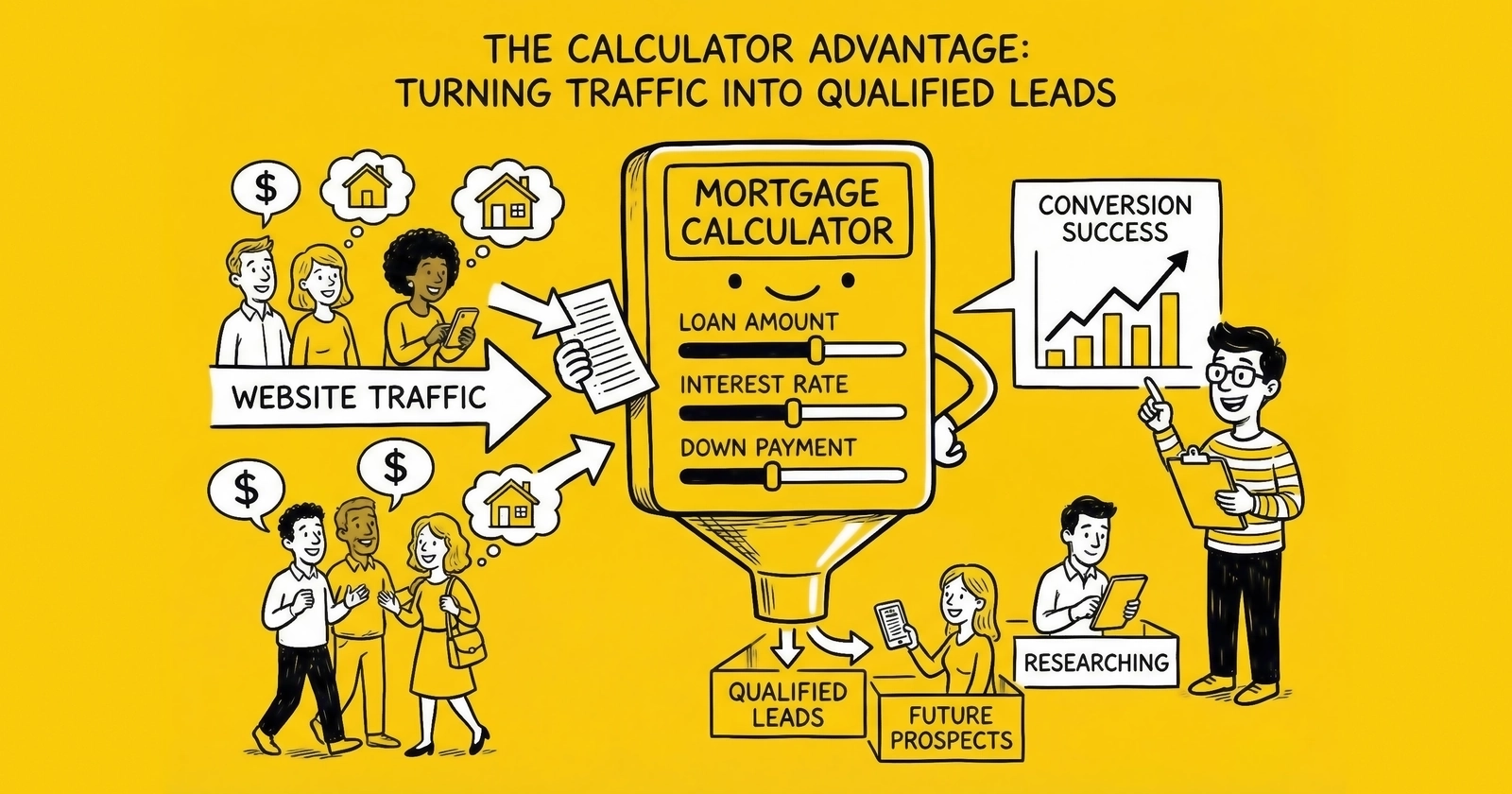

Calculator tools generate 15-25% conversion rates in mortgage lead generation, compared to 3-8% for standard landing pages. Here is how to build, optimize, and monetize mortgage calculators that turn traffic into qualified leads.

Why Mortgage Calculators Dominate Lead Generation

A single mortgage calculator ranking on page one for “mortgage payment calculator” generates thousands of leads monthly at zero marginal acquisition cost. The same traffic volume from paid search costs $50,000-100,000 monthly in ad spend, depending on geographic targeting and keyword competition.

The economics explain why serious mortgage lead generators treat calculators as infrastructure, not marketing. Paid traffic buys speed. Calculator traffic buys compounding returns that grow every month you hold rankings.

Mortgage calculators convert because they deliver personalized value before asking for information. A consumer who calculates their monthly payment on a $400,000 home at current rates has already invested effort. The psychological commitment makes them substantially more likely to complete a lead form when offered actual quotes from lenders.

Industry data shows mortgage calculators converting at 15-25%, compared to standard landing page conversion rates of 3-8%. The difference represents the core principle of value-first lead generation: give consumers something useful, then ask for contact information to provide even more value.

This guide provides the complete framework for building mortgage calculator lead generation operations. You will learn which calculator types perform best, how to optimize for both search engines and conversions, and how to structure lead capture that turns anonymous visitors into qualified mortgage leads worth $50-200 each.

