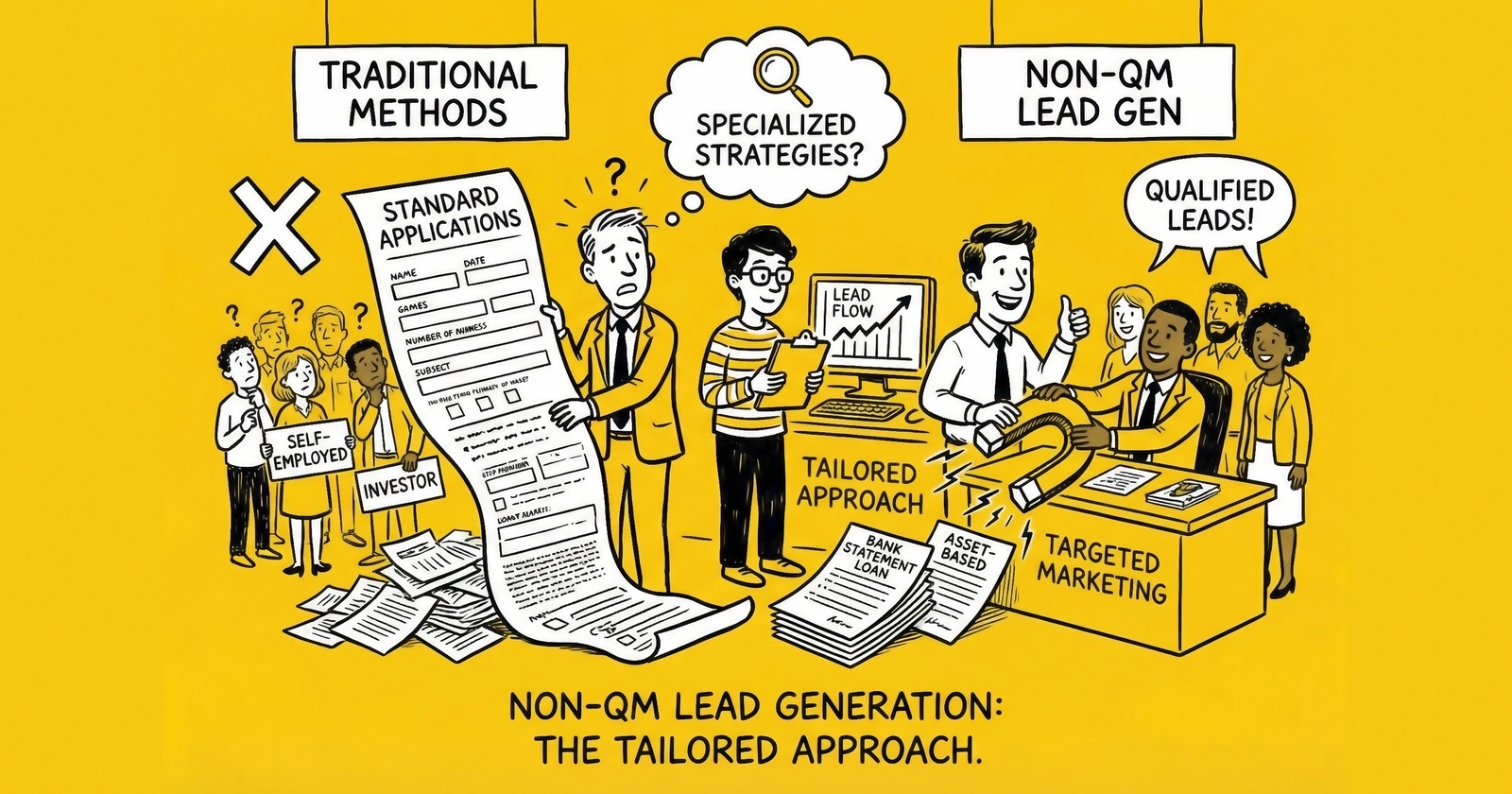

Non-QM mortgages serve borrowers conventional lending overlooks. Generating quality leads for this segment requires understanding who these borrowers are and where to find them.

The Non-QM Opportunity in Modern Mortgage Markets

The qualified mortgage (QM) framework, established by the Consumer Financial Protection Bureau following the 2008 financial crisis, created standardized lending criteria designed to protect both borrowers and lenders. Most mortgages today conform to QM standards – documented ability to repay, limited fees, standard amortization. But the QM framework, by design, excludes borrowers who do not fit conventional documentation patterns even when those borrowers present acceptable credit risk.

The post-crisis regulatory framework drew bright lines around what constitutes a qualified mortgage, creating certainty for lenders who wanted liability protection but simultaneously creating a population of creditworthy borrowers with no conventional path to homeownership or refinancing. These are not the subprime borrowers of the mid-2000s who received loans they could never repay. Non-QM borrowers today often possess substantial assets, strong income, and genuine ability to service mortgage debt – they simply cannot prove it through the documentation channels that QM guidelines require.

