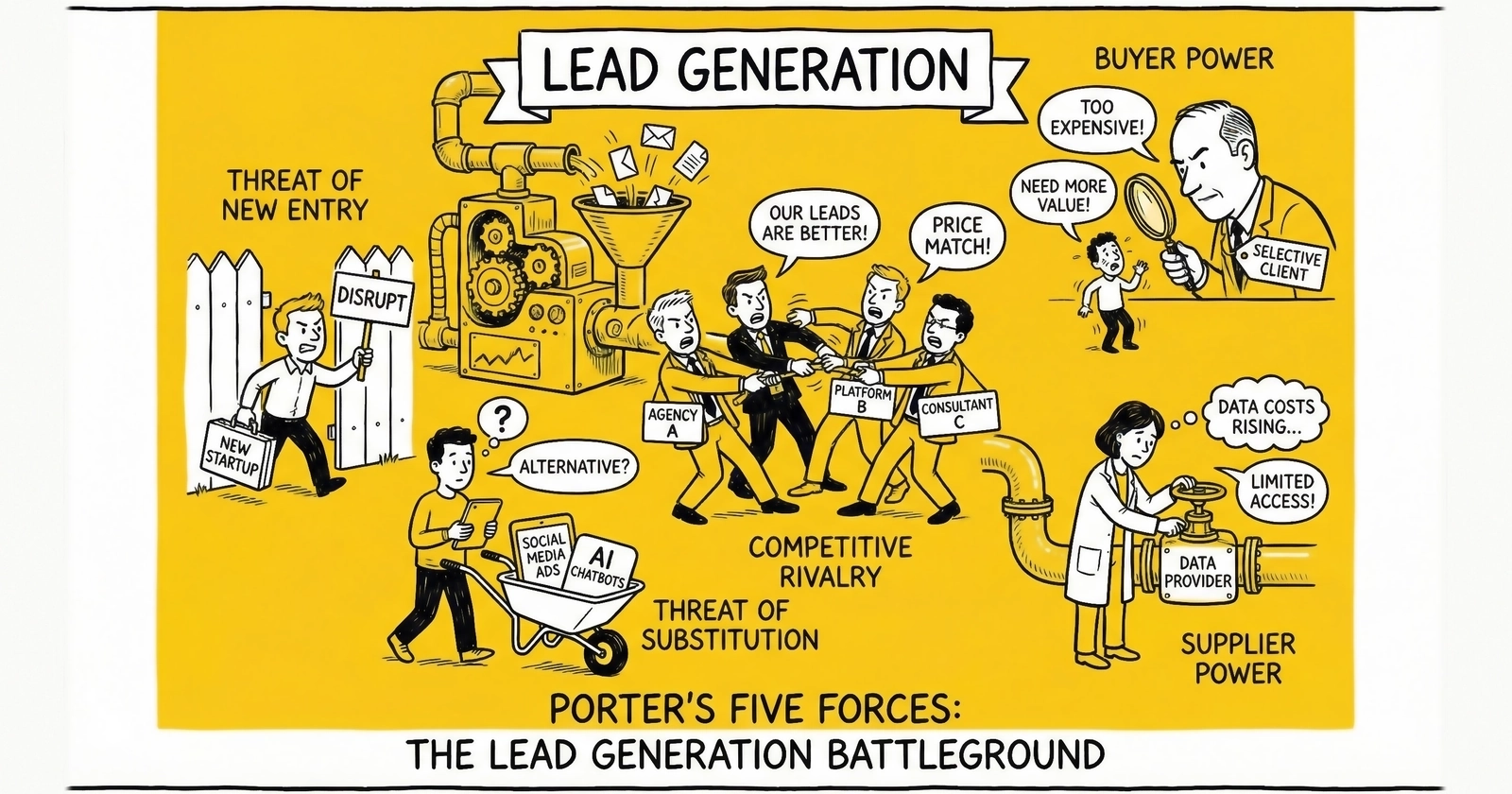

Apply Michael Porter’s Five Forces framework to lead generation – understand competitive rivalry, supplier power, buyer power, substitution threats, and entry barriers to improve strategic positioning.

Michael Porter’s Five Forces framework, introduced in 1979, remains the foundational tool for understanding industry profitability and competitive dynamics. For lead generation operators navigating a market projected to grow from $5.03 billion in 2024 to $21.43 billion by 2033, this framework reveals why some companies thrive while others struggle despite similar business models. The five forces – competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants – collectively determine the structural attractiveness of the lead generation industry and illuminate strategic paths to sustainable profitability.

