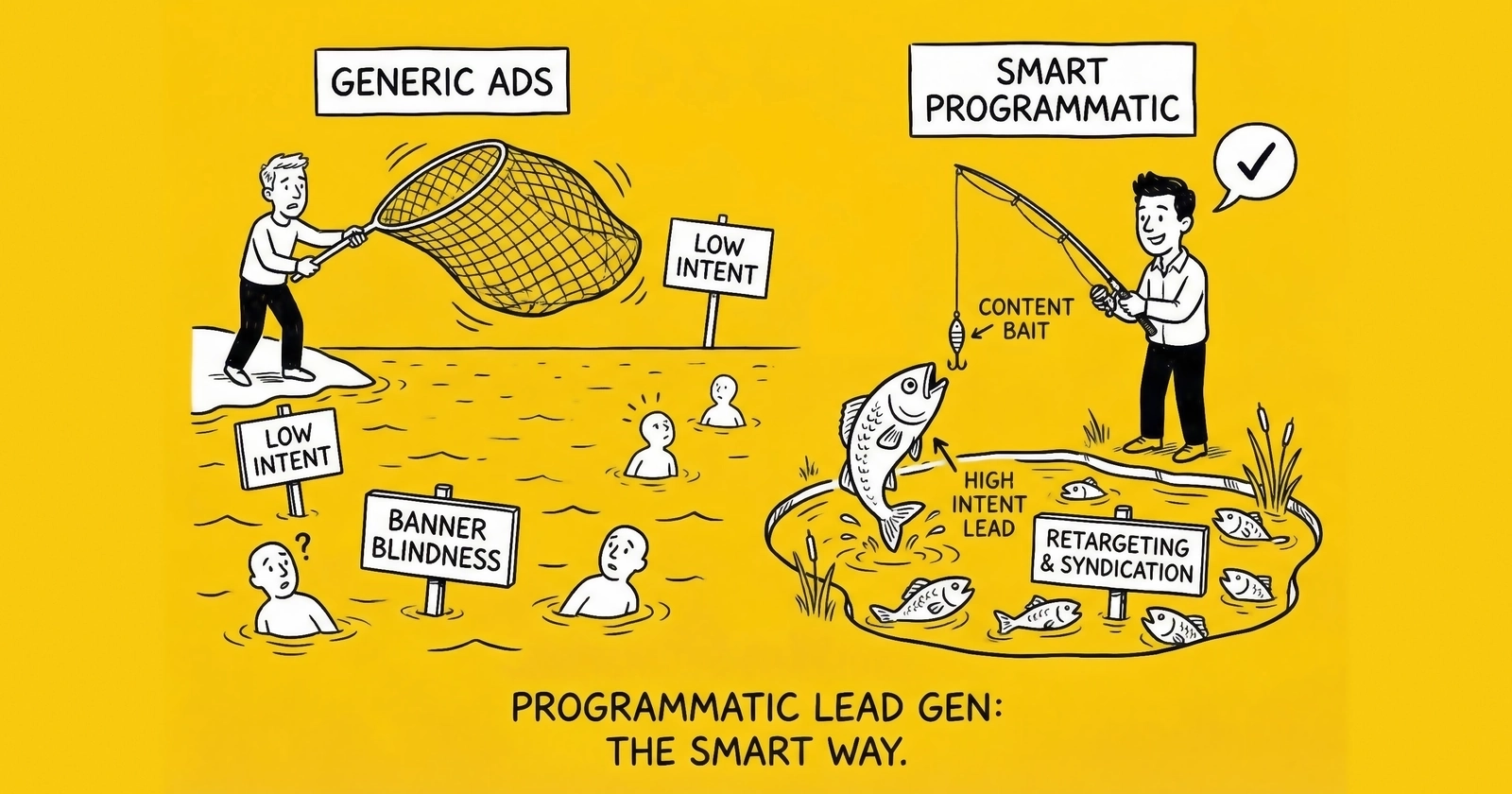

Master programmatic display buying to reach high-value audiences across premium inventory at scale, with real CPL benchmarks, DSP selection criteria, and targeting strategies that deliver qualified leads beyond walled gardens.

Programmatic advertising accounts for 91% of all digital display ad spending in 2026. That represents over $168 billion in the United States alone. While most lead generators focus exclusively on Google and Meta, a massive opportunity exists in the programmatic ecosystem – automated buying across millions of premium websites, apps, and connected TV platforms.

Those who figure out programmatic access audience reach that dwarfs any single platform. Instead of competing in Facebook’s auction against every other lead generator targeting the same audiences, programmatic lets you reach those same consumers on ESPN, The New York Times, Weather.com, and thousands of other properties – often at lower CPMs and with less audience fatigue.

But programmatic is not a set-and-forget solution. It requires understanding demand-side platforms, real-time bidding mechanics, data targeting capabilities, viewability standards, and fraud prevention. Get it right, and you diversify your traffic sources while accessing premium inventory your competitors ignore. Get it wrong, and you waste budget on non-viewable impressions, fraudulent traffic, and audiences that never convert.

What Is Programmatic Display Advertising?

Programmatic advertising is the automated buying and selling of digital ad inventory through software platforms. Instead of negotiating directly with publishers for ad placements, advertisers use demand-side platforms (DSPs) to bid on impressions in real-time auctions that complete in milliseconds.

When a user loads a webpage containing ad space, that impression becomes available in an auction. Multiple advertisers submit bids simultaneously through their DSPs. The winning bid gets the impression, and the ad loads – all before the page finishes rendering. This entire process takes less than 100 milliseconds.

How Programmatic Works for Lead Generation

For lead generators, programmatic offers several advantages over platform-specific advertising.