Non-qualified mortgages (non-QM) fill this gap. These products serve borrowers whose income, credit history, or property characteristics place them outside conventional guidelines despite underlying creditworthiness. The self-employed business owner with strong cash flow but unconventional documentation. The real estate investor assembling a rental portfolio. The foreign national with substantial assets but no U.S. credit history. The professional recovering from a bankruptcy or foreclosure triggered by specific circumstances.

The non-QM market has grown substantially since its post-crisis reconstitution, reaching approximately $25-30 billion in annual origination volume according to industry data from CoreLogic and Inside Mortgage Finance. While this represents a small fraction of the $2+ trillion total mortgage market, it offers meaningful opportunity for lead generators serving specialized lender relationships. Non-QM products show particular resilience during high-rate environments when conventional refinancing volume collapses.

Non-QM lead generation differs fundamentally from conventional mortgage marketing. The borrower population is harder to identify and reach. The value proposition is different – access rather than rate optimization. The buyer landscape is more concentrated, with specialized non-QM lenders rather than the broad conventional originator market. Understanding these differences enables building sustainable non-QM lead operations that serve an underserved borrower population.

This guide examines non-QM borrower profiles, targeting strategies that reach these segments, buyer relationship considerations, and operational approaches specific to non-QM lead generation.

Understanding Non-QM Borrower Profiles

Non-QM borrowers are not a monolithic group. They represent distinct segments with different characteristics, different needs, and different pathways to reaching them. Effective non-QM lead generation requires understanding these segments individually.

The common thread connecting non-QM borrower segments is documentation mismatch rather than credit deficiency. A self-employed consultant with $400,000 annual revenue, a real estate investor with 15 cash-flowing properties, and a recently divorced executive rebuilding after a short sale share little demographically. What they share is a situation where their financial reality does not translate into conventional documentation formats. This understanding shapes targeting strategy: non-QM lead generation must identify borrowers whose circumstances create documentation gaps rather than borrowers with poor credit or insufficient income.

Self-Employed and Business Owner Borrowers

Self-employed borrowers represent the largest non-QM segment, comprising an estimated 40-50% of non-QM origination volume. These borrowers often have strong actual income but documentation challenges that conventional underwriting cannot accommodate.

The documentation gap is the core issue. Conventional QM underwriting relies on W-2 income, tax returns, and employer verification. Self-employed borrowers may show modest taxable income on returns due to legitimate business deductions while having substantial actual cash flow. A business owner with $300,000 in actual income may show $80,000 on Schedule C after depreciation, vehicle expenses, home office deduction, and other legitimate write-offs. QM guidelines see an $80,000 borrower; the business generates $300,000.

Bank statement programs address this documentation gap by using 12-24 months of business or personal bank statements to calculate effective income. These programs examine deposits, exclude obvious non-income transactions, and derive qualifying income that better reflects actual cash flow. Bank statement programs typically carry rate premiums of 0.5-1.5% over conventional rates but enable qualification that QM guidelines prevent.

The self-employed population is substantial and growing. Bureau of Labor Statistics data shows approximately 16 million self-employed Americans, with additional millions in gig economy, contractor, and freelance arrangements that create similar documentation challenges. This population includes:

- High-income professionals (consultants, attorneys, physicians in private practice)

- Small business owners across industries

- Real estate professionals

- Technology contractors and freelancers

Real Estate Investor Borrowers

Real estate investors represent the second major non-QM segment, accounting for approximately 25-35% of non-QM volume. These borrowers seek financing for investment properties under structures that conventional lending does not accommodate.

Investor-specific products address needs that conventional investment property loans cannot meet. Debt Service Coverage Ratio (DSCR) loans qualify based on property cash flow rather than borrower income – if the property generates 1.25x its debt service, qualification proceeds regardless of borrower tax returns. This approach suits investors whose personal income documentation does not support multiple property acquisitions.

Portfolio limitations drive investor non-QM demand. Conventional guidelines typically limit financed properties to 10, with many lenders imposing lower caps. Investors building larger portfolios require non-QM products that accommodate 15, 20, or more financed properties.

Entity ownership preferences create non-QM need. Many investors hold properties in LLCs for liability protection. Conventional programs require personal guarantee and individual ownership; non-QM products accommodate LLC ownership with appropriate structure.

The investor borrower population includes:

- Long-term rental investors building passive income portfolios

- Fix-and-flip investors requiring bridge financing

- Short-term rental operators (Airbnb, VRBO) whose income volatility challenges conventional documentation

- Commercial transition investors moving from residential to small commercial

Recent Credit Event Borrowers

Borrowers with recent credit events – bankruptcy, foreclosure, short sale, deed-in-lieu – often cannot qualify for conventional or government programs due to seasoning requirements. Non-QM provides pathways for these borrowers to finance home purchases or refinances before conventional timelines permit.

Conventional seasoning requirements are substantial. FHA requires 2-3 years after bankruptcy and 3 years after foreclosure. Conventional loans require 4-7 years for major derogatory events. These timelines leave borrowers without financing options despite potentially strong current financial positions.

