all. Prior Express Written Consent (PEWC) is the gold standard for telemarketing, requiring a written agreement (electronic signatures count) that clearly authorizes marketing contact.

Data. The lead includes contact information sufficient to reach the consumer: typically phone number, email address, or both. Additional data fields like geographic location, credit score, or stated timeline increase the lead’s value by enabling better routing and qualification.

First-party data (collected directly from consumers on your own properties) typically achieves 90% match rates against verification databases. Third-party data (purchased or aggregated from external sources) drops to 50-60% match rates. This quality differential shows up directly in contact rates and conversion performance.

Timing. Leads are perishable assets. Industry data shows leads lose approximately 10% of their value per hour and 50% within 24-48 hours. A lead captured this morning is worth multiples of one captured last week. Real-time leads deliver within seconds of consumer submission. Aged leads are unsold inventory from days or weeks prior, typically priced at 5-20% of fresh lead value.

Types of Leads

The lead market has developed specific classifications that affect pricing and buyer expectations.

Exclusive vs. Shared. Exclusive leads sell to exactly one buyer. Shared leads sell to multiple buyers, typically three to seven. Exclusive leads command premium pricing (2-3x shared leads) because the buyer doesn’t compete for the prospect’s attention. A $25 shared auto insurance lead might sell for $60-75 as an exclusive.

Real-time vs. Aged. Real-time leads deliver within seconds of submission. The consumer is still thinking about insurance or solar or mortgages. Aged leads are unsold inventory that didn’t move in the initial distribution window. The value decay curve is brutal: a real-time mortgage lead worth $100 might fetch $20 at 30 days old.

Call Leads vs. Form Leads. Call leads involve a live consumer on the phone, having called a tracking number and possibly completed IVR qualification. Form leads consist of information submitted through an online form, requiring outbound contact. Call leads command premium pricing because they represent immediate, high-intent engagement.

Pre-qualified vs. Raw. Pre-qualified leads have been screened against criteria beyond basic form completion. A mortgage lead might be pre-qualified for credit score, loan amount, and property value. Raw leads have minimal screening. Pre-qualification increases buyer conversion rates and commands higher prices.

What Is a Prospect?

A prospect is a lead that has been contacted, confirmed as viable, and determined to be a legitimate sales opportunity. The critical distinction: a lead represents captured information, while a prospect represents a validated opportunity.

How Leads Become Prospects

The transition from lead to prospect happens through direct contact. Someone on your team (or your client’s team) has spoken with the individual, confirmed their needs, verified their information, and determined they’re genuinely interested in moving forward.

This qualification process typically answers several questions:

- Does the contact information work? (Phone answered, email valid)

- Is this the right person with decision-making authority?

- Do their needs match what we offer?

- What’s their timeline for making a decision?

- Do they meet basic qualification criteria? (Credit score, budget, geography)

A lead with a 50% contact rate means half won’t become prospects simply because you can’t reach them. Of those contacted, perhaps 60-70% qualify based on needs match and readiness. The funnel narrows significantly between lead and prospect.

Why the Distinction Matters

Pricing implications. Leads are priced based on projected conversion rates across large populations. Prospects carry higher individual value because the qualification work has already happened. Appointment-setting services that deliver qualified prospects rather than raw leads charge 3-5x what raw lead suppliers charge, reflecting the cost of contact attempts and qualification.

Performance metrics. Lead-to-prospect conversion rate reveals the quality of your lead sources. If you’re converting 5% of leads to prospects and the industry average is 15%, your lead sources need scrutiny. If you’re at 25%, you may be overpaying for lead quality you don’t need.

Sales team efficiency. Sales representatives working prospects rather than leads spend time on conversations likely to convert rather than dialing through uncontacted or unqualified names. This affects hiring decisions, compensation structures, and capacity planning.

What Qualifies as a Qualified Prospect?

