The complete guide to selling leads to multiple buyers, from scenario optimization to waterfall recovery. Learn the routing logic, platform capabilities, and operational practices that extract maximum value from every lead.

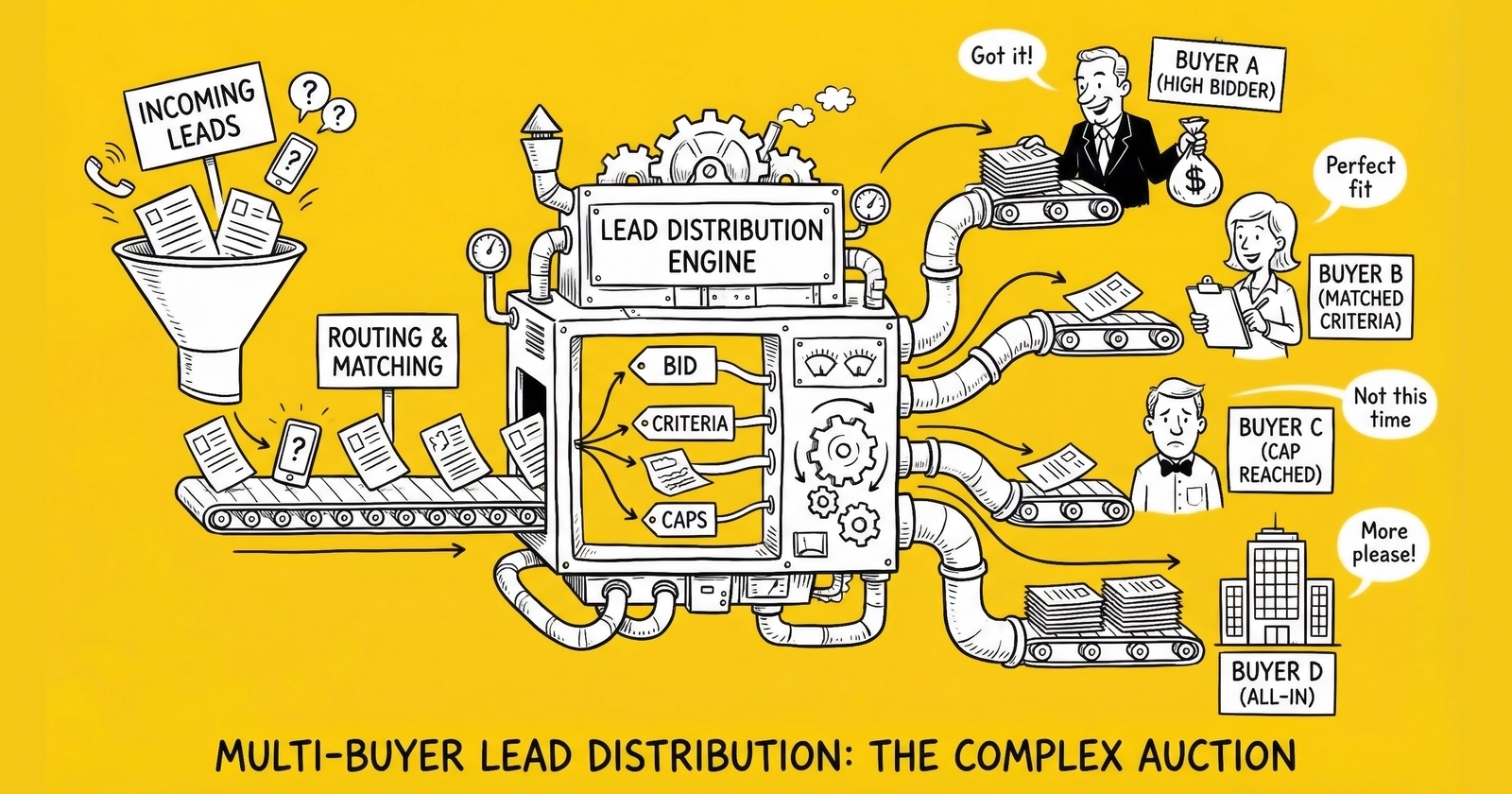

A consumer submits an insurance quote form. Within 200 milliseconds, twelve buyers receive a ping containing zip code, coverage type, and credit tier. Eight return bids ranging from $28 to $67. Three request exclusive access. Two accept shared distribution. Your distribution platform calculates that selling to three shared buyers at $35, $32, and $28 ($95 total) exceeds the highest exclusive bid of $67. The consumer sees a confirmation page, unaware that a real-time auction just determined which agents will compete for their business.

This is multi-buyer distribution: the routing logic that decides whether each lead sells to one buyer or many, at what prices, and in what sequence. Those who master multi-buyer distribution generate 15-30% higher revenue per lead than those using simple single-buyer routing. The difference compounds across thousands of monthly transactions into substantial margin improvement.

This guide covers everything you need to understand and implement multi-buyer distribution: the strategic frameworks, the routing logic, the platform capabilities, the pricing dynamics, and the operational practices that separate professional operations from amateur ones.