Non-QM credit event products enable qualification as early as one day after discharge or completion, though with rate premiums reflecting increased risk. A borrower who filed Chapter 7 bankruptcy due to medical bills but now has stable income and savings can purchase a home without waiting 4-7 years.

The credit event population is larger than commonly assumed. Approximately 750,000 Americans file bankruptcy annually. The 2008-2012 housing crisis left millions with foreclosures that remained within conventional seasoning windows through 2019 or later. Medical events, divorce, job loss, and other circumstantial triggers create credit events among otherwise creditworthy borrowers.

Foreign National Borrowers

Foreign nationals – non-U.S. citizens and non-permanent residents – often cannot qualify for conventional mortgages due to credit history, documentation, and residency requirements. Non-QM programs serve this population with adapted qualification criteria.

Credit history alternatives substitute for U.S. credit scores. International credit references, rental history, utility payments, and asset-based qualification enable evaluation of foreign national creditworthiness.

Documentation adaptations accommodate international income. Foreign employment verification, international tax returns translated and converted, and bank statements from international institutions support qualification.

The foreign national population includes:

- Permanent residents with insufficient U.S. credit history

- Non-resident investors purchasing U.S. real estate

- Temporary workers (H-1B, L-1, O-1 visa holders) seeking home purchases

Additional Non-QM Segments

Beyond major categories, non-QM serves several additional borrower segments.

Asset depletion borrowers have substantial assets but limited income – retirees, trust beneficiaries, entrepreneurs between ventures. Asset depletion programs divide assets over expected loan term to derive qualifying income. These borrowers may also seek cash-out refinancing to access home equity as an alternative to asset depletion.

Interest-only borrowers seek payment structures that conventional guidelines restrict. Interest-only periods on non-QM loans accommodate borrowers with irregular income or specific cash flow needs.

Jumbo borrowers exceeding agency limits with non-standard income or property types may require non-QM solutions when bank portfolio products are unavailable or insufficient.

Non-warrantable condo borrowers seek financing for properties that conventional programs exclude due to investor concentration, pending litigation, commercial use percentage, or HOA characteristics.

Targeting Strategies for Non-QM Borrower Segments

Reaching non-QM borrowers requires different targeting approaches than conventional mortgage marketing. These borrowers are not searching “mortgage rates” – they often do not know non-QM products exist.

The targeting challenge for non-QM lead generation is fundamentally different from conventional mortgage targeting. Conventional mortgage seekers know they want a mortgage and actively search for options. Non-QM prospects often do not know products exist that could serve their situation. They may have been rejected by conventional lenders and assume homeownership is not available to them. They may not realize their income documentation challenges have solutions. Effective non-QM targeting must therefore combine reaching the right population with educating them about options they did not know existed.

Self-Employed Targeting Approaches

Self-employed borrowers concentrate in specific industries and exhibit identifiable behavioral patterns that enable targeted acquisition.

Industry and occupation targeting reaches self-employment-concentrated professions:

- Contractors and construction trades

- Real estate agents and brokers

- Consultants across industries

- Creative professionals (designers, photographers, writers)

- Technology freelancers and contractors

- Healthcare professionals in private practice

- Legal professionals in small firms

Business-related interest and behavior signals identify self-employed individuals. Engagement with small business content, accounting software usage, business banking indicators, professional networking activity, and business conference attendance correlate with self-employment status.

Platform and community presence reveals self-employment. LinkedIn profiles indicating consulting or self-employment, Upwork and freelance platform presence, small business forum participation, and professional association membership enable identification.

Keyword strategies should emphasize documentation challenges and alternative qualification. Terms like “self-employed mortgage,” “bank statement mortgage,” “mortgage without tax returns,” “self-employed home loan,” “1099 mortgage,” and “business owner mortgage” capture self-employed searchers who understand their documentation challenge.

Content marketing addressing self-employed mortgage challenges captures organic search traffic. Topics like “How Self-Employed Borrowers Qualify for Mortgages,” “Bank Statement Loans Explained,” and “Mortgage Options When Tax Returns Don’t Show Your Real Income” attract self-employed researchers.

Investor Targeting Approaches

Real estate investor targeting benefits from concentrated communities, predictable behaviors, and identifiable property patterns.

Investor community presence creates targeting opportunities. Real estate investor associations (REIAs), BiggerPockets and similar forums, real estate investing podcasts and content, and investor networking events concentrate the target audience.

Property ownership patterns identify investors. Owners of multiple properties, owners of properties in LLC names, absentee owners (address different from property), and owners with recent cash purchases may seek financing for future acquisitions.

Investment-focused keyword strategies capture active investors. Terms like “DSCR loan,” “investor mortgage,” “rental property financing,” “no income verification mortgage,” “investment property loan,” and “landlord mortgage” indicate investor intent.

