The infrastructure that transformed lead distribution from fixed-price procurement into dynamic markets where milliseconds and competitive pressure determine value for every transaction.

When a consumer clicks “submit” on an insurance quote form at 2:47 PM on a Tuesday, a technical sequence begins that would have seemed implausible a decade ago. Within 50 milliseconds, partial information about that lead broadcasts simultaneously to fourteen potential buyers. Each buyer’s system evaluates the data against complex filtering rules, calculates a bid price, and returns a response. The auction closes at 150 milliseconds. By 200 milliseconds, the winning buyer receives complete lead data. By 500 milliseconds, their agent’s screen displays the consumer’s information, and the phone is already dialing.

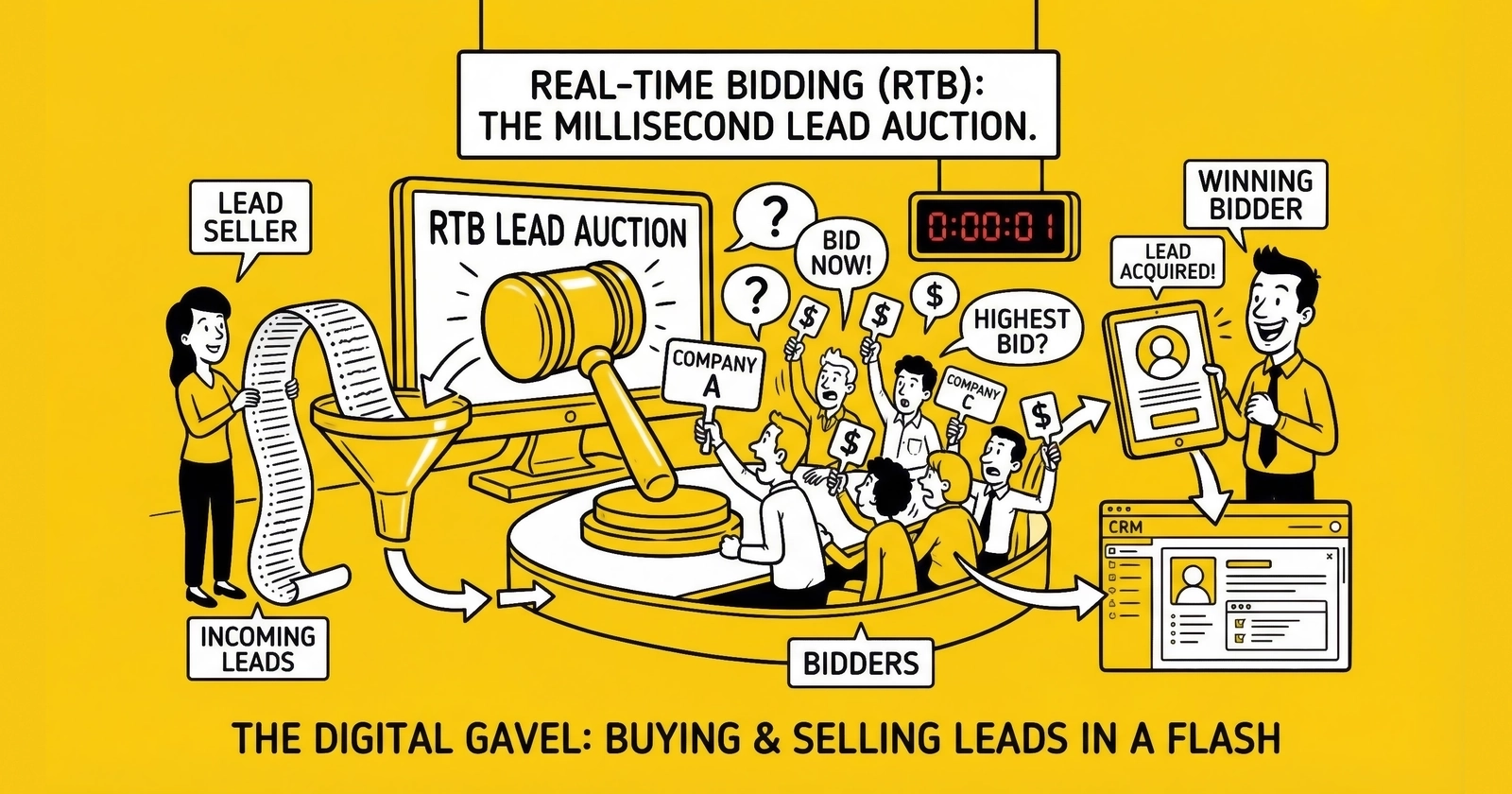

This is real-time bidding for lead auctions. It represents the most sophisticated lead routing technology in the industry, and understanding its mechanics separates professional operators from those still negotiating quarterly fixed-price contracts. Whether you are buying leads, selling leads, or building infrastructure that connects buyers and sellers, mastering RTB technology determines your ability to compete in the modern lead economy.