What Is Multi-Buyer Lead Distribution?

Multi-buyer distribution is the practice of selling a single lead to more than one buyer, either simultaneously or through sequential fallback. Unlike exclusive distribution where one buyer receives sole access to a consumer, multi-buyer distribution allows multiple buyers to compete for the same prospect.

The core premise is straightforward: combined revenue from multiple buyers often exceeds revenue from a single exclusive buyer. Three buyers paying $30 each ($90 total) beats one exclusive buyer paying $65. Four buyers at $25 each ($100) beats one at $80.

But multi-buyer distribution involves more than simple arithmetic. You must balance immediate revenue against buyer relationships. You must manage consumer experience when multiple companies call. You must configure platform logic that makes optimal decisions in milliseconds. You must track performance across scenarios to continuously optimize.

The Three Distribution Models

Lead distribution operates across three primary models, each with distinct economics and operational requirements.

Exclusive Distribution sells each lead to exactly one buyer. The buyer pays premium pricing for guaranteed exclusivity, knowing no competitors will contact the same consumer. Exclusive leads typically command 2-3x the price of shared leads. Buyers value exclusivity because it eliminates competition during the sales process and generally produces higher conversion rates.

Shared Distribution sells the same lead to multiple buyers, typically 3-5 companies who understand they compete with others for the consumer’s business. Each buyer pays less per lead, but combined revenue often exceeds exclusive pricing. Shared leads work best in competitive markets where consumers actively shop multiple providers.

Hybrid Distribution dynamically selects between exclusive and shared based on real-time bid patterns. A platform might route exclusively when the top bid exceeds the combined value of shared alternatives, or route shared when multiple buyers collectively offer more than any single exclusive bidder. This scenario optimization extracts maximum value from every lead.

Most sophisticated operations use hybrid distribution, letting the market determine optimal routing for each transaction rather than forcing all leads into a single model.

Why Multi-Buyer Distribution Matters

Multi-buyer distribution creates value across multiple dimensions: revenue optimization, buyer coverage, and risk reduction. Understanding these dynamics informs both strategic decisions and tactical configuration.

Revenue Optimization

The primary driver for multi-buyer distribution is revenue maximization. Consider a lead in the auto insurance vertical with the following bid pattern:

| Buyer | Bid Type | Bid Amount |

|---|---|---|

| Buyer A | Exclusive | $52 |

| Buyer B | Shared | $28 |

| Buyer C | Shared | $24 |

| Buyer D | Shared | $22 |

Simple math suggests routing to the three shared buyers ($74 total) beats the exclusive option ($52). But sophisticated practitioners factor in additional variables: buyer acceptance rates, return rates, and payment reliability.

If Buyer A accepts 95% of posts and returns 5% of accepted leads, their expected value is $52 x 0.95 x 0.95 = $46.93.

If Buyers B, C, and D each accept 85% of posts and return 10% of accepted leads, their combined expected value is:

- Buyer B: $28 x 0.85 x 0.90 = $21.42

- Buyer C: $24 x 0.85 x 0.90 = $18.36

- Buyer D: $22 x 0.85 x 0.90 = $16.83

- Total: $56.61

Even with lower individual acceptance rates, the shared scenario wins. But the margin is smaller than raw bids suggest. Professional operators build expected value calculations into their routing logic, not just gross bid comparisons.

Buyer Coverage and Fill Rate

Multi-buyer distribution improves fill rates by creating more opportunities for each lead to find a buyer. A lead that doesn’t match Buyer A’s exclusive criteria might qualify for Buyers B, C, or D at shared prices. A lead rejected in the exclusive auction might recover through shared fallback.

Industry benchmarks show that operations with robust multi-buyer distribution achieve 85-95% fill rates, compared to 70-80% for exclusive-only operations. The difference represents recovered revenue from leads that would otherwise go unsold.

Geographic coverage particularly benefits from multi-buyer approaches. A lead from rural Montana might not attract exclusive bids from major carriers but could find three regional buyers willing to pay shared rates. Multi-buyer distribution turns thin markets into viable ones.

Risk Diversification

Concentrating revenue on single buyers creates risk. If your top exclusive buyer changes their targeting criteria, caps down, or experiences operational problems, leads stack up unsold. Multi-buyer distribution spreads this risk across multiple buyer relationships.

Payment risk follows similar logic. If one buyer delays payment or disputes invoices, multi-buyer distribution means that lead still generated revenue from other purchasers. Your exposure to any single buyer’s credit problems decreases proportionally with buyer count.

Market fluctuation risk also diminishes. When exclusive buyers reduce bids during slow seasons, shared buyers often maintain consistent pricing because their unit economics depend less on any individual lead. Multi-buyer portfolios smooth revenue volatility.

Multi-Buyer Routing Strategies

Routing strategy determines how your distribution platform selects between exclusive and shared options, which buyers receive which leads, and how fallback logic recovers from rejections. The right strategy depends on your vertical, buyer mix, and operational capabilities.

