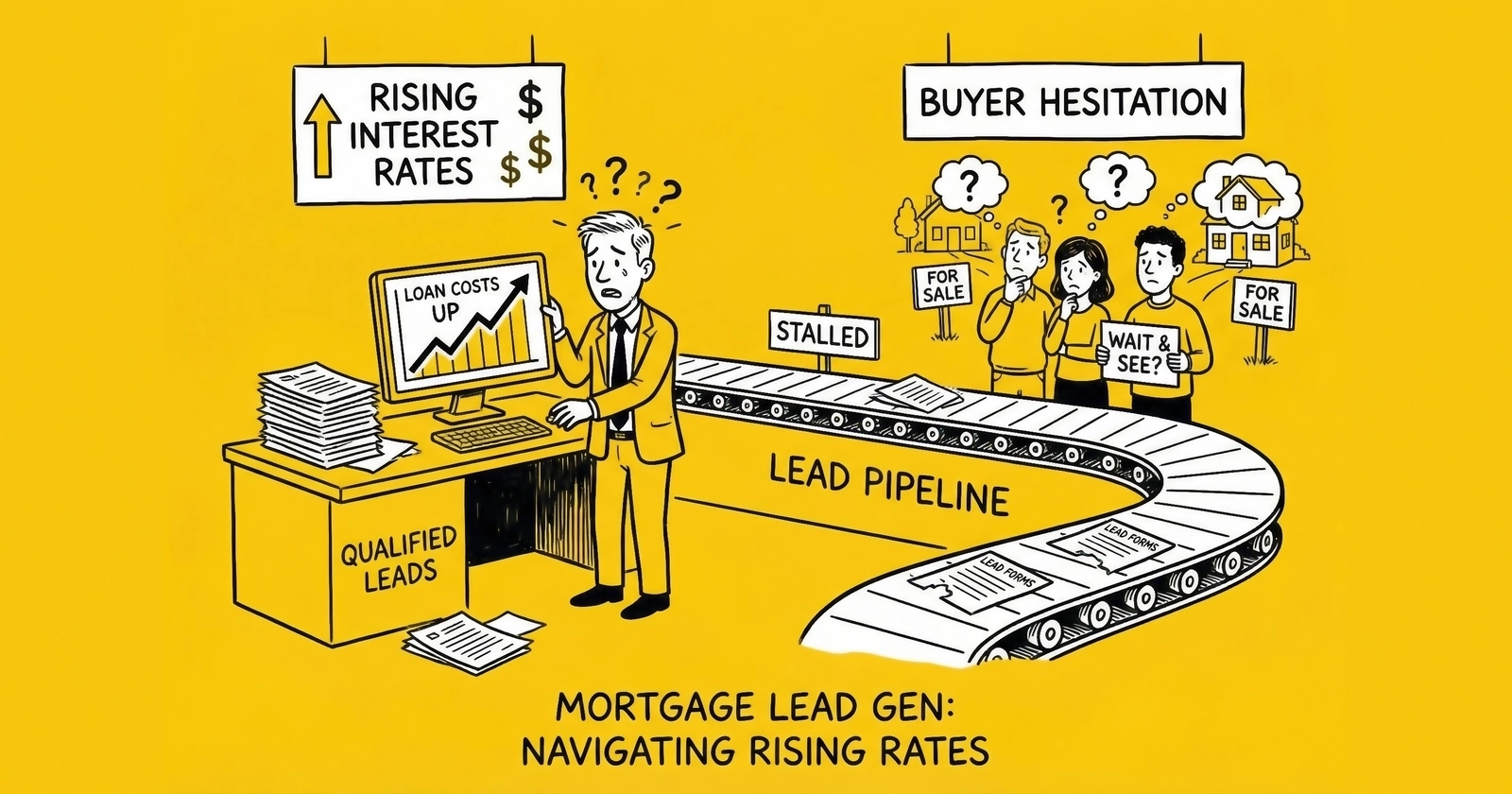

When rates climb, the playbook changes. Those who thrive in 6%+ environments build fundamentally different businesses than those who flourished when money was cheap. Here is how to generate, price, and convert mortgage leads when rising interest rates reshape every assumption.