The lead generation industry has evolved from simple handshake deals to automated marketplaces processing billions of dollars annually. Public companies like MediaAlpha ($864.7 million in 2024 revenue) and EverQuote ($500.2 million in 2024 revenue) built their businesses on real-time bidding infrastructure. The technology that enables these marketplaces is no longer optional for serious operators. It is the foundation of competitive lead distribution.

The Evolution from Fixed Pricing to Real-Time Auctions

Before real-time bidding became the industry standard, lead distribution operated on what professionals now call the “static waterfall” model. A lead generator would establish fixed relationships with buyers, prioritized by some combination of price and reliability. When a lead arrived, the system would offer it to Buyer A first at their contracted price. If rejected, it moved to Buyer B at their contracted price, then C, and so on down the waterfall.

The waterfall model had fundamental limitations that constrained market efficiency for both sellers and buyers.

Fixed Pricing Prevented Value Discovery. Buyers had no incentive to increase their prices since they knew exactly where they sat in the queue. A buyer paying $40 for first-position access would never volunteer to pay $55, even if that lead was worth $80 to their business. Sellers had no mechanism for discovering what their leads were actually worth in the market because they simply accepted whatever their highest-priority buyer was willing to pay.

Sequential Processing Degraded Lead Value. Each rejection added seconds to the total response time. Research consistently shows that leads contacted within one minute convert at 391% higher rates. The five-minute rule documents this decay curve in detail. By the time a lead cascaded through five buyers in a waterfall, precious minutes had elapsed. The lead’s value decayed while the seller’s system methodically worked through priority positions.

Position Monopoly Created Unfair Advantage. First-position buyers captured disproportionate value regardless of their actual willingness to pay. A buyer willing to pay $75 for a specific lead might never see it because a $40 buyer held first position through a legacy contract. Position determined access rather than value, creating systematic market inefficiency.

No Competitive Pressure Enabled Stagnation. Without competing bids, buyers faced no pressure to improve offers over time. Annual contract negotiations moved prices incrementally while market conditions shifted dramatically. Sellers left significant value on the table during periods of high demand, and buyers overpaid during slow periods.

Real-time bidding solved these problems by introducing competitive auction mechanics to lead distribution. Instead of sequential offers at predetermined prices, RTB broadcasts lead attributes to all qualified buyers simultaneously and awards the lead to whoever values it most. The result is true market-based pricing for every individual lead.

The shift from waterfall to RTB mirrors broader market evolution across industries. Just as programmatic advertising replaced direct insertion orders with real-time bidding, RTB transformed lead distribution from procurement into trading. The economic implications are substantial: under a waterfall system, a lead generator might sell 1,000 leads daily at $45 each to their first-position buyer, generating $45,000 in daily revenue. Under RTB with the same buyer pool, the same 1,000 leads might generate bids ranging from $30 to $85, with an average winning bid of $52. Daily revenue increases to $52,000 with no change in lead quality or buyer relationships. That 15-30% revenue improvement explains why RTB has become the dominant distribution model for high-volume verticals.

How RTB Technology Works: The Ping-Post Protocol

Real-time bidding for lead auctions operates through a bifurcated transaction protocol commonly called “ping-post.” This protocol splits lead distribution into two distinct phases that serve different purposes while maintaining transaction integrity and consumer privacy.

Phase One: The Ping (Blind Bid Solicitation)

When a consumer completes a lead form, the distribution platform immediately extracts non-identifying attributes and broadcasts them simultaneously to all qualified buyers. This broadcast, called the “ping,” happens within 20 milliseconds of form submission.

The ping contains enough information for buyers to make informed bidding decisions without revealing the consumer’s identity. The specific attributes transmitted vary by vertical, but follow a consistent principle: provide sufficient signal for value calculation while transmitting zero personally identifiable information.

Geographic Data Included in Pings:

- ZIP code (5-digit, enabling neighborhood-level targeting)

- State (for regulatory and market segmentation)

- Area code (additional geographic signal)

- Metropolitan statistical area when relevant

Vertical-Specific Lead Attributes: For auto insurance pings, the data typically includes vehicle year, make, and model (but never the VIN, which could identify specific consumers), current carrier name, driver count, incident history, and credit tier bracket. For mortgage leads, pings include loan amount requested, estimated property value, calculated loan-to-value ratio, credit score bracket (ranges like 660-699 rather than exact scores), and loan purpose. For solar leads, pings carry homeownership status, electric bill range, roof shading classification, and credit bracket.

Metadata and Source Identification: Beyond consumer-derived attributes, pings carry operational metadata: source ID identifying which publisher generated the lead, sub-source IDs for granular traffic tracking, timestamp indicating capture moment, device information (mobile versus desktop), and exclusivity flags indicating whether the lead will sell to one buyer or multiple.

The golden rule of ping design is never transmitting personally identifiable information during the ping phase. Buyers have not committed to purchase anything yet. Providing consumer contact information at this stage creates three serious problems that undermine the entire system.

