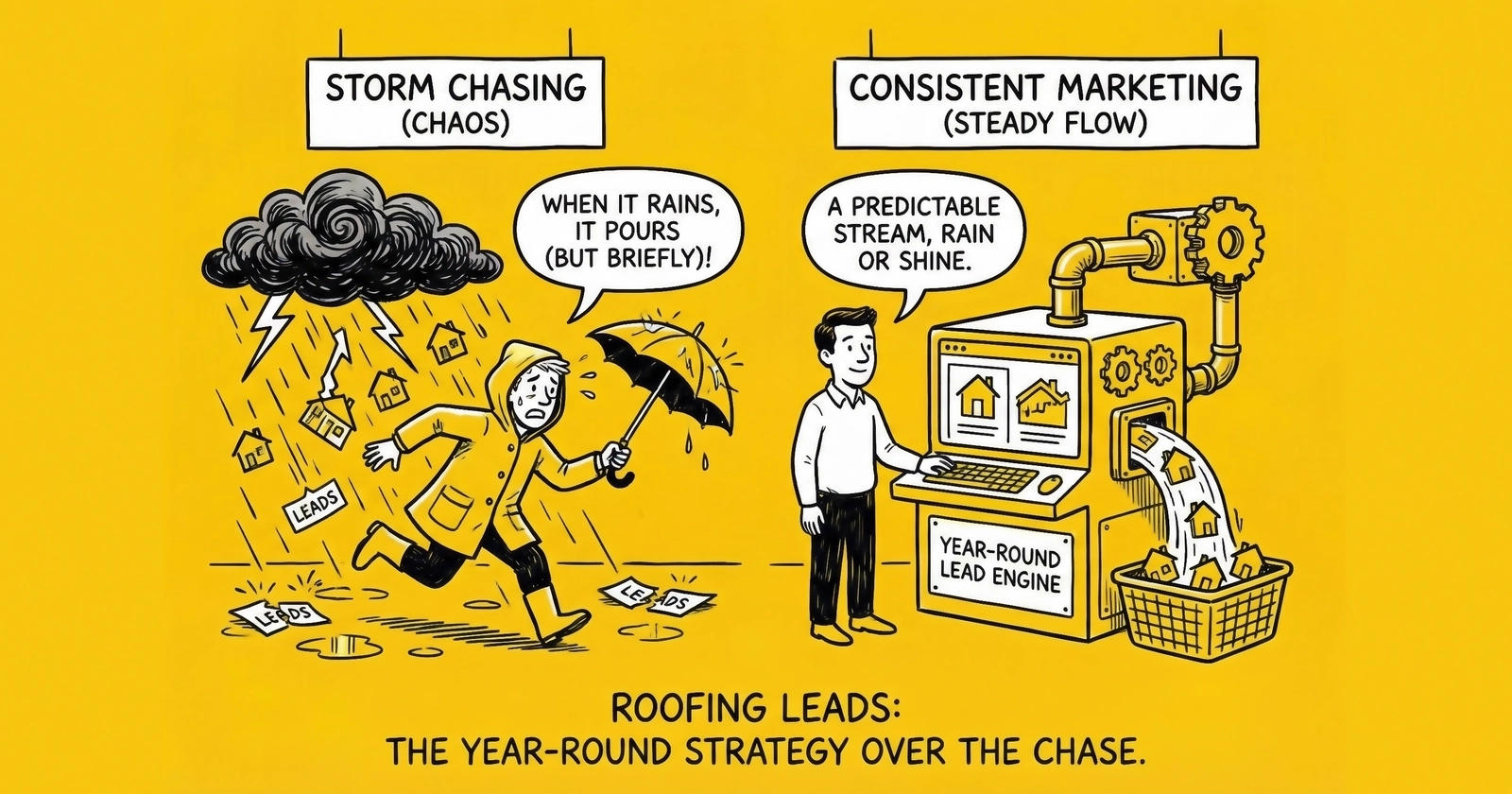

The roofing lead market splits into two distinct worlds: operators who chase hail trails and disappear between storms, and those who build sustainable year-round operations. Both can work. Neither is inherently superior. The question is which model fits your operation, your risk tolerance, and your contractor relationships.

The roofing lead vertical presents a fundamental strategic choice that shapes every operational decision. Storm-chasing operators mobilize after major weather events, generating leads at scale when demand peaks and homeowners are desperate for repairs. Year-round operators build steady pipelines of planned replacements, maintenance inquiries, and local market share that compounds over time.

This guide provides the complete framework for roofing lead generation in 2024-2025: storm-response economics, year-round marketing strategies, lead pricing by category, geographic market dynamics, insurance claim lead considerations, contractor relationship management, and the seasonal patterns that determine profitability. The numbers come from current market data. The strategic recommendations come from operational experience watching both models succeed and fail.

The roofing industry generates approximately $56 billion in annual revenue in the United States. Residential roofing represents roughly 75% of that total, split between repair work (often storm-driven) and replacement projects (a mix of storm damage and planned upgrades). Understanding which segment you serve determines your entire approach to lead generation.

The Storm-Chasing Model

Storm chasing in roofing refers to the practice of deploying marketing resources, sales teams, and sometimes entire operations to geographic areas recently affected by severe weather. A hailstorm in Dallas, a hurricane making landfall in Florida, or a tornado outbreak across the Midwest creates sudden, concentrated demand for roofing services. Storm chasers capitalize on this demand spike.