Introduction: The New Normal Is Not Temporary

The mortgage lead generation landscape transformed between 2022 and 2025 in ways that caught most practitioners off guard. When 30-year fixed rates hovered near 3% in 2021, the industry processed $4.51 trillion in mortgages, the highest annual volume ever recorded. By 2023, with rates cresting above 7%, that figure collapsed to $1.50 trillion. Same lenders, same forms, same buildings. Two-thirds of the volume vanished because a single number changed.

As we navigate late 2025, rates have moderated but remain elevated. The 30-year fixed mortgage rate sits in the 6.2-6.8% range, down from 2023-2024 peaks but far above the historically low levels that created refinance gold rushes. Federal Reserve projections suggest rates will likely remain above 6% through at least 2026. The operators waiting for conditions to return to “normal” are waiting for a future that may not arrive for years.

This guide provides the complete framework for mortgage lead generation in rising rate environments. You will learn how to pivot from refinance to purchase strategies, restructure your messaging for rate-sensitive consumers, manage costs when volume compresses, and build infrastructure that positions you for opportunity regardless of which direction rates move next.

The mortgage lead market represents approximately $5.6 billion in annual transaction value, making it one of the largest consumer lead verticals. But the structure of this market differs fundamentally from insurance or solar. Rate sensitivity is not just a variable; it is the defining characteristic. Operations that do not account for rate cycle volatility find themselves either overextended when conditions tighten or undercapitalized when opportunity emerges.

Understanding Rate Environment Impact on Lead Economics

How Rate Movements Reshape the Market

Rising interest rates affect mortgage lead generation through three primary mechanisms, each requiring distinct strategic responses.

Refinance demand collapses immediately. The mathematics are straightforward. A homeowner with a 3% mortgage will not refinance into a 6.5% rate regardless of how compelling your marketing is. The approximately 14 million homeowners who locked in sub-4% rates during 2020-2021 represent a permanently unavailable market segment until rates drop substantially below their existing loans. Industry estimates suggest rates would need to fall to approximately 5% before this pool shows meaningful refinance activity.

Purchase demand compresses but persists. Life circumstances, job changes, family growth, and relocations force purchase decisions regardless of financing costs. The question becomes affordability, not willingness. When rates rise from 3% to 6.5%, the monthly payment on a $400,000 mortgage increases from $1,686 to $2,528, adding $842 per month. Some buyers adjust by purchasing less expensive homes. Others delay. But purchase demand never disappears entirely because people still need housing.

Home equity products gain relative appeal. Homeowners with locked-in low first-mortgage rates who need cash increasingly turn to HELOCs and second mortgages rather than refinancing their entire loan. Even at 8-10% HELOC rates, preserving a 3% first mortgage makes mathematical sense for specific borrowing needs.

Current Lead Pricing Dynamics

Lead costs in rising rate environments reflect market conditions and product type shifts. The following ranges represent 2024-2025 market realities.

| Lead Type | CPL Range | Key Driver |

|---|---|---|

| Exclusive Purchase | $50-$200+ | Geographic premium (CA, NY metros at high end) |

| Shared Purchase | $20-$60 | Competition density and credit tier |

| Exclusive Refinance | $75-$200 | Scarcity of qualified candidates |

| Home Equity | $30-$100 | Growing demand segment |

| Aged Leads (30-180 days) | $12-$25 | Requires nurture infrastructure |

Geographic variation compounds these ranges significantly. California coastal markets command premiums that would be economically nonsensical in Midwest markets. A $150 purchase lead in San Francisco might represent reasonable economics given loan sizes and closing rates. The same price for a $180,000 home in rural Ohio makes no mathematical sense regardless of lead quality.

Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, industry practice has reshaped lead distribution economics. Many sophisticated buyers now require one-to-one consent regardless of regulatory minimums. Exclusive leads command premiums because they have become the practical default for compliance-conscious buyers.

Conversion Rate Realities

Understanding conversion rates at each stage helps calibrate expectations and identify optimization opportunities. These benchmarks assume operational excellence and reflect 2024-2025 market conditions.

| Stage | Benchmark Range |

|---|---|

| Contact Rate | 20-40% |

| Application Rate (from contacts) | 15-30% |

| Pull-Through (application to funded) | 65-75% |

| Overall Conversion (lead to funded) | 2-4% |

These numbers vary significantly based on lead quality, response speed, and operational execution. Speed-to-contact matters more in mortgage than almost any other vertical. Research consistently shows leads contacted within one minute convert at 391% higher rates. Leads reached within five minutes show 100x better outcomes than those contacted after 30 minutes.