Content marketing for investors addresses their specific concerns. Topics like “DSCR Loans Explained: Qualifying Based on Property Income,” “How to Finance Your 11th Investment Property,” and “LLC Ownership and Mortgage Financing” attract investor researchers.

Retargeting from investment property listings, real estate investment content, and financial independence communities can reach investors before they actively search for financing.

Credit Event Targeting Approaches

Credit event borrowers are difficult to target directly due to data restrictions and sensitivity, but behavioral and circumstantial signals enable reaching this population.

Credit-related search behavior captures active seekers. Terms like “mortgage after bankruptcy,” “home loan after foreclosure,” “buy house with bad credit,” “mortgage after short sale,” and “credit rebuilding mortgage” indicate credit event borrowers seeking options.

Credit repair and credit education content engagement identifies recovering borrowers. Those reading credit repair guides, using credit monitoring services, or engaging with second-chance financing content may be non-QM candidates.

Life event signals sometimes correlate with credit recovery. Divorce often triggers credit events; divorced individuals seeking home purchases may have credit challenges. Medical-heavy search behavior may indicate medical debt contributors to credit issues.

Content marketing should address credit recovery pathways. Topics like “Buying a Home After Bankruptcy: Your Timeline and Options,” “Mortgage Options 1 Year After Foreclosure,” and “How Non-QM Loans Help Borrowers Rebuild” capture organic traffic from credit event borrowers.

Sensitivity matters in credit event targeting. Messaging should be informative and supportive rather than exploitative. Borrowers navigating credit recovery respond to resources that acknowledge their challenges while presenting solutions.

Foreign National Targeting Approaches

Foreign national targeting varies based on the specific segment – permanent residents, temporary workers, or non-resident investors.

Visa-type targeting for temporary workers reaches H-1B, L-1, O-1, and other visa holders who may seek home purchases. Technology company concentrations, specific industries with high visa usage, and visa-holder communities provide targeting opportunities.

International investor channels reach non-resident buyers. International real estate portals, wealth management referrals, immigration attorney relationships, and cross-border investment content attract foreign national investors.

Expat and immigrant community engagement reaches permanent residents building U.S. credit. Ethnic media, community organizations, cultural associations, and immigration-focused content create touchpoints.

Keyword strategies should include visa-specific terms. Searches like “H1B mortgage,” “visa holder home loan,” “foreign national mortgage,” “non-resident mortgage,” and “ITIN mortgage” capture targeted traffic.

Content marketing addressing foreign national challenges attracts searchers. Topics like “Home Buying for H-1B Visa Holders,” “Mortgage Options Without U.S. Credit History,” and “Non-Resident Real Estate Investment Financing” capture organic traffic.

Landing Page Strategies for Non-QM

Non-QM landing pages require different approaches than conventional mortgage pages because the borrower population, value proposition, and qualification process differ fundamentally.

Value Proposition Framing

Non-QM landing pages must lead with access rather than rate. Conventional mortgage pages emphasize rate comparison and payment savings. Non-QM borrowers seek qualification – the ability to obtain financing at all. Rate is secondary to approval.

Headlines should emphasize qualification and options. Effective patterns include “Mortgage Options for Self-Employed Professionals,” “Financing Solutions When Banks Say No,” “Home Loans Based on Your Bank Statements, Not Tax Returns,” and “Investment Property Loans Based on Rental Income.”

The positioning acknowledges that non-QM borrowers have been declined elsewhere or anticipate difficulty. Messaging should validate their situation without being condescending. “If your income doesn’t fit standard documentation, you’re not alone” resonates better than “Bad credit? No problem!”

Qualification Questions for Non-QM

Form design must capture information relevant to non-QM qualification rather than conventional mortgage qualification.

Employment type determination is foundational. Self-employed versus W-2 status determines product pathway. For self-employed, years in business, business type, and estimated monthly revenue inform bank statement product fit.

Property purpose (primary residence, second home, investment) and for investment properties, rental income estimates enable DSCR product assessment.

Credit event history (bankruptcy within 7 years, foreclosure within 5 years, short sale within 5 years) with timeline information determines non-QM credit event product eligibility.

Documentation capability (availability of bank statements, willingness to provide alternative documentation) assesses non-QM pathway fit.

Citizenship and residency status for foreign national products determines product track.

These qualification questions differ substantially from conventional mortgage forms and should be designed specifically for non-QM rather than adapted from conventional templates.

Trust and Credibility Elements

Non-QM borrowers often approach lenders with skepticism based on prior rejection experiences. Landing pages must establish credibility quickly.

Lender partnership disclosure shows access to actual non-QM products. Generic claims without named lender relationships reduce trust.

Case study or scenario examples make abstract products concrete. “How a consultant with $180,000 income and $60,000 on tax returns qualified for a $500,000 mortgage” demonstrates actual outcomes.

Educational content positioning establishes expertise. Non-QM is complex; pages that explain products clearly demonstrate competence and build trust.

Transparent rate acknowledgment addresses expectations. Non-QM rates carry premiums over conventional; acknowledging this upfront prevents surprise and builds credibility.