The mortgage vertical operates on a $5.6 billion annual lead market. Calculator-based lead generation represents one of the most sustainable approaches to capturing share of that market, building assets that appreciate over time rather than depleting with each ad dollar spent.

The Mortgage Calculator Landscape

Calculator Types and Their Use Cases

Different calculator types serve different stages of the homebuying journey. Understanding these stages helps you build tools that capture consumers at peak intent.

Payment Calculators address the most fundamental question: “How much will my monthly payment be?” These calculators take loan amount, interest rate, and term as inputs, outputting monthly principal and interest payments. Some versions include property taxes, insurance, and PMI for total housing payment estimates.

Payment calculators capture mid-funnel traffic. Users have already determined they want to buy or refinance; they’re validating affordability. Conversion rates run 15-20% when paired with effective lead capture asking users to “get your personalized rate” after seeing calculated payments.

Affordability Calculators work backward from income and expenses to determine maximum home price. Users input annual income, monthly debts, down payment amount, and estimated credit score. The calculator outputs affordable home price ranges and corresponding payment estimates.

These tools capture earlier-funnel traffic. Users haven’t settled on a specific home or loan amount. They’re exploring what’s possible. Conversion rates run 12-18%, slightly lower than payment calculators because users are earlier in their journey. However, these leads often have higher qualification rates since the calculator itself pre-screens for basic financial viability.

Refinance Calculators compare current mortgage costs against potential new loan terms. Users input current loan balance, interest rate, remaining term, and potential new rate. The calculator shows monthly savings, break-even point for closing costs, and total interest savings over the loan term.

Refinance calculators perform differently based on rate environment. In 2025, with 30-year fixed rates ranging from 6.35% to 7.04%, refinance calculator traffic targets borrowers who financed at 2022-2023 peak rates (7%+) and now find savings opportunities as rates decline. Conversion rates during favorable rate environments reach 18-25%; during rate plateaus, they drop to 8-12% as fewer consumers find compelling savings.

Home Equity Calculators estimate available equity and potential borrowing amounts. Users input home value, current mortgage balance, and credit score estimate. The calculator shows available equity and potential HELOC or second mortgage amounts.

Home equity calculators have emerged as strong performers during 2024-2025 elevated rate environments. Homeowners with sub-4% first mortgages from 2020-2021 won’t refinance into 6%+ rates but will tap equity for major purchases or debt consolidation. LendingTree reported home equity revenue of $30.3 million in Q2 2025, growing 38% year-over-year, demonstrating sustained demand in this segment.

Amortization Calculators show payment breakdown over the loan term, illustrating how much goes to principal versus interest at each payment. These tools serve educational purposes and attract research-stage traffic with lower immediate conversion rates (8-12%) but strong remarketing value.

Traffic Volume and Keyword Opportunity

Mortgage calculator keywords command substantial search volume with clear commercial intent. Understanding the keyword landscape helps prioritize development and content efforts.

Primary calculator keywords:

| Keyword | Monthly Search Volume (US) | Typical CPL Range |

|---|---|---|

| Mortgage calculator | 500,000-800,000 | $40-80 |

| Mortgage payment calculator | 200,000-350,000 | $45-90 |

| Home loan calculator | 100,000-180,000 | $50-100 |

| Refinance calculator | 80,000-150,000 | $60-120 |

| How much house can I afford | 150,000-250,000 | $35-75 |

| HELOC calculator | 30,000-60,000 | $40-80 |

These volumes represent nationwide averages. Local variations matter significantly. “Mortgage calculator California” and similar geo-modified terms capture traffic with specific geographic intent, enabling targeted lead routing to originators licensed in those states.

Long-tail opportunities exist for specific use cases:

- “15 year vs 30 year mortgage calculator”

- “Mortgage calculator with PMI and taxes”

- “FHA loan calculator”

- “VA loan calculator”

- “Jumbo mortgage calculator”

Long-tail keywords often convert better because they indicate more specific intent. A user searching “FHA loan calculator” has likely already determined they need an FHA loan and is further along in the decision process than someone searching the generic “mortgage calculator.”

Competitive Landscape

The mortgage calculator space is dominated by established players with significant domain authority and content depth.

Bankrate commands premium positioning with comprehensive mortgage content and calculator tools, generating approximately 4 million monthly mortgage page views. Their calculators serve as lead generation tools for a marketplace connecting consumers with lender partners.

NerdWallet approaches mortgage calculators through educational content, excelling with first-time buyers navigating mortgage decisions. Their calculator pages combine tools with explanatory content that answers the questions consumers have while using the calculator.

Zillow captures calculator traffic through real estate listing integration. Consumers researching homes on Zillow naturally use integrated payment calculators, creating seamless lead flow from property browsing to mortgage inquiry.

Major lenders including Chase, Bank of America, and Rocket Mortgage operate their own calculator properties. These capture brand-loyal traffic but don’t compete directly with comparison-focused independents.

For independent operators, the competitive reality requires strategic focus. Competing for “mortgage calculator” as a head term against Bankrate and NerdWallet requires massive content investment and years of authority building. Targeting long-tail variations, geographic modifiers, and specific use cases offers faster paths to traffic.

Building High-Converting Mortgage Calculators

Core Functionality Requirements

Effective mortgage calculators balance comprehensive functionality with user-friendly simplicity. The goal is providing genuine utility that creates psychological investment before lead capture.