The Economics of Storm Response

Storm events create demand concentrations that dwarf normal market conditions. A single significant hailstorm can generate 10,000 to 50,000 roofing claims in a metropolitan area within days. This concentrated demand creates a temporary seller’s market where lead economics shift dramatically.

The pricing paradox confuses newcomers: leads are cheapest immediately after storms because supply surges. Every lead generator with weather monitoring pivots to the affected area, flooding the market with inventory. In the immediate aftermath (days 0-7), exclusive leads trade at $25-$50. As the first week passes and early response continues through day 30, pricing climbs to $40-$75 per exclusive lead. The market matures between days 30 and 90, with leads commanding $60-$100. Late-market leads, 90 days or more post-storm, reach $75-$125 per exclusive lead. Prices rise as storm markets mature because early inventory clears, casual operators move on, and remaining homeowners become harder to reach.

Contractor demand mirrors predictable waves. Storm-chasing contractors arrive within 24-72 hours of major events. The first wave consists of experienced storm restoration companies with established deployment protocols, pre-negotiated hotel blocks, and crews ready to travel. The second wave arrives within 1-2 weeks as smaller contractors recognize the opportunity. The third wave – often inexperienced practitioners attracted by stories of storm profits – arrives after 30 days and frequently struggles.

Lead demand mirrors these waves. First-wave contractors buy aggressively at any price because speed to market matters more than lead cost when competition is minimal. Second-wave contractors become price-sensitive as competition increases. Third-wave contractors often cannot profitably purchase leads because earlier arrivals have already captured most accessible demand.

Geographic Targeting for Storm Response

Effective storm chasing requires sophisticated weather monitoring and rapid response capability. The primary storm corridors each have distinct characteristics that shape your deployment strategy.

Texas, Oklahoma, and Kansas – the heart of Tornado Alley – experience peak activity from March through June, with hail and tornado damage driving most claims. The Florida Gulf Coast operates on a different calendar entirely, with hurricane season running June through November. Colorado’s Front Range has earned its reputation for intense hail, with April through September representing the active season and May through July delivering the most concentrated damage. The Southeast, particularly Georgia and the Carolinas, sees spring severe weather combined with summer hurricanes. The Upper Midwest states like Minnesota, Wisconsin, and Iowa experience severe thunderstorms from May through August.

Not all hailstorms generate significant roofing demand. Industry benchmarks have established clear thresholds for deployment decisions. Quarter-sized hail (1 inch) causes minimal roof damage and presents limited lead opportunity. Golf ball-sized hail (1.5 inches) creates moderate damage and viable lead generation conditions. Hen egg-sized hail (2 inches) causes significant damage with strong lead demand. Baseball-sized hail (2.5 inches or larger) represents catastrophic damage and maximum opportunity.

Monitoring services like HailTrace, CoreLogic, and specialized weather data providers offer real-time storm tracking and damage estimation. Investing in accurate storm intelligence pays for itself by preventing deployment to marginal events and ensuring presence at high-value storms.

Storm Lead Generation Tactics

Rapid deployment advertising forms the backbone of storm response. Smart practitioners pre-build Google Ads campaigns for target metro areas that can activate within hours of confirmed damage. Facebook and Instagram campaigns target affected geographic areas with storm-specific messaging. Landing pages emphasize storm-specific urgency and local contractor matching. Call-only campaigns capture maximum intent during the critical first hours.

Local presence marketing amplifies digital efforts. Door-to-door canvassing in affected neighborhoods generates face-to-face leads where legal. Vehicle wraps and yard signs create visibility that compounds throughout the recovery period. Community event presence at recovery-focused gatherings builds trust. Local radio and streaming audio deliver rapid awareness to affected residents.

Content and SEO provide longer-term capture. Pre-built content templates for search queries like “[City] hail damage roof repair” enable rapid deployment. Location-specific landing pages go live within hours of storm confirmation. Press release distribution can earn local news pickup. Social proof from previous storm market work establishes credibility with homeowners researching their options.

Regulatory Considerations for Storm Markets

Storm-affected areas often implement special regulations affecting roofing contractors and lead generation. Understanding these requirements protects both you and your contractor partners.

Contractor registration requirements vary significantly by state. Texas requires contractor registration in disaster-declared counties. Florida mandates licensing for roofing work with no reciprocity for out-of-state licenses. Louisiana requires registration and a $10,000 bond for storm work. Colorado requires licensing in storm-affected municipalities. Lead generators serving storm markets must verify contractor licensing status before routing leads – selling to unlicensed contractors exposes both parties to legal risk and damages reputation when projects fail.

Some municipalities implement temporary anti-solicitation ordinances after storms. These may include prohibitions on door-to-door sales within specified periods (often 72 hours to 2 weeks), required permits for canvassing activities, and restrictions on yard sign placement. These ordinances rarely affect digital lead generation but do impact ground operations. Contractors who violate ordinances face fines and potential contract voidability.

Storm markets attract bad actors, prompting increased scrutiny from state insurance commissioners and attorneys general during active storm seasons. Lead generators should verify contractor insurance and licensing documentation, avoid promising insurance claim outcomes in advertising, refuse to work with contractors who advocate assignment of benefits (AOB) schemes in states where restricted, and document all lead transactions for potential investigation response.