Scale Beyond Walled Gardens: While Facebook has 3 billion users and Google reaches most of the internet through search, programmatic buying accesses inventory across hundreds of thousands of websites, apps, and connected TV platforms. You can reach your target audience wherever they consume content, not just within platform boundaries.

Audience Portability: Data segments you build or purchase work across all inventory sources. A custom audience of homeowners aged 45-65 in Texas can be targeted on local news sites, weather apps, sports streaming platforms, and premium publishers – all through a single DSP campaign.

Premium Inventory Access: Direct publisher relationships that once required six-figure commitments and months of negotiation are now accessible through programmatic. You can serve ads on Forbes, CNN, ESPN, and The Wall Street Journal through the same platform you use for smaller publishers.

Frequency Control: Unlike platform-specific campaigns where you control frequency only within that platform, programmatic lets you manage ad exposure across all your display inventory. This prevents the audience fatigue that kills conversion rates.

The Programmatic Ecosystem

Understanding the ecosystem helps you navigate it effectively.

Demand-Side Platforms (DSPs): These are the platforms advertisers use to buy inventory. They connect to multiple ad exchanges and supply-side platforms, providing access to billions of daily impressions. Major DSPs include Google’s DV360, The Trade Desk, Amazon DSP, and several mid-market options.

Supply-Side Platforms (SSPs): Publishers use SSPs to make their inventory available for programmatic buying. SSPs connect to DSPs through ad exchanges, maximizing revenue for publishers while providing advertisers access to quality inventory.

Ad Exchanges: These are the marketplaces where DSPs and SSPs connect. They facilitate real-time auctions and handle the technical infrastructure for millions of transactions per second.

Data Management Platforms (DMPs): These platforms aggregate and organize audience data from multiple sources, enabling sophisticated targeting. Many DMPs integrate directly with DSPs for streamlined audience activation.

Major DSP Platforms for Lead Generation

Choosing the right DSP determines your reach, targeting capabilities, and operational complexity. Each platform serves different needs based on budget, technical resources, and vertical focus.

Google Display & Video 360 (DV360)

DV360 is Google’s enterprise DSP, providing access to Google’s display network plus all major ad exchanges. It represents the largest single source of programmatic inventory.

Reach and Scale: DV360 accesses over 80 ad exchanges and SSPs, reaching over 90% of global internet users. It integrates smoothly with Google’s ecosystem – YouTube, Gmail, Discover, and Google Display Network – while also accessing third-party inventory.

Targeting Capabilities: The platform offers Google’s first-party audience segments built from search behavior, YouTube viewing, and Chrome browsing data. Combined with third-party data providers, you can build highly specific audience segments. Affinity audiences, in-market audiences, and custom intent audiences work across all inventory sources.

Cost Structure: Minimum commitments typically start at $10,000-25,000 monthly, though access is often available through agency relationships at lower thresholds. Platform fees run approximately 10-15% of media spend.

Best For: Advertisers with $25,000+ monthly programmatic budgets who want maximum reach and integration with existing Google Ads campaigns. The learning curve is significant – expect 30-60 days to optimize campaigns effectively.

Lead Generation Performance: Insurance and financial services advertisers report CPLs of $35-85 through DV360, with strong performance in retargeting and audience extension campaigns. Display prospecting typically runs 30-50% higher CPL than search but provides scale that search cannot match.

The Trade Desk

The Trade Desk has emerged as the leading independent DSP, valued for transparency, advanced targeting, and connected TV capabilities. It lacks the conflicts of interest that come with Google’s dual role as publisher and ad platform.

Reach and Scale: Access to all major ad exchanges and SSPs, with particular strength in connected TV inventory. The platform reaches 700+ million connected TV devices and maintains direct integrations with major streaming platforms.

Targeting Capabilities: The Trade Desk’s Unified ID 2.0 initiative addresses cookie deprecation by creating a privacy-compliant identity framework. The platform offers advanced contextual targeting, third-party data integrations, and sophisticated lookalike modeling.

Cost Structure: No minimum spend requirements for direct access, though most users work through agencies or managed service. Platform fees are typically transparent and competitive.

Best For: Advertisers seeking independence from Google/Meta ecosystems, those prioritizing connected TV, or those requiring maximum transparency into auction dynamics and inventory sources.

Lead Generation Performance: Particularly strong for upper-funnel prospecting where visual impact matters. Solar, home services, and insurance verticals report CPMs of $8-18 and CPLs of $40-110 depending on targeting precision and vertical.

Amazon DSP

Amazon’s DSP accesses both Amazon-owned properties and third-party inventory, with unique access to Amazon’s purchase data for targeting.

Reach and Scale: Reaches Amazon properties (including Fire TV, IMDb, Twitch) plus third-party inventory through major exchanges. The platform covers approximately 270 million unique monthly users in the United States.

Targeting Capabilities: Amazon’s purchase behavior data provides targeting capabilities unavailable elsewhere. You can target consumers who purchased solar panels, recently bought a home, or subscribe to specific services. This purchase-intent data often outperforms demographic or behavioral targeting.

Cost Structure: Self-service requires $35,000+ minimum spend, though managed service options are available at lower thresholds through agency relationships.

Best For: E-commerce-adjacent verticals and advertisers who want to leverage purchase behavior data. Home services, insurance, and financial services benefit from Amazon’s ability to identify life-stage transitions (new homeowners, parents, retirees).

Lead Generation Performance: Strong for targeting based on purchase behavior. Home insurance advertisers report reaching new homeowners within 30 days of purchase at CPMs of $10-20. The platform’s audience data often justifies premium CPMs through improved lead quality.