Essential inputs for payment calculators:

- Home price or loan amount

- Down payment (dollar amount or percentage)

- Interest rate (with current rate default)

- Loan term (15, 20, 30 years)

- Property taxes (estimated by zip code default)

- Homeowners insurance (estimated by zip code default)

- PMI (automatically calculated if down payment < 20%)

- HOA fees (optional field)

Essential outputs:

- Total monthly payment (comprehensive, not just P&I)

- Principal and interest breakdown

- Amortization schedule (at minimum, first 5 years and total interest)

- Visual breakdown (pie chart or bar showing payment components)

- Comparison feature (show how payment changes with different rates or terms)

Smart defaults reduce friction. Pre-populate the interest rate field with current average 30-year fixed rates (pulling from a rate feed or updating weekly). Default property tax and insurance estimates based on zip code input. These defaults reduce cognitive load while ensuring users see realistic calculations.

Rate refresh matters. In 2025, with 30-year fixed rates ranging between 6.35% and 7.04%, stale rate data destroys calculator credibility. Users arriving from rate-focused searches expect current information. Update rate defaults at least weekly; daily updates are preferable for comparison-focused sites.

User Experience Optimization

Calculator UX directly impacts conversion rates. Every friction point costs leads.

Single-page experience. The most effective calculators keep all inputs on one screen with results updating in real-time. Multi-page flows that require “Calculate” button clicks add friction without adding value. Real-time updates create engagement as users experiment with different scenarios.

Mobile-first design is mandatory. Mortgage calculator traffic runs 60-70% mobile. Form fields need adequate spacing (44x44 pixel minimum tap targets), dropdown selections rather than free-form inputs where possible, and thumb-friendly number pads that auto-appear for numerical fields.

Visual results outperform text. A pie chart showing payment breakdown (principal, interest, taxes, insurance, PMI) communicates instantly what takes paragraphs to explain textually. Interactive amortization charts where users can hover to see specific months create engagement that extends session duration.

Comparison functionality drives conversions. Allow users to compare scenarios side-by-side: 15-year vs 30-year terms, different down payment amounts, or rate differences. Comparison views naturally lead to “get actual quotes” calls-to-action when users see how much rate differences matter.

Save and share features. Users who can save their calculation or email it to themselves provide contact information willingly as a feature benefit. “Email my results” is a low-friction lead capture mechanism that feels like service rather than solicitation.

Technical Implementation Choices

Build vs. embed decisions have long-term strategic implications for traffic generation.

Custom-built calculators require development investment ($3,000-15,000 for professional implementations) but provide full ownership, customization flexibility, and complete lead capture control. Custom implementations can integrate directly with CRM systems, support A/B testing of form variations, and evolve with business needs.

Embedded third-party calculators require no development investment but limit customization and may restrict lead capture options. Widgets from companies like MortgageCalculator.org offer functional tools but send leads to third parties or require revenue sharing arrangements.

API-based approaches pull calculation logic from services like Zillow or RateCity while maintaining control of the user interface and lead capture. These offer middle-ground economics: lower development cost than fully custom builds, more control than embedded widgets.

For practitioners building sustainable lead generation assets, custom implementation almost always provides better long-term ROI. The development investment amortizes across years of traffic generation, while third-party dependencies create ongoing costs and strategic limitations.

Technical performance requirements:

- Page load under 2.5 seconds (Core Web Vitals LCP target)

- Calculation results within 200 milliseconds of input change

- Mobile responsiveness with responsive breakpoints, not just scaling

- Cross-browser compatibility (Chrome, Safari, Firefox, Edge)

- Accessibility compliance (WCAG 2.1 AA for liability protection)

SEO Strategy for Calculator Traffic

Keyword Targeting and Content Architecture

Capturing organic calculator traffic requires strategic keyword targeting combined with supporting content that establishes topical authority.

Primary calculator pages target head terms like “mortgage payment calculator” with fully featured tools, comprehensive supporting content (how to use, what inputs mean, what results indicate), and structured data markup for rich result eligibility.

Supporting content clusters target related informational queries:

- “How to calculate mortgage payments” (educational content linking to calculator)

- “What is included in a mortgage payment” (definitional content)

- “Mortgage payment breakdown explained” (component explanation)

- “How much house can I afford on X salary” (income-based content)

- “15 vs 30 year mortgage” (comparison content featuring calculator)

The cluster model works because Google rewards topical depth. A site with a single calculator page struggles to outrank established authorities. A site with 15-20 pieces of supporting content on mortgage calculations, payments, and home buying finances demonstrates expertise that search algorithms recognize.

Geographic content variations target local intent:

- “Mortgage calculator California”

- “Home affordability in Texas”

- “Florida mortgage rates and payment calculator”

Geographic pages should include state-specific information: local property tax averages, insurance cost estimates, first-time buyer programs, and licensing information. Generic content with city names swapped triggers duplicate content penalties.

On-Page Optimization for Calculator Pages

Calculator pages require specific optimization approaches that differ from standard content pages.

Title tag formula for calculators:

[Primary Keyword] - [Benefit/Differentiator] | [Brand]Examples:

- “Mortgage Payment Calculator - See Your Monthly Costs in 60 Seconds | RateWatch”

- “Home Affordability Calculator - Personalized Estimate with Current Rates | LoanGuide”

- “Refinance Calculator - See If Refinancing Saves You Money | MortgageTools”

Meta descriptions should emphasize speed and personalization:

“Calculate your mortgage payment in under 60 seconds. Enter home price, down payment, and see your total monthly costs including taxes and insurance. Get personalized rate quotes from top lenders.”