Scenario Optimization

Scenario optimization calculates the optimal distribution path for each lead by comparing revenue under different routing scenarios. This approach requires platforms capable of evaluating multiple paths simultaneously and selecting the best outcome.

The calculation flow works as follows:

- Lead arrives at distribution platform

- Platform pings all qualified buyers (exclusive and shared)

- Buyers return bids within timeout window (typically 100-200ms)

- Platform calculates revenue under each scenario:

- Scenario A: Best exclusive bid

- Scenario B: Top 2 shared bids combined

- Scenario C: Top 3 shared bids combined

- Scenario D: Top 4 shared bids combined (if applicable)

- Platform applies expected value adjustments (acceptance rates, return rates)

- Platform selects highest expected value scenario

- Post delivers to winning buyer(s)

Advanced platforms like boberdoo recalculate scenarios after each rejection, often recovering 20-40% additional revenue from leads that initial buyers decline. If your exclusive winner rejects the post, the platform instantly evaluates whether remaining bidders offer better value as shared or as a new exclusive option.

Priority Waterfall with Shared Fallback

Priority waterfall routes leads to a ranked sequence of buyers, with shared distribution serving as fallback for rejected exclusive offers. This approach works when you have premium exclusive relationships that deserve first access but want shared revenue as backup.

The logic flows sequentially:

- Offer lead to Priority 1 exclusive buyer

- If rejected, offer to Priority 2 exclusive buyer

- If rejected, offer to Priority 3 exclusive buyer

- If all exclusive options exhausted, route to shared buyers

- If shared buyers accept, distribute to top 3-5 bidders

This approach protects exclusive buyer relationships by guaranteeing first access while ensuring leads find buyers even when exclusive demand is weak. The downside is potential revenue loss: your Priority 1 buyer at $45 exclusive might win over a shared combination worth $60.

Simultaneous Exclusive/Shared Auction

Simultaneous auction pings both exclusive and shared buyers in the same round, comparing all bids against each other in real-time. This creates true market competition between distribution models.

The mechanics require that your ping indicate both exclusive and shared availability. Buyers who want exclusive access bid at exclusive rates. Buyers accepting shared access bid at shared rates. The platform then compares:

- Highest exclusive bid

- Sum of top shared bids (typically 3-5 buyers)

- Expected values adjusted for buyer reliability

The highest expected value scenario wins. This approach maximizes revenue per lead but requires buyers comfortable competing against alternative distribution models.

Geographic Arbitrage Distribution

Geographic arbitrage exploits regional variations in buyer demand. Some markets have deep exclusive buyer pools; others have limited exclusive demand but strong shared appetites.

The strategy involves configuring distribution rules by geography:

- High-demand markets (California, Texas, Florida): Route to exclusive auction first, shared fallback

- Medium-demand markets: Simultaneous exclusive/shared comparison

- Low-demand markets: Route directly to shared pool, skip exclusive

This approach optimizes for market reality rather than forcing uniform distribution logic across varied geographies. A solar lead from Arizona with strong installer demand follows different routing than an identical lead from North Dakota where buyer competition is thin.

Time-Based Distribution Switching

Buyer behavior varies by time of day and day of week. Exclusive demand typically peaks during business hours when buyers have staff ready to work leads immediately. Shared demand may remain steady because buyers with automated follow-up systems can work leads regardless of timing.

Time-based switching adjusts distribution logic accordingly:

- Business hours (8 AM - 6 PM local): Priority to exclusive, shared fallback

- Evening hours (6 PM - 10 PM): Simultaneous comparison, equal weight

- Overnight and weekend: Shared-first routing, exclusive only if bid exceeds threshold

This approach captures premium exclusive pricing when buyer engagement is highest while maintaining revenue during off-peak periods when exclusive demand softens.

Platform Requirements for Multi-Buyer Distribution

Not all lead distribution platforms support sophisticated multi-buyer scenarios. Before implementing multi-buyer strategies, verify your platform provides the necessary capabilities.

Essential Platform Features

Simultaneous Ping Broadcasting sends ping requests to all qualified buyers in parallel rather than sequentially. Parallel processing ensures all bids arrive within the timeout window, enabling true market comparison. Platforms that ping sequentially cannot effectively compare exclusive versus shared scenarios because later buyers’ bids arrive too late.

Scenario Calculation Engine evaluates multiple distribution paths and selects the optimal outcome. The engine must compare exclusive bids against various shared combinations, apply expected value adjustments, and execute the winning scenario. Platforms without scenario engines require manual configuration of distribution priority, limiting optimization.

Post-Rejection Recalculation automatically reevaluates remaining options when a buyer rejects the post. If your exclusive winner declines, the platform should immediately recalculate whether remaining shared bidders offer the best path forward. Without recalculation, rejected leads cascade to preset fallback without optimization.