The mathematics are unforgiving. If your contact rate drops from 35% to 25% because of slow response, you have lost nearly 30% of your conversion opportunity before the sales conversation even begins.

The Purchase Pivot: Restructuring for the Dominant Opportunity

When refinance volume collapses, purchase leads become the primary opportunity. This requires more than simply shifting traffic allocation. It requires rebuilding your entire operation around different consumer psychology, longer sales cycles, and distinct qualification criteria.

Why Purchase Leads Require Different Operations

Purchase leads connect buyers actively seeking homes with originators who can provide financing. The decision to buy involves life circumstances that operate independently of rate conditions. A family expecting their third child needs a larger home regardless of whether rates are 4% or 7%. An employee relocating for a new job must purchase in the destination market regardless of financing costs.

This independence from rate sensitivity creates stability that refinance leads lack. But it also creates complexity.

Longer consideration cycles demand sustained engagement. Purchase decisions involve property searches that may take months. A consumer who submits a mortgage inquiry in March might not close until September. Lead generators and buyers who abandon leads after initial non-conversion leave significant value on the table. Approximately 80% of mortgage leads require nurturing before making a decision.

Geographic specificity constrains distribution. Borrowers search for homes in specific locations. A purchase lead for a buyer seeking a home in Miami holds no value for an originator licensed only in Colorado. Your routing infrastructure must validate buyer licensing against lead geography before distribution, rejecting or re-routing leads that would flow to improperly licensed recipients.

Multiple decision factors reduce rate sensitivity. While rate matters, purchase borrowers also evaluate pre-approval speed, loan product expertise, closing reliability, and originator responsiveness. A purchase lead contacted quickly by a knowledgeable loan officer converts even when that originator quotes rates 0.125% higher than a competitor who responds slowly.

Purchase Lead Acquisition Strategies That Work

The most effective purchase lead sources align with homebuyer journey touchpoints where intent is highest.

Real estate platform integration captures consumers at the property search stage. Platforms like Zillow, Redfin, and Realtor.com see millions of monthly visitors actively browsing homes. Zillow’s Custom Quotes program offers rate table advertising and lead generation with per-lead costs typically ranging from $75-$150 depending on loan type and metro area. The intent quality justifies the premium.

First-time buyer content marketing attracts consumers making their first purchase. This segment is often less rate-sensitive than repeat buyers because they lack comparison benchmarks and face a simpler decision: buy now or continue renting. Educational content addressing down payment requirements, credit score impacts, and mortgage basics captures high-intent traffic at reasonable acquisition costs.

Rate comparison positioning reaches consumers actively shopping. Platforms like Bankrate and NerdWallet command premium positioning through comprehensive mortgage content, generating millions of monthly mortgage page views. These consumers arrive with clear intent and often convert at higher rates than general real estate platform traffic.

Relocation and life event targeting identifies near-term purchase intent regardless of rate environment. Job change signals, corporate relocation announcements, and life event indicators like engagement announcements and pregnancy reveal purchase intent that proceeds regardless of rate conditions.

Adjusting Messaging for Rate-Sensitive Purchase Buyers

Even purchase-motivated consumers feel rate sensitivity. Your messaging must acknowledge this reality while redirecting focus to solvable problems.

Lead with payment, not rate. Consumers understand monthly payments intuitively. They struggle to convert rate percentages into real-world impact. Instead of “competitive rates starting at 6.25%,” use “your home payment could be $2,100/month.” The payment number grounds the conversation in tangible reality.

Emphasize affordability solutions. Rising rates reduce purchasing power. A buyer who qualified for $450,000 at 3% might qualify for only $325,000 at 6.5%. Messaging that highlights solutions, such as adjustable-rate mortgages for buyers planning to move within 5-7 years, down payment assistance programs, temporary buydowns, or smaller homes as stepping stones, addresses the actual pain point.

Acknowledge rate reality without dwelling on it. Pretending rates are not elevated insults consumer intelligence. Acknowledging the environment while positioning your offering as the best available option builds credibility. “Yes, rates are higher than they were in 2021. Here’s how to get the best available rate for your situation” outperforms both ignoring rates and apologizing for them.

Focus on the alternative cost. Every month a potential buyer waits hoping for lower rates, they pay rent. If rent is $2,200/month and a mortgage payment would be $2,400/month, the buyer is paying $200/month extra for the privilege of waiting, plus losing potential appreciation and building no equity. This reframe helps rate-hesitant buyers see the complete picture.