Heading structure for calculator pages:

- H1: Primary keyword + benefit (e.g., “Mortgage Payment Calculator: See Your Monthly Costs”)

- H2: Calculator section (actual tool placement)

- H2: How to use this calculator

- H2: Understanding your results

- H2: What factors affect your mortgage payment

- H2: Next steps: Get your personalized rate

- H2: FAQ section

- H2: Related calculators

Content depth requirements. Calculator pages that rank typically include 1,500-3,000 words of supporting content alongside the tool. This content explains how to use the calculator, what inputs and outputs mean, factors that affect mortgage payments, and guidance on next steps. Thin pages with just the calculator struggle against content-rich competitors.

Technical SEO for Calculator Pages

Calculator functionality requires JavaScript, creating potential SEO challenges that need deliberate solutions.

Server-side rendering ensures search engines can access calculator content. Pure client-side JavaScript calculators may not be indexed properly. Pre-render the default calculator state server-side, with JavaScript enabling interactivity for users.

Structured data markup enhances search result appearance:

{

"@context": "https://schema.org",

"@type": "WebApplication",

"name": "Mortgage Payment Calculator",

"applicationCategory": "FinanceApplication",

"operatingSystem": "All",

"offers": {

"@type": "Offer",

"price": "0",

"priceCurrency": "USD"

}

}FAQ schema for question-answer content on calculator pages can generate rich results:

{

"@context": "https://schema.org",

"@type": "FAQPage",

"mainEntity": [{

"@type": "Question",

"name": "How is a mortgage payment calculated?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Monthly mortgage payments are calculated using the loan amount, interest rate, and loan term..."

}

}]

}Core Web Vitals attention. Calculator pages often struggle with Core Web Vitals due to JavaScript complexity. Priorities include optimizing Largest Contentful Paint by ensuring the calculator form renders quickly (lazy-load non-essential elements), minimizing Cumulative Layout Shift by reserving space for calculator components before JavaScript loads, and ensuring Interaction to Next Paint stays under 200ms by optimizing calculation logic.

Link Building for Calculator Authority

Calculators naturally earn links, but deliberate promotion accelerates authority building.

Linkable calculator features:

- Unique functionality competitors lack (e.g., incorporating state-specific first-time buyer programs)

- Data visualizations worth citing (infographics showing mortgage payment breakdowns)

- Embeddable widgets others can use on their sites (with attribution links)

Outreach strategies:

- Personal finance bloggers: “Use our calculator for your home buying guide content”

- Real estate agents: “Embed our calculator on your buyer resources page”

- Local news: “Here’s our data on mortgage affordability in [market]”

- Journalists covering housing: HARO/source requests related to mortgage costs

Link building investment benchmarks. Expect to invest $200-500 per quality link through outreach efforts. DIY link building requires 2-5 hours per link. Calculator pages with unique data or superior functionality earn links more easily than commodity tools.

Lead Capture and Conversion Optimization

Strategic Form Placement

Where you place lead capture relative to calculator results dramatically impacts conversion rates.

Pre-calculation capture (gated calculators) asks for contact information before showing results. This approach maximizes lead volume but sacrifices conversion quality. Users may provide fake information to access results, and those who abandon provide no value. Reserve this approach only for premium calculators with genuinely unique data.

Post-calculation capture shows full results, then offers personalized quotes as a logical next step. “You’re looking at an estimated payment of $2,847/month. Get actual rate quotes from lenders to see your real costs.” This approach converts 15-25% of calculator users.

Inline capture integrates lead forms within the calculator experience. “Enter your email to save your calculation and receive rate updates.” This lower-commitment ask captures contact information for nurture sequences, converting users who aren’t ready for immediate lender contact.

Multiple touchpoints maximize capture across user intent levels:

- Soft capture after calculation: “Email my results” (captures 8-12%)

- Primary CTA after results: “Get personalized quotes” (captures 15-25%)

- Exit intent: “See how much you could save with today’s rates” (captures 3-5%)

Form Design for Mortgage Calculator Leads

Form optimization applies differently to calculator contexts than standard landing pages.

Progressive disclosure works exceptionally well. Calculator users have already invested effort. Leverage that investment with multi-step forms that start simple and build.

Step 1: “Get your personalized rate” (button only) Step 2: Purpose (Purchase or Refinance) Step 3: Property location (zip code) Step 4: Credit score range (dropdown) Step 5: Contact information (name, phone, email)

Multi-step forms in mortgage contexts convert 86% better than single-step equivalents. The key is each step must feel like progress toward a valuable outcome. After completing a calculator, users expect some qualification process before getting lender quotes.

Pre-populate from calculator inputs. If the user already entered home price, down payment, and zip code in the calculator, carry those values into the lead form. Don’t ask the same questions twice.

Smart defaults reduce friction. Default property type to single-family residence (the majority). Default loan purpose based on page context (purchase calculator defaults to purchase). Default credit score to the “Good” range if not already captured.

Trust Elements That Increase Conversion

Calculator users need permission to proceed from calculation to lead submission. Trust elements provide that permission.