Different industries and companies define qualification differently, but common frameworks include:

BANT. Budget, Authority, Need, Timeline. The prospect has budget for the purchase, authority to make the decision, a genuine need for the solution, and a timeline for moving forward.

Lead Scoring. Numerical values assigned based on demographic fit and behavioral signals. A prospect with a credit score above 700, an income above $75,000, and engagement with pricing content scores higher than someone who only downloaded a general guide.

Sales Accepted Lead (SAL). A lead that the sales team has reviewed and agreed to work. This handoff formalizes the transition from marketing-generated lead to sales-worked prospect.

The terminology varies, but the principle remains: prospects have been vetted and confirmed as genuine opportunities worthy of sales attention.

What Is a Customer?

A customer is a prospect who has completed a transaction. They have exchanged money for a product or service. The relationship has moved from potential to actual.

The Conversion Event

The specific event that transforms a prospect into a customer varies by industry:

- Insurance: The prospect binds a policy and makes a first premium payment.

- Mortgage: The loan closes and funds disburse.

- Solar: The installation contract is signed and the deposit is collected.

- Legal: The retainer agreement is executed and the client-attorney relationship begins.

- Home Services: The job is completed and payment is received.

The conversion event is unambiguous. Either the transaction happened or it didn’t. This clarity makes customer metrics (customer acquisition cost, lifetime value, retention rate) more reliable than lead or prospect metrics.

Why Customer Economics Drive Lead Economics

The lead generation industry exists because customers are valuable. Insurance carriers, mortgage lenders, solar installers, and law firms all calculate what a customer is worth over time, then work backward to determine what they can afford to pay for leads.

Customer Lifetime Value (LTV) measures total revenue over the customer relationship: Auto Insurance ($1,500-$3,000), Medicare ($800-$1,200), Mortgage ($3,000-$8,000), Solar ($5,000-$15,000), Legal ($10,000+).

These figures inform buyer economics. An insurance carrier with $2,400 average LTV might accept $800 in acquisition cost. That budget flows backward through the funnel to determine lead pricing.

Customer Acquisition Cost (CAC) measures total spend to acquire a customer, including lead costs, sales labor, and overhead. Sustainable businesses target LTV-to-CAC ratios of 3:1 or better.

The Full Funnel Math

Here’s how the lead-to-customer funnel works in practice, using auto insurance as an example:

| Stage | Conversion Rate | Cumulative Conversion |

|---|---|---|

| Lead (100) | - | 100 leads |

| Contact Rate | 50% | 50 contacted |

| Prospect Qualified | 60% | 30 prospects |

| Proposal/Quote | 70% | 21 quoted |

| Customer Conversion | 35% | 7 customers |

In this example, 100 leads produce 7 customers, a 7% lead-to-customer conversion rate. If lead cost is $40, the 100 leads cost $4,000. Seven customers means customer acquisition cost of $571 per customer, excluding sales labor and overhead.

If customer LTV is $2,000, the LTV-to-CAC ratio is approximately 3.5:1, leaving room for sales costs and profit. If lead cost rises to $70 per lead, the math gets tighter. If conversion rates drop, the economics fail entirely.

This is why precise terminology matters. A supplier claiming “12% conversion” might mean lead-to-prospect, lead-to-customer, or something else entirely. The numbers are meaningless without definitions.

The Lead-to-Customer Journey: Metrics at Each Stage

The sales funnel contains distinct stages, each with its own metrics and conversion benchmarks.

Stage 1: Lead Capture

Key Metric: Cost Per Lead (CPL)

This measures what you pay to acquire a lead, whether through paid advertising, organic traffic conversion, or purchasing from external sources.

Benchmarks by Vertical:

| Vertical | Typical CPL Range |

|---|---|

| Auto Insurance | $25-$75 |

| Mortgage | $50-$150 |

| Solar | $75-$200 |

| Legal | $200-$500 |

| Home Services | $40-$100 |

Google Ads average CPL reached $70.11 in 2025, up 5% year-over-year. Facebook Lead Ads average around $27.66. Costs vary dramatically by vertical, geography, and competitive intensity.