First, data leakage enables bad actors. A buyer could build a database of consumer intent signals without ever purchasing a single lead. Even buyers without malicious intent accumulate compliance and security obligations from data they received but never paid for.

Second, cherry-picking distorts market pricing. If buyers can identify specific consumers from ping data, they can bid selectively based on information the seller did not intend to share. This information asymmetry undermines fair price discovery.

Third, trust erosion damages marketplace integrity. Sellers who leak PII in pings quickly find legitimate buyers losing confidence in the system. Professional buyers will not participate in marketplaces where their competitors might harvest data without payment.

Buyer Bid Logic and Response

When a buyer’s system receives a ping, it executes a sequence of operations that typically complete in 20-50 milliseconds. The speed requirement is non-negotiable: buyers whose systems cannot respond within timeout windows are simply excluded from auctions.

The bid calculation sequence proceeds through defined stages:

Validation Stage (2-5 milliseconds): Confirm the ping contains all required fields and meets format specifications. Malformed pings receive immediate rejection responses.

Filter Evaluation Stage (5-15 milliseconds): Match ping attributes against buyer targeting criteria. A buyer targeting only California might immediately reject a Texas ping. A buyer at daily cap might reject all pings regardless of quality. Filter evaluation often involves checking hundreds of rules against ping data.

Bid Calculation Stage (10-30 milliseconds): If the lead passes filters, calculate a bid price based on pricing rules. Sophisticated buyers implement tiered pricing with multiple variables rather than flat bids.

A simplified example of buyer bid logic: base bid of $30, plus $10 for credit scores above 700, plus $15 for specific high-value ZIP codes, minus $5 for mobile device leads, plus $8 for weekend submissions when call centers are less congested. The calculation produces a final bid reflecting the buyer’s estimated value of that specific lead based on their historical conversion rates and customer lifetime value in that segment.

Rejection Code Transmission: When buyers reject pings, they return standardized codes explaining why. Common codes include geographic mismatch, filter criteria not met, daily cap reached, duplicate detection (buyer already has this consumer in their system), and price floor not met (calculated bid falls below buyer’s minimum threshold). These rejection codes provide sellers with diagnostic data for optimizing their buyer mix and improving fill rates.

Phase Two: The Post (Full Delivery)

Once the ping auction closes and a winner emerges, the post phase begins. The platform transmits complete lead information to the winning bidder and only the winning bidder.

Bid Aggregation and Timeout Management: The platform waits for all buyer responses or until the timeout window expires, whichever comes first. Industry standards allow 100 milliseconds for ping responses. Late responses are ignored even if they would have won. This strict timeout enforcement is what forces buyers to maintain fast, well-optimized systems. Buyers who consistently exceed thresholds simply do not participate in a significant portion of available auctions.

Winner Selection Logic: For exclusive leads, the highest bid typically wins. For shared (non-exclusive) distribution, the calculation becomes more complex. The platform must compare the highest exclusive bid against the sum of potential shared sales. If Buyer A bids $60 for exclusive rights but Buyers B, C, and D collectively offer $35 + $28 + $25 = $88 for shared access, the optimal financial outcome is shared distribution, assuming seller policies permit it.

Some platforms weight bids based on factors beyond raw price. A buyer with 95% historical acceptance rate might receive a weighting advantage over a buyer with 70% acceptance rate. The economic logic: a $55 bid with 95% acceptance probability has expected value of $52.25, while a $60 bid with 70% acceptance probability has expected value of only $42.00. Sophisticated platforms optimize for expected value rather than nominal bid price.

Complete Data Transmission: When the post delivers complete lead information to the winning buyer, the transaction crosses a significant threshold. The buyer receives everything needed to contact the consumer: full name, phone number, email address, complete street address, and all detailed qualification data collected on the form. This transmission is encrypted, logged for compliance purposes, and represents the actual asset being purchased.

The “winning bidder only” principle is fundamental to RTB integrity. Only the buyer who committed to pay receives consumer contact information. Losing bidders receive nothing beyond bid-loss notifications. This ensures RTB systems do not become mechanisms for data harvesting.

Post-Rejection Recovery Through Waterfall Fallback

Even after winning the auction and receiving the full post, buyers sometimes reject leads. Perhaps the full data reveals a duplicate they did not catch during the ping phase. Perhaps detailed information triggers a fraud detection flag. Perhaps the buyer’s CRM validation fails on a data formatting issue. Perhaps the buyer’s capacity changed between ping and post.

Post rejection triggers what the industry calls “waterfall-on-failure” logic. The platform immediately recalculates the best scenario among remaining bidders, considering current conditions like cap status and time elapsed. The lead then attempts delivery to the next-best option. This cascade continues until either a buyer accepts or all viable options exhaust.

Industry data from major platforms indicates that well-implemented waterfall-on-failure systems recover 20-40% of revenue that would otherwise be lost to post rejections, buyer timeouts, and system failures. For a platform processing $1 million in monthly lead volume, that recovery represents $200,000-$400,000 in annual revenue that would otherwise disappear.