Non-QM Buyer Landscape and Relationship Structures

The non-QM buyer landscape differs from conventional mortgage leads, with more concentrated specialization and different relationship dynamics.

Understanding the non-QM buyer ecosystem is essential for sustainable lead operations. Unlike conventional mortgage leads where hundreds of potential buyers compete for inventory, non-QM leads flow through a more concentrated market of specialized lenders, brokers, and non-bank originators. This concentration creates both opportunity and risk: fewer buyers mean potentially stronger individual relationships, but also greater vulnerability if key buyer relationships deteriorate. Building a sustainable non-QM lead business requires understanding buyer specializations, capability requirements, and market positioning within this smaller ecosystem.

Non-QM Lender Categories

Understanding non-QM lender types enables effective buyer relationship building.

Non-QM wholesale lenders provide products through mortgage brokers. These lenders include companies like Angel Oak, Deephaven, Athas Capital, and A&D Mortgage. They require broker relationships and do not purchase leads directly but support brokers who do. Understanding the differences between mortgage lenders and brokers as lead buyers helps navigate these relationship structures.

Non-QM correspondent lenders purchase closed loans from originators. These include United Wholesale Mortgage (UWM) and various regional players. Like wholesale lenders, they typically do not purchase leads directly.

Non-QM retail lenders originate directly to consumers and represent the primary lead buyer category. These include lenders like New American Funding, Caliber Home Loans, and various regional non-QM-focused retail operations.

Mortgage brokers with non-QM wholesale relationships represent significant lead buyers. Brokers specializing in non-QM have established wholesale relationships and convert leads through those channels.

Non-bank mortgage companies focused on non-QM serve as lead buyers with direct origination capability and non-QM product expertise.

Buyer Qualification for Non-QM Leads

Not all mortgage lead buyers can convert non-QM leads. Lead generators must verify buyer capability before routing non-QM inventory.

Product availability verification confirms buyers have access to relevant non-QM products – bank statement programs, DSCR loans, recent credit event programs, or foreign national products. A buyer with only conventional and FHA capability cannot convert non-QM leads.

Underwriting expertise matters for non-QM conversion. Non-QM loans require different documentation review, different income calculation methods, and different exception handling than conventional loans. Buyers without non-QM experience struggle to convert even with product availability.

Processing capacity for non-QM differs from conventional. Non-QM loans typically take longer to close due to manual underwriting and increased documentation. Buyers must have operational capacity for non-QM pipeline management.

Investor relationships affect non-QM conversion. Non-QM loans sell into different secondary markets than conventional – investors like Towd Point, PIMCO, or Verus rather than Fannie Mae and Freddie Mac. Buyers need established investor relationships to fund loans post-origination.

Pricing Dynamics for Non-QM Leads

Non-QM lead pricing reflects different economics than conventional leads.

Lower competition enables different pricing structures. Fewer lead generators focus on non-QM, creating less price competition. However, smaller buyer pools moderate pricing power.

Product-specific value variations exist within non-QM. Self-employed bank statement leads often command premiums given segment size and relative accessibility. DSCR investor leads may price differently based on property type and market. Credit event leads may trade at discounts reflecting conversion uncertainty.

Exclusive versus shared dynamics differ for non-QM. Given limited buyer pools, exclusive relationships may be more common than the broad shared distribution typical in conventional.

Benchmark pricing ranges for quality non-QM leads typically fall between $60-120 for exclusive self-employed leads, $50-100 for exclusive investor DSCR leads, $40-80 for exclusive credit event leads, and $50-90 for exclusive foreign national leads. These ranges vary significantly based on qualification depth, geographic market, and buyer relationships.

Building Non-QM Buyer Relationships

Developing non-QM buyer relationships requires specific approaches.

Specialty identification helps match leads to buyer focus. Some buyers specialize in self-employed bank statement products; others focus on DSCR investor lending; still others concentrate on credit repair scenarios. Understanding buyer specialty enables appropriate matching.

Volume calibration for concentrated markets is essential. The non-QM buyer pool is smaller than conventional, so relationship development matters more than conventional lead generation where buyers are plentiful.

Quality emphasis addresses buyer concerns. Non-QM buyers often experience low-quality lead flow from generators who do not understand non-QM qualification. Demonstrating qualification understanding and lead quality differentiates.

Product education requests help lead generators understand buyer capability. Asking buyers about their specific programs, guidelines, and preferences enables better lead routing and qualification.

Conversion Optimization for Non-QM Leads

Non-QM lead conversion follows different patterns than conventional mortgage leads, requiring adapted optimization approaches.

The conversion dynamics for non-QM leads reflect the educational journey these borrowers must complete before transacting. A conventional refinance prospect knows what they want and can compare options efficiently. A non-QM prospect often needs to understand product options they did not know existed, learn how alternative documentation works, and develop confidence that their unique situation has a viable path forward. This educational requirement extends conversion timelines but also creates relationship depth that can translate into higher lifetime value and referral potential.

