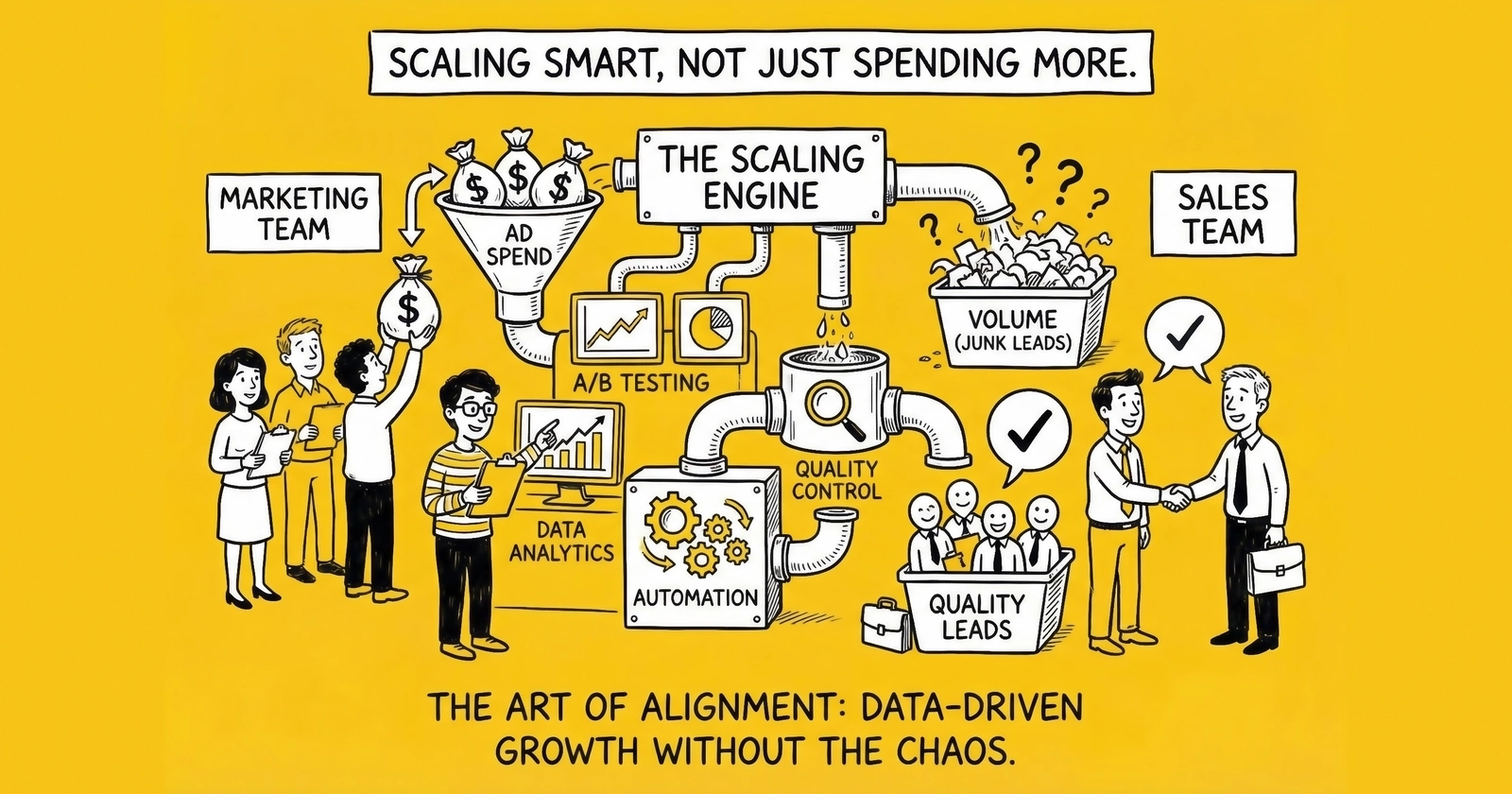

A tactical guide for lead generation professionals who want to grow from $10K to $100K monthly ad spend while maintaining – or improving – the quality metrics that keep buyers happy and margins intact.

You scaled your ad spend by 50% last month. Your lead volume increased by 47%. Your buyer called to say they’re pausing because contact rates dropped from 62% to 41% and their sales team is wasting time on leads that never answer.

This is the scaling trap. Every operator hits it. The mechanics are predictable: you push more money into campaigns, algorithms find cheaper traffic to spend it on, and that cheaper traffic produces leads that look identical on paper but perform worse when the phone rings.

The solution is not to avoid scaling. The solution is to scale in a way that forces quality accountability at every step – before your buyer’s call center tells you what you should have caught yourself.

This guide covers the tactical framework for scaling ad spend from $10K to $100K monthly (or beyond) while maintaining the quality thresholds that determine long-term profitability. Not theory. The actual process that separates operators who scale successfully from those who crater their buyer relationships trying.

Why Quality Degrades When You Scale

Quality degradation during scaling is not a bug. It is a predictable outcome of how advertising platforms allocate budget increases.

When you increase daily spend on a campaign, the platform faces a choice: find more of the same high-quality conversions, or find cheaper conversions to hit volume targets. The algorithm almost always chooses the latter. Not because it is malicious – because cheaper conversions are easier to find.

The Three Mechanisms of Quality Degradation

The first mechanism is audience expansion. At $200/day, your campaign targets your ideal demographic with precision. At $800/day, the platform exhausts that core audience and expands to lookalike audiences, secondary geographic regions, and demographic segments you never explicitly approved. Google’s Performance Max and Facebook’s Advantage+ campaigns accelerate this problem. These AI-driven campaign types are designed to find