Buyer-Specific Exclusivity Flags allow each buyer to indicate whether they want exclusive access, accept shared access, or participate in both. Your platform must track these preferences and route accordingly. Sending exclusive-only buyers into shared distributions damages relationships.

Sale Count Management tracks how many times each lead has sold and prevents overselling – a key factor when weighing exclusive versus shared lead models. If your shared limit is 4 buyers, the platform must prevent a fifth sale even if additional bids arrive. Sale count must persist across sessions and cascade attempts.

Deduplication Across Buyers prevents the same consumer from reaching the same buyer through multiple distribution paths. A buyer who already has this consumer (from prior purchase or internal generation) should automatically filter out of subsequent routing, whether exclusive or shared.

Platform Comparison for Multi-Buyer Distribution

| Platform | Scenario Optimization | Post-Reject Recalc | Sale Count Mgmt | Best For |

|---|---|---|---|---|

| boberdoo | Native, automatic | Yes, real-time | Configurable | Enterprise multi-buyer |

| LeadExec | 5 distribution types | Yes | Native | Multi-channel operations |

| LeadsPedia | Hybrid lead/affiliate | Limited | Yes | Operations with affiliate traffic |

| LeadHoop | Full funnel visibility | Yes | Yes | Aggregators with diverse sources |

| Lead Prosper | API-first | Basic | Yes | SMB/agile operations |

boberdoo leads the market for complex multi-buyer scenarios, as covered in our lead distribution platform comparison, providing what they describe as automatic scenario recalculation after post rejects, recovering 20-40% additional revenue from initially rejected leads. For operations processing substantial volume with diverse buyer relationships, this recalculation capability justifies the platform investment.

Smaller operations may find simpler platforms adequate initially, transitioning to more sophisticated infrastructure as multi-buyer complexity increases.

Pricing Dynamics in Multi-Buyer Distribution

Pricing for multi-buyer distribution follows different dynamics than exclusive pricing. Understanding these dynamics enables better buyer negotiations and platform configuration.

Shared Pricing Economics

Shared leads sell at discounts to exclusive because buyers face competition. The standard discount ranges from 40-60% off exclusive pricing. A $60 exclusive lead might sell for $25-36 shared to each buyer.

This discount reflects several economic realities:

Lower conversion probability: When three companies call the same consumer, each converts roughly one-third as often as an exclusive buyer would. Buyers price accordingly.

Faster lead decay: Shared leads create a race to contact first. The buyer who reaches the consumer second or third faces dramatically lower conversion odds. This urgency compresses the effective value window.

Comparison shopping behavior: Consumers receiving multiple calls are actively comparing options, making them harder to close than consumers contacted by a single company. The sales cycle lengthens and conversion rates drop.

Despite these discounts, shared distribution often generates higher total revenue because multiple payments sum to more than a single exclusive sale. The mathematics favor shared distribution when:

Shared Revenue = (Shared Price per Buyer) x (Number of Buyers) > Exclusive Price

With typical 3-5 buyer distribution and 40-60% discounts, this inequality often holds.

Dynamic Pricing and Bid Floors

Multi-buyer distribution benefits from dynamic pricing that adjusts based on supply and demand conditions. During high-demand periods, both exclusive and shared bids increase. During slow periods, shared distribution may maintain value better than exclusive because aggregate demand remains more stable.

Bid floors establish minimum acceptable prices for each distribution type. Common configurations include:

- Exclusive floor: $40

- Shared floor: $15 per buyer

- Minimum shared total: $45 (must equal or exceed exclusive alternative)

Floors prevent scenarios where low shared bids combine to produce less revenue than would selling exclusive. They also protect margin by ensuring distribution covers costs regardless of buyer demand fluctuations.

Buyer Caps and Allocation

Multi-buyer distribution requires careful cap management to ensure buyer volume commitments are met without over-delivering. Caps operate at multiple levels:

Daily caps limit how many leads each buyer receives per day. A buyer capped at 50 daily leads might receive 30 exclusive and 20 shared, or all 50 shared, depending on routing logic.

Shared distribution caps limit how many times a single lead can sell. Industry standard ranges from 3-5 buyers per shared lead. Exceeding this limit frustrates consumers with excessive calls and damages buyer satisfaction as conversion rates plummet.

Period-based allocation ensures buyers receive their contracted share across the month. A buyer contracted for 1,000 monthly leads should receive approximately 50 per business day. Multi-buyer distribution must pace appropriately rather than front-loading or back-loading delivery.

Buyer Management for Multi-Buyer Success

Multi-buyer distribution succeeds or fails based on buyer relationships. Managing expectations, monitoring performance, and maintaining satisfaction requires ongoing attention.

Setting Buyer Expectations

Transparency about shared distribution prevents relationship damage. Buyers must understand:

- Whether leads they receive are exclusive or shared

- How many other buyers receive shared leads

- What consumer experience results from shared distribution

- How pricing reflects exclusivity status

Some buyers accept only exclusive leads. Others actively prefer shared leads because lower per-lead pricing fits their conversion economics. Many accept both at appropriate price points. Understanding each buyer’s preference prevents routing mismatches.