Stage 2: Lead to Contact

Key Metric: Contact Rate

This measures the percentage of leads successfully reached by phone, email, or other contact method.

Benchmarks:

- Fresh leads (under 5 minutes): 60-80% contact rate

- Leads over 30 minutes: 40-55% contact rate

- Aged leads (7+ days): 15-30% contact rate

The speed-to-contact data is unambiguous: leads contacted within one minute show 391% higher conversion rates. The first responder wins 78% of the time. This single variable explains more variance in conversion rates than lead source quality or sales script effectiveness.

Stage 3: Contact to Prospect

Key Metric: Qualification Rate

This measures the percentage of contacted leads that qualify as legitimate sales opportunities.

Factors Affecting Qualification:

- Accuracy of lead data (real information vs. fraud)

- Intent strength (actively shopping vs. casual inquiry)

- Criteria match (credit, geography, product fit)

- Decision authority (can they make the purchase?)

- Timeline (ready to act vs. researching for later)

Typical qualification rates range from 30-70% of contacted leads, depending on lead source quality and buyer requirements.

Stage 4: Prospect to Customer

Key Metric: Close Rate (or Conversion Rate)

This measures the percentage of qualified prospects who become paying customers.

Benchmarks by Vertical:

| Vertical | Typical Close Rate |

|---|---|

| Auto Insurance | 8-12% of contacts |

| Medicare | 6-10% of contacts |

| Mortgage | 3-5% of contacts |

| Solar | 4-8% of contacts |

| Legal | 2-4% of contacts |

Note these are percentages of contacted leads, not leads purchased. The overall lead-to-customer conversion combines all funnel stages.

Stage 5: Customer to Retention

Key Metric: Retention Rate / Churn Rate

Customer value extends beyond the initial transaction. Retention measures how long customers stay, affecting lifetime value calculations.

Example: An insurance customer who stays five years at $500 annual premium has $2,500 LTV. One who churns after one year has $500 LTV. Same acquisition cost, vastly different economics.

Why These Distinctions Matter for Pricing

The difference between lead, prospect, and customer isn’t academic. It directly affects how transactions are priced and what you should expect to pay or receive.

Lead Pricing vs. Appointment Pricing vs. Customer Pricing

The lead generation market offers three primary pricing models, each corresponding to a different point in the funnel:

Cost Per Lead (CPL): You pay for each lead delivered, regardless of contact or conversion outcome. The buyer assumes all downstream risk. Typical pricing ranges from $20-$300 depending on vertical and quality.

Cost Per Appointment (CPA): You pay only when a qualified prospect is delivered, typically confirmed by a scheduled appointment or live transfer. The supplier handles contact attempts and initial qualification. Pricing runs 3-5x CPL rates, reflecting the work and risk the supplier absorbs.

Cost Per Acquisition/Sale: You pay only when a customer converts. This is revenue share or commission pricing, where the supplier’s compensation depends entirely on downstream outcomes. This model only works when the buyer can accurately track and report conversions, and when trust exists between parties.

The Risk Transfer in Each Model

Each pricing model transfers risk differently between buyer and seller:

| Model | Supplier Risk | Buyer Risk |

|---|---|---|

| CPL | Lead generation only | Contact, qualification, conversion |

| CPA | Lead + Contact + Qualification | Conversion only |

| CPS | Full funnel risk | None (pays on success) |

Buyers with strong sales operations prefer CPL models that give them control over contact and conversion. Buyers with weaker sales operations may prefer CPA or CPS models that shift performance risk to suppliers.

Suppliers with strong lead quality prefer CPL models where their value is captured at delivery. Suppliers confident in downstream conversion may accept CPA or CPS for higher potential payouts.