Mid-Market DSP Options

Several platforms serve advertisers with smaller budgets or specific vertical needs.

StackAdapt: Canadian-based DSP with strong native and connected TV capabilities. Minimum spend around $5,000-10,000 monthly. Particularly popular with agencies serving mid-market clients. Self-serve interface is more accessible than enterprise platforms.

Basis (Centro): Combines DSP functionality with campaign management tools. Strong for advertisers managing multiple channels who want unified reporting. Minimum commitments typically $10,000+ monthly.

Simpli.fi: Focuses on localized advertising with strong geo-targeting capabilities. Minimum spend approximately $5,000 monthly. Particularly effective for home services and local service-area businesses.

Criteo: Originally a retargeting specialist, now offers full-funnel programmatic. Strong retail and e-commerce data. Minimum spend varies but typically accessible at $3,000-5,000 monthly.

DSP Comparison for Lead Generation

| Platform | Min. Monthly | Best For | CPM Range | Lead Gen CPL Range |

|---|---|---|---|---|

| DV360 | $10,000-25,000 | Scale, Google integration | $3-12 | $35-85 |

| Trade Desk | No minimum | CTV, transparency | $5-18 | $40-110 |

| Amazon DSP | $35,000 | Purchase data targeting | $10-25 | $45-95 |

| StackAdapt | $5,000-10,000 | Native, mid-market | $4-15 | $30-80 |

| Simpli.fi | $5,000 | Local targeting | $3-10 | $35-90 |

Audience Targeting Strategies for Lead Generation

Programmatic’s power comes from layering multiple targeting dimensions. Unlike platform-specific advertising where you are limited to that platform’s data, programmatic lets you combine first-party, third-party, and contextual data for precision targeting.

First-Party Data Activation

Your existing customer and prospect data becomes your most valuable programmatic asset. First-party data outperforms third-party data by 2-3x in most lead generation applications.

Customer File Matching: Upload your customer email lists and phone numbers to DSPs. Platforms match these identities against their user databases, creating targetable segments. Match rates typically run 40-70% depending on data quality and platform. Use these segments for:

- Lookalike modeling to find similar prospects

- Exclusion targeting to avoid existing customers

- Cross-sell campaigns to existing customer base

- Win-back campaigns for lapsed customers

Website Visitor Retargeting: Pixel your landing pages to build retargeting audiences. Segment by behavior – users who started but abandoned forms are more valuable than those who bounced immediately. Create frequency caps specific to retargeting (3-5 impressions daily maximum) to avoid the creepy factor that kills brand perception.

CRM Integration: Connect your CRM to your DSP for real-time audience updates. When a prospect moves through your sales funnel, automatically shift their targeting from awareness messaging to consideration messaging. Remove converted customers from prospecting campaigns within 24 hours.

Third-Party Data Segments

Third-party data providers aggregate behavioral, demographic, and intent signals from multiple sources. These segments extend your reach beyond your own data.

Intent Data: Segments built from recent browsing behavior indicating purchase intent. A consumer researching “auto insurance quotes” across multiple sites triggers intent signals that third-party providers capture and package. Major providers include Bombora (B2B focus), Oracle Data Cloud, and Eyeota.

Demographic Data: Age, income, homeownership status, and life-stage data from providers like Experian, TransUnion, and Acxiom. These segments cost $1-3 CPM premium but significantly improve targeting precision for verticals where demographics drive conversion.

Life Event Data: Recently moved, just married, new parent, approaching retirement. These life events correlate strongly with insurance, financial services, and home services purchase intent. Targeting consumers within 30-90 days of a life event typically doubles conversion rates compared to demographic targeting alone. Our guide on seasonal trends in lead generation covers how timing affects lead quality across verticals.

Automotive Data: For auto insurance and related verticals, providers like Polk and Edmunds offer segments based on vehicle ownership, lease expiration timing, and purchase intent. A consumer whose lease expires in 90 days is dramatically more likely to shop insurance than a random driver.

Third-Party Data Provider Comparison

| Provider | Strength | Best Segments for Lead Gen | Typical CPM Premium |

|---|---|---|---|

| Oracle Data Cloud | Scale, variety | Intent, automotive, life events | $1.50-3.00 |

| Experian | Demographics, credit | Homeownership, income, credit tier | $1.00-2.50 |

| TransUnion | Life events, automotive | New movers, vehicle data | $1.50-3.50 |

| Bombora | B2B intent | Company-level research intent | $3.00-6.00 |

| LiveRamp | Identity, matching | Cross-device, household | $0.50-1.50 |

Contextual Targeting

With cookie deprecation and privacy regulations limiting behavioral targeting, contextual targeting has resurged. Instead of targeting users based on their history, you target based on the content they are currently consuming.

Category Targeting: Reach users on content categories related to your vertical. Auto insurance ads on automotive content. Solar ads on home improvement content. Mortgage ads on real estate content. This approach requires no user data and faces no privacy restrictions.

Keyword Contextual: More granular than category targeting, keyword contextual places your ads on pages containing specific terms. An ad for Medicare supplements appearing on pages discussing “Medicare enrollment” or “turning 65” reaches high-intent audiences without behavioral tracking.

Contextual Intelligence Platforms: Advanced providers like Oracle Contextual Intelligence, GumGum, and Peer39 analyze page content semantically, understanding meaning rather than just matching keywords. This prevents embarrassing adjacencies (your ad next to negative content) while improving relevance.

Performance Reality: Contextual targeting typically delivers 15-30% lower conversion rates than behavioral targeting but at 20-40% lower CPMs. The math often favors contextual for prospecting campaigns where scale matters more than precision.