Technical Infrastructure Requirements

Operating an RTB system for lead auctions at scale requires substantial technical infrastructure. The difference between a well-optimized system and a mediocre one can represent millions of dollars in annual revenue. Understanding these requirements helps both platform operators and participants optimize their positions.

Latency Requirements and Speed Constraints

Speed is not just a technical preference in RTB systems. It is a fundamental constraint that shapes every architectural decision. The industry has established timing standards that participants must meet to compete effectively.

Industry Timing Standards:

- Ping broadcast from platform: Under 20 milliseconds

- Buyer ping response: Under 100 milliseconds

- Total ping phase (broadcast to bid collection): 100-200 milliseconds

- Winner selection and post initiation: Under 50 milliseconds

- Post delivery to buyer: Under 300 milliseconds

- Post acceptance by buyer: Under 1,000 milliseconds

- Total transaction time: 650-1,500 milliseconds

These numbers are not targets. They are requirements. Buyers who consistently exceed response thresholds get fewer leads because auctions close before their responses arrive. Sellers who operate slow platforms lose buyer participation as bidders experience timeouts.

Consider what happens during a typical RTB auction: The seller’s platform broadcasts a ping to fifteen buyers simultaneously. Each buyer has 100 milliseconds to receive the ping, route it to processing servers, evaluate it against potentially hundreds of filter rules, calculate a bid price, and return a response. The seller then has 50 milliseconds to aggregate bids, identify the winner, handle tie-breaking, and initiate the post. The winning buyer has another 500-1,000 milliseconds to validate complete data and return acceptance.

This timing explains why successful RTB platforms invest heavily in infrastructure. Geographic distribution matters. A buyer in Miami evaluating a ping that originated in Seattle and routes through a server in Dallas adds precious milliseconds with each network hop. Response optimization matters. Every database query, every business rule evaluation, every logging operation consumes time that could cost an auction.

Infrastructure Components

Production RTB systems require several interconnected components: geographic distribution of servers near major buyer concentrations to reduce round-trip times, database optimization with in-memory caching (Redis, Memcached) to eliminate disk I/O during time-critical operations, asynchronous processing architecture for simultaneous buyer communication, horizontal scaling capability through auto-scaling and load balancing, and reliability standards targeting 99.99% uptime with automatic failover.

API Standardization and Integration

RTB platforms must handle heterogeneous data exchange efficiently. At minimum, platforms support JSON, XML, and HTTP POST with extensions to SOAP APIs and webhooks. Field mapping capabilities address the reality that buyer systems expect different field names and structures, requiring static mappings, concatenation, splitting, and value translation without adding latency.

Auction Mechanics and Pricing Dynamics

RTB systems are fundamentally auction mechanisms, and the specific auction design significantly impacts seller revenue and buyer experience. Understanding auction mechanics helps operators optimize their positions on whichever side of the marketplace they occupy.

First-Price Versus Second-Price Auction Models

The lead distribution industry has largely settled on first-price auctions, though understanding both models provides important context. Exclusive versus shared lead distribution also affects how these auction mechanics apply in practice.

First-Price Auctions (Dominant Model): The winning bidder pays exactly what they bid. If Buyer A bids $50 and Buyer B bids $45, Buyer A wins and pays $50. This model dominates lead distribution because of its simplicity and transparency. Buyers understand exactly what they will pay if they win.

First-price auctions create strategic incentives that can suppress bid prices. Sophisticated buyers learn to “shade” their bids, submitting less than their true willingness to pay because they only need to exceed the next-highest bid, not reveal their maximum value. If a buyer values a lead at $50 but suspects competition will bid $35, they might bid $38 and keep the $12 difference as additional margin.

Second-Price Auctions (Rare in Lead Distribution): The winning bidder pays slightly more than the second-highest bid, not their own bid. Using the same example, Buyer A would win but pay $46 instead of $50. This design theoretically encourages truthful bidding because bidders never pay more than necessary to win. There is no advantage to bid shading since paying your true value never costs more than the next-highest bid.

Second-price auctions are rare in lead distribution for practical reasons. Buyers find them confusing. Sellers find them revenue-suppressing since the winning bid is always discounted. The theoretical benefits assume rational actors with accurate value estimates, which is not always realistic in fast-moving lead markets with imperfect information.

Granular Attribute-Based Pricing

The true power of RTB emerges when buyers implement granular, attribute-based pricing rather than flat rates. This granularity enables efficient price discovery across diverse lead populations.

Credit Score Tier Pricing: In financial services verticals, credit score drives pricing more than any other attribute. A buyer might bid $65 for 720+ credit scores, $50 for 680-719, $35 for 640-679, $20 for 600-639, and $0 (no bid) for anything below 600. This tiering reflects dramatically different conversion rates and customer lifetime values across credit segments.