Longer Sales Cycles and Nurture Requirements

Non-QM leads typically require longer conversion timelines than conventional mortgage leads.

Education requirements extend the cycle. Many non-QM borrowers do not understand their options or the products available. Initial contacts often involve explanation and education before moving toward application.

Documentation complexity adds time. Bank statement collection, alternative income calculation, and non-standard paperwork take longer than W-2 and paystub verification.

Credit repair timing for credit event borrowers may require waiting for specific milestones – bankruptcy discharge completion, foreclosure seasoning thresholds, or credit score improvements.

Nurture sequences should anticipate longer timelines. Automated follow-up over 30-60-90 days maintains engagement with borrowers not immediately ready. Educational drip content reinforces product understanding and maintains lender presence.

Contact and Engagement Patterns

Non-QM borrower engagement often differs from conventional patterns.

Initial skepticism is common. Borrowers may have experienced rejection from conventional lenders and approach with doubt about non-QM viability. First contacts must establish credibility quickly.

Detail orientation characterizes non-QM borrowers. Self-employed professionals and investors often ask detailed questions about qualification criteria, rate structures, and documentation requirements. Contact representatives need product knowledge beyond basic scripts.

Higher-touch requirements increase conversion cost. Non-QM conversion typically requires more contact time per funded loan than conventional, affecting buyer economics and lead pricing sustainability.

Consultation positioning rather than sales pressure often converts better. Non-QM borrowers seeking education respond to consultative approaches that explain options rather than pressure tactics that push applications.

Conversion Rate Benchmarks

Non-QM conversion rates typically run lower than conventional mortgage leads due to segment complexity.

| Non-QM Segment | Contact Rate | Application Rate | Funding Rate | Overall Conversion |

|---|---|---|---|---|

| Self-Employed | 45-55% | 18-25% | 55-65% | 4-9% |

| Investor DSCR | 50-60% | 20-28% | 60-70% | 6-12% |

| Credit Event | 40-50% | 12-18% | 45-55% | 2-5% |

| Foreign National | 45-55% | 15-22% | 50-60% | 3-7% |

These benchmarks reflect quality leads and capable buyers; actual performance varies significantly based on lead source, buyer expertise, and market conditions.

Quality Indicators Specific to Non-QM

Non-QM lead quality indicators differ from conventional leads.

Documentation readiness matters more. Self-employed borrowers who can provide 12-24 months of bank statements convert faster than those requiring document collection assistance.

Business tenure for self-employed borrowers affects bank statement program eligibility (typically requiring 2+ years in business).

Property identification for investor leads (specific property identified versus general financing interest) affects DSCR program qualification.

Discharge timing for credit event borrowers determines product eligibility windows.

Credit score context for non-QM matters differently than conventional. A 620 score with recent foreclosure differs from a 620 score without major derogatories; non-QM qualification considers both score and event type.

Compliance Considerations for Non-QM Lead Generation

Non-QM lead generation operates under standard mortgage lead compliance frameworks with additional considerations specific to the non-QM context.

Standard Mortgage Compliance Requirements

TCPA consent requirements apply fully to non-QM leads as with all mortgage lead generation. Prior Express Written Consent is required for autodialed or prerecorded calls. Consent documentation through TrustedForm, Jornaya, or equivalent provides compliance evidence.

State licensing requirements through NMLS apply to entities engaged in mortgage origination activities. Lead generators selling to licensed originators generally do not require NMLS registration for pure lead generation activities.

RESPA Section 8 prohibitions on kickbacks for referrals apply to non-QM as to conventional mortgage lead generation.

Fair lending requirements apply to marketing and targeting practices for non-QM leads.

Non-QM-Specific Compliance Considerations

Ability to repay emphasis differs for non-QM. While non-QM loans fall outside the QM safe harbor, lenders must still document ability to repay under TILA. Lead generation messaging should not imply that non-QM eliminates ability to repay requirements – it accommodates alternative documentation, not no documentation.

Higher-priced mortgage loan (HPML) disclosures may apply to non-QM loans depending on rate relationship to APOR. Lead generators should understand that non-QM loans may carry additional consumer protections and disclosure requirements.

Rate advertising requires accuracy. If marketing materials reference non-QM rates, those rates must be available and accurately represented. Non-QM rates vary significantly by borrower profile; generic rate claims may misrepresent.

Credit history marketing requires sensitivity. Marketing targeting credit event borrowers must avoid discriminatory implications or predatory positioning. Messaging should inform about options, not exploit vulnerability.

Buyer Verification Importance

Non-QM buyer verification matters for compliance because not all mortgage companies can legally originate non-QM products.

State licensing verification confirms buyer authority to lend in target states. Non-QM products may have different state availability than conventional.

Investor approval verification confirms buyers have secondary market outlets for non-QM loans. Buyers without investor relationships cannot fund non-QM loans even if they accept applications.

Product-specific compliance verification ensures buyers can appropriately handle non-QM documentation, disclosures, and ability-to-repay requirements.