Connected TV Targeting

Connected TV (CTV) advertising has emerged as a powerful prospecting channel, combining television’s visual impact with digital’s targeting precision.

Device Targeting: Reach specific streaming platforms (Roku, Fire TV, Apple TV) or specific apps (Hulu, Peacock, Pluto TV). Different platforms skew different demographics – understanding these skews improves targeting efficiency.

Household Targeting: CTV enables household-level targeting using IP-based matching. Target households with specific characteristics (homeowners, income levels, recent movers) and reach all viewers in that household.

ACR Data: Automatic Content Recognition technology identifies what programs users watch, enabling targeting based on viewing behavior. Target viewers of home improvement shows for solar ads or financial news viewers for investment services.

Cross-Device Extension: Viewers who see your CTV ad can be retargeted on their mobile devices and desktops, creating an integrated cross-screen journey. CTV builds awareness; display and mobile drive conversion.

Campaign Structure and Optimization

Effective programmatic campaigns for lead generation require deliberate structure that separates prospecting from retargeting, controls for frequency, and enables clean performance analysis.

Campaign Architecture

Prospecting Campaigns: Target new audiences who have not previously engaged with your brand. Use third-party data, contextual targeting, and lookalike audiences. Accept higher CPLs in exchange for reaching new potential customers. Budget 60-70% of programmatic spend to prospecting.

Retargeting Campaigns: Target users who have visited your landing pages or engaged with your brand. These audiences convert at 3-5x the rate of prospecting campaigns but have limited scale. Budget 25-35% of spend to retargeting.

CTV/Video Campaigns: Separate video formats from display. Video optimizes differently, has different CPM ranges, and serves different funnel positions. Budget 10-20% of spend to video if your creative assets support it.

Bid Strategy Considerations

Programmatic platforms offer multiple bidding approaches, each suited to different objectives.

CPM Bidding: You set the maximum price per thousand impressions. Use for awareness campaigns where impression delivery matters more than immediate conversion. Typical range: $3-15 for display, $15-35 for CTV.

CPC Bidding: Available on some platforms, you pay only when users click. Risk shifts to the platform, which may prioritize click-prone placements over quality inventory. Monitor closely for click fraud.

CPA Bidding: The platform optimizes toward your target cost per acquisition. Requires sufficient conversion volume (typically 50+ conversions weekly) for algorithm optimization. Start with CPM bidding to gather data, then transition to CPA once you have conversion history.

Viewable CPM (vCPM): You pay only for viewable impressions (50%+ of pixels visible for 1+ second). Protects against paying for below-the-fold inventory that users never see. Expect 10-20% premium over standard CPM.

Frequency Management

Overexposure kills programmatic performance. Users who see your ad 20 times without converting are unlikely to convert on impression 21 – but they are likely to develop negative brand associations.

Frequency Caps by Stage:

- Prospecting: 5-7 impressions per user per week

- Retargeting (first 7 days): 7-10 impressions per user

- Retargeting (7-30 days): 3-5 impressions per user

- CTV: 3-5 impressions per household per week

Cross-Platform Frequency: If you run programmatic alongside Facebook and Google Display, total frequency across all platforms matters. Users seeing your ad 5 times on each of three platforms experience 15 impressions – too many. Coordinate frequency management across channels.

Creative Requirements

Display advertising success depends heavily on creative quality. Programmatic amplifies this – your creative competes against all advertisers targeting similar audiences across millions of placements.

Standard Display Sizes: Prioritize 300x250 (medium rectangle), 728x90 (leaderboard), 160x600 (wide skyscraper), and 300x600 (half page). These four sizes cover 75-80% of available inventory.

Mobile Sizes: 320x50 (mobile leaderboard) and 300x250 are essential for mobile inventory.

Rich Media and HTML5: Animated and interactive ads achieve 20-40% higher CTR than static images. Most DSPs support HTML5 creative. Investment in rich media pays back through improved performance.

Creative Rotation: Run 5-10 creative variations per campaign. Rotate based on performance. Replace underperformers every 2-4 weeks. Creative fatigue sets in faster on programmatic than on platform-specific channels due to broader reach.

Brand Safety: Review creative for brand-safe messaging. Provocative or controversial creative may be blocked from premium inventory, limiting your reach to lower-quality placements.

Viewability and Fraud Prevention

Two challenges define the programmatic quality conversation: viewability (did anyone actually see your ad?) and fraud (was the “viewer” even human?). Ignoring these issues means paying for impressions that deliver zero value.

Understanding Viewability

The Media Rating Council (MRC) standard defines a viewable display impression as one where 50% of the ad’s pixels are visible in the viewable area of the browser for at least one continuous second. For video, 50% of pixels must be visible with the video playing for at least two continuous seconds.

Industry Benchmarks: Average display viewability runs 54-60% across the industry. This means 40-46% of impressions you pay for are never actually seen by humans. Premium publishers achieve 65-75% viewability; remnant inventory may drop below 40%.

Viewability by Placement:

- Above the fold: 68-75% viewability

- Below the fold: 30-45% viewability

- In-banner video: 55-65% viewability

- Interstitial mobile: 85-95% viewability

Viewability Impact on Performance: A campaign running on 50% viewable inventory needs to achieve twice the conversion rate of a 100% viewable campaign to deliver equivalent results. The 10-20% premium for viewable CPM bidding typically pays for itself.

Measuring Viewability

Third-party verification vendors measure viewability independently from DSPs. Do not rely solely on platform-reported viewability – conflicts of interest exist.