Geographic Adjustments: Some states have more competitive environments, higher customer values, or better regulatory conditions. Buyers adjust bids to reflect local market realities. A solar installer might bid premium prices in California where incentives are strong while bidding minimally in states with unfavorable net metering policies.

Time-of-Day Factors: Leads arriving at 11 PM have lower value than leads arriving at 11 AM because there is no agent available for immediate contact. Some buyers shut off bidding entirely during off-hours. Others bid at steep discounts, planning to work the leads the next morning. Peak business hours typically see bid prices 10-25% higher than overnight periods.

Source Quality Scoring: Buyers tracking conversion rates by publisher can pay more for leads from high-performing sources and less for sources with poor historical outcomes. A publisher with consistent 15% contact rates might receive 30% bid premiums over one with 8% contact rates. This feedback mechanism rewards quality traffic sources.

Bid Modifier Frameworks: Sophisticated buyers layer multiple modifiers rather than managing hundreds of separate bid rules. A base bid of $40 might receive +20% for weekend leads, -15% for mobile traffic, +25% for target ZIP codes, and -30% for pre-7 AM submissions. The final bid reflects the product of all applicable modifiers.

Floor Pricing and Revenue Protection

Floor pricing establishes minimum acceptable bids from the seller’s perspective. A seller might set a $25 floor for exclusive auto insurance leads, meaning any bid below that threshold is treated as a rejection.

Market-Based Floor Setting: Effective floors reflect actual market data rather than arbitrary targets. If leads consistently attract $35-55 bids, a $30 floor captures most volume while protecting against race-to-the-bottom pricing during low-demand periods.

Dynamic Floor Adjustments: Advanced platforms adjust floors based on real-time supply and demand conditions. During high-demand periods when multiple buyers compete aggressively, raising floors captures surplus value. During low-demand periods, lowering floors clears inventory that might otherwise go unsold.

Tiered Floor Structures: Different lead types warrant different minimums. Premium leads with strong validation, complete data, and documented consent command higher floors than basic leads with minimal verification.

Performance Metrics and Optimization

Operating an RTB system effectively requires continuous measurement across multiple dimensions. The metrics that matter differ somewhat between sellers (optimizing revenue and fill rate) and buyers (optimizing cost efficiency and conversion).

Seller Performance Metrics

Fill Rate: The percentage of leads that successfully sell through the RTB system. A 90% fill rate means 10% of leads receive no acceptable bids and generate zero revenue. Industry benchmarks:

- Below 70%: Poor, indicates significant buyer coverage gaps or floor pricing problems

- 70-80%: Acceptable but improvable

- 80-90%: Strong performance

- Above 90%: Elite performance

Average Winning Bid: Mean price of successfully sold leads. Track trends over time rather than absolute values, as market conditions shift. A declining trend may indicate buyer fatigue, quality issues, or market saturation.

Bid Density: Average number of bids received per lead. Higher density creates competitive pressure and typically correlates with higher prices. Target 5-15 active bidders per segment.

Time-to-Route: Duration from lead capture to successful delivery. Under 2 seconds is acceptable. Under 1 second is strong. Sub-500 milliseconds is elite. Longer times correlate with lower conversion rates downstream.

Waterfall Recovery Rate: Percentage of initially rejected leads successfully sold to secondary bidders. Recovery rates of 20-40% indicate healthy waterfall systems. Rates below 15% suggest insufficient secondary buyer coverage.

Buyer Performance Metrics

Win Rate: Percentage of bids that result in lead acquisition. Very high win rates (above 80%) suggest overbidding. Very low rates (below 10%) indicate underbidding or filter misalignment. Target 30-60% depending on volume objectives.

Post Acceptance Rate: Percentage of won leads that pass final validation. Rates below 80% indicate misalignment between ping filters and post acceptance criteria. Every post rejection wastes processing capacity and may frustrate sellers.

Response Time: Average milliseconds from ping receipt to bid return. Track timeout rate separately. If more than 5% of pings timeout, infrastructure investment or bid logic simplification is required.

Effective Cost Per Lead: Total cost including rejected leads divided by successfully acquired leads. This metric matters more than nominal bid price because it reflects actual acquisition economics.

Downstream Conversion Tracking: Connect RTB acquisition data to ultimate business outcomes. Track contact rates, appointment rates, and conversion rates by source, geography, and lead attributes to refine bidding over time.

Fill Rate Optimization Strategies

Fill rate is the single most impactful metric for RTB sellers because unsold leads generate zero revenue. A 10-percentage-point improvement in fill rate translates directly to 10% more revenue with no change in traffic acquisition costs.

Buyer Coverage Expansion

The most direct path to higher fill rates is ensuring leads have enough potential bidders.

Geographic Coverage: If your buyer network only covers 40 states, leads from the other 10 states have zero fill rate by definition. Identify geographic gaps through rejection code analysis and recruit buyers to fill them.