Home Equity: The Rising Rate Outperformer

Home equity leads emerged as the standout performer in elevated rate environments. Understanding why helps you capture this opportunity effectively.

The Economics Driving HELOC Demand

The logic is straightforward. A homeowner with a 3% first mortgage who needs $50,000 for home improvements faces a choice.

Option A: Cash-out refinance of $350,000 total at 6.5%. Monthly payment increases from $1,476 to $2,212. Interest cost on the $50,000 over 30 years: $44,760.

Option B: HELOC of $50,000 at 8.5% with 10-year term. Additional monthly payment: $619. Total interest cost: $24,280. First mortgage stays at $1,476.

Option B costs approximately $25,000 less over the life of the loans and preserves the 3% first mortgage. The mathematics strongly favor home equity products for homeowners who locked in low first-mortgage rates and need cash.

LendingTree’s home equity revenue reached $30.3 million in Q2 2025, growing 38% year-over-year – a trend reflected in current CPL benchmarks. This growth occurred while mortgage revenue declined, demonstrating the opportunity for operators who pivot toward this product.

Home Equity Lead Characteristics

Purpose-driven inquiries dominate. Unlike refinance leads where rate arbitrage is the sole motivation, home equity prospects have specific uses for funds. Home improvement, debt consolidation, major purchases, and education expenses drive demand. Understanding purpose helps with routing and conversion because different buyers specialize in different use cases.

Equity requirements create natural qualification. Leads need sufficient equity to qualify, typically at least 20% equity and often more. Properties purchased before 2020 often have substantial equity due to appreciation. Recent purchases may not qualify. Form questions about purchase date and approximate home value help filter.

Different buyer profiles expand distribution options. Credit unions and community banks are active home equity buyers alongside traditional mortgage lenders. This buyer diversity provides more distribution options than traditional mortgage products where large lenders dominate.

Rate sensitivity differs from first mortgages. Borrowers accept higher HELOC rates because they are borrowing incremental funds, not replacing low-rate first mortgages. A homeowner who would never refinance from 3% to 6.5% might gladly take an 8.5% HELOC for specific needs.

Capturing Home Equity Leads Effectively

Target the right homeowners. Properties purchased between 2015 and 2019 represent the sweet spot: enough time to build equity through appreciation, plus financing during the low-rate era that makes refinancing unappealing. First-party data sources and property databases help identify this cohort.

Lead with use case, not product. “Financing your kitchen remodel” or “consolidating high-interest debt” resonate more than “get a HELOC.” Consumers think in terms of goals, not products. Your landing pages and ad creative should reflect this.

Qualify for purpose and timeline. A homeowner researching deck construction for next summer has different urgency than one facing roof repair after a storm. Timeline qualification helps prioritize leads and set buyer expectations.

Verify equity position where possible. Self-reported home values are notoriously unreliable. Automated valuation model (AVM) integration or requiring an estimated equity range helps filter leads that will not qualify.

Cost Management When Volume Compresses

Rising rate environments compress lead volume. The refinance market that might generate 10,000 leads monthly at peak conditions might produce only 2,000 leads in elevated rate periods. Managing costs during this compression determines survival.

Fixed Cost Discipline

Those who sized their businesses for 2021 refinance volumes face painful restructuring in elevated rate environments. Operations sized for current conditions preserve optionality.

Platform costs must scale with volume. Monthly platform fees of $500-$1,000 that seemed trivial at 10,000 leads/month become significant overhead at 2,000 leads/month. Evaluate whether your platform costs include per-lead components that scale down with volume or fixed monthly fees that persist regardless of activity.

Personnel costs require realistic assessment. A media buying team of three managing $500,000 monthly ad spend makes sense. The same team managing $100,000 monthly cannot justify their overhead. Difficult decisions about staffing levels must reflect current volume realities, not hoped-for recoveries.

Traffic acquisition efficiency matters more in compressed markets. When volume is abundant, slightly inefficient traffic acquisition is tolerable. When volume is scarce, every percentage point of conversion rate improvement and every dollar of CPL reduction directly affects margin. The discipline that seemed optional in boom times becomes survival requirement in contractions.

Variable Cost Optimization

Negotiate buyer return policies during volume downturns. When leads are scarce, buyers may accept longer return windows or reduced return rights to secure volume. These negotiations that seemed impossible during boom times become feasible when buyer alternatives are limited.