Major Verification Vendors:

- Integral Ad Science (IAS): Industry standard for viewability, brand safety, and fraud detection

- DoubleVerify: Comprehensive verification suite with strong fraud prevention

- Moat (Oracle): Viewability and attention metrics

- Google Campaign Manager: Viewability measurement included for DV360 users

Cost for verification typically runs $0.02-0.05 CPM. This investment pays back through improved campaign quality and the ability to optimize based on verified data.

Ad Fraud in Programmatic

Ad fraud costs the industry $84 billion annually by some estimates. Fraudsters create fake websites, deploy bots that simulate human behavior, and generate fake impressions and clicks that advertisers pay for. Our guide on click fraud prevention covers detection and mitigation strategies.

Common Fraud Types:

- Bot Traffic: Automated programs that load web pages and “view” ads without human involvement

- Domain Spoofing: Low-quality sites pretending to be premium publishers to command higher CPMs

- Click Fraud: Bots or low-wage humans clicking ads to drain advertiser budgets

- Ad Stacking: Multiple ads loaded in a single placement, with only the top ad visible

- Pixel Stuffing: Ads loaded in 1x1 pixel frames invisible to users

Fraud Detection Signals:

- Conversion rates dramatically below benchmarks (sub-0.1%)

- Click rates abnormally high (above 2-3% for display)

- Traffic spikes from unusual geographies

- Extremely low viewability rates

- High impression volume from unknown publishers

Fraud Prevention Strategies

Pre-Bid Filtering: Most DSPs offer pre-bid fraud filtering that prevents bidding on suspected fraudulent inventory. Enable these filters – they reduce reach slightly but dramatically improve quality.

Inclusion Lists: Rather than trying to block all bad inventory, create inclusion lists (formerly called whitelists) of verified, high-quality publishers. Start with 100-200 trusted properties and expand based on performance.

Exclusion Lists: Block categories prone to fraud (made-for-advertising sites, click farms, incentivized traffic). Share industry exclusion lists with your DSP.

Private Marketplaces (PMPs): Negotiate direct deals with premium publishers, bypassing open exchanges. PMP inventory costs 20-50% more but delivers significantly higher quality and near-zero fraud.

Post-Campaign Audits: Work with verification vendors to audit campaigns for fraud indicators. Legitimate DSPs will credit fraudulent impressions; use this data to refine your approach.

Brand Safety Considerations

Beyond fraud, brand safety protects your reputation from appearing adjacent to controversial, violent, or inappropriate content.

Category Exclusions: Most DSPs allow excluding content categories – adult content, violence, hate speech, fake news, controversial politics. Enable standard category exclusions as a baseline.

Keyword Blocking: Block specific keywords to prevent adjacency to negative content. A solar company might block “solar scam,” “environmental disaster,” or “power outage.”

Page-Level Analysis: Advanced brand safety tools analyze page content in real-time, blocking placements on specific articles even if the publisher is generally acceptable.

News Adjacency: Consider whether you want to appear on news content at all. Breaking news often covers tragedy and controversy. Some advertisers block news categories entirely; others accept the reach in exchange for occasional problematic adjacency.

CPL Benchmarks by Vertical

Programmatic display typically delivers higher CPLs than search but at significantly greater scale. The following benchmarks reflect optimized campaign performance – initial testing will run 30-50% higher.

Insurance Verticals

| Sub-Vertical | Programmatic CPL | Search CPL | Prospecting CPM |

|---|---|---|---|

| Auto Insurance | $45-85 | $50-80 | $6-12 |

| Home Insurance | $55-95 | $65-95 | $8-15 |

| Life Insurance | $40-75 | $50-150 | $7-14 |

| Medicare | $30-60 | $40-65 | $10-18 |

| Health Insurance | $50-110 | $80-150 | $8-16 |

Financial Services

| Sub-Vertical | Programmatic CPL | Search CPL | Prospecting CPM |

|---|---|---|---|

| Mortgage | $60-120 | $85-160 | $10-20 |

| Refinance | $55-110 | $75-150 | $9-18 |

| Personal Loans | $35-70 | $45-100 | $5-12 |

| Debt Consolidation | $40-85 | $55-110 | $6-14 |

| Credit Cards | $45-90 | $60-120 | $7-15 |

Home Services

| Sub-Vertical | Programmatic CPL | Search CPL | Prospecting CPM |

|---|---|---|---|

| Solar | $75-150 | $110-220 | $12-22 |

| Roofing | $50-110 | $70-150 | $8-16 |

| HVAC | $45-95 | $60-130 | $7-14 |

| Windows | $55-120 | $80-160 | $9-18 |

| Home Security | $35-70 | $50-100 | $6-12 |

Legal

| Sub-Vertical | Programmatic CPL | Search CPL | Prospecting CPM |

|---|---|---|---|

| Personal Injury | $120-280 | $160-320 | $15-30 |

| Mass Torts | $80-200 | $100-300 | $12-25 |

| Workers Comp | $90-180 | $120-250 | $10-20 |

| Disability | $65-140 | $90-200 | $8-18 |

Factors Affecting CPL

Targeting Precision: Highly targeted campaigns using first-party lookalikes and life-event data deliver 30-50% lower CPLs than broad demographic targeting.

Creative Quality: Rich media and animated creative achieve 20-40% higher CTR, directly reducing effective CPL.

Landing Page Conversion: A landing page converting at 8% versus 4% halves your effective CPL. Programmatic traffic often converts 20-30% lower than search traffic – optimize landing pages specifically for display audiences. See our guide on multi-step forms for conversion optimization.

Viewability Settings: Running on viewable-only inventory (vCPM bidding) increases CPM by 10-20% but often reduces CPL by improving engagement quality.

Retargeting Mix: Retargeting campaigns achieve 3-5x the conversion rate of prospecting. A portfolio with 30% retargeting will show materially lower blended CPL than pure prospecting.