Vertical Expansion: Adding buyers for adjacent product types creates additional bidding opportunities. An auto insurance lead might also qualify for home insurance or life insurance buyers seeking cross-sell opportunities.

Buyer Density by Segment: More buyers competing for the same lead type creates pricing tension and reduces the probability that no buyer wants a particular lead. Aim for 5-15 active bidders per segment. Below five limits competition. Above fifteen rarely adds value while increasing complexity.

Floor Pricing Calibration

Floor pricing protects value but floors set too high leave leads unsold.

Data-Driven Floors: Set floors based on bid distribution data rather than assumptions. If 95% of leads receive bids above $30, a $25 floor protects against outliers without rejecting significant volume.

Segment-Specific Floors: Different segments warrant different minimums. Premium credit tier leads might have $40 floors while subprime segments have $15 floors reflecting their different market values.

Time-Sensitive Adjustments: Consider lower floors during off-peak hours when buyer capacity exceeds supply. The alternative to accepting a $20 bid at 2 AM is often $0 in revenue.

Secondary Distribution Channels

For leads that do not sell in the primary auction, secondary channels recover partial value.

Aged Lead Specialists: Some buyers specialize in purchasing leads that did not sell in real-time, typically paying 5-20% of fresh lead value. A $50 lead that aged out might still generate $5-10 through aged lead buyers.

Cross-Vertical Routing: A lead that did not match insurance buyers might have value for financial services or home improvement buyers. Multi-vertical routing expands the potential buyer pool.

Batch Aggregation: Collect unsold leads over periods (daily or weekly) and offer them as bulk packages to buyers with different economics than real-time purchasers.

Lead Quality Investment

Buyer willingness to bid increases with demonstrated quality.

Enhanced Validation: Phone verification, email validation, and address confirmation give buyers confidence that leads are contactable. Verified leads command higher bids.

Consent Documentation: TrustedForm certificates and Jornaya LeadiD provide compliance evidence that many buyers require for participation. Without consent documentation, some buyers will not bid at all.

Fraud Prevention: Industry data indicates that approximately 30% of third-party leads contain fraudulent or materially false information. Removing fraud before leads enter the auction improves buyer experience and increases bid amounts over time. Real-time lead validation helps filter out bad data before it reaches buyers.

RTB for Voice Channels: Real-Time Call Auctions

The convergence of voice and data channels has extended RTB principles to live phone calls. Traditional call distribution used static routing rules. Modern platforms enable real-time competitive bidding on callers before connecting them to the winning buyer’s agent.

How Call RTB Works

When a consumer calls a tracking number, an IVR (Interactive Voice Response) system collects basic qualification data through voice prompts or keypad inputs: ZIP code, service type needed, current provider status, credit range. This data feeds a ping to potential buyers while the consumer waits.

The consumer’s hold time, which they experience anyway in traditional call routing, becomes productive auction time. Inbound call lead generation provides detailed coverage of these call-based monetization models. The caller waits 10-20 seconds listening to hold music while buyers compete in real-time for the right to receive that call. When the auction completes, the winning buyer’s dedicated phone number receives the transferred call, and their agent’s screen already displays the caller’s qualification data.

The Call Conversion Premium

Calls convert at dramatically higher rates than web forms. Industry benchmarks show:

- Inbound calls: 25-40% conversion to sale or appointment

- Web form leads: Approximately 2% conversion

This conversion advantage explains why call leads command significant premiums. A caller actively engaging by phone demonstrates higher intent than someone who filled out a form between other browser tabs. Buyers can justify paying $80-150 for a qualified call when the same demographic information as a web form might command only $30-50.

IVR Design Trade-offs

The demographic data available for call bidding depends entirely on IVR design. Simple IVRs collect only ZIP code and general intent. Sophisticated systems gather insurance type, current carrier, household size, homeownership status, credit range, and more.

The trade-off is caller patience. Every IVR question adds seconds to hold time and increases abandon rates. Studies suggest abandon rates increase 3-5 percentage points for each additional 10 seconds of hold time. Effective IVR design collects maximum bidding data with minimum friction, typically through 3-5 quick questions that can be answered via keypad.

Major RTB Platforms for Lead Distribution

Several platforms dominate the RTB lead distribution market. Understanding their capabilities helps operators select appropriate technology for their requirements.

boberdoo is the enterprise standard for high-volume ping-post distribution. Features include parallel pinging to all matched buyers simultaneously, scenario optimization that recalculates outcomes after post rejects (recovering 20-40% of potentially lost revenue), and 85+ standard reports covering every dimension of lead operations. Pricing typically starts around $1,000/month plus setup fees, with transaction fees varying by volume.

LeadExec provides browser-based platform supporting web leads, phone leads, and full ping-post capabilities. Five distribution methods (price-based, priority, round robin, weighted, percentage) and nine delivery methods provide integration flexibility. Offers a free tier (250 leads/month, 10,000 pings/month) with paid plans scaling based on volume.