Rate transparency builds confidence. Show current average rates on the page. Users who see their calculation uses realistic rate assumptions trust the results and the subsequent lead capture process.

Lender transparency for marketplace models. If leads will be distributed to multiple lenders, disclose this clearly: “Your information will be shared with up to 5 lenders who will compete to offer you the best rate.” Transparent disclosure often increases conversion because it frames lead submission as accessing a competitive marketplace rather than surrendering information.

Privacy assurance specific to financial data. “Your information is protected with bank-level encryption. We never sell your data to third parties outside of our lending partner network.”

Social proof with specificity. “Join 500,000+ homeowners who have used our calculators” works better than “Trusted by many.” Numbers create credibility.

Security badges near form submission buttons provide final conversion support. Norton, McAfee, or BBB badges increase conversion 5-15% in financial services contexts.

Compliance Requirements for Mortgage Lead Capture

Mortgage lead generation operates under regulatory frameworks requiring specific disclosures and consent structures.

TCPA consent requirements apply to leads that will receive telephone contact. Consent language must clearly explain that the consumer agrees to receive calls and/or texts, potentially using automated technology, from mortgage lenders or their marketing partners. Pre-checked boxes do not constitute valid consent.

State licensing disclosures may be required depending on your business model. If you operate as a licensed mortgage broker, NMLS disclosures are mandatory. If you’re a pure lead generator selling to licensed originators, disclosure requirements are less stringent but buyer verification obligations exist.

RESPA considerations affect relationships with real estate partners. The Real Estate Settlement Procedures Act prohibits giving or receiving anything of value for referral of settlement service business. Lead generators working with real estate brokerages or other settlement service providers must structure relationships carefully to avoid RESPA violations.

TrustedForm or equivalent consent documentation provides litigation protection. When a lead is generated, TrustedForm records exactly what the consumer saw and clicked, creating independent third-party evidence of consent. This documentation is increasingly required by sophisticated lead buyers and provides essential protection against TCPA claims averaging $6.6 million in settlements.

Lead Monetization Strategies

Direct Lender Partnerships

Exclusive relationships with mortgage lenders offer premium pricing and streamlined operations.

Pricing for exclusive calculator leads:

| Lead Type | CPL Range | Quality Requirements |

|---|---|---|

| Purchase, exclusive | $75-175 | Phone validated, TrustedForm certified |

| Refinance, exclusive | $80-200 | Current rate 7%+, loan balance $100K+ |

| Home equity, exclusive | $50-120 | Equity estimate $50K+, credit 640+ |

Exclusive arrangements typically involve 60-90 day buyer testing periods before permanent pricing is established. Buyers need time to measure contact rates, application rates, and ultimate conversion to funded loans before committing to volume.

Building lender relationships:

- Start with data: Track contact rate, application rate, and (where possible) funded loan rate from your leads

- Lead with quality: Offer 7-14 day return windows with full refunds for non-contacts or unqualified leads

- Provide transparency: Share source-level data, consent documentation, and validation results

- Scale gradually: Start with 50-100 leads monthly before committing to larger volumes

Geographic routing becomes essential for exclusive arrangements. Different lenders serve different states based on their licensing. Your lead routing must validate buyer licensing against lead geography before distribution.

Marketplace Distribution

Selling leads to multiple buyers through marketplace platforms offers faster scale but lower per-lead prices.

Major mortgage marketplace platforms:

- LendingTree: 500+ lender partners, established infrastructure, competitive bidding

- Bankrate/Red Ventures: Premium positioning, higher buyer standards

- Zillow Custom Quotes: Rate table advertising with per-lead pricing ($75-150)

- Independent networks: boberdoo, LeadsPedia, Phonexa enable direct buyer relationships

Marketplace economics:

Shared distribution where the same lead goes to 3-5 buyers may generate $100-150 total revenue per lead (versus $75-175 for exclusive). The tradeoff is volume: marketplaces accept leads that might not meet exclusive buyer criteria.

Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, buyer-driven consent requirements have reshaped marketplace economics. Many sophisticated lenders require seller-specific consent regardless of federal minimums. Marketplace operators have adapted through comparison shopping frameworks where consumers actively select lenders rather than having their information automatically distributed.

Aged Lead Strategies

Leads that don’t immediately convert retain value for extended periods in mortgage.

Aged lead pricing:

| Age | Typical Value | Use Case |

|---|---|---|

| 0-7 days | Full price | Standard distribution |

| 8-30 days | 50-70% | Secondary buyer distribution |

| 31-90 days | $15-25 | Nurture + remarketing |

| 91-180 days | $5-12 | High-volume call center operations |

Nurture sequences for aged mortgage leads:

Mortgage decisions often take 30-90 days from initial inquiry. A consumer who calculated payments in January may be ready to apply in March. Effective nurture includes weekly rate update emails, educational content on the mortgage process, periodic SMS check-ins, and retargeting across display and social.

Research indicates approximately 80% of mortgage leads require nurturing before making a decision. Lead generators who abandon leads after initial non-conversion leave significant value on the table.

Revenue Optimization Framework

Maximizing calculator lead revenue requires optimization across multiple dimensions.

Conversion rate optimization:

A 2-percentage-point improvement in calculator-to-lead conversion (from 15% to 17%) on 100,000 monthly calculator users generates 2,000 additional leads. At $100 average lead value, that’s $200,000 monthly revenue improvement from conversion optimization alone.