Getting Started with Programmatic

Launching programmatic requires deliberate planning. Unlike self-serve platforms where you can start spending in hours, programmatic demands infrastructure, creative assets, and strategic setup.

Prerequisites Checklist

Tracking Infrastructure: You need robust conversion tracking before launching programmatic. Implement:

- Site-wide pixel from your DSP

- Conversion pixels for form submissions

- View-through conversion windows (7-14 days recommended)

- Server-side tracking if possible (recovers 20-40% of lost conversions)

Audience Foundation: Prepare your first-party data:

- Customer email list (minimum 5,000 records for effective matching)

- Website visitor retargeting pool (minimum 10,000 cookies)

- CRM integration for real-time audience updates

Creative Assets:

- Display ads in 4-6 standard sizes

- 5-10 creative variations per campaign

- Rich media/HTML5 versions if possible

- Landing pages optimized for display traffic

Budget Allocation: Plan for 90-day evaluation periods:

- Minimum $5,000-10,000 monthly for meaningful testing

- $15,000-25,000 monthly for multi-vertical operations

- $50,000+ monthly for full-scale programmatic programs

Launch Sequence

Week 1-2: Platform Setup

- Select DSP based on budget and needs

- Implement tracking pixels

- Upload customer lists for matching

- Create retargeting audiences

- Build campaign structure

Week 3-4: Retargeting Launch

- Launch retargeting campaigns first (highest probability of success)

- Test 5+ creative variations

- Establish baseline conversion rates

- Validate tracking accuracy

Week 5-8: Prospecting Expansion

- Launch prospecting campaigns with third-party data

- Test multiple audience segments simultaneously

- Compare performance across data providers

- Identify winning combinations

Week 9-12: Optimization and Scale

- Pause underperforming segments

- Increase budget on winners

- Test connected TV and video formats

- Explore private marketplace deals

Success Metrics and Targets

Viewability: Target 60%+ for display, 70%+ for video. Below these thresholds indicates quality issues.

CTR: Display prospecting should achieve 0.08-0.15%. Retargeting should hit 0.20-0.40%. Below these ranges suggests creative or targeting problems.

Conversion Rate: Display traffic converts 30-50% lower than search. Target 2-4% for retargeting, 0.5-1.5% for prospecting.

Frequency: Monitor average frequency weekly. If prospecting frequency exceeds 7-10 impressions per user without conversion, you are over-saturating your audience.

Invalid Traffic Rate: Verification vendors should report less than 5% invalid traffic. Above 10% indicates serious quality issues requiring immediate intervention.

Emerging Trends in Programmatic Lead Generation

The programmatic landscape continues evolving rapidly, driven by privacy regulations, technological innovation, and changing consumer behavior. Understanding where the market is heading helps lead generators position their operations for future success.

The Cookieless Future and Identity Solutions

The deprecation of third-party cookies represents the most significant shift in programmatic targeting since the advent of real-time bidding. While Google has delayed full deprecation multiple times, the trajectory remains clear: behavioral targeting based on third-party cookies will eventually become impossible in Chrome, as it already has in Safari and Firefox.

Several identity solutions have emerged to address this challenge. The Trade Desk’s Unified ID 2.0 creates a privacy-compliant identifier based on hashed email addresses. LiveRamp’s Authenticated Traffic Solution enables publishers to connect authenticated users across properties. Google’s Privacy Sandbox initiatives, including Topics API, propose alternative targeting mechanisms that preserve some behavioral capability while limiting cross-site tracking.

For lead generators, the practical implications are significant. First-party data becomes exponentially more valuable when third-party behavioral targeting degrades. Building robust email lists and authentication mechanisms now prepares you for a future where these assets become essential rather than supplementary. Testing cookieless targeting approaches, including contextual and first-party-only campaigns, establishes baseline performance before forced migration.

AI-Powered Campaign Optimization

Artificial intelligence has moved beyond buzzword status to deliver measurable programmatic performance improvements. Machine learning algorithms now optimize bidding, creative selection, and audience targeting with sophistication that manual management cannot match.

Predictive bidding models analyze historical conversion patterns to optimize bids in real-time. Rather than setting static CPM caps, AI systems adjust bids based on predicted conversion probability for each impression opportunity. A user matching multiple high-value signals might justify a $25 CPM bid, while a marginal match might warrant only $3. This dynamic optimization improves both volume and efficiency simultaneously.

Creative optimization through AI extends beyond simple A/B testing. Dynamic creative systems assemble ads from component libraries, testing combinations of headlines, images, and calls-to-action at scale impossible for human teams. The winning combinations emerge from algorithmic analysis rather than creative intuition, often revealing unexpected high performers.

Audience discovery uses machine learning to identify converting user patterns that human analysts might miss. Rather than relying solely on defined segments, AI systems analyze conversion data to find common characteristics and expand targeting to similar users automatically. This approach surfaces opportunities in overlooked audience niches.

Connected TV Growth and Opportunity

Connected TV advertising has emerged as one of the fastest-growing segments within programmatic, combining television’s visual impact and engagement with digital’s targeting precision and measurability.

CTV reach now exceeds traditional linear television for many demographics. Streaming platforms including Hulu, Peacock, Pluto TV, and Tubi provide programmatic access to audiences who have abandoned cable entirely. For lead generators, this represents access to premium video environments previously available only through expensive broadcast buys.

The targeting capabilities of CTV match or exceed display advertising. Household-level targeting enables reaching specific demographics, income levels, and life stages. ACR (Automatic Content Recognition) data identifies viewing preferences that correlate with purchase intent. Cross-device tracking connects CTV exposure to downstream website visits and conversions.