Reduce verification layers selectively. Every verification step costs money. In abundant markets, comprehensive verification stacks improve quality and justify premium pricing. In compressed markets, evaluate which verification steps drive sufficient return reduction to justify their cost. A $2 phone validation that reduces returns 5% pays for itself at $50 CPL. At $150 CPL, it pays for itself many times over.

Shift traffic acquisition toward lower-CPL channels. Paid search that delivers $50 CPL during boom times might deliver $80 CPL during contractions as competition intensifies for limited volume. SEO-driven organic traffic, content marketing, and email list cultivation deliver leads at lower marginal cost, even if they require longer development timelines.

Cash Flow Management in Volatile Environments

The 60-day float rule, where lead businesses typically pay suppliers within 15-30 days but collect from buyers in 45-60 days, creates working capital requirements that become more challenging when volume volatility increases.

Maintain 6-12 months operating expense reserves. Rate cycle transitions can be sudden and prolonged. Operations that reinvest all profits during good times find themselves undercapitalized precisely when preservation matters most.

Tighten buyer payment terms during uncertainty. Net-45 terms that seemed acceptable from stable buyers become concerning when volume declines suggest financial stress. Consider requiring shorter payment windows, deposits, or payment upon delivery for newer or at-risk buyers.

Diversify buyer relationships to reduce concentration risk. A lead generator selling exclusively to three large originators faces catastrophic revenue loss if one exits the market or dramatically cuts lead spend. Aim for no single buyer representing more than 25% of revenue.

Building for Rate Cycle Transitions

Those who thrive long-term in mortgage lead generation build for rate cycle transitions rather than optimizing solely for current conditions. The rate environment will change. The question is whether your operation will be positioned to capture opportunity when it does.

Structural Preparation Across Products

Maintain capabilities across purchase, refinance, and home equity even when current conditions favor one segment. When rates eventually decline, refinance demand will surge. Practitioners who maintained refinance infrastructure (landing pages, buyer relationships, traffic sources) can pivot in weeks. Those who abandoned refinance entirely face months of reconstruction while competitors capture opportunity.

Geographic diversification protects against regional weakness. California’s housing market responds differently to rate changes than Florida’s or Texas’s. Hot markets maintain activity even in challenging rate environments while oversupplied markets see dramatic pullbacks. Portfolio diversification across geographies reduces volatility.

Lender diversification reduces concentration risk. Different buyer types respond differently to rate environments. Large national lenders might cut lead spend dramatically during contractions while regional credit unions maintain stable volume. A diversified buyer portfolio smooths revenue across conditions.

Scenario Planning for Rate Movements

Build operational playbooks for different rate environments.

If rates drop to 5.5%: Refinance demand surges from recent-vintage borrowers who financed at 2022-2024 peak rates. Purchase affordability improves. Lead volume opportunity expands significantly. You need infrastructure that can scale traffic acquisition rapidly: available ad budget capacity, landing pages ready to deploy, buyer relationships with headroom, and staff capacity to manage increased volume.

If rates rise to 7.5%: Refinance evaporates almost entirely. Purchase contracts to life-event-driven minimum. Home equity becomes the primary viable product. You need cost structures that can accommodate volume reduction without destroying margin. Know your break-even volume and have plans for what to cut if volume drops below that threshold.

If rates plateau at 6.0-6.5%: Current conditions extend. Modest refinance opportunity remains from peak-rate borrowers. Steady purchase demand persists at constrained levels. This is sustainable if operations are sized appropriately. Those who stopped waiting for conditions to return to “normal” and recognized that elevated rates may persist for years are positioned to thrive.

Infrastructure That Positions for Opportunity

Build refinance trigger systems. When rates decline, the first operators to recognize the shift and activate refinance campaigns capture disproportionate market share. Automated monitoring that tracks rate movements and triggers campaign activation gives you first-mover advantage. A system that sends you an alert when the 30-year fixed drops 25 basis points below recent averages lets you activate refinance campaigns before competitors react.

Maintain dormant buyer relationships. Buyers who paused lead purchasing during contractions often restart when conditions improve. Keeping relationships warm through quarterly check-ins, market updates, and maintaining technical integration means you can reactivate them in days rather than months when conditions change.