Prioritize testing:

- Lead form placement and design

- CTA copy and button design

- Trust element selection and positioning

- Form length and field selection

- Mobile-specific optimizations

Pricing optimization:

Lead pricing should reflect actual buyer economics, not arbitrary markups. For a buyer with $5,000 average lifetime value per funded mortgage, 2% lead-to-funded conversion, and 3:1 target LTV:CAC ratio:

Maximum sustainable CPL = $5,000 x 0.02 / 3 = $33

This sets the ceiling. Your costs (traffic acquisition, technology, compliance, labor) set the floor. The spread between them is your margin.

Quality optimization:

Return rates directly impact net revenue. A 15% return rate on $100 leads costs $15 per lead in lost revenue. Source-level return tracking identifies quality issues before they compound.

Quality improvements that reduce returns from 15% to 8% often generate more margin improvement than equivalent percentage improvements in conversion rate or pricing.

Rate Environment Strategies

Operating in Elevated Rate Markets

With 30-year fixed mortgage rates ranging from 6.35% to 7.04% in late 2025, calculator strategy must adapt to rate realities.

Purchase calculator emphasis: Purchase decisions derive from life circumstances (job changes, family growth, relocations) that operate independently of rate conditions. Purchase calculators maintain steady traffic and conversion regardless of rate environment.

Refinance calculator targeting: Traditional refinance is limited when rates are elevated. However, borrowers who financed at 2022-2023 peak rates (7%+) now find savings opportunities. Target refinance calculator content toward this audience: “Calculate if refinancing your 7.5% mortgage makes sense at today’s rates.”

Home equity calculator opportunity: Homeowners with sub-4% first mortgages from 2020-2021 won’t refinance into 6%+ rates but will tap equity for major purchases or debt consolidation. LendingTree’s home equity revenue grew 38% year-over-year through Q2 2025, demonstrating sustained demand. Home equity calculators serve this growing segment.

Rate alert functionality: Allow calculator users to set target rates. “Alert me when rates drop to X%.” This captures leads who aren’t ready to apply now but will be ready when conditions change. These leads have extended value for nurture sequences.

Preparing for Rate Cycle Changes

Mortgage lead economics can shift rapidly with Federal Reserve policy. Calculator operations should maintain flexibility.

If rates drop to 5.5%:

- Refinance demand surges from 2020-2023 vintage mortgages

- Calculator traffic increases 30-50% on refinance tools

- Lead volume opportunity expands significantly

- Ensure infrastructure can handle traffic spikes

If rates rise to 7.5%:

- Refinance evaporates almost entirely

- Purchase contracts to life-event-driven minimum

- Home equity becomes primary viable product

- Shift content and advertising emphasis accordingly

Scenario planning for calculator content:

Maintain calculators for all three major products (purchase, refinance, home equity) regardless of current rate environment. When rates shift, you want established authority and traffic patterns rather than starting from scratch.

Update calculator rate defaults promptly when Fed decisions move markets. Stale rates destroy credibility with rate-conscious calculator users.

Analytics and Performance Measurement

Key Metrics for Calculator Lead Generation

Measuring calculator performance requires tracking both tool engagement and lead generation outcomes.

Calculator engagement metrics:

| Metric | Benchmark | Optimization Trigger |

|---|---|---|

| Calculator completion rate | 60-75% | Below 50% indicates UX issues |

| Time on calculator | 2-4 minutes | Under 1 minute suggests tool isn’t engaging |

| Calculations per session | 1.5-2.5 | Single calculations miss comparison value |

| Mobile completion rate | 55-70% | Below 50% indicates mobile UX problems |

Lead generation metrics:

| Metric | Benchmark | Optimization Trigger |

|---|---|---|

| Calculator-to-lead rate | 15-25% | Below 12% indicates capture problems |

| Lead-to-contact rate | 35-50% | Below 30% indicates quality issues |

| Contact-to-application rate | 15-25% | Below 12% suggests misaligned expectations |

| Return rate | 8-12% | Above 15% requires source investigation |

Revenue metrics:

| Metric | Calculation | Target |

|---|---|---|

| Revenue per calculator user | Total revenue / Calculator sessions | $3-8 depending on lead value |

| True CPL | All costs / Net leads delivered | Below 60% of sale price |

| LTV:CAC for buyers | Buyer lifetime value / Cost to acquire | 3:1 or higher |

Attribution for Calculator Traffic

Calculator lead generation involves multiple touchpoints, creating attribution complexity.

Multi-touch reality: A typical calculator lead journey might include organic search discovery of educational content, return visit directly to calculator, email signup for rate alerts, and finally lead form completion days or weeks later. Each touchpoint contributed.

Practical attribution approach:

For most calculator operations, first-touch attribution provides the clearest view of SEO investment returns. Credit the channel that introduced the user to your calculator, even if conversion happened on a later visit through direct navigation.

Track last-touch separately to understand which final interactions drive conversions. The gap between first and last touch reveals the role of nurturing and remarketing.

Attribution implementation:

- Tag all traffic sources with UTM parameters

- Store original source in CRM with lead record

- Track calculator engagement events (calculations, comparisons, saves)

- Connect engagement data to conversion events

- Report on both first-touch and last-touch attribution

Return Rate Tracking and Management

Returns destroy mortgage lead economics. Systematic tracking enables source-level optimization.