Operational Considerations for Non-QM Lead Generation

Building non-QM lead generation operations requires specific operational adaptations beyond conventional mortgage practices.

Traffic Source Development

Non-QM traffic sources differ from conventional mortgage acquisition channels.

Organic content investment pays returns for non-QM given lower competition for non-QM keywords and significant educational content opportunity. Building comprehensive non-QM content attracts searchers over time.

Paid search for non-QM keywords faces less competition than conventional mortgage terms, often enabling lower CPCs. However, volume is also lower, limiting scale potential.

Programmatic targeting combining self-employment signals, investor behaviors, or credit recovery interest enables reaching non-QM candidates who are not actively searching.

Community and partnership development with self-employed professional networks, investor groups, and credit repair services creates referral pathways.

Social media targeting for self-employed and investor demographics can reach candidates before they actively search for financing.

Lead Qualification Depth

Non-QM leads require deeper qualification than conventional to enable appropriate buyer matching and conversion optimization.

Employment type and documentation capability determine bank statement versus alternative qualification pathways.

Property purpose and rental income estimates for investment properties enable DSCR product matching.

Credit event specifics including type, timing, and current status determine program eligibility.

Residency and citizenship status for foreign national programs determine product track.

Income estimation approaches for non-W-2 borrowers help assess qualification probability.

Form design, phone verification processes, and qualification scripts must address these non-QM-specific factors rather than applying conventional templates.

Buyer Portfolio Concentration

The smaller non-QM buyer pool requires different portfolio management than conventional mortgage leads.

Relationship depth over breadth matters more for non-QM. Developing strong relationships with fewer specialized buyers often outperforms thin relationships with many buyers.

Backup buyer development ensures distribution options if primary buyers reduce volume or exit. Non-QM buyer markets are smaller, making backup planning more important.

Buyer capability matching by non-QM sub-segment enables appropriate routing. A buyer strong in bank statement products may not have DSCR capability; routing should reflect these differences.

Technology and Routing Adaptations

Lead distribution systems need non-QM-specific configuration.

Non-QM qualification fields must flow into lead records and routing logic. Employment type, credit event status, citizenship status, and other non-QM-relevant fields must be captured and used.

Product-based routing logic should direct self-employed leads to bank statement specialists, investor leads to DSCR-capable buyers, and credit event leads to buyers with appropriate programs.

Buyer capability flags in distribution systems should track which buyers handle which non-QM product types.

Conversion tracking by non-QM segment enables performance optimization specific to each borrower type rather than aggregated conventional metrics.

Frequently Asked Questions

What is non-QM mortgage lead generation?

Non-QM mortgage lead generation focuses on reaching borrowers who do not qualify for conventional or government-backed mortgages under standard documentation and qualification guidelines. These borrowers include self-employed individuals with income documentation challenges, real estate investors seeking property cash flow-based qualification, borrowers with recent credit events like bankruptcy or foreclosure, and foreign nationals without U.S. credit history. Non-QM lead generation requires different targeting strategies, landing page approaches, and buyer relationships than conventional mortgage marketing because the borrower population, value proposition, and product landscape differ fundamentally.

Who are the primary buyers for non-QM leads?

Non-QM leads sell to specialized buyers with non-QM origination capability. Primary buyer categories include non-QM retail lenders who originate directly to consumers, mortgage brokers with wholesale relationships to non-QM lenders, and non-bank mortgage companies focused on non-QM products. Unlike conventional mortgage leads with broad buyer pools, non-QM leads require buyers with specific product access (bank statement programs, DSCR products, credit event programs), underwriting expertise for non-standard documentation, and investor relationships for secondary market sale. Verifying buyer capability before routing leads prevents mismatches that generate returns.

How do I target self-employed borrowers for non-QM leads?

Self-employed borrower targeting combines industry focus, behavioral signals, and keyword strategy. Target self-employment-concentrated industries including contractors, real estate agents, consultants, creative professionals, and technology freelancers. Use behavioral signals like small business content engagement, accounting software usage, and professional network activity. Keyword strategies should emphasize documentation challenges with terms like “self-employed mortgage,” “bank statement loan,” and “mortgage without tax returns.” Content marketing addressing self-employed mortgage challenges captures organic search traffic. LinkedIn and professional network targeting reaches self-employed individuals directly.

What conversion rates should I expect from non-QM leads?

Non-QM leads typically convert at lower rates than conventional mortgage leads due to segment complexity and longer sales cycles. Self-employed leads show overall lead-to-funding rates of approximately 4-9%, with contact rates of 45-55%, application rates of 18-25% from contacts, and funding rates of 55-65% from applications. Investor DSCR leads perform slightly better at 6-12% overall. Credit event leads convert lower at 2-5% due to qualification uncertainty. These benchmarks assume quality leads and capable buyers; performance varies significantly based on lead source quality, buyer expertise, and market conditions.

How does non-QM lead pricing compare to conventional mortgage leads?