Porter’s model examines five structural forces that shape long-term profitability in any industry. Unlike transient factors like marketing campaigns or economic cycles, these forces represent persistent industry characteristics that determine the upper bounds of profitability for all participants. In lead generation, where gross margins typically range from 15% to 40% depending on vertical and business model, understanding these forces explains the variance and points toward strategic improvement.

The lead generation industry presents a compelling case study because it sits at the intersection of technology, marketing, and regulated consumer transactions. This complexity means all five forces operate with significant intensity, making strategic positioning both more challenging and more valuable when achieved correctly.

Force 1: Competitive Rivalry (High Intensity)

Competitive rivalry in lead generation is intense by any measure. The industry exhibits nearly every characteristic Porter identified as driving fierce competition.

Fragmented Competition

Despite significant consolidation activity – including HubSpot’s April 2024 acquisition of Terminus – the lead generation market remains highly fragmented. The top five global solution providers serve only 34% of B2B companies using lead generation tools. Even the top 15 providers collectively control just 48% of global lead gen spend. This fragmentation means no single competitor can set industry prices or standards, forcing continuous competition on multiple dimensions.

Product Commoditization

Leads themselves are largely undifferentiated commodities. An insurance lead – as distinct from prospects and customers – meeting specific demographic and coverage criteria is functionally interchangeable regardless of which operator generated it. This commoditization drives price-based competition that erodes margins across the industry. Operators who fail to differentiate through quality metrics, compliance documentation, or service levels find themselves competing solely on price – a race to the bottom that benefits no one except lead buyers.

High Exit Barriers

Lead generation businesses often carry significant exit barriers including:

- Technology investments in ping-post platforms, CRM integrations, and compliance infrastructure

- Publisher relationships developed over years

- Contractual obligations with buyers

- Specialized workforce knowledge difficult to redeploy

These barriers keep struggling operators in the market longer than profitability would suggest, perpetuating competitive intensity even during downturns. Unlike industries where unprofitable competitors exit cleanly, lead generation sees prolonged price competition from operators who can’t easily shut down.

Low Switching Costs

Both buyers and publishers can switch between lead generation operators with minimal friction. Most ping-post integrations require days rather than months to implement. This liquidity in business relationships intensifies competition because no relationship is truly secure. Operators must continuously justify their value proposition or risk losing partners to competitors offering marginally better terms.

Implications for Operators

High competitive rivalry means sustainable profits require either scale advantages that reduce unit costs or differentiation that commands premium pricing. Operators stuck in the middle – without scale or differentiation – face the most challenging position. The data shows this clearly: while the overall market grows at 17.48% CAGR, profitability varies dramatically among participants.

Force 2: Supplier Power (Increasing)

In lead generation, suppliers are primarily publishers – the website operators, content creators, and traffic generators who produce the raw material (consumer attention and engagement) that becomes leads. Secondary suppliers include technology vendors, data providers, and compliance infrastructure companies.

Publisher Power Dynamics

Publisher power has increased substantially as digital advertising costs rise and quality traffic sources become scarcer. Several factors drive this shift:

Concentration of Quality Traffic: While thousands of publishers exist, a relatively small number generate high-quality, compliant traffic that converts well and survives compliance scrutiny. These premium publishers can command favorable terms because lead generation operators compete intensely for their inventory.

Rising Traffic Acquisition Costs: Google and Facebook advertising costs have increased steadily, squeezing publisher margins and giving negotiating power to publishers who have developed alternative traffic sources. Publishers with owned-and-operated content, organic search rankings, or proprietary traffic channels command premium rates.

Forward Integration Capability: Sophisticated publishers increasingly bypass lead aggregators to sell directly to end buyers. Publishers who build direct relationships with insurance carriers or mortgage lenders capture margin that previously went to lead generation operators. This credible threat of forward integration strengthens publisher negotiating position.

Unique Content and Compliance: Publishers who maintain proprietary consent language, TCPA-compliant capture mechanisms, and documented compliance infrastructure become more valuable as regulatory scrutiny intensifies. These publishers have invested in differentiation that cannot be easily replicated.