Contractual documentation should specify:

- Exclusivity requirements or preferences

- Shared lead pricing versus exclusive pricing

- Maximum buyers per shared lead

- Notification requirements for distribution type changes

Monitoring Buyer Performance

Multi-buyer distribution generates performance data that informs ongoing optimization. Track these metrics by buyer:

Acceptance rate: What percentage of routed leads does this buyer accept? Low acceptance rates indicate filter misalignment or buyer capacity issues.

Return rate: What percentage of accepted leads does this buyer return? High return rates suggest quality problems or stricter post-sale validation.

Time to contact: How quickly does this buyer contact shared leads? Slow contact times reduce conversion probability, which may indicate deprioritization of shared leads.

Conversion rate (when available): What percentage of leads convert to customers? Buyers with strong conversion rates add value beyond their bid prices through relationship stability.

Build dashboards that compare these metrics across exclusive and shared distribution. Some buyers perform well on exclusive leads but poorly on shared. Others excel at shared competition. Routing logic should reflect these performance patterns.

Managing Consumer Experience

Multi-buyer distribution means multiple companies calling the same consumer. This creates potential for consumer frustration if not managed appropriately.

Call timing coordination reduces annoyance. Some platforms offer staggered delivery, sending leads to buyers with slight time delays to prevent simultaneous calls. A consumer receiving calls 30 minutes apart experiences less frustration than one receiving three calls within five minutes.

Buyer quality standards matter more in shared scenarios. A single aggressive or unprofessional buyer among three creates negative consumer experience that reflects on all parties. Maintain quality standards for shared participation and remove buyers who damage consumer relationships.

Optimal buyer count balances revenue against experience. Industry standard is 3-5 buyers per shared lead. More than 5 creates excessive contact that frustrates consumers and depresses conversion rates for all buyers. Less than 3 may leave revenue on the table. Test to find the optimal count for your vertical and consumer base.

Technical Implementation Guide

Implementing multi-buyer distribution requires platform configuration, integration setup, and ongoing optimization. This section provides the technical framework for implementation.

Distribution Rule Configuration

Configure distribution rules that define when leads route exclusively versus shared. Common rule structures include:

Threshold-based rules: Route exclusive if top bid exceeds $X, otherwise route shared. Example: “If any exclusive bid > $50, route exclusive. Otherwise, route to top 3 shared buyers.”

Scenario comparison rules: Compare exclusive bid against shared sum, route to higher value. Example: “Calculate exclusive expected value and shared expected value (top 3). Route to higher scenario.”

Buyer-preference rules: Honor buyer preferences for exclusivity. Example: “If Buyer A bids exclusive, route exclusive to Buyer A. If no exclusive bids, route shared.”

Geographic rules: Vary distribution by location. Example: “If state = CA, route exclusive-first. If state = MT, route shared-first.”

Most platforms allow rule stacking where multiple conditions combine. Build rules that start with highest-priority conditions and cascade to defaults:

- If any exclusive bid > $60, route exclusive

- If exclusive bid > shared sum + $10, route exclusive

- If shared sum > exclusive bid, route to top 4 shared buyers

- Default: Route to any available buyer

API Integration for Ping/Post

Multi-buyer distribution typically operates through ping/post protocols. Your integration must support:

Ping request: Include an exclusivity flag indicating whether this lead is available exclusively, shared, or both. Buyers use this flag to determine bid type.

Bid response: Accept bids with exclusivity specification. Buyers indicate whether their bid is for exclusive access, shared access, or either.

Post delivery: Transmit complete lead data to all winning buyers. For shared distribution, execute multiple posts within the transaction.

Confirmation handling: Process acceptance/rejection from each buyer. Track partial acceptance scenarios where some shared buyers accept while others reject.

Handling Post Rejections

Post rejections trigger recalculation logic. Configure your platform to:

- Remove rejecting buyer from consideration

- Recalculate optimal scenario from remaining bidders

- Evaluate whether remaining exclusive bids or shared combinations offer better value

- Execute revised routing decision

- Repeat until lead sells or options exhaust

This waterfall-on-failure logic recovers substantial revenue. Industry benchmarks show 20-40% of post-rejected leads can resell through effective recalculation.

Set timeout windows appropriate to your vertical. Standard timeouts:

- Ping response: 100-200ms

- Post acceptance: 500-1000ms

- Recalculation processing: 50-100ms

Total transaction time from lead arrival to final disposition should remain under 2 seconds for real-time distribution.

Tracking and Attribution

Multi-buyer distribution complicates attribution because a single lead generates multiple transactions. Your tracking must:

Maintain lead-level records: Each original lead should have a unique identifier that persists across all distribution events.

Track per-buyer transactions: Each buyer’s purchase, acceptance, and any returns constitute separate transaction records linked to the parent lead.

Calculate aggregate revenue: Sum all buyer payments for total lead revenue. Subtract returns. Calculate effective revenue per lead across distribution.