How Pricing Reflects Quality Expectations

A $25 shared auto insurance lead and a $75 exclusive auto insurance lead are priced differently because buyers expect different outcomes. The shared lead sells to 3-5 buyers who compete for prospect attention, resulting in lower contact and conversion rates per buyer. The exclusive lead goes to one buyer only, delivering higher contact and conversion rates without competition.

Neither price is “wrong.” They reflect different value propositions for different buyer needs. Confusing the two in a contract creates misaligned expectations and relationship damage.

Industry-Specific Terminology

While lead, prospect, and customer apply universally, each major vertical has developed specialized vocabulary.

Insurance Leads

Bind. The insurance-specific term for customer conversion. When a prospect becomes a policyholder, they “bind” coverage. Bind rates are the equivalent of close rates.

Quote. An estimate provided to the prospect. Quote volume and quote-to-bind ratios are key metrics.

Carrier vs. Agent. Carriers underwrite policies; agents sell them. Lead flows differently depending on whether leads go to carriers or agents.

Sub-vertical specificity: Auto, home, life, health, and Medicare leads have different economics, regulations, and buyer ecosystems. A “good insurance lead” means different things in each.

Mortgage Leads

Application. The mortgage equivalent of serious prospect status. Application rates matter more than raw lead counts.

Pre-qualification vs. Pre-approval. Pre-qualification is preliminary; pre-approval is a verified commitment. Lead quality depends on which stage the prospect has reached.

Rate sensitivity. Mortgage lead demand and pricing fluctuate with interest rates. Economics differ dramatically between high-rate and low-rate environments.

Solar Leads

Site survey. The critical qualification step evaluating installation feasibility. Leads progressing to site surveys represent serious prospects.

Net metering. State policy affecting solar economics. Lead value varies by geography based on net metering availability.

Legal Leads

Signed case. The legal equivalent of customer conversion. The prospect signs a retainer agreement and becomes a client.

Case value. Estimated settlement value, which drives CPL willingness. Mass tort leads for high-value cases command premiums.

Common Terminology Mistakes

Newcomers to lead generation consistently make the same vocabulary errors. These mistakes cost money and damage credibility.

Mistake 1: Calling Every Contact a “Lead”

Not every name in your database is a lead. Names scraped from directories, purchased cold lists, or captured without intent are not leads. They’re contacts. Treating them as leads inflates your lead count, deflates your conversion metrics, and misleads decision-making.

The fix: Define leads as intent-driven, permission-based submissions. Everything else is a contact requiring different handling and different expectations.

Mistake 2: Confusing Lead Quality with Lead Volume

Buying 1,000 leads at $20 each isn’t better than buying 500 leads at $40 each if the expensive leads convert twice as well. Unit economics, not unit counts, determine outcomes.

The fix: Track cost per acquisition (CPA), not just cost per lead. A $40 lead that converts at 10% costs $400 per customer. A $20 lead that converts at 2% costs $1,000 per customer. The expensive lead is cheaper.

Mistake 3: Using “Conversion Rate” Without Definition

When someone says “our conversion rate is 8%,” ask: conversion from what to what? Lead to prospect? Prospect to customer? Lead to customer?

An 8% lead-to-prospect rate is concerning. An 8% prospect-to-customer rate might be excellent. An 8% lead-to-customer rate is strong in most verticals.

The fix: Always specify the numerator and denominator. “Our lead-to-customer conversion rate is 8%” leaves no ambiguity.

Mistake 4: Ignoring the Time Dimension

A “lead” contacted six months after submission is barely a lead anymore. Leads decay. Treating aged leads like fresh leads guarantees disappointment.

The fix: Segment analysis by lead age. Track decay curves. Price accordingly.

Mistake 5: Assuming “Qualified” Means the Same Thing Everywhere

Your qualification criteria differ from your buyer’s criteria. “Qualified lead” without specific definition is meaningless.