Preserve tested traffic sources. Ad accounts with conversion history, SEO positions that took years to build, and email lists that require ongoing engagement all require maintenance even during low-volume periods. The cost of maintenance is typically far lower than the cost of rebuilding from scratch.

Messaging Pivots for Rising Rate Environments

Consumer psychology shifts when rates rise. The messaging that worked when rates were falling fails when rates are climbing. Understanding these psychological shifts helps you craft messaging that converts.

From Rate Focus to Value Focus

When rates were falling, messaging focused on the opportunity to lock in low rates before they rose. “Rates are at historic lows” and “lock in before rates rise” drove urgency and action.

Rising rate environments invert this psychology. Consumers feel they have missed the opportunity. Messaging that reminds them rates were once lower creates regret rather than action. The pivot must move away from rate focus entirely.

Emphasize equity and ownership benefits. Every mortgage payment builds equity. Every rent payment builds the landlord’s equity. Over 10 years, a homeowner making $2,500/month payments might build $150,000+ in equity through principal paydown and appreciation. A renter making the same $2,500/month payment builds nothing. This comparison works regardless of rate environment.

Focus on lifestyle and stability. Homeownership provides stability that renting cannot match. No landlord can force sale of a home you own. No lease non-renewal can force relocation. These benefits have value independent of financing costs.

Address rate trajectory concerns directly. “Marry the house, date the rate” has become industry shorthand for the idea that you can always refinance later if rates decline, but you cannot always buy the home you want. Messaging that acknowledges current rates while positioning refinance as future optionality addresses consumer concerns head-on.

Urgency Without Rate Panic

Creating urgency in rising rate environments requires different approaches than during falling rate periods.

Home price appreciation urgency. Even in higher rate environments, home prices in many markets continue rising. Every month of waiting means higher purchase prices, even if rates stabilize. “Waiting for rates to drop while prices rise might cost you more than today’s rates.”

Life event urgency. The family outgrowing their home, the couple expecting their first child, the employee relocating for a new job all face timeline pressure independent of rates. Messaging that connects to these real deadlines creates genuine urgency.

Inventory and competition urgency. Desirable homes in desirable neighborhoods attract multiple offers regardless of rate environment. “Your dream home won’t wait for lower rates” connects to the reality that individual properties have limited availability.

Educational Content That Builds Trust

Rising rate environments create consumer confusion that educational content can address.

Rate buydown explanations. Temporary or permanent rate buydowns let buyers pay upfront to reduce their rate. A seller-funded 2-1 buydown that provides 2% lower rates in year one and 1% lower in year two makes homes more affordable initially, with payments stepping up as borrower income presumably grows. Explaining these options positions you as a helpful advisor rather than a salesperson.

Adjustable-rate mortgage education. ARMs with 5, 7, or 10-year fixed periods offer lower initial rates than 30-year fixed products. For buyers who plan to sell or refinance within the fixed period, ARMs provide real savings. Educational content that explains when ARMs make sense captures an audience that fixed-rate-only messaging misses.

Total cost of homeownership analysis. Rent versus buy calculations that account for tax benefits, equity building, and potential appreciation help consumers understand true costs beyond monthly payments. Providing calculators or worksheets that help consumers work through this analysis builds trust and captures leads from consumers doing research.

Speed-to-Contact: Even More Critical in Rising Rate Environments

Response speed matters in every lead vertical. It matters even more in mortgage during rising rate environments because consumer confidence is lower and comparison shopping is higher.

Why Speed Matters More When Rates Rise

When rates were at historic lows, consumers felt confident in their decision to pursue a mortgage. Low rates made the decision obviously attractive. Quick response mattered, but even slow responders could convert leads because consumer motivation was high.

In elevated rate environments, consumers are less certain about their decisions. They are more likely to compare multiple lenders, more likely to procrastinate, and more likely to abandon the process entirely. The first responder has disproportionate influence in shaping this uncertain consumer’s journey.

Data supports this asymmetry:

- Leads contacted within one minute have 391% higher conversion rates

- 78% of customers purchase from the first company that responds

- Leads contacted within five minutes show 100x better outcomes than those contacted after 30 minutes

- If response time drops from one minute to ten minutes, qualification odds decline by 80%

Technology Requirements for Speed

Meeting one-minute response standards requires technology infrastructure that eliminates human latency.

Real-time lead delivery routes new submissions immediately to available sales team members through SMS alerts, phone system integration, or CRM push notifications. Batched hourly delivery that was tolerable in boom times is unacceptable when every lead matters more.