Monitor by distribution type: Compare exclusive versus shared performance at aggregate level. Track revenue per lead, return rates, and fill rates by distribution type.

Enable buyer-level analysis: Drill into individual buyer performance within shared distribution. Identify buyers who underperform on shared leads versus exclusive.

Optimization and Performance Improvement

Multi-buyer distribution requires continuous optimization to maximize revenue. Establish review cadences and testing frameworks that drive ongoing improvement.

Key Performance Metrics

Track these metrics to assess multi-buyer distribution performance:

| Metric | Definition | Target | Warning Sign |

|---|---|---|---|

| Revenue per Lead | Total revenue from all buyers / total leads | Vertical dependent | Declining trend |

| Exclusive vs Shared Mix | Percentage routed to each type | Based on strategy | Unintended shift |

| Shared Buyer Count | Average buyers per shared lead | 3-4 buyers | Below 2 or above 5 |

| Fill Rate | Leads sold / leads received | >85% | Below 75% |

| Post Acceptance Rate | Posts accepted / posts sent | >85% | Below 75% |

| Waterfall Recovery | Rejected leads resold / rejected leads | 20-40% | Below 15% |

| Return Rate | Leads returned / leads sold | <10% | Above 15% |

Build dashboards that track these metrics daily. Review trends weekly. Investigate any metric that moves significantly from baseline.

A/B Testing Distribution Strategies

Test distribution strategies systematically rather than assuming optimal configuration. Common tests include:

Shared buyer count tests: Compare 3-buyer versus 4-buyer versus 5-buyer distribution. Measure total revenue, buyer satisfaction, and consumer complaints.

Threshold tests: Test different exclusive/shared switching thresholds. Does routing exclusive when the top bid exceeds $50 produce more revenue than a $40 threshold?

Scenario weight tests: Adjust expected value calculations for acceptance and return rates. Test whether tighter or looser adjustments improve actual revenue.

Run tests with sufficient sample size for statistical significance. Minimum 200-500 leads per test variant depending on baseline conversion rates. Allow tests to run for at least one week to capture day-of-week variation.

Buyer Pool Optimization

The composition of your buyer pool affects multi-buyer performance. Optimize by:

Adding shared-friendly buyers: Recruit buyers who specifically seek shared leads. These buyers often have different business models (call centers, automated follow-up) that perform well in competitive scenarios.

Removing underperformers: Buyers with high rejection or return rates drag down shared distribution economics. Consider removing them from shared eligibility while maintaining exclusive relationships.

Balancing exclusive and shared demand: Aim for buyer pools where exclusive and shared demand roughly balance. Too much exclusive demand leaves shared revenue on the table. Too little creates exclusive-only leads that could generate more as shared.

Geographic expansion: Add buyers in markets where shared coverage is thin. Regional buyers often accept shared distribution more readily than national carriers focused on exclusive arrangements.

Vertical-Specific Multi-Buyer Considerations

Multi-buyer distribution dynamics vary significantly by vertical. Consumer expectations, buyer competition, and regulatory requirements all influence optimal strategy.

Insurance Leads

Insurance leads represent the most mature multi-buyer market. Consumers actively shop multiple carriers, making shared distribution natural. Typical configuration:

- Shared buyer count: 3-5 buyers per lead

- Exclusive premium: 2-2.5x shared pricing

- Consumer expectation: Multiple calls expected

- Optimal strategy: Scenario optimization with exclusive floor

Insurance buyers are sophisticated about shared economics. Many have built operations specifically for shared lead conversion. Expect strong shared demand in most geographies.

Mortgage Leads

Mortgage leads face regulatory constraints that affect multi-buyer distribution. RESPA requirements around marketing service agreements and affiliated business arrangements create compliance considerations. Typical configuration:

- Shared buyer count: 2-4 buyers per lead

- Exclusive premium: 2-3x shared pricing

- Consumer expectation: Some expect multiple calls from rate shopping

- Optimal strategy: Priority exclusive with shared fallback

Mortgage consumers are rate-sensitive and often expect multiple quotes. Shared distribution aligns with consumer behavior. However, higher-intent purchase leads often command exclusive pricing when buyer demand supports it.

Solar Leads

Solar leads vary dramatically by geography. Strong markets (California, Arizona, Texas) have deep buyer pools supporting both exclusive and shared distribution. Weak markets may struggle to find any buyers. Typical configuration:

- Shared buyer count: 2-4 buyers per lead

- Exclusive premium: 2-3x shared pricing

- Consumer expectation: Varies by market

- Optimal strategy: Geographic arbitrage with market-specific rules

Solar installers often operate regionally, creating geographic pockets of demand. Configure distribution rules that reflect local market conditions rather than applying national logic uniformly.