Non-QM leads typically price in the $40-120 range for exclusive leads, comparable to or slightly below prime conventional mortgage leads despite lower conversion rates. Lower competition among lead generators and higher per-loan value for non-QM lenders support pricing. Self-employed bank statement leads often command premiums ($60-120) given segment size. Investor DSCR leads price mid-range ($50-100). Credit event leads may trade at discounts ($40-80) reflecting conversion uncertainty. Market conditions, qualification depth, and buyer relationships affect actual pricing. The smaller buyer pool for non-QM leads may support exclusive arrangements more than conventional leads.

What compliance considerations apply specifically to non-QM lead generation?

Non-QM lead generation operates under standard mortgage compliance frameworks (TCPA, RESPA, state licensing, fair lending) with additional considerations. Messaging must not imply that non-QM eliminates ability-to-repay requirements – lenders must still document repayment ability under TILA. Rate advertising requires accuracy; non-QM rates vary significantly by borrower profile. Marketing to credit event borrowers requires sensitivity to avoid predatory positioning. Buyer verification matters because not all mortgage companies can legally originate non-QM products. State licensing, investor approvals, and product-specific capabilities should be verified before routing leads.

How do I build landing pages for non-QM leads?

Non-QM landing pages should lead with access and qualification rather than rate comparison. Headlines should emphasize options and solutions (“Mortgage Options for Self-Employed Professionals,” “Financing Solutions When Banks Say No”). Form design must capture non-QM-relevant information including employment type, business tenure for self-employed, property purpose and rental income for investors, credit event history and timing, and citizenship status for foreign national products. Trust elements should include lender partnership disclosure, case study examples, educational positioning, and transparent rate acknowledgment. Non-QM borrowers often approach with skepticism from prior rejections; credibility establishment matters.

How long is the sales cycle for non-QM leads?

Non-QM leads typically require longer conversion timelines than conventional mortgage leads, often 30-60-90 days from lead to funded loan. Extended timelines result from education requirements (many borrowers do not understand non-QM products), documentation complexity (bank statement collection, alternative income calculation), and timing dependencies for credit event borrowers (waiting for seasoning milestones). Nurture sequences should anticipate these longer timelines with automated follow-up and educational content. Higher-touch requirements increase conversion cost; contact representatives need non-QM product knowledge beyond basic scripts. Consultation positioning typically converts better than sales pressure.

What non-QM borrower segments offer the best opportunity?

Self-employed borrowers represent the largest non-QM segment (40-50% of volume) and offer strong opportunity given population size and relative accessibility through professional network targeting. Real estate investors (25-35% of volume) concentrate in identifiable communities and exhibit predictable behaviors, enabling efficient targeting. Credit event borrowers are harder to reach directly but respond to credit recovery content and second-chance financing messaging. Foreign nationals require segment-specific channels (visa-type targeting, international investor platforms, immigrant community engagement). Most sustainable non-QM operations develop capability across multiple segments rather than concentrating on one.

Key Takeaways

-

Non-QM mortgages serve a substantial market segment – approximately $25-30 billion annually – that conventional lead generation approaches cannot effectively reach. Borrowers in this segment include self-employed professionals with income documentation challenges, real estate investors seeking property cash flow-based qualification, individuals recovering from credit events, and foreign nationals building U.S. credit presence.

-

Targeting strategies must reflect non-QM borrower characteristics. Self-employed targeting emphasizes industry concentration, professional network presence, and documentation-focused keywords. Investor targeting benefits from community engagement, property ownership pattern identification, and DSCR-specific content. Credit event targeting requires sensitivity while addressing searcher intent for second-chance financing options.

-

Landing pages for non-QM must lead with access and qualification rather than rate comparison. Non-QM borrowers seek approval – the ability to obtain financing at all. Forms must capture non-QM-relevant qualification information including employment type, business tenure, property purpose, credit event history, and residency status.

-

The non-QM buyer landscape concentrates among specialized lenders with non-QM product access, underwriting expertise, and investor relationships. Buyer verification before routing prevents mismatches that generate returns. Relationship depth matters more than breadth given the smaller buyer pool.

-

Conversion rates for non-QM run lower than conventional (2-12% depending on segment) with longer sales cycles (30-90 days) and higher-touch requirements. Nurture sequences, educational content, and consultation positioning support conversion. Contact representatives need genuine non-QM product knowledge.

-

Compliance considerations include standard mortgage requirements (TCPA, RESPA, licensing, fair lending) plus non-QM-specific elements around ability-to-repay messaging, rate advertising accuracy, and sensitive positioning for credit event borrowers.

-

Operational success requires non-QM-specific traffic source development (lower-competition keywords, professional networks, investor communities), deep qualification processes, concentrated buyer relationships, and technology systems configured for non-QM routing logic.

Market data and pricing benchmarks current as of December 2025. Non-QM products, lender guidelines, and market conditions change continuously. Validate current conditions through industry sources and buyer feedback before making significant operational decisions. This article provides general information about non-QM mortgage lead generation and does not constitute legal or financial advice.