Performance measurement in CTV requires different approaches than display. View-through attribution becomes essential since CTV viewers cannot click. Integration with incrementality measurement helps quantify true CTV impact beyond correlation. QR codes and dedicated landing pages provide direct response mechanisms that translate CTV awareness into measurable lead generation.

Retail Media Networks

Retail media networks represent a new frontier in programmatic access, providing targeting based on actual purchase behavior rather than inferred intent.

Amazon pioneered this approach, but competitors have rapidly expanded the landscape. Walmart Connect, Target Roundel, Kroger Precision Marketing, and others now offer programmatic access to their customer data. For lead generators in relevant verticals, this purchase-intent data can dramatically improve targeting precision.

Home services lead generators benefit particularly from retail media data. A consumer who recently purchased a home security system from Best Buy or ring doorbell from Amazon demonstrates clear intent for related services. A consumer who bought baby products signals life-stage transition relevant to insurance and financial services. These signals often outperform demographic or behavioral proxies.

The challenge lies in minimum spend requirements and platform fragmentation. Most retail media networks require significant commitments, and managing campaigns across multiple networks adds operational complexity. However, for lead generators with sufficient scale, retail media provides targeting advantages unavailable elsewhere.

Advanced Optimization Strategies

Beyond fundamental campaign management, advanced optimization strategies separate top performers from average practitioners. These approaches require greater sophistication but deliver proportionally greater results.

Incrementality Testing

Standard attribution measures correlation between ad exposure and conversion, but correlation does not prove causation. Incrementality testing measures whether conversions would have occurred without ad exposure, quantifying true programmatic contribution.

The methodology involves dividing your audience into test and control groups. The test group sees your ads; the control group sees public service announcements or no ads at all. Comparing conversion rates between groups reveals incremental lift attributable to your advertising.

For lead generators, incrementality testing often reveals that retargeting delivers less incremental value than it appears. Users who visited your landing page and later converted might have converted anyway through direct navigation or search. Understanding true incrementality enables budget reallocation toward genuinely incremental channels and audiences.

Implementation requires sufficient scale for statistical significance and careful control group construction. Most DSPs offer built-in incrementality testing capabilities, or you can work with measurement partners like Nielsen, Measured, or AppsFlyer for independent validation.

Dynamic Creative Optimization

Dynamic creative optimization (DCO) automatically assembles and tests ad variations using component libraries, finding winning combinations at scale impossible through manual testing.

The approach involves creating component libraries: multiple headlines, multiple images, multiple calls-to-action, multiple value propositions. The DCO system assembles combinations, serves them to different audience segments, and analyzes performance to identify winners. Over time, the system automatically weights toward high performers while continuing to test new combinations.

For lead generation, DCO enables personalization at scale. Different audience segments receive different messaging based on their characteristics and behavior. Homeowners see home-focused messaging; renters see different value propositions. Users in different stages of the consideration journey see appropriate urgency levels. This personalization improves both relevance and conversion rates.

Implementation requires creative investment in component development and integration with DCO platforms. Google’s Studio or independent platforms like Flashtalking and Clinch provide DCO capabilities that integrate with major DSPs.

Bid Multiplier Strategies

Sophisticated bid management goes beyond simple CPM caps to layer multipliers based on conversion probability signals.

Time-of-day multipliers adjust bids based on historical conversion patterns. If your leads convert best on Tuesday afternoons, increase bids during that window and decrease during lower-performing periods. Device multipliers recognize that mobile users may convert differently than desktop users. Geographic multipliers account for regional conversion rate variation.

The implementation involves analyzing historical data to identify performance patterns, calculating appropriate multipliers, and configuring your DSP to apply them automatically. Most enterprise DSPs support layered bid multipliers; mid-market platforms may require manual dayparting or segment-level bid adjustments.

Testing bid multiplier strategies requires controlled experiments comparing multiplier performance against flat bidding. The complexity adds operational overhead, so ensure the performance improvement justifies the management investment.

Frequently Asked Questions

What is programmatic display advertising and how does it work?

Programmatic display advertising is automated buying of digital ad inventory through software platforms called demand-side platforms (DSPs). When a user loads a webpage with ad space, an auction occurs in milliseconds. Your DSP submits a bid based on your targeting criteria and budget. If you win, your ad appears. The entire process – from page load to ad display – completes in under 100 milliseconds. For lead generators, programmatic provides access to billions of impressions across premium publishers, apps, and connected TV at scale impossible to achieve through direct publisher relationships.

How does programmatic compare to Google Display Network?

Google Display Network (GDN) is one source of programmatic inventory, not the entire market. GDN accesses Google-owned inventory and properties using Google’s ad server. Enterprise DSPs like The Trade Desk or DV360 access GDN inventory plus 80+ additional ad exchanges, dramatically expanding reach. DSPs also offer superior targeting options – third-party data integrations, cross-device tracking, and connected TV – that GDN lacks. Most mature lead generators use both: GDN for Google-integrated campaigns and independent DSPs for broader programmatic reach.

What DSP should I choose for lead generation?

Your choice depends on budget and needs. For $25,000+ monthly budgets with Google Ads integration requirements, DV360 provides maximum scale. For connected TV focus and platform independence, The Trade Desk excels. For purchase-data targeting, Amazon DSP is unmatched. For mid-market budgets ($5,000-15,000), StackAdapt or Simpli.fi offer accessible self-serve interfaces. Start with one platform, master it over 90 days, then evaluate adding a second for incremental reach.

What CPL should I expect from programmatic display?