The Year-Round Marketing Model

Year-round roofing lead generation builds sustainable demand independent of weather events. This model focuses on planned replacements, aging roof upgrades, cosmetic improvements, and relationship-driven referrals. While less dramatic than storm chasing, year-round operations often produce more predictable profitability and stronger contractor relationships.

Market Sizing for Non-Storm Demand

The average residential roof has a 20-25 year lifespan, depending on material and climate. With approximately 140 million housing units in the United States, simple math suggests 5-7 million roofs reach replacement age annually – without any storm damage.

Year-round demand spans multiple categories. Age-related replacement captures shingles approaching or exceeding manufacturer warranties. Cosmetic upgrades serve homeowners improving curb appeal for personal preference or sale preparation. Energy efficiency projects include solar readiness, cool roofs, and attic ventilation improvements. Leak repairs address non-storm water intrusion issues. Insurance requirements increasingly drive replacement as carriers mandate roof upgrades for continued coverage.

This baseline demand exists in every market regardless of weather patterns. The challenge is reaching homeowners at their decision point rather than waiting for a storm to create urgency.

Geographic Considerations for Year-Round Operations

Year-round success requires matching marketing strategy to local market characteristics.

The Sun Belt presents unique opportunity. Arizona, Nevada, and Southern California experience minimal storm activity but have massive housing stock with aging roofs. The lack of storm-chasing competition creates opportunity for operators focused on age-related replacement.

Florida presents a hybrid market that deserves special attention. Hurricane damage drives significant volume, but the state’s aggressive insurance reform has created year-round replacement demand as carriers refuse to renew policies on roofs older than 15 years. This regulatory-driven replacement market operates independently of storm activity.

Coastal markets from Maine to the Carolinas experience storm activity but also have substantial year-round demand driven by salt air degradation, luxury home maintenance, and seasonal resident preparation.

Traditional Midwest and Northeast markets show pronounced seasonality. Spring and fall represent peak installation seasons; winter and summer see reduced activity. Marketing spend should align with contractor capacity – ramping during installation seasons and conserving during slow periods.

Year-Round Lead Generation Tactics

Search engine optimization captures homeowners during their research phase. Target informational queries like “how long does a roof last,” “signs you need a new roof,” and “roof replacement cost [city].” Build location pages for every service area to capture geographic intent. Create content addressing common homeowner questions that position you as a trusted resource. Pursue local citations and directory listings to strengthen local search presence.

Paid search reaches planning-stage homeowners with different intent than storm searches. Keywords like “roof replacement estimate,” “roofing contractor near me,” and “best roofing company [city]” indicate research rather than emergency. Lower urgency requires different conversion approaches – compelling content rather than just phone numbers. Longer consideration cycles necessitate remarketing strategies that maintain presence throughout the decision journey. Quality Score optimization matters more when CPCs remain consistent rather than spiking with storm events.

Social media and display advertising build awareness and capture intent. Facebook and Instagram targeting can reach homeowners in target demographics using home equity and home age signals. Programmatic display supports brand awareness and remarketing sequences. YouTube pre-roll delivers educational content that establishes expertise. NextDoor presence builds community trust that converts when neighbors need recommendations.

Email and content nurturing convert leads not ready to purchase immediately. Lead magnets like “Roof Inspection Checklist” or “Understanding Your Roof Warranty” capture contact information for future follow-up. Nurture sequences maintain engagement until purchase readiness. Seasonal maintenance reminders keep your brand top-of-mind. Referral requests from satisfied customers generate low-cost leads from high-trust sources.

Relationship Marketing Advantages

Year-round operations build competitive moats that storm chasers cannot replicate.

Referral networks compound over time. Satisfied customers refer neighbors, friends, and family. A contractor with 500 completed jobs has 500 potential referral sources generating leads at near-zero cost. Storm chasers leave markets before referral networks develop.

Real estate partnerships deliver steady volume. Realtors need trusted roofing contractors for pre-sale repairs and buyer inspections. Year-round operators can build relationships that generate steady referral volume. Storm chasers are unknown quantities realtors will not risk recommending.

Insurance adjuster relationships develop through repeated interaction. Local adjusters develop preferences for contractors who do quality work, cooperate professionally, and resolve claims efficiently. Year-round contractors build these relationships through consistent presence that storm chasers cannot match.

Community presence creates brand recognition. Sponsoring little league teams, participating in community events, and maintaining visible local presence creates awareness that converts when homeowners need roofing services.

Lead Pricing Benchmarks by Category

Roofing lead pricing varies dramatically by lead type, source, and market conditions. Understanding these variations prevents both overpaying for commodity leads and undervaluing premium inventory.

Exclusive Lead Pricing

Exclusive leads sell to a single contractor, eliminating competition from other buyers calling the same homeowner.

| Lead Type | Price Range | Typical Close Rate |

|---|---|---|

| Storm damage (early) | $25-$75 | 12-20% |

| Storm damage (mature) | $75-$150 | 8-15% |

| Planned replacement | $60-$100 | 10-18% |

| Insurance claim | $75-$150 | 10-15% |

| Repair inquiry | $30-$60 | 15-25% |

| Inspection request | $20-$40 | 5-10% |

Shared Lead Pricing

Shared leads sell to multiple contractors, typically 3-5 buyers who compete for the same homeowner.

| Lead Type | Price Range | Typical Close Rate |

|---|---|---|

| Storm damage | $15-$40 | 5-10% |

| Planned replacement | $25-$50 | 4-8% |

| Insurance claim | $30-$60 | 5-10% |

| Repair inquiry | $15-$30 | 6-12% |

Live Transfer and Appointment Pricing

Premium lead products that increase conversion probability.