Technology Supplier Dynamics

Technology vendors – particularly those providing ping-post platforms, consent management, and compliance documentation – have gained power as regulatory requirements tighten. Operators locked into specific technology ecosystems face switching costs that strengthen vendor bargaining positions. The trend toward integrated platforms (exemplified by ZoomInfo’s May 2024 launch of AI-powered Copilot) increases this dependency.

Strategic Response to Supplier Power

Operators can mitigate supplier power through:

- Publisher diversification to reduce dependency on any single traffic source

- Backward integration into owned-and-operated properties

- Long-term contracts with performance guarantees that create mutual dependency

- Investment in proprietary technology that reduces reliance on third-party vendors

Force 3: Buyer Power (Significant)

Lead buyers – the insurance carriers, mortgage lenders, home services companies, and other businesses purchasing leads – wield considerable power in most lead generation relationships.

Concentration and Scale

In many verticals, lead buying is concentrated among relatively few large purchasers. In insurance, major carriers like Progressive, GEICO, and Allstate purchase substantial portions of available inventory. In mortgage, large lenders and aggregators dominate buying. This concentration gives individual buyers significant negotiating power.

The contrast with supplier fragmentation is stark: while publishers are numerous and fragmented, buyers are often consolidated. This asymmetry shifts industry profitability toward buyers and away from lead generation operators.

Price Transparency and Comparison

Ping-post technology has dramatically increased price transparency for lead buyers. Real-time bidding enables buyers to compare offers across multiple lead sources simultaneously. This transparency eliminates information advantages that lead generation operators might otherwise exploit and commoditizes pricing across the market.

Forward Integration Threat

Large lead buyers credibly threaten to build internal lead generation capabilities. Insurance carriers have established in-house digital marketing teams. Mortgage lenders have acquired lead generation companies. Solar companies have developed direct-to-consumer marketing operations. This credible threat of backward integration (from the buyer’s perspective) strengthens buyer bargaining position in all negotiations.

Low Switching Costs

Buyers can add or remove lead sources quickly. Most lead distribution platforms support multiple simultaneous sources, making it easy for buyers to shift volume toward better-performing or lower-cost providers. This liquidity intensifies price pressure on lead generation operators.

Quality Sensitivity Creates Opportunity

Despite significant buyer power, quality-focused operators find advantage in performance metrics. Buyers care deeply about contact rates, conversion rates, and compliance documentation. Operators who demonstrably outperform on these metrics can command premium pricing even in commoditized markets. The challenge lies in proving quality – which requires comprehensive tracking, transparent reporting, and documented compliance processes.

Force 4: Threat of Substitution (Underestimated)

Substitution threats in lead generation are often underestimated because they don’t come from traditional competitors. Instead, they emerge from alternative approaches to the same fundamental problem: customer acquisition.

AI-Powered Customer Acquisition

Artificial intelligence is transforming how companies identify and acquire customers. Companies using AI report up to 50% increases in lead generation efficiency and 47% higher conversion rates. More significantly, AI enables approaches that bypass traditional lead generation entirely:

- Predictive analytics that identify high-propensity prospects from existing customer data

- Intent data platforms that detect buying signals before consumers actively seek quotes

- Automated outreach that engages prospects at scale without purchasing third-party leads

- Conversational AI that qualifies prospects in real-time

These AI capabilities don’t compete with lead generation operators directly – they substitute for the entire category.

Social Media Direct Response

Platforms like Facebook, Instagram, and LinkedIn enable advertisers to generate leads directly without intermediaries. Meta’s lead generation ad formats provide native form fills within the platform experience. For advertisers with sufficient scale and expertise, these direct channels substitute for third-party lead sources while offering greater control over targeting and messaging.

The 80% of B2B leads generated through LinkedIn demonstrates how platform-native lead generation can dominate specific segments.

In-House Lead Generation Programs

Large enterprises increasingly build internal teams to handle functions previously outsourced to lead generation companies. The same digital marketing expertise that lead generation operators sell as a service is now available through hiring, training, and technology investments. While capital-intensive, in-house programs eliminate margin paid to intermediaries and provide greater control over compliance and quality.

Content Marketing and SEO

Content marketing represents a substitution threat because it generates leads through owned assets rather than paid acquisition. Companies investing in SEO, thought leadership, and educational content generate leads at marginal costs approaching zero once content assets exist. While time-to-value is longer than purchased leads, the unit economics often prove superior over time.