Return rate benchmarks by source:

| Traffic Source | Expected Return Rate | Action Threshold |

|---|---|---|

| Organic (brand) | 5-8% | Above 10% |

| Organic (non-brand) | 8-12% | Above 15% |

| Paid search | 10-15% | Above 18% |

| Display/programmatic | 12-18% | Above 22% |

| Social | 10-16% | Above 20% |

Return investigation process:

When return rates exceed thresholds:

- Review consent documentation for affected leads

- Check validation results (phone verification, email validation)

- Analyze buyer feedback on return reasons

- Compare traffic source characteristics

- Implement filtering or source pausing if quality issues persist

Weekly return monitoring: Track 7-day rolling return rates by source. A single bad day shouldn’t trigger action, but two consecutive weeks above threshold requires investigation.

Frequently Asked Questions

Q1: What conversion rate should I expect from a mortgage calculator?

Well-optimized mortgage calculators convert 15-25% of users who complete a calculation into leads. This compares favorably to standard landing page conversion rates of 3-8% in mortgage. The higher conversion reflects the value-first approach: users receive useful information before being asked for contact details.

Conversion rates vary by calculator type and user intent. Refinance calculators during favorable rate environments can reach 20-25%. Affordability calculators targeting early-stage buyers may run 12-18%. Payment calculators capturing mid-funnel traffic typically hit 15-20%.

If your calculator converts below 12%, investigate form placement, call-to-action messaging, and trust element presence. Below 8% usually indicates fundamental UX or form design problems requiring systematic redesign.

Q2: How much traffic do mortgage calculator pages need to rank?

Ranking for competitive calculator keywords requires sustained investment. Primary terms like “mortgage calculator” and “mortgage payment calculator” face competition from Bankrate, NerdWallet, Zillow, and major lenders. Expect 12-24 months of content development and link building before achieving page one positions.

Long-tail keywords offer faster paths. “FHA loan calculator,” “VA mortgage calculator,” and geographic variations like “Texas mortgage calculator” face less competition. Sites with established domain authority may achieve page one rankings within 6-12 months.

Content depth matters as much as links. Calculator pages that rank typically include 1,500-3,000 words of supporting content explaining how to use the tool, what results mean, and what factors affect mortgage payments. Thin pages with just calculators struggle against content-rich competitors.

Q3: Should I build a custom calculator or embed a third-party widget?

Custom-built calculators require development investment ($3,000-15,000) but provide complete control over user experience, lead capture, and data ownership. Third-party widgets offer faster deployment but limit customization and may restrict lead capture options or require revenue sharing.

For practitioners building sustainable lead generation assets, custom implementation provides better long-term ROI. The development investment amortizes across years of traffic, while third-party dependencies create ongoing costs and strategic limitations.

API-based approaches offer a middle ground: pull calculation logic from services while maintaining control of the interface and lead capture. This reduces development complexity while preserving ownership of the user relationship.

Q4: What compliance requirements apply to mortgage calculator leads?

Mortgage calculator leads face multiple compliance requirements. TCPA regulations require clear consent disclosure for telephone contact, with consumers taking affirmative action (checking an unchecked box) to indicate consent. Pre-checked boxes do not constitute valid consent.

RESPA (Real Estate Settlement Procedures Act) affects arrangements with real estate partners. Section 8 prohibits giving or receiving anything of value for referral of settlement service business. Lead generators working with real estate brokerages must structure relationships carefully to avoid prohibited referral fee characterization.

State licensing requirements through NMLS create geographic routing obligations. Leads for California borrowers cannot go to originators licensed only in Texas. Lead routing systems must validate buyer licensing against lead geography before distribution.

TrustedForm or equivalent consent documentation provides litigation protection and is increasingly required by sophisticated lead buyers. TCPA settlements average $6.6 million; consent documentation is essential protection.

Q5: How do I monetize mortgage calculator leads in a high-rate environment?

Elevated rate environments (6%+ 30-year fixed rates as of late 2025) require strategic product emphasis. Purchase calculators maintain steady demand because home purchases derive from life circumstances rather than rate arbitrage. Home equity calculators capture consumers who won’t refinance low-rate first mortgages but will tap equity for major purchases.

Refinance calculators should target recent-vintage borrowers who financed at 2022-2023 peak rates (7%+). These consumers now find savings opportunities as rates moderate from peaks.

Pricing expectations in high-rate environments:

- Purchase leads (exclusive): $75-150

- Home equity leads: $50-100

- Refinance leads (qualified): $80-175

Rate alert functionality captures leads who aren’t ready now but will act when conditions change. These leads have extended nurture value.

Q6: What distinguishes high-quality calculator leads from low-quality leads?

High-quality mortgage calculator leads share several characteristics: accurate contact information (phone and email validated), clear purchase intent or refinance opportunity, property location in an active buyer’s licensed territory, credit profile meeting basic qualification thresholds, and proper consent documentation.

Low-quality leads often exhibit: disconnected or wrong phone numbers, incomplete or fake contact information, unrealistic property parameters, intent misalignment (just researching, not ready to apply), or missing consent documentation.

Source-level quality tracking reveals patterns. Return rates by traffic source should drive optimization decisions. A source showing 25% returns at $50 CPL actually costs more than a source with 8% returns at $75 CPL when you account for refund processing and lost revenue.