| Lead Type | Price Range | Typical Close Rate |

|---|---|---|

| Live transfer call | $75-$150 | 20-35% |

| Set appointment | $100-$200 | 25-40% |

| Confirmed inspection | $125-$250 | 30-45% |

Aged Lead Pricing

Leads older than 30 days that failed to convert for original buyers.

| Lead Age | Price Range | Typical Close Rate |

|---|---|---|

| 30-60 days | $10-$25 | 3-6% |

| 60-90 days | $5-$15 | 2-4% |

| 90+ days | $2-$8 | 1-3% |

Geographic Variations

Lead pricing varies significantly by market competitiveness and average project value.

Premium markets command higher pricing due to project values and competitive intensity. California coastal markets run 30-50% above national averages. Florida adds 20-40% due to insurance complexity premiums. Texas major metros price 10-25% higher. Northeast urban markets command 15-30% premiums.

Standard markets represent benchmark pricing: Midwest metros, Mountain West, and Mid-Atlantic regions generally align with national averages.

Value markets price lower due to reduced project values and competition. Rural areas run 20-40% below national averages. Low-cost-of-living regions typically see 15-25% discounts.

Insurance Claim Leads: A Specialized Segment

Insurance claim roofing leads represent a distinct category requiring specialized knowledge and contractor capabilities. These leads involve homeowners who have filed or intend to file insurance claims for roof damage, typically storm-related.

The Insurance Claim Process

Understanding the claim lifecycle helps lead generators create appropriate content and set accurate expectations.

The process begins with damage discovery, when homeowners identify potential damage, often after storms. Claim filing follows as the homeowner contacts their insurance carrier. The adjuster inspection comes next, with the insurance adjuster evaluating damage and coverage. Estimate negotiation may occur if the contractor disputes the adjuster’s assessment. Approval and payment follow successful claim processing. Work completion concludes the cycle with the contractor performing repairs or replacement.

Lead generation typically targets homeowners in the first three stages. By the time estimate negotiation begins, most homeowners have already selected contractors.

Advertising Considerations for Insurance Claims

Marketing insurance claim assistance requires careful compliance with state regulations and insurance industry standards.

Permitted messaging keeps focus on services rather than outcomes. Phrases like “Free roof inspection,” “Storm damage assessment,” “Help navigating the claims process,” and “Working with all insurance companies” describe legitimate services without making promises.

Certain messaging creates legal risk and should be avoided. Never promise specific claim outcomes. Do not guarantee insurance will pay. Never offer to pay deductibles (illegal in most states). Avoid suggesting insurance fraud techniques. Do not promote aggressive assignment of benefits arrangements in restricted states.

State-specific restrictions add complexity. Florida heavily restricts AOB for roofing following 2019 reforms. Texas prohibits unlicensed public adjusting by contractors. Louisiana requires specific contractor registration for storm work. Many states restrict contractor contingency fee arrangements with public adjusters.

Contractor Requirements for Insurance Leads

Not all roofing contractors can effectively work insurance claim leads. Lead generators should verify capabilities before routing this lead type.

Necessary capabilities include experience reading and interpreting insurance policies, Xactimate proficiency (the industry-standard estimating software), supplement negotiation experience, understanding of depreciation and actual cash value versus replacement cost, and patience for extended claim timelines (60-120 days typical).

Warning signs should trigger caution. Be wary of contractors who do not understand recoverable depreciation, those who want payment before insurance claims close, operators who promise specific claim amounts, and contractors without appropriate insurance coverage.

Seasonal Patterns and Calendar Strategy

Roofing lead generation follows predictable seasonal patterns that vary by geography and lead type. Aligning marketing spend with these patterns maximizes ROI.

National Seasonal Trends

Spring from March through May marks the beginning of peak installation season. Homeowners emerge from winter to address deferred maintenance. Tax refund season provides down payment capital. Storm season begins in Tornado Alley. Lead demand and pricing increase 20-40% above winter baseline.

Summer from June through August represents peak installation capacity in northern markets while southern markets slow due to extreme heat. Hurricane season activity affects coastal markets. Storm-chasing opportunities arise in the upper Midwest. Lead demand varies by geography, but pricing remains elevated across most regions.

Fall from September through November brings a secondary peak for installations. Hurricane season continues through October. Homeowners prepare for winter. Insurance deadline pressure intensifies in Florida and other regulated markets. Lead demand and pricing remain strong through October before declining in November.

Winter from December through February sees minimal installation activity in northern markets, though southern markets continue. This is planning season for spring projects. Lower lead costs coincide with reduced contractor appetite. Lead demand hits annual minimums with pricing 20-35% below peak.

Storm Season Calendar

Each storm corridor follows its own rhythm. Tornado Alley spanning Texas, Oklahoma, and Kansas sees primary activity from March through June with peak storms in April and May. A secondary season runs September through October. Response windows extend from immediately post-storm through 90 days.

The Colorado Front Range experiences hail season from April through September, with peak activity concentrated in May through July. The density of hail events creates concentrated opportunities, and response windows extend through 120 days or more.

Florida and the Gulf Coast operate on hurricane season from June through November, with peak activity from August through October. Storm response can extend 12 months or more for major hurricanes as insurance market complications extend demand cycles.

The Southeast including Georgia and the Carolinas sees spring severe weather from March through May and hurricane influence from June through November. Year-round mild climate supports extended installation seasons.

Budget Allocation by Season

Strategic budget allocation maximizes return by matching spend to opportunity. January and February warrant 60-70% of average monthly budget, focusing on nurturing, relationship building, and planning-stage leads while storm activity remains minimal except along the Gulf Coast.

March and April should see 90-110% of average monthly budget as spring demand awakens, storm season begins, and contractor capacity becomes available. May and June justify aggressive spending at 120-140% of average monthly budget during peak storm season with high demand and competition. Strong conversion rates justify aggressive acquisition.

July and August return to 100-120% of average monthly budget. Northern markets hit peak installations while southern heat causes slowdowns. Hurricane preparation messaging gains relevance. September and October warrant 110-130% of average monthly budget as fall demand spikes, hurricane season continues, and pre-winter urgency messaging resonates.

November and December should pull back to 70-80% of average monthly budget during seasonal slowdown. Holiday distractions reduce engagement. Focus shifts to relationship marketing and referral cultivation.

Building Contractor Relationships

For lead generators serving roofing contractors (rather than operating as contractors), relationship quality determines long-term success. The roofing industry’s fragmented nature – thousands of small operators, significant contractor churn, and boom-bust cycles – makes partner selection and management critical.

Contractor Selection Criteria

Not all roofing contractors make good lead buyers. Selecting partners who can convert leads effectively protects your reputation and builds sustainable relationships.

Operational requirements establish baseline capabilities. Look for adequate crew capacity for timely completion (minimum 2-3 crews), sales capability for lead follow-up (dedicated sales staff or owner engagement), CRM or lead management system (even basic spreadsheet tracking suffices), current and verifiable insurance and licensing documentation, and geographic service area matching your lead generation focus.

Financial stability indicators protect against payment issues. Prioritize established business history (2+ years preferred for year-round operations, demonstrated storm experience for chasers), consistent payment history with suppliers and subcontractors, adequate credit line for lead purchasing and job financing, and no history of payment disputes or bankruptcy.

Reputation indicators reveal contractor quality. Check for positive Google reviews (4.0+ average with 25+ reviews minimum), satisfactory BBB rating where applicable, clean state license board complaint history, and positive references from suppliers and subcontractors.

Storm Chaser Considerations

Storm-chasing contractors present unique evaluation challenges that require additional scrutiny.

Positive indicators include a track record across multiple storm markets, established deployment infrastructure (vehicles, equipment, crew lodging), insurance claim experience with documented success, relationships with supplementing firms and public adjusters, and consistent payment history during previous storm seasons.

Warning signs should disqualify potential partners. Be cautious of first-time storm response operators with no established playbook, undercapitalized operations relying on homeowner deposits, histories of aggressive sales tactics, complaints in previous storm markets, and resistance to compliance documentation.

Relationship Management

Once contractors are onboarded, ongoing relationship management sustains performance.

Regular communication maintains alignment. Weekly check-ins work well during active engagement periods. Monthly reviews suit year-round partners. Quarterly business reviews analyze performance data and identify optimization opportunities. Advance notice of market changes and storm opportunities helps contractors prepare.

Performance transparency builds trust. Share lead quality metrics including contact rates, quote rates, and close rates. Discuss return patterns and root causes openly. Provide competitive benchmarking (anonymized) so contractors understand their performance relative to peers. Collaborate on optimization opportunities rather than simply pushing volume.

Capacity monitoring prevents burnout. Track response time trends – slowing indicates capacity stress. Monitor close rate changes, as declining rates may indicate oversupply. Adjust lead volume proactively before contractors request changes. Building trust through proactive management creates partnerships that survive competitive pressure.

Pricing and Terms

Lead pricing structures should align contractor and generator incentives. Each model has distinct characteristics.

Per-lead pricing offers simplicity, remains the most common approach, and provides immediate cash flow. Performance-based pricing reduces base costs while adding bonuses for closed sales. Revenue share creates full incentive alignment but adds complexity. Subscription or retainer models deliver predictable costs and guaranteed volume access.

Term considerations shape the relationship structure. Minimum volume commitments protect against cherry-picking. Exclusivity arrangements may cover geographic areas or specific lead types. Return policies define what qualifies for credit and maximum return percentages. Payment terms range from prepaid through net 7, net 15, and net 30.

Storm-specific terms accommodate the unique dynamics of weather-driven markets. Rapid scaling provisions enable aggressive acquisition during storm events. Geographic mobility provisions serve storm-chasing contractors following weather patterns. Expedited payment supports high-velocity periods when cash flow demands intensify. Volume discounts reward aggressive acquisition during limited-window opportunities.

Lead Quality and Verification

Roofing leads face quality challenges common to home services: fake submissions, tire-kickers, renters claiming homeownership, and lead recycling. A comprehensive quality verification stack separates profitable operations from those bleeding money on bad inventory.

Common Quality Issues

Homeownership verification presents the fundamental qualification question: does this person own the property they are inquiring about? Renters cannot authorize roofing work, yet self-reported ownership has significant error rates. Property database matching through services like ATTOM or CoreLogic confirms name-to-address match and ownership status. Utility verification suggests residence but not necessarily ownership. Credit header data can confirm address and sometimes mortgage presence. Self-attestation alone is insufficient for premium lead products.

Property qualification filters out poor candidates for roofing work. Mobile and manufactured homes have different requirements and limited contractor interest. Commercial properties sometimes mix into residential lead flows. Multi-unit properties require HOA or management approval. Properties with title or lien issues may have financing complications.

Contact validity determines whether leads are workable. Phone verification via SMS or voice callback confirms active numbers. Email verification through confirmation links ensures deliverability. Address standardization and validation catches input errors. Duplicate detection against historical databases prevents repeated sales of the same lead.

Quality Verification Stack

Implementing systematic verification reduces return rates and builds buyer confidence.

Form-level validation provides the first filter. Phone number format verification catches obvious errors. Email syntax and deliverability checks eliminate invalid addresses. Address standardization and geocoding confirm location validity. Required field completion for qualification questions ensures data completeness.

Real-time verification adds depth. Phone carrier lookup identifies line type (mobile, landline, VoIP) and flags high-risk patterns. Email domain reputation scoring identifies disposable and problematic addresses. Address verification against postal databases confirms deliverability. Duplicate detection against 30-90 day lookback prevents recycling.

Enhanced verification supports premium lead products. Property database ownership confirmation eliminates renter leads. Credit header matching adds identity verification. TrustedForm or Jornaya session recording documents form completion behavior and consent. Phone verification via SMS code or voice callback confirms engagement.

Post-delivery verification completes the feedback loop. Buyer contact rate feedback identifies systematic quality issues. Disposition tracking enables conversion analysis. Return rate monitoring by source and verification level guides optimization. Pattern detection identifies fraud indicators before they damage relationships.

Return Rate Management

Industry return rates for roofing leads typically range 10-20% depending on verification level and lead type. Storm leads with high urgency show 8-15% return rates. Planned replacement leads run 12-18%. Repair inquiries fall in the 10-15% range. Insurance claims, with their higher complexity, see 15-25% returns.

Return rates correlate directly with verification investment. Basic verification alone produces 18-25% return rates. Standard verification stacks reduce returns to 12-18%. Premium verification including ownership confirmation and callback verification achieves 8-12% return rates.

The cost-benefit analysis favors verification investment. Adding $3-$5 in verification costs per lead typically reduces returns by 40-60%. On a $75 exclusive lead without verification, a 20% return rate creates an effective cost of $93.75. With verification at $4 per lead and a 10% return rate, effective cost drops to $86.67. The verification investment pays for itself while improving buyer relationships.

Comparing the Models: Storm Chasing vs Year-Round

The strategic choice between storm chasing and year-round marketing involves tradeoffs across multiple dimensions. Neither model is inherently superior; each fits different operators, risk tolerances, and competitive advantages.

Storm Chasing Advantages

Higher peak profitability attracts operators comfortable with volatility. Storm markets create demand spikes where well-positioned operators can generate extraordinary returns. A single major hailstorm can produce 60-90 days of concentrated lead flow at premium conversion rates.

Lower fixed cost structure reduces baseline risk. Storm chasers can operate with minimal fixed infrastructure. Marketing campaigns activate on demand. Staff scales with storm activity. No year-round overhead burden drains resources during quiet periods.

Geographic optionality provides diversification. Storm chasers follow opportunity wherever it emerges. Poor storm seasons in one region can be offset by activity elsewhere. No dependence on single-market conditions limits exposure.

Faster feedback loops accelerate learning. Storm markets mature quickly. Campaign performance reveals itself within days, not months. Optimization cycles compress, enabling rapid improvement.

Storm Chasing Disadvantages

Revenue volatility creates planning challenges. Storm activity is inherently unpredictable. A calm season can devastate operations dependent on storm revenue. Reduced severe weather activity hurts many storm-focused operators.

Competition intensity compresses margins during major events. Major storms attract every lead generator in the industry. CPCs spike dramatically. Quality differentiation becomes critical when dozens of operators target the same metro area.

Regulatory risk adds uncertainty. Storm markets face increased regulatory scrutiny. New ordinances, licensing requirements, and enforcement actions can materialize with minimal warning.

No relationship compounding limits long-term value creation. Storm chasers leave markets before building referral networks, repeat customer relationships, or community presence. Every storm requires starting from zero.

Year-Round Advantages

Revenue predictability enables sustainable operations. Steady demand enables financial planning, staffing stability, and consistent contractor relationships. No feast-or-famine cycles disrupt operations.

Relationship compounding builds cumulative value. Every satisfied customer becomes a potential referral source. Contractor relationships deepen over time. Community presence builds brand equity that converts for years.

Competitive moats develop over time. SEO authority, review accumulation, and local reputation cannot be replicated overnight. Year-round operators build sustainable competitive advantages that new entrants cannot quickly overcome.

Reduced regulatory risk simplifies compliance. Operating in established markets with known regulations reduces compliance surprises.

Year-Round Disadvantages

Lower peak margins limit upside potential. Year-round markets lack the urgency premiums of storm response. Margins are consistent but rarely spectacular.

Higher fixed cost burden requires consistent volume. Year-round operations require consistent marketing investment, staff, and infrastructure regardless of lead volume.

Geographic concentration risk creates dependence. Single-market operators depend on local economic conditions, contractor health, and competitive dynamics.

Longer optimization cycles slow improvement. Without storm-driven urgency, campaign performance reveals itself more slowly. A/B tests require weeks or months rather than days.

Hybrid Approaches

Many successful operators combine elements of both models to capture the advantages while mitigating the disadvantages.

Year-round base with storm response provides stability plus upside. Maintain stable year-round operations in core markets while deploying additional resources during storm opportunities. The year-round base provides stability; storm response provides upside during favorable conditions.

Regional specialization balances depth with optionality. Focus year-round efforts in 2-3 core markets while maintaining storm-response capability in the broader region. Deep local presence combines with opportunistic expansion.

Contractor portfolio diversification matches leads to buyers. Work with both year-round local contractors and storm-chasing nationals. Different contractor types absorb different lead inventory, maximizing monetization across all market conditions.

Frequently Asked Questions

What is the average cost per lead for roofing?

Roofing CPL varies significantly by lead type, market conditions, and exclusivity. Exclusive leads for planned replacements typically range $60-$100 nationally, with storm damage leads ranging $25-$75 immediately post-storm to $75-$150 in mature storm markets. Shared leads cost $15-$50 depending on buyer count and lead type. Live transfer leads command $75-$150, and set appointments range $100-$200. Geographic premiums apply in coastal California (+30-50%), Florida (+20-40%), and Texas major metros (+10-25%). The relevant metric is cost per acquisition rather than cost per lead – a $100 lead converting at 15% yields an effective CPA of $667, which may be acceptable for a $15,000 roof replacement but prohibitive for a $500 repair.

Should I focus on storm leads or year-round leads for roofing?

The optimal approach depends on your operational capabilities, risk tolerance, and contractor relationships. Storm leads offer higher peak profitability but revenue volatility, intense competition, and no relationship compounding. Year-round leads provide predictable revenue, relationship building, and sustainable competitive advantages but lower peak margins. Most successful operators run hybrid models: year-round base operations in core markets supplemented by storm-response capability when opportunities arise. If you have limited capital and high risk tolerance, pure storm chasing may work. If you prioritize stability and long-term market position, year-round focus makes sense. The worst approach is half-commitment to either model.

How do I generate leads immediately after a storm event?

Post-storm lead generation requires rapid deployment across multiple channels. Pre-build Google Ads campaigns for target metro areas that can activate within hours of confirmed damage, using keywords like “[city] hail damage roof repair” and “[city] storm damage roofing.” Deploy Facebook and Instagram campaigns with geographic targeting and storm-specific messaging. Create location-specific landing pages addressing the specific storm event. Use call-only campaigns for maximum urgency capture. Simultaneously, ground operations should deploy canvassing teams (where permitted), vehicle wraps for visibility, and yard signs in affected neighborhoods. Storm-specific content and press releases can capture earned media. The first 7 days post-storm offer the lowest CPLs but highest competition; days 7-30 represent the optimal value window for most practitioners.

What qualifications should roofing leads include?

Essential qualification data for roofing leads includes homeownership confirmation, property address, property type (single-family, multi-family, manufactured), approximate roof age, current roof material, specific issue or project type (repair, replacement, inspection, insurance claim), timeline for work, and contact preferences. Highly valuable additional data includes insurance claim status, damage type for storm leads, electric bill or home value proxies for project sizing, and financing interest. For insurance claim leads, add claim filed status, insurance carrier, and damage discovery date. Property database verification confirming ownership transforms self-reported data into verified leads worth premium pricing.

How long does the opportunity last after a major storm?

Storm market opportunity windows vary by storm severity and market size. Typical patterns show the immediate phase (days 0-30) featuring maximum lead volume, lowest CPLs due to supply surge, and first-wave contractor demand. The active phase (days 30-90) sees reduced volume, stabilizing prices, and second-wave contractor competition. The mature phase (days 90-180) features declining volume, rising CPLs as remaining leads become harder to reach, and third-wave contractor struggles. The extended phase (180+ days) involves minimal volume, premium pricing for remaining legitimate demand, and focus on insurance claim supplements. Major hurricanes can extend these windows to 12-18 months. Minor hailstorms may conclude within 60-90 days. Market saturation from competitor activity often determines practical duration more than underlying demand.

What regulations apply specifically to roofing lead generation?

Roofing lead generation faces both general advertising regulations and industry-specific requirements. General requirements include FTC truth-in-advertising standards, TCPA compliance for calls and texts, state telemarketing registration, and consent documentation. Industry-specific considerations include contractor licensing verification before lead delivery, state-specific storm work registration requirements (Texas, Louisiana, Florida), anti-solicitation ordinances in disaster-declared areas, insurance claim advertising restrictions (no promised outcomes, no deductible payment offers), and assignment of benefits restrictions in states like Florida. Lead generators should verify contractor licensing before selling roofing leads, include appropriate disclaimers in insurance-related advertising, and monitor local ordinances in storm-affected areas.

How do I work with insurance claim leads for roofing?

Insurance claim roofing leads require specialized handling. Qualify leads for claim status (filed, planning to file, unsure of coverage), damage type, insurance carrier, and timeline since damage discovery. Route these leads only to contractors with demonstrated insurance claim experience, including Xactimate proficiency, supplement negotiation capability, and understanding of depreciation recovery. Advertising should focus on inspection services and claims process assistance rather than promised outcomes. Avoid implying insurance will definitely pay, offering deductible assistance (illegal in most states), or promoting aggressive assignment of benefits arrangements. Set expectations for extended timelines – insurance claim roofing projects typically take 60-120 days from lead to completion. Price insurance claim leads at premium rates ($75-$150 exclusive) reflecting their complexity and longer sales cycles.

What booking rate should roofing contractors expect from leads?

Booking rates (leads converting to scheduled estimates or inspections) vary by lead type and contractor execution. Exclusive planned replacement leads typically book at 10-18%. Storm damage leads book at 12-20% during early storm response, declining to 8-15% in mature markets. Repair inquiry leads book at 15-25% due to higher urgency. Live transfer leads achieve 20-35% booking rates. Set appointments book at 25-40%. Shared leads book at 4-10% depending on competition intensity. Contractor execution dramatically affects these rates. Response time within 5 minutes versus 1 hour can double or triple booking rates. Systematic follow-up sequences capture an additional 30-50% of leads that do not answer initial contact. Script quality, voicemail messaging, and SMS/email coordination all affect outcomes.

How do seasonal patterns affect roofing lead generation?

Roofing follows pronounced seasonal patterns varying by geography. Northern markets see peak installation seasons in spring (March-May) and fall (September-October), with minimal winter activity. Southern markets maintain year-round activity with summer heat creating some slowdown. Storm season overlays these patterns: Tornado Alley peaks March-June, Colorado hail season runs April-September, and hurricane season affects coastal markets June-November. Lead pricing and demand track these patterns – spring and fall command 20-40% premiums over winter in northern markets. Budget allocation should mirror seasonality: 120-140% of average monthly budget during peak seasons, 60-70% during winter troughs. Nurturing leads captured during slow seasons for spring conversion can improve annual economics.

How can I verify that roofing leads are legitimate homeowners?

Homeownership verification uses multiple methods with varying cost and accuracy. Property database services (ATTOM, CoreLogic) provide name-to-address matching and ownership confirmation for $0.50-$2.00 per lookup. Credit header data can confirm address history and sometimes indicate mortgage presence. Utility bill verification suggests residence but not necessarily ownership. Phone verification via SMS or voice callback confirms contact validity and consumer engagement. TrustedForm or Jornaya session recording documents form completion behavior and consent. For premium exclusive leads, combining property database verification with phone callback confirmation reduces return rates by 40-60% while enabling premium pricing. Self-reported homeownership alone has 15-25% error rates and should not be trusted for high-value leads.

What makes a good roofing contractor partner for lead purchasing?

Strong roofing contractor partners demonstrate operational capability, financial stability, and professional reputation. Operational requirements include adequate crew capacity (minimum 2-3 active crews), dedicated sales function for lead follow-up, systematic lead management (CRM or at least spreadsheet tracking), and geographic coverage matching your lead inventory. Financial indicators include established business history (2+ years), consistent payment track record with suppliers, adequate credit for lead purchasing volume, and no bankruptcy or major dispute history. Reputation markers include positive online reviews (4.0+ average, 25+ reviews), clean state license board records, current insurance and licensing, and verifiable references. For storm-chasing contractors specifically, verify experience across multiple storm markets, established deployment infrastructure, and payment history during previous storm seasons.

Key Takeaways

-

The roofing lead market divides into storm-chasing and year-round models with fundamentally different economics, risk profiles, and operational requirements. Neither is inherently superior; the optimal choice depends on your capabilities, risk tolerance, and contractor relationships. Most successful operators run hybrid approaches combining year-round base operations with storm-response capability.

-

Storm lead pricing follows a counterintuitive pattern: cheapest immediately post-storm (days 0-7, $25-$50 exclusive) when supply floods the market, then rising through mature phases (days 30-90, $75-$125) as inventory clears and remaining homeowners become harder to reach. Understanding this pattern enables strategic timing of acquisition investment.

-

Year-round roofing demand from age-related replacement, cosmetic upgrades, and regulatory requirements exceeds 5 million roof replacements annually – providing substantial opportunity independent of weather events. Markets like Arizona and Southern California with minimal storm activity but aging housing stock offer particularly favorable year-round economics.

-

Insurance claim leads require specialized handling, including contractor verification for Xactimate proficiency and supplement experience, careful advertising compliance avoiding promised outcomes or deductible incentives, and appropriate pricing reflecting extended sales cycles. Route these leads only to contractors with demonstrated claims experience.

-

Homeownership verification using property database services ($0.50-$2.00 per lookup) reduces return rates by 40-60%, transforming the investment from expense to profit center. The verification cost typically pays for itself within a single lead cohort through reduced returns and premium pricing enablement.

-

Seasonal patterns create budget allocation opportunities: 120-140% of average monthly budget during peak seasons (spring and fall), 60-70% during winter troughs. Storm season calendar overlay adds complexity – Tornado Alley peaks March-June, hurricane season runs June-November, Colorado hail concentrates April-September.

-

Contractor relationship quality determines long-term success more than lead generation tactics. Selecting partners with operational capability, financial stability, and professional reputation protects lead generator reputation and enables sustainable partnerships. Capacity monitoring and proactive volume adjustment build trust that survives competitive pressure.

-

Speed-to-contact remains the primary conversion driver across all roofing lead types. Contractors who respond within 5 minutes convert at 2-3x the rate of those responding within an hour. Lead generators should prioritize real-time delivery and help contractors implement rapid response systems.

Market data current as of Q4 2024. Storm patterns and regulatory requirements change frequently. Verify current conditions and consult local compliance requirements before deploying marketing campaigns or establishing contractor relationships in new markets.