The fix: Define qualification criteria explicitly in contracts. Align expectations before delivery.

Mistake 6: Treating Shared and Exclusive Leads Identically

Shared leads sell to multiple buyers. Exclusive leads sell to one. This fundamentally changes contact rates, conversion rates, and appropriate pricing.

The fix: Track shared and exclusive leads separately. Apply appropriate conversion expectations to each.

The Vocabulary of Negotiation

How terminology functions in actual business negotiations reveals why precision matters beyond abstract clarity. Experienced negotiators understand that terminology framing shapes deal outcomes, and they choose their words accordingly.

When Sellers Control Terminology

Sellers benefit when leads are defined broadly. A definition that includes all form submissions captures more volume than one requiring verified contact information. A conversion definition that counts contacts rather than customers makes the seller’s product appear more valuable. A quality standard that measures validation at capture rather than buyer acceptance shifts risk to the buyer.

Watch for these seller-favorable definitions in contracts:

- “Lead” defined as any form submission rather than verified, compliant submissions

- “Conversion” measured at contact or appointment rather than sale

- “Quality” assessed at delivery rather than after buyer evaluation

- “Return eligibility” narrowly defined with short windows and limited reasons

- “Exclusive” with carve-outs for affiliate channels or partner programs

None of these framings are inherently dishonest. They represent legitimate business positions. But buyers who accept them without understanding the implications often discover later that their expected economics do not materialize.

When Buyers Control Terminology

Buyers benefit from narrow lead definitions, broad return eligibility, and conversion metrics measured at the point of customer acquisition. These framings shift risk to the seller and protect buyer investment.

Buyer-favorable definitions include:

- “Lead” requiring verified contact information, documented consent, and qualification criteria

- “Conversion” measured only at bound policy, closed loan, or signed contract

- “Quality” assessed based on buyer conversion rates or return frequency

- “Return eligibility” including broad reasons and extended windows

- “Exclusive” meaning no other buyer contact under any circumstance

Again, these framings represent legitimate positions. Sellers accepting them assume more risk and should price accordingly.

The Negotiation Middle Ground

Sophisticated transactions recognize the tension between buyer and seller definitions and establish explicit compromises. Rather than adopting either party’s preferred framing wholesale, the contract specifies exactly what each term means for this particular relationship.

This middle ground might include leads defined as verified form submissions with documented consent, returns allowed for specific enumerated reasons within a defined window, quality measured by a blend of delivery validation and buyer acceptance, and pricing that reflects the risk allocation created by these definitions.

The most successful buyer-seller relationships emerge from negotiations where both parties understand the terminology game and collaborate on definitions that create aligned incentives rather than adversarial positioning.

Glossary of Essential Lead Generation Terms

| Term | Definition |

|---|---|

| Lead | Consumer intent captured with permission, contact data, and timing |

| Prospect | A lead that has been contacted and confirmed as viable |

| Customer | A prospect who has completed a transaction |

| Exclusive Lead | Sold to one buyer only (premium: 2-3x shared pricing) |

| Shared Lead | Sold to multiple buyers (typically 3-7) |

| Real-Time Lead | Delivered within seconds of consumer submission |

| Aged Lead | Unsold inventory from days/weeks prior (5-20% of fresh value) |

| CPL | Cost Per Lead: price paid for each lead delivered |

| CPA | Cost Per Action: price paid for qualified prospect or customer |

| EPL | Earnings Per Lead: net revenue after returns and costs |

| CAC | Customer Acquisition Cost: total cost to acquire a customer |

| LTV | Lifetime Value: total revenue over customer relationship |

| Contact Rate | Percentage of leads successfully reached |

| Close Rate | Percentage of prospects who become customers |

| Return Rate | Percentage of leads returned by buyer (industry avg: 8-15%) |

| Ping/Post | Two-stage distribution: ping solicits bids, post delivers to winners |