Legal Leads

Legal leads command the highest CPLs in the industry and typically route exclusively. Law firms generally refuse shared leads because case intake economics require exclusive access. Typical configuration:

- Shared buyer count: 1 (exclusive only) for most case types

- Exceptions: Mass tort leads sometimes distribute shared

- Consumer expectation: Single attorney contact

- Optimal strategy: Exclusive waterfall, no shared distribution

Legal leads represent an exception to multi-buyer optimization. The vertical’s ethics rules, case intake economics, and consumer expectations all favor exclusive distribution despite the revenue potential of shared scenarios.

Home Services Leads

Home services leads (HVAC, roofing, plumbing, remodeling) commonly distribute to multiple buyers. Consumers expect multiple quotes for home improvement projects. Typical configuration:

- Shared buyer count: 3-5 buyers per lead

- Exclusive premium: 1.5-2x shared pricing

- Consumer expectation: Multiple quotes standard

- Optimal strategy: Shared-first, exclusive only for premium buyers

Home services consumers actively want multiple quotes, making shared distribution the natural model. Contractors are accustomed to competing for business and have built pricing around shared economics.

Compliance and Legal Considerations

Multi-buyer distribution creates specific compliance requirements around consent, data handling, and consumer communication.

TCPA Consent for Multiple Buyers

When distributing leads to multiple buyers, consent documentation must support contact from each buyer. The FCC’s one-to-one consent rule (though vacated in January 2025) established that consent should identify specific parties authorized to contact the consumer.

Best practices for multi-buyer consent align with guidance from our TCPA compliance guide:

Disclose shared distribution: Your consent language should indicate the consumer may be contacted by multiple companies. Avoid implying exclusive contact from a single party.

Name or identify potential buyers: To the extent possible, identify the companies or types of companies that may receive the lead. “You may be contacted by up to 5 insurance agencies” provides consumer notice.

Maintain consent certificates: Store TrustedForm or Jornaya certificates for each lead. These certificates document what the consumer saw and agreed to at the time of submission.

Match consent to distribution: If your consent language authorizes contact from insurance companies, do not distribute the lead to non-insurance buyers. Distribution scope must match consent scope.

Data Sharing Across Buyers

Shared distribution means transmitting consumer PII to multiple parties. Each transmission creates data handling obligations:

Encrypt all transmissions: Use HTTPS for all lead delivery. Encrypt data at rest in buyer systems.

Limit data to necessary fields: Transmit only the data each buyer needs. Avoid sharing optional fields that buyers don’t use.

Document data flows: Maintain records of which buyers received which leads. These records support compliance audits and consumer inquiries.

Buyer agreements: Execute data processing agreements with each buyer specifying their obligations for data handling, security, and deletion.

Consumer Request Handling

Consumers may request information about who received their data, or demand deletion across all parties. Multi-buyer distribution complicates these requests:

Track all recipients: Maintain searchable records linking leads to every buyer who received them. When a consumer requests their data history, you can provide complete information.

Coordinate deletion requests: When a consumer requests deletion, notify all buyers who received that lead. Document their compliance with deletion requests.

Respond within required timeframes: CCPA and similar regulations specify response windows (typically 45 days). Build systems that can identify all buyers and coordinate responses within required periods.

Frequently Asked Questions

Q1: What is multi-buyer lead distribution?

Multi-buyer lead distribution is the practice of selling a single lead to more than one buyer. Instead of routing exclusively to a single purchaser, the lead distributes to 3-5 buyers who compete for the consumer’s business. Combined revenue from multiple buyers often exceeds what a single exclusive buyer would pay. Multi-buyer distribution also improves fill rates by creating more sales opportunities per lead and reduces risk by diversifying revenue across multiple buyer relationships.

Q2: How many buyers should receive each shared lead?

Industry standard is 3-5 buyers per shared lead. Fewer than 3 buyers may leave revenue on the table without significantly improving consumer experience. More than 5 buyers creates excessive contact that frustrates consumers and depresses conversion rates for all buyers as competition intensifies. The optimal number depends on your vertical: insurance commonly uses 4-5 buyers, mortgage 2-4, solar 2-4, and home services 3-5. Test different buyer counts to find the optimal balance for your specific market.

Q3: How much less do shared leads sell for compared to exclusive?

Shared leads typically sell at 40-60% discount to exclusive pricing. A lead commanding $60 exclusive might sell for $24-36 per buyer in shared distribution. Despite lower per-buyer pricing, combined revenue from multiple shared sales often exceeds exclusive revenue. Three buyers at $28 each ($84 total) beats one exclusive buyer at $60. The economics favor shared distribution when combined shared revenue exceeds exclusive pricing, which occurs frequently with 3-5 buyer distribution.

Q4: How do I prevent over-contacting consumers?

Limit shared distribution to 3-5 buyers maximum per lead. Consider staggered delivery that spaces buyer access over 15-30 minutes rather than simultaneous distribution, reducing the chance of multiple calls within minutes. Maintain buyer quality standards and remove buyers who generate consumer complaints. Track complaint rates by buyer and adjust distribution accordingly. Some platforms offer coordination features that prevent the same consumer from receiving calls from multiple buyers simultaneously.

Q5: What platform capabilities do I need for multi-buyer distribution?