Auto-dialer integration initiates outbound calls within seconds of lead receipt. Manual dialing adds 30-60 seconds of latency that compounds across volume. Modern dialers can begin calling before a human agent even sees the lead notification.

Automated response sequences provide immediate engagement even when human agents are not instantly available. Text messages confirming receipt, emails with relevant rate information, and chatbot interactions maintain connection while human agents prepare.

Round-robin routing distributes leads fairly while ensuring someone always receives the lead immediately, with backup rules escalating leads when primary recipients do not respond within 2-3 minutes.

Mobile alerts keep originators connected during non-desk hours. A lead submitted at 6:30 PM should not wait until 9 AM the next morning. Extended coverage hours capture consumers who research mortgages after work hours.

Frequently Asked Questions

How do rising interest rates affect mortgage lead pricing?

Rising rates create a bifurcated pricing environment. Refinance leads become scarcer and therefore more expensive, with qualified exclusive leads ranging from $75-$200 when available. The pool of in-the-money borrowers shrinks as rates rise, reducing supply while lenders still want refinance volume. Purchase leads maintain relatively stable pricing ($50-$200 for exclusive leads) because purchase demand derives from life circumstances rather than rate arbitrage. Home equity leads ($30-$100) have emerged as a growing segment because homeowners with low-rate first mortgages prefer second liens to refinancing their primary loan.

What conversion rate should I expect for mortgage leads in a high-rate environment?

Expect overall lead-to-funded conversion rates of 2-4% with operational excellence. This breaks down into 20-40% contact rate, 15-30% application rate from contacts, and 65-75% pull-through from application to funded loan. Conversion rates are generally lower in rising rate environments than falling rate environments because consumer confidence is reduced and comparison shopping increases. Speed-to-contact has even greater impact on conversion in these conditions. Leads contacted within five minutes convert at dramatically higher rates than those contacted after 30 minutes.

Should I focus on purchase or refinance leads when rates are rising?

Focus primarily on purchase leads, which maintain stable demand driven by life circumstances, while maintaining minimal refinance capability for future rate declines. Refinance leads have extremely limited supply in rising rate environments because the vast majority of existing borrowers have rates lower than current market rates. The approximately 14 million homeowners who locked in sub-4% rates during 2020-2021 will not refinance until rates fall substantially. Home equity leads offer a third option that performs well in elevated rate environments and should not be overlooked.

How do I adjust my messaging when rates are high?

Shift from rate-focused messaging to value-focused messaging. Lead with monthly payment amounts rather than rate percentages. Emphasize equity building and wealth creation benefits of homeownership versus renting. Address rate concerns directly with concepts like “marry the house, date the rate,” which acknowledges current rates while positioning future refinance as optionality. Create urgency through home price appreciation, life event timelines, and inventory competition rather than rate-based urgency. Educational content that explains buydowns, ARMs, and total cost of homeownership builds trust with uncertain consumers.

What lead quality issues are specific to rising rate environments?

Rising rate environments attract more tire-kickers and fewer ready buyers. Consumers submit inquiries to understand their options without genuine purchase intent. This increases lead volume relative to qualified opportunity. Additionally, affordability constraints mean more leads fail credit or income qualification that would have passed in lower-rate environments when the same income qualified borrowers for larger loans. Verification becomes more important because margin compression means you cannot absorb as many returns. Phone verification, income self-attestation, and credit qualification questions help filter leads that will not convert.

How do I maintain buyer relationships when lead volume drops?

Proactive communication builds trust even when volume is reduced. Provide regular market updates, share insights about rate trends and consumer behavior, and maintain technical integration even during low-volume periods. Flexibility on pricing during difficult periods, while protecting your floor margin, can preserve relationships that become valuable when conditions improve. Diversify your buyer base so no single relationship becomes critical. Quarterly business reviews that include performance data, market trends, and joint planning maintain engagement when transaction volume is lower.

What role do home equity leads play in a rising rate strategy?

Home equity leads have emerged as the standout performer in elevated rate environments. Homeowners with locked-in low first-mortgage rates who need cash increasingly turn to HELOCs and second mortgages rather than refinancing their primary loan. Even at 8-10% HELOC rates, preserving a 3% first mortgage makes mathematical sense. This creates a growing segment with different economics: lower individual loan sizes but consistent demand. Home equity leads typically range $30-$100 and attract a broader buyer base including credit unions and community banks alongside traditional mortgage lenders.