Q7: How do consent requirements affect calculator lead distribution?

The FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, meaning multi-seller consent remains legally permissible under federal law. However, many sophisticated lender buyers now require seller-specific consent regardless of federal minimums.

Operators have adapted through comparison shopping frameworks where consumers actively select which lenders should contact them, rather than automatic distribution to multiple buyers. Exclusive lead arrangements have gained preference because they satisfy buyer consent requirements.

Building consent infrastructure that exceeds federal minimums provides competitive advantage. Structure consent capture to identify specific companies or provide genuine comparison shopping where consumers make selections. This positions your operation favorably as quality buyers increasingly require seller-specific consent sources.

Q8: What return rate should trigger source termination?

Establish tiered thresholds based on return severity and persistence:

- Yellow alert (12-15% returns for one week): Increase monitoring, review quality filters, communicate with source

- Red alert (15-20% returns for two weeks): Reduce volume, implement additional filtering, direct source review

- Termination (20%+ returns sustained over two+ weeks): Pause source immediately, investigate root causes before resuming

Track returns on 7-day and 30-day rolling windows. Single-day spikes shouldn’t trigger termination, but sustained poor quality requires action. Also investigate sudden improvement, which may indicate source manipulation rather than genuine quality improvement.

Q9: How long does it take to build profitable calculator traffic?

Expect 6-12 months before organic calculator traffic contributes meaningful lead volume. Initial rankings may appear in 3-4 months for long-tail keywords, but traffic volume needed for consistent leads takes longer to build.

The timeline depends on several factors: existing domain authority (established sites rank faster), content investment depth (comprehensive calculator pages with supporting content rank higher), link building intensity (quality backlinks accelerate authority), and competitive targeting (long-tail keywords yield faster results than head terms).

Budget SEO as a 12-24 month program, not a 3-month test. Practitioners who abandon at month 6 often quit right before compounding begins. Meanwhile, run paid traffic for immediate lead generation while building organic assets.

Q10: What technology stack supports mortgage calculator lead generation?

A complete mortgage calculator lead generation stack includes:

Calculator infrastructure: Custom development or API-based calculation engine, mobile-responsive interface, real-time rate feeds for default values

Lead capture and management: CRM integration (Salesforce, HubSpot, or specialized lead platforms), TrustedForm for consent documentation, phone and email validation services, lead routing rules engine

Distribution platform: boberdoo, LeadsPedia, or Phonexa for buyer connectivity, ping/post capabilities for marketplace distribution, geographic and qualification-based routing

Analytics: Google Analytics 4 for traffic analysis, conversion tracking across touchpoints, return rate monitoring by source, revenue attribution

Content and SEO: Content management system supporting technical SEO requirements, structured data implementation, performance optimization tools

Platform costs typically run $500-2,000 monthly at moderate scale (1,000-5,000 leads monthly), plus per-lead fees of $0.25-0.75 for validation and consent documentation.

Key Takeaways

-

Mortgage calculators convert at 15-25%, compared to 3-8% for standard landing pages. The value-first approach (useful calculation before lead capture) creates psychological investment that dramatically improves conversion rates.

-

Calculator SEO compounds over time. Organic traffic from ranking calculators costs nothing at the margin. A page ranking for “mortgage payment calculator” generates thousands of monthly leads without ongoing ad spend. Budget for 12-24 months of content and link building investment.

-

Multi-step lead capture outperforms single-step forms by 86%. Calculator users have already invested effort. Leverage that investment with progressive forms that feel like a natural continuation rather than an interruption.

-

Rate environment determines product emphasis. In elevated rate markets (6%+ as of late 2025), purchase and home equity calculators outperform refinance. Target refinance content toward borrowers who financed at 2022-2023 peak rates.

-

Compliance infrastructure is non-negotiable. TCPA, RESPA, and state licensing requirements create specific obligations. TrustedForm documentation, proper consent disclosure, and buyer license verification protect against $6.6 million average TCPA settlements.

-

Return rates destroy margins faster than any other factor. A swing from 8% to 15% returns transforms profitable operations into loss-makers. Track returns by source weekly, investigate anomalies immediately, and terminate persistently poor performers.

-

Speed-to-contact matters as much as lead generation. Leads contacted within five minutes convert at 21x higher rates than those contacted after 30 minutes. Calculator leads should route to buyers with sub-five-minute response capabilities.

-

Home equity represents the 2025 opportunity. With homeowners locked into sub-4% first mortgages unwilling to refinance, home equity products capture consumers who need cash without disturbing primary loan terms. LendingTree home equity revenue grew 38% year-over-year through Q2 2025.

-

Custom calculator development provides better long-term ROI than embedded widgets. The $3,000-15,000 development investment amortizes across years of traffic generation, while third-party dependencies create ongoing costs and strategic limitations.

-

Conversion rate optimization generates the highest ROI. A 2-percentage-point improvement in calculator-to-lead conversion on 100,000 monthly users generates 2,000 additional leads monthly. At $100 per lead, that is $200,000 monthly improvement from optimization alone.

Statistics current as of December 2025. Rate environments, lead pricing, and market conditions change continuously. Regulatory information reflects current status but should be verified with compliance counsel before implementation. This article provides general information and does not constitute legal or financial advice.