LeadsPedia offers hybrid platform combining lead distribution with affiliate management. Unified tracking for clicks and leads in single dashboard suits operations running both affiliate programs and lead distribution. Pricing ranges from $450-2,500/month.

Phonexa provides enterprise multi-channel suite with “Ping Post Calls 2.0” supporting all five lead flows: ping-post web leads, inbound calls, click listings, direct post, and hybrid ping-post calls. Best suited for large operations monetizing across multiple channels.

Lead Prosper delivers API-first platform designed for smaller operations. “Bid penalties” automatically adjust for high-return buyers. Transaction-based pricing with volume tiers provides accessible entry point.

ActiveProspect LeadConduit functions as compliance middleware layering in front of other platforms. As TrustedForm creator, it provides consent documentation that many buyers require for RTB participation.

The Economics of RTB Participation

Understanding the economics helps both buyers and sellers optimize their RTB positions.

Seller Economics

RTB sellers benefit from price discovery, competitive pressure, and reduced buyer concentration risk. A seller processing 100,000 leads monthly at $40 average fixed price generates $4 million annually. The same volume at $48 average auction price generates $4.8 million. That $800,000 difference typically exceeds platform costs ($7,000-30,000 annually) and integration development ($20,000-100,000 one-time) within the first year.

Buyer Economics

RTB buyers gain precise pricing, granular targeting, and elimination of position lock-in from waterfall systems. The trade-off is volume unpredictability. Successful buyers track unit economics obsessively, calculating customer lifetime value, conversion rate, and acceptable acquisition cost for each segment.

| Vertical | Customer LTV | Close Rate | Max Viable CPL |

|---|---|---|---|

| Auto Insurance | $800-1,200 | 6-10% | $55-85 |

| Medicare Supplement | $1,500-2,500 | 8-15% | $80-150 |

| Solar Installation | $4,000-8,000 | 4-8% | $120-250 |

| Personal Injury Legal | $8,000-25,000 | 1-3% | $150-400 |

These maximum viable CPLs represent ceilings at which leads remain profitable. Competitive auctions typically drive prices below these ceilings.

Frequently Asked Questions

What is Real-Time Bidding (RTB) for lead auctions?

Real-Time Bidding for lead auctions enables competitive pricing of leads through automated auctions completing in milliseconds. When a consumer submits a lead form, the system broadcasts partial lead information (without personally identifiable data) to multiple buyers simultaneously. Buyers evaluate data against targeting criteria and return bid prices. The highest bidder receives complete lead information. The entire process completes in under two seconds. RTB replaces fixed-price arrangements with market-based pricing reflecting actual buyer demand for each lead’s characteristics.

How does ping-post differ from traditional lead distribution?

Traditional “waterfall” systems offered leads sequentially at predetermined prices. Buyer A at $40 saw every lead first; only rejected leads went to Buyer B at $35, then Buyer C. This created fixed pricing, position monopoly, and no competitive pressure. Ping-post introduces parallel bidding: all buyers see lead attributes simultaneously and compete. The highest bidder wins regardless of relationship position, creating true price discovery. The ping phase transmits non-identifying data for bid calculation; the post phase transmits complete consumer data only to the winning bidder.

What timing requirements must RTB systems meet?

Industry standards require ping responses within 100 milliseconds and total transaction completion within 1,500 milliseconds. The breakdown: ping broadcast under 20ms, buyer response under 100ms, bid aggregation under 50ms, post delivery under 300ms, post acceptance under 1,000ms. Buyers whose systems cannot respond within timeout windows are excluded from auctions. These requirements drive significant infrastructure investment in geographic server distribution, in-memory caching, and horizontal scaling.

What information is included in a ping versus a post?

The ping contains geographic data (ZIP code, state, area code), vertical-specific attributes (credit tier, loan amount, vehicle type), and metadata (source ID, timestamp, device type). The ping never contains personally identifiable information. The post includes everything from the ping plus complete PII: consumer name, phone, email, address, and consent documentation. Only the winning bidder receives post data, enabling price discovery while protecting consumer privacy until purchase commitment.

What fill rate should RTB sellers target?

Strong operations achieve 80-90% fill rates. Elite operations exceed 90%. Fill rates below 70% indicate problems: insufficient buyer coverage, floor prices too high, or lead quality issues. Improving fill rate requires expanding buyer coverage, calibrating floor prices based on bid distribution data, implementing secondary channels, and investing in lead quality improvements.

How do buyers determine their bid amounts?

Sophisticated buyers implement granular pricing: base bids by vertical and geography, credit tier adjustments (+$15 for 720+ scores), time-of-day modifiers (-$10 for evening leads), and source quality factors based on historical conversion rates. The final bid reflects expected value based on conversion rates and customer lifetime value. Buyers track performance data and adjust bidding to reflect actual outcomes. Win rates between 30-60% typically indicate appropriate bid calibration.

What happens when the winning buyer rejects a lead after receiving full data?

Post rejection triggers waterfall-on-failure logic. The platform recalculates the best scenario among remaining bidders and attempts delivery to the next-best option. This cascade continues until a buyer accepts or options exhaust. Well-implemented waterfall systems recover 20-40% of revenue otherwise lost. Common rejection reasons include duplicate detection, stricter validation revealing issues, and buyer capacity changes between ping and post phases.

What platforms support RTB for lead auctions?

Major platforms include boberdoo (enterprise standard, ~$1,000/month+), LeadExec (free tier available), LeadsPedia ($450-2,500/month), Phonexa (call-focused), Lead Prosper (transaction-based pricing), and LeadHoop (aggregator-focused). ActiveProspect LeadConduit provides compliance middleware with TrustedForm integration. Platform selection depends on volume requirements, vertical focus, and budget.

How does RTB work for phone calls instead of web leads?

Call RTB uses IVR (Interactive Voice Response) systems to collect caller qualification data during hold time. When a consumer calls, automated prompts gather ZIP code, service type, current provider status, and credit range through voice or keypad input. This data feeds a ping to potential buyers while the caller waits on hold. Buyers return bids, and the call routes to the winning bidder’s dedicated number. The consumer’s hold time (typically 10-20 seconds) becomes the auction window. This approach combines the high intent of phone calls (25-40% conversion rate versus 2% for web forms) with competitive pricing optimization. Modern platforms support multiple call flows including inbound IVR, click-to-call, warm transfer from qualifying agents, and hybrid web-plus-call scenarios.

What return rate is acceptable in RTB lead distribution?

Target return rates below 10% for healthy buyer-seller relationships. Rates of 5-8% are typical for well-matched partnerships with aligned expectations. Rates above 15% signal significant problems: filter misalignment between ping and post criteria, source quality issues, data accuracy problems, or relationship friction. Investigate return patterns by source, attribute, and buyer to identify root causes. Valid return reasons typically include invalid contact information (disconnected phone, bounced email), duplicate leads (consumer already in buyer’s system), and filter criteria mismatch that slipped through ping evaluation. Chronic high return rates from specific buyers may indicate unreasonable return practices or fundamental misalignment that requires relationship adjustment.

What minimum scale makes RTB economically viable?

RTB typically becomes economically viable at 5,000-10,000 leads monthly. Below this threshold, the technology investment (platform costs, integration development, ongoing maintenance) may exceed the revenue lift from competitive bidding. Additionally, low volume makes it difficult to attract enough buyers for meaningful competition. With only two or three bidders, prices remain close to what fixed contracts would achieve. At 10,000+ monthly leads with 5-15 active bidders per segment, the 15-30% revenue improvement from market-based pricing typically covers platform costs within the first year while delivering ongoing margin improvement. Very high volume operations (100,000+ monthly leads) may justify custom platform development to eliminate third-party fees.

Key Takeaways

-

Real-time bidding transformed lead distribution from fixed-price procurement into dynamic markets where competitive pressure determines value for every individual lead. The technology enables 15-30% revenue improvements over fixed contracts by ensuring leads sell at market value rather than negotiated averages.

-

The ping-post protocol separates bid solicitation from data delivery. Pings broadcast non-identifying attributes to all buyers simultaneously for competitive bidding. Posts deliver complete consumer information only to winning bidders. This bifurcation enables price discovery while protecting consumer privacy until purchase commitment.

-

Speed is a structural requirement, not a preference. Industry standards demand sub-100 millisecond ping responses and total transaction times under 1,500 milliseconds. Systems that cannot meet these thresholds lose auction participation and revenue. Achieving this speed requires geographic server distribution, in-memory caching, asynchronous processing, and horizontal scaling.

-

Fill rate optimization directly impacts revenue. Strong operations achieve 80-90% fill rates through buyer coverage expansion (geographic and vertical), market-based floor pricing, secondary distribution channels, and lead quality investments that increase buyer confidence.

-

Granular attribute-based bidding enables efficient price discovery. Buyers who implement tiered pricing based on credit score, geography, time-of-day, and source quality capture more value than those using flat bids. Sellers benefit from prices that reflect actual demand for specific lead characteristics.

-

Waterfall-on-failure recovery captures 20-40% of otherwise lost revenue. When primary winners reject leads, cascading to secondary bidders recovers significant value. This automated failover distinguishes professional platforms from basic implementations.

-

Call RTB extends auction mechanics to voice channels. IVR qualification during hold time enables competitive bidding on callers who convert at 25-40% rates compared to 2% for web forms. The conversion premium justifies significant infrastructure investment in call routing technology.

-

Minimum viable scale for RTB is approximately 5,000-10,000 monthly leads. Below this threshold, technology costs may exceed revenue improvement. Above this threshold, competitive dynamics and market-based pricing typically justify investment within the first year of operation.

For comprehensive coverage of lead distribution systems, auction mechanics, and technology platform selection, explore The Lead Economy, the complete guide to building and operating profitable lead generation businesses.