How should I prepare for potential rate decreases?

Build trigger systems that activate when rates decline. Maintain dormant refinance landing pages, buyer relationships, and traffic source accounts so you can pivot quickly. When rates eventually decline significantly, refinance demand will surge. Those who maintained infrastructure capture opportunity in weeks while those who abandoned refinance face months of reconstruction. Set rate monitoring alerts that notify you when the 30-year fixed drops 25-50 basis points below recent averages. Have ad creative and campaigns ready to deploy. Maintain buyer relationships through regular check-ins even when they are not actively purchasing.

What are realistic margin expectations in a high-rate market?

Margins compress in high-rate environments due to reduced volume spreading fixed costs across fewer leads and increased competition for scarce inventory. Where operators might target 20-25% net margin in favorable conditions, 12-18% may be more realistic in challenging environments – a dynamic that requires careful calculation of true cost per lead. Some operators accept break-even or slight losses during contractions to maintain market position and infrastructure. The key is sizing your operation for current volume levels rather than waiting for conditions to improve. Practitioners who sized for 2021 volume faced painful restructuring. Those sized for current conditions preserve optionality.

How do I balance cost cutting with maintaining capability?

Reduce variable costs where possible while protecting core capabilities that would take months to rebuild. Platform costs should scale with volume. Personnel reductions should focus on roles that added marginal value during boom times rather than core functions. Preserve tested traffic sources even at reduced spend levels since ad account history, SEO positions, and email list health all require ongoing maintenance. Maintain buyer relationships through regular communication even when transaction volume is lower. The goal is emerging from the challenging period positioned to capture opportunity when conditions improve rather than starting from scratch.

Key Takeaways

-

Rising rate environments require fundamentally different strategies than falling rate periods. The playbook that worked when rates were declining fails when rates are climbing. Refinance volume collapses, purchase demand persists but compresses, and home equity products gain relative appeal.

-

Purchase leads become the primary opportunity when rates rise. Purchase demand derives from life circumstances rather than rate arbitrage, creating stable albeit compressed volume. Success requires rebuilding operations around longer sales cycles, geographic specificity, and messaging that focuses on value rather than rates.

-

Home equity leads are the 2024-2025 outperformer. Homeowners with locked-in low first-mortgage rates prefer second liens to refinancing their primary loan. This segment offers consistent demand and attracts diverse buyers including credit unions and community banks.

-

Messaging must pivot from rate focus to value focus. Lead with monthly payment amounts rather than rate percentages. Emphasize equity building and wealth creation. Address rate concerns directly with “marry the house, date the rate” concepts. Create urgency through factors other than rates.

-

Speed-to-contact matters even more in uncertain rate environments. Consumer confidence is lower and comparison shopping is higher. First responders capture disproportionate share. Target one-minute response times. Leads contacted within five minutes convert 100x better than 30-minute responses.

-

Cost discipline determines survival during volume compression. Fixed costs must scale with volume where possible. Personnel decisions must reflect current realities, not hoped-for recoveries. Maintain 6-12 months operating expense reserves. Tighten buyer payment terms during uncertainty.

-

Build for rate cycle transitions, not just current conditions. Maintain capabilities across purchase, refinance, and home equity products. Create trigger systems that activate when rates decline. Preserve tested traffic sources and buyer relationships for rapid reactivation.

-

Diversification protects against concentration risk. Geographic diversification smooths regional variation. Buyer diversification prevents catastrophic revenue loss if major buyers exit. Product diversification positions you for whatever rate environment emerges next.

-

The 60-day float rule creates working capital challenges that intensify during volatility. Pay suppliers in 15-30 days, collect from buyers in 45-60 days. This float requirement becomes more challenging when volume is unpredictable. Cash reserves and tightened buyer terms provide protection.

-

Operators who stopped waiting for “normal” to return and sized for current conditions outperform those still hoping rates will drop. The 30-year fixed rate is projected to remain above 6% through at least 2026. Build your business for this reality while maintaining infrastructure that can capture opportunity when conditions eventually change.

Market data current as of December 2025. Mortgage rates, lead pricing, and market conditions change continuously. Validate current conditions through industry sources before making significant investment decisions. This article provides general information and does not constitute legal or financial advice. Consult qualified professionals for specific compliance questions.