Implications of Substitution Threats

Substitution threats are most dangerous when they’re invisible until it’s too late. Lead generation operators who focus exclusively on competing with other lead generation operators may miss the more fundamental threat from companies abandoning third-party leads entirely. Strategic monitoring of substitution trends – AI adoption rates, in-house investment patterns, platform-native lead generation growth – provides early warning of shifting demand.

Force 5: Threat of New Entrants (Moderate)

The lead generation industry presents a complex picture for potential new entrants. While some barriers exist, they’re insufficient to prevent determined competitors from entering.

Low Capital Requirements

Unlike manufacturing or infrastructure businesses, lead generation requires modest capital investment. Cloud-based platforms, pay-per-click advertising, and SaaS technology stacks enable new entrants to begin operations with limited upfront investment. The 68% of lead generation solutions deployed via cloud in 2024 reflects this low-capital-intensity reality.

Technology Accessibility

Ping-post platforms, consent management tools, and CRM integrations are available as commercial services. New entrants need not build proprietary technology – they can assemble functional operations from available components. This accessibility lowers technical barriers that might otherwise protect incumbents.

Regulatory Complexity as Barrier

Compliance requirements create meaningful barriers for new entrants. TCPA litigation risk, FTC enforcement scrutiny, state mini-TCPA laws, and evolving consent requirements demand specialized knowledge and infrastructure. New entrants who underestimate compliance complexity face significant liability exposure. However, this barrier protects only against unsophisticated entrants – well-capitalized competitors with compliance expertise can still enter readily.

Relationship Barriers

Established operators benefit from buyer and publisher relationships developed over years. Trust, performance history, and integration depth create switching costs that benefit incumbents. However, these relationship barriers erode over time as buyers and publishers continuously evaluate alternatives.

Scale Economies Are Limited

Unlike industries with significant scale economies, lead generation provides modest benefits from size. Larger operators don’t benefit from dramatically lower unit costs – a lead costs roughly the same to generate regardless of company size. This absence of scale economies means new entrants can achieve cost parity relatively quickly.

Brand and Reputation

In an industry plagued by compliance violations and quality issues, established reputation provides meaningful advantage. Buyers prefer known quantities, and publishers prefer partners with track records of payment reliability. However, reputation barriers are surmountable through demonstrated performance.

Strategic Responses: Porter’s Generic Strategies

Porter identified three fundamental strategic approaches for competing in any industry: cost leadership, differentiation, and focus. In lead generation, each approach manifests distinctly.

Cost Leadership

Cost leadership in lead generation means achieving the lowest cost per lead through operational efficiency, technology automation, and traffic source optimization. Cost leaders can compete on price while maintaining acceptable margins – or capture above-average margins while pricing at market rates.

Achieving cost leadership requires:

- Scale in traffic acquisition that provides buying power with publishers and platforms

- Technology automation that reduces manual processing costs

- Vertical integration into owned traffic sources

- Operational discipline that eliminates waste

Cost leadership carries risks in lead generation because quality frequently suffers when operators optimize purely for cost. Buyers eventually detect quality degradation through performance metrics, eroding the sustainable advantage that cost leadership should provide.

Differentiation

Differentiation means providing superior value that commands premium pricing. In lead generation, differentiation typically manifests as:

Quality Differentiation: Higher contact rates, better conversion rates, and superior lead attributes justify premium pricing. Quality differentiation requires investment in traffic source management, compliance infrastructure, and performance optimization that demonstrates true ROI.

Compliance Differentiation: Comprehensive consent documentation, TrustedForm certificates, call recording compliance, and regulatory expertise reduce buyer risk. As litigation costs rise, compliance differentiation commands increasing premiums.

Service Differentiation: Dedicated account management, custom integrations, real-time performance reporting, and consultative support create value beyond the lead itself. Service differentiation builds switching costs that strengthen relationships.

Vertical Expertise: Deep knowledge of specific industries – insurance types, mortgage products, home services categories – enables better matching, improved conversion, and superior buyer service.

Focus (Niche Strategy)

Focus means serving a narrow market segment better than broad competitors can. In lead generation, focus strategies include:

Vertical Focus: Specializing exclusively in specific industries like Medicare, solar, or legal enables deep expertise impossible for generalists to match.

Geographic Focus: Concentrating on specific regions enables local market knowledge and relationship depth.

Product Focus: Specializing in specific lead types (live transfers vs. form fills, exclusive vs. shared) enables optimization impossible for operators selling everything.