| Waterfall | Sequential distribution through prioritized buyer list |

| Live Transfer | Connecting a consumer on phone directly with buyer’s agent |

| TCPA | Telephone Consumer Protection Act: primary federal telemarketing regulation |

| PEWC | Prior Express Written Consent: gold standard for telemarketing compliance |

| DNC | Do Not Call registry |

| Float | Cash tied up between paying suppliers and collecting from buyers |

| Dedupe | Removing duplicate leads from a dataset |

| Validation | Confirming data meets technical criteria |

| Verification | Confirming data accuracy and ownership |

Frequently Asked Questions

What is the main difference between a lead and a prospect?

A lead is captured information with intent and permission. A prospect is a lead that has been contacted and confirmed as viable. The difference is validation: leads are potential; prospects are verified.

How quickly do leads lose value?

Leads lose approximately 10% of value per hour and 50% within 24-48 hours. This decay curve drives the emphasis on speed-to-contact in lead generation.

What is a good lead-to-customer conversion rate?

Overall lead-to-customer conversion rates typically range from 3-10% depending on vertical. Auto insurance sees 4-7%. Mortgage sees 1-2%.

What should I expect to pay for leads vs. appointments?

Appointment pricing runs 3-5x lead pricing in the same vertical. A $50 auto insurance lead corresponds to a $150-$250 appointment, reflecting contact attempts and qualification work.

How do I know if my leads are “qualified”?

Qualification criteria should be defined explicitly before delivery. Common frameworks include BANT (Budget, Authority, Need, Timeline). Ask suppliers to document their qualification definition.

What’s the difference between exclusive and shared leads?

Exclusive leads sell to one buyer only. Shared leads sell to multiple buyers (typically 3-7). Exclusive leads cost 2-3x more but deliver higher contact and conversion rates.

Why are aged leads so much cheaper than fresh leads?

Value decay. Leads lose 50% of value within 24-48 hours. At 30 days old, a lead is worth 5-20% of its fresh price.

What conversion rate should I use to evaluate lead ROI?

Use lead-to-customer conversion rate for true ROI calculation. Intermediate metrics help diagnose funnel problems but don’t reveal actual economics.

How do I reduce lead returns from buyers?

Reduce returns by improving validation at capture, aligning lead criteria with buyer requirements, implementing dedupe before delivery, and investing in fraud prevention.

What does “lead scoring” actually measure?

Lead scoring assigns numerical values predicting conversion likelihood based on demographic fit and behavioral signals. Higher scores justify premium pricing and priority routing.

Key Takeaways

-

A lead is intent captured with permission and data. A prospect is a lead that has been contacted and qualified. A customer has completed a transaction. These are not interchangeable terms.

-

Leads decay at approximately 10% per hour. Speed-to-contact is the single highest-leverage variable in lead conversion, with leads contacted within one minute converting at 391% higher rates.

-

Lead pricing (CPL) transfers downstream risk to buyers. Appointment pricing (CPA) transfers contact and qualification risk to suppliers. Structure deals based on where you want risk to reside.

-

Conversion rate benchmarks require context. Always specify numerator and denominator: lead-to-prospect, prospect-to-customer, or lead-to-customer conversion rates tell different stories.

-

Customer lifetime value drives lead economics backward through the funnel. Buyers calculate acceptable CAC from LTV, then work backward to determine lead pricing. Understanding buyer economics reveals pricing opportunities.

-

Industry-specific vocabulary exists. Insurance “binds,” mortgages “close,” legal matters “sign.” Learn the vertical terminology for your market to negotiate effectively and avoid misunderstandings.

-

Track metrics at each funnel stage. CPL without contact rate, qualification rate, and close rate tells an incomplete story. Full-funnel visibility reveals where optimization opportunities exist.

Statistics and benchmarks current as of December 2025. Lead pricing, conversion rates, and regulatory requirements change continuously. Verify current conditions before making significant investment decisions.