Essential capabilities include simultaneous ping broadcasting (parallel rather than sequential buyer queries), scenario calculation engine (comparing exclusive versus shared revenue options), post-rejection recalculation (re-evaluating remaining options when buyers reject), buyer-specific exclusivity flags (tracking which buyers accept shared versus exclusive), and sale count management (preventing overselling beyond your shared limit). Platforms like boberdoo, LeadExec, and LeadHoop provide these capabilities natively. Simpler platforms may require workarounds or manual configuration.

Q6: Should I route all leads to multi-buyer distribution?

No. Multi-buyer distribution works best when combined shared revenue exceeds exclusive alternatives. Configure scenario optimization that evaluates both options for each lead and routes to the higher-value path. Some leads will route exclusive (when a single buyer offers more than combined shared), while others route shared (when multiple buyers collectively offer more). The optimal mix depends on your buyer pool composition and bid patterns. Let market dynamics determine distribution rather than forcing all leads into a single model.

Q7: How do buyers feel about shared leads?

Buyer attitudes vary significantly. Some buyers actively prefer shared leads because lower per-lead pricing fits their conversion economics, especially call centers with high-velocity sales processes. Others prefer or require exclusive leads because their sales process works best without competition. Many buyers accept both at appropriate price points. Understand each buyer’s preference through explicit discussion and track their performance by distribution type. Buyers who underperform on shared leads may be better candidates for exclusive-only relationships.

Q8: What return rate should I expect for shared versus exclusive leads?

Shared leads typically generate higher return rates than exclusive leads. Expect 8-12% returns on shared compared to 5-8% on exclusive. Higher shared returns reflect duplicate detection (consumer already contacted this buyer through another path) and quality concerns (buyer can’t verify quality before multiple competitors contact). Factor expected return rates into your scenario calculations. A shared scenario with 10% expected returns needs higher gross revenue to beat an exclusive scenario with 5% expected returns.

Q9: How does multi-buyer distribution affect TCPA compliance?

Multi-buyer distribution requires consent language that authorizes contact from multiple parties. Your consent disclosure should indicate the consumer may be contacted by multiple companies and, ideally, identify or describe those companies. Maintain consent certificates (TrustedForm, Jornaya) documenting what the consumer saw and agreed to. Match distribution scope to consent scope, meaning you should not distribute to buyer types not covered by your consent language. Track which buyers received each lead to support consumer inquiries and deletion requests.

Q10: How do I measure multi-buyer distribution performance?

Track revenue per lead (total revenue from all buyers divided by total leads), exclusive versus shared mix (percentage routed to each type), shared buyer count (average buyers per shared lead), fill rate (leads sold divided by leads received), post acceptance rate (posts accepted divided by posts sent), waterfall recovery rate (rejected leads resold divided by total rejected), and return rate (leads returned divided by leads sold). Build dashboards that track these metrics daily and review trends weekly. Investigate any metric that moves significantly from baseline performance.

Key Takeaways

-

Multi-buyer distribution generates 15-30% higher revenue per lead by selling to multiple buyers rather than single exclusive purchasers. Combined revenue from 3-5 shared buyers frequently exceeds even premium exclusive pricing.

-

Scenario optimization is essential. Configure your platform to compare exclusive bids against combined shared alternatives in real-time, routing each lead to the highest-value path rather than forcing uniform distribution.

-

Post-rejection recalculation recovers 20-40% of initially rejected leads. When a buyer rejects a post, sophisticated platforms automatically reevaluate remaining options and route to the next-best scenario.

-

Shared leads sell at 40-60% discount to exclusive. Per-buyer pricing is lower, but combined revenue often exceeds exclusive alternatives. The math favors shared when (Shared Price x Buyer Count) exceeds Exclusive Price.

-

Limit shared distribution to 3-5 buyers per lead. Fewer buyers may leave revenue unrealized. More buyers creates excessive consumer contact that damages experience and conversion rates.

-

Platform capabilities determine what is possible. Verify your platform supports parallel ping broadcasting, scenario calculation, post-rejection recalculation, and sale count management before implementing sophisticated multi-buyer strategies.

-

Buyer relationships require explicit communication. Transparency about shared distribution, pricing differences, and consumer experience expectations prevents relationship damage. Honor buyer preferences for exclusivity.

-

TCPA compliance requires consent for multiple contacts. Your consent language must authorize contact from multiple companies. Track which buyers received each lead to support consumer requests.

-

Vertical dynamics vary significantly. Insurance and home services naturally fit shared distribution. Legal leads typically require exclusive routing. Configure vertical-specific strategies rather than applying uniform logic.

-

Continuous optimization drives improvement. Track key metrics daily, A/B test distribution strategies systematically, and optimize buyer pool composition to maximize multi-buyer performance.

This article provides educational information about multi-buyer lead distribution strategies. Platform capabilities and market dynamics change; verify current specifications and benchmark your specific performance before making distribution decisions. Statistics and operational practices current as of December 2025.