Focus strategies sacrifice scale for depth. Focused operators often achieve superior unit economics within their niches while remaining too small to attract competition from larger players.

Applying Five Forces Analysis: A Practical Framework

Lead generation operators can apply Porter’s framework through structured analysis:

Step 1: Map Industry Structure

Identify specific competitors, publishers, buyers, substitutes, and potential entrants in your market segments. Generic analysis provides less value than specific understanding of your competitive environment.

Step 2: Assess Force Intensity

Rate each force’s intensity (low, moderate, high) based on specific evidence. Document the factors driving each assessment. This documentation enables tracking changes over time and provides foundation for strategic planning.

Step 3: Identify Force Interdependencies

Forces interact with each other. High buyer power may attract new entrants hoping to serve underserved buyers. Intense rivalry may drive consolidation that changes competitive dynamics. Understanding interdependencies enables more sophisticated strategic planning.

Step 4: Project Force Evolution

Forces change over time. AI adoption may intensify substitution threats. Regulatory changes may raise entry barriers. Publisher consolidation may shift supplier power. Projecting force evolution enables proactive rather than reactive strategy.

Step 5: Position Against Forces

Select strategic positions that protect against unfavorable forces while leveraging favorable ones. If buyer power is high, differentiation strategies that create switching costs may be most valuable. If substitution threats are rising, vertical integration into buyer operations may provide protection.

Common Pitfalls in Lead Generation Strategy

Porter’s framework reveals common strategic errors in lead generation:

Ignoring Interdependencies

Operators who analyze forces in isolation miss critical interactions. Intense rivalry drives down prices, which reduces publisher payments, which drives quality publishers toward direct buyer relationships, which intensifies rivalry further. Understanding these feedback loops enables more effective strategy.

Mistaking Growth for Profitability

The lead generation market’s 17.48% projected CAGR attracts operators who assume growth equals profit. However, growth attracting new entrants and intensified rivalry often captures industry growth as competitive activity rather than participant profits. Strategic positioning within growing markets matters more than market growth itself.

Underestimating Substitution

Lead generation operators typically focus on competing with other lead generation operators while ignoring substitution threats from AI, in-house programs, and platform-native advertising. This narrow focus leaves operators vulnerable to category-level disruption.

Static Analysis

Porter’s framework describes forces at a point in time, but forces evolve continuously. Operators who treat five forces analysis as a one-time exercise miss shifts that create strategic opportunities or threats. Regular reassessment enables adaptive strategy.

The AI Era: Five Forces Under Technological Disruption

The emergence of AI capabilities is reshaping all five forces in lead generation:

Competitive Rivalry: AI enables smaller operators to achieve efficiency previously requiring scale, potentially intensifying rivalry as capability gaps narrow.

Supplier Power: AI-generated content may reduce dependency on traditional publishers while AI traffic detection may strengthen quality publishers’ position.

Buyer Power: AI-powered lead scoring enables buyers to discriminate more effectively among sources, potentially increasing buyer power through better information.

Substitution Threats: AI represents the most significant intensifier of substitution threats, enabling approaches that bypass lead generation entirely.

Entry Barriers: AI lowers some entry barriers (technology accessibility) while raising others (sophistication required to compete effectively).

Operators who integrate AI capabilities while maintaining compliance rigor position themselves advantageously as these force shifts continue.

Conclusion

Porter’s Five Forces framework reveals why lead generation profitability varies so dramatically among participants despite similar business models. The industry’s intense competitive rivalry, increasing supplier power, significant buyer power, underestimated substitution threats, and moderate entry barriers collectively squeeze margins for undifferentiated operators while creating opportunity for those who position strategically.

In a market projected to grow from $5.03 billion to $21.43 billion over the next decade, strategic positioning matters more than market participation alone. Operators who achieve cost leadership, meaningful differentiation, or focused expertise can capture above-average returns. Those stuck in the middle – without scale, differentiation, or focus – face the structural forces that Porter’s framework so clearly illuminates.

The framework’s enduring value lies not in providing easy answers but in structuring strategic thinking. Lead generation operators who regularly assess their competitive position against these five forces, project force evolution, and adjust strategy accordingly position themselves to thrive amid industry transformation.

Key Takeaways

-

Lead generation exhibits intense competitive rivalry driven by commoditized products, low switching costs, and a fragmented market where the top 15 providers control only 48% of global spend.

-

Publisher power (suppliers) has increased dramatically as traffic costs rise and quality traffic sources become scarcer, with top-performing publishers commanding premium rates and credibly threatening forward integration.

-

Lead buyers (customers) wield significant power through concentration, price transparency via ping-post technology, and the credible threat of building in-house lead generation capabilities.

-

Substitution threats are the most underestimated force – AI-powered customer acquisition, social media direct response, and in-house programs don’t compete with lead sellers directly but replace the need for purchased leads entirely.

-

Strategic differentiation offers more sustainable positioning than price competition – compliance infrastructure, vertical specialization, and technology integration create defensible advantages.

-

The market’s 17.48% CAGR attracts new entrants, but growth doesn’t guarantee profitability – operators must position strategically within the growing market to capture value.

-

Exit barriers keep struggling operators in the market longer than profitability suggests, perpetuating competitive intensity even during downturns through technology investments and relationship dependencies.

-

AI is reshaping all five forces simultaneously – intensifying substitution threats while potentially moderating entry barriers through technology accessibility.

-

Porter’s three generic strategies apply directly to lead generation: cost leadership through operational efficiency, differentiation through quality and compliance, and focus through vertical or geographic specialization.

-

The framework’s enduring value lies in structuring strategic thinking, not providing easy answers – operators who regularly assess competitive position against these five forces can adapt to industry transformation.

Understanding Porter’s Five Forces in Lead Generation Context

Frequently Asked Questions

How often should lead generation companies perform Five Forces analysis?

Comprehensive Five Forces analysis should be conducted annually, with quarterly monitoring of key force indicators. Significant market events – major acquisitions, regulatory changes, technology disruptions – warrant immediate reassessment. The lead generation industry’s rapid evolution means static analysis quickly becomes obsolete.

Which force poses the greatest threat to lead generation profitability?

Substitution threats are currently the most underestimated danger. While operators focus on competitive rivalry, AI-powered customer acquisition, social media direct response, and in-house lead generation programs threaten the category itself. Operators should monitor buyer AI adoption rates, in-house investment patterns, and platform-native lead generation growth as leading indicators.

How can small operators compete against larger competitors using Porter’s framework?

Focus strategies offer the most viable path for smaller operators. By specializing in specific verticals (Medicare, solar, legal), geographic regions, or lead types (live transfers, exclusive leads), smaller operators can achieve superior expertise and service quality that generalist competitors cannot match. The framework shows that scale provides limited advantage in lead generation, making focus strategies particularly effective.

Does Porter’s Five Forces framework still apply in the AI era?

The framework remains relevant but requires adaptation. AI affects all five forces simultaneously – intensifying some (substitution threats), potentially moderating others (entry barriers through technology accessibility), and creating new dynamics (AI-powered quality discrimination by buyers). The fundamental insight – that industry structure determines profitability potential – holds true regardless of technological context.

How do compliance requirements affect competitive dynamics in lead generation?

Compliance requirements create meaningful entry barriers and differentiation opportunities. TCPA litigation risk, FTC enforcement, and state mini-TCPA laws require specialized knowledge and infrastructure that unsophisticated entrants often lack. Operators who invest in comprehensive compliance documentation, TrustedForm certificates, and regulatory expertise can differentiate on risk reduction, commanding premium pricing from compliance-conscious buyers.

What is the relationship between Porter’s Five Forces and profitability in lead generation?

Porter’s framework explains profitability variance by revealing structural forces that compress or expand margins industry-wide. In lead generation, intense rivalry, high buyer power, and rising substitution threats collectively limit profitability for undifferentiated operators regardless of execution quality. The top 15 providers controlling only 48% of market spend indicates fragmentation that intensifies price competition. Operators achieving above-average profitability typically do so through strategic positioning – cost leadership, differentiation, or focus – that protects against unfavorable forces rather than simply outworking competitors.

Sources

- Business Research Insights - Lead Generation Solutions Market

- Market Research Future - B2B Lead Generation Market

- Roots Analysis - Lead Generation Market

- Market.us - Lead Generation Statistics

- UpLead - Lead Generation Statistics 2025

- Porter, Michael E. “Competitive Strategy: Techniques for Analyzing Industries and Competitors.” Free Press, 1980.

- Porter, Michael E. “The Five Competitive Forces That Shape Strategy.” Harvard Business Review, January 2008.