Programmatic CPLs typically run 20-40% higher than search but provide scale that search cannot match. Insurance verticals see $30-85 CPLs. Solar runs $75-150. Legal ranges $80-280 depending on case type. Mortgage runs $60-120. These ranges reflect optimized campaigns – expect 30-50% higher CPLs during initial testing. Retargeting campaigns achieve 3-5x better CPLs than prospecting; a healthy programmatic program blends both.

How do I prevent ad fraud in programmatic campaigns?

Enable pre-bid fraud filtering in your DSP – this blocks suspected fraudulent inventory before you bid. Work with verification vendors (IAS, DoubleVerify, Moat) to measure and report fraud rates. Create inclusion lists of verified publishers rather than trying to block all bad inventory. Use private marketplace deals with premium publishers for guaranteed quality. Monitor for fraud signals: abnormally high click rates, zero conversions, traffic from unusual geographies. Legitimate DSPs credit fraudulent impressions; document issues for recovery.

What is viewability and why does it matter?

Viewability measures whether ads were actually seen by humans. The industry standard requires 50% of an ad’s pixels visible for at least one second. Average display viewability runs 54-60%, meaning 40-46% of impressions you pay for are never seen. Viewable CPM (vCPM) bidding pays only for viewable impressions at a 10-20% premium – typically worth the cost. Use third-party verification to measure viewability independently from your DSP. Target 60%+ viewability for display, 70%+ for video.

How should I structure programmatic campaigns?

Separate prospecting from retargeting – they optimize differently and require different budgets and expectations. Prospecting targets new audiences using third-party data, lookalikes, and contextual targeting. Retargeting reaches users who visited your landing pages. Budget 60-70% to prospecting, 25-35% to retargeting. Within each category, create separate campaigns by audience segment (demographic, intent, life event) to enable clean performance analysis. Separate video/CTV from display formats.

What targeting options work best for lead generation?

First-party data outperforms third-party by 2-3x – start with customer lookalikes and website retargeting. Layer third-party intent data (from Bombora, Oracle) to reach users actively researching your category. Add demographic and life-event data (from Experian, TransUnion) for qualification. For home services and insurance, new mover data is particularly valuable. Contextual targeting works when behavioral data is limited – target content relevant to your vertical. Test multiple approaches simultaneously and let performance data guide budget allocation.

How long before programmatic becomes profitable?

Expect 60-90 days for initial profitability on straightforward verticals with quality landing pages. Retargeting achieves profitability fastest – often within 30 days. Prospecting requires more testing and optimization, typically 60-90 days. Complex verticals (legal, solar) or competitive markets may require 4-6 months. Plan testing budgets separately from performance budgets. If no positive signals emerge by day 45-60, re-evaluate targeting, creative, or landing pages before continuing spend.

Should I use programmatic alongside other channels?

Yes. Programmatic complements rather than replaces platform-specific advertising. Use search for high-intent queries where consumers actively seek your product. Use Facebook/Instagram for social proof and community building. Use programmatic for scale, frequency management, and premium inventory access. Coordinate frequency across all channels – users seeing your ad 5 times on each of three platforms experience 15 total impressions. Programmatic’s value increases in a multi-channel portfolio because it extends reach beyond walled garden limitations.

How do I measure attribution for programmatic campaigns?

Programmatic often contributes to conversions that close on other channels. A user sees your display ad, later searches your brand on Google, and converts through search – search gets last-click credit while programmatic gets nothing. Use view-through conversion windows (7-14 days) to credit programmatic for conversions where users saw but did not click ads. Implement cross-device tracking to connect impressions across phones, tablets, and desktops. For sophisticated measurement, consider multi-touch attribution or incrementality testing to understand true programmatic contribution beyond last-click metrics.

Key Takeaways

-

Programmatic represents 91% of display advertising and $168+ billion in US spending. This scale offers reach beyond any single platform, accessing premium inventory on ESPN, Forbes, NYT, and millions of other properties through automated buying.

-

DSP selection depends on budget and priorities. DV360 for maximum scale and Google integration ($25,000+ monthly). The Trade Desk for independence and connected TV. Amazon DSP for purchase-data targeting. StackAdapt or Simpli.fi for mid-market accessibility ($5,000-15,000 monthly).

-

First-party data outperforms third-party by 2-3x. Prioritize customer lookalikes and website retargeting before layering third-party intent, demographic, and life-event data. The combination delivers precision targeting across all inventory sources.

-

Viewability averages 54-60%, meaning 40-46% of impressions are never seen. Use viewable CPM bidding to pay only for visible impressions. Invest in third-party verification (IAS, DoubleVerify) for independent measurement. Target 60%+ viewability for display campaigns.

-

Ad fraud costs $84 billion annually across the industry. Enable pre-bid filtering, create inclusion lists of verified publishers, and use private marketplace deals for premium inventory. Monitor for fraud signals: abnormal click rates, zero conversions, unusual traffic patterns.

-

Expect 60-90 days to profitability. Launch retargeting first (30-day path to profitability), then expand to prospecting. CPLs run 20-40% higher than search but at dramatically greater scale. Blend retargeting (25-35% of budget) with prospecting (60-70%) for optimal portfolio performance.

-

Programmatic complements other channels rather than replacing them. Coordinate frequency across platforms – users seeing ads 15 times across three channels experience fatigue regardless of channel-specific caps. Programmatic extends reach beyond walled gardens while enabling unified frequency management.

Programmatic display advertising offers lead generators access to premium inventory and targeting precision unavailable through platform-specific advertising. The learning curve is real – DSP selection, audience strategy, fraud prevention, and viewability management all require investment. But operators who master programmatic access scale, reduce platform dependency, and reach audiences their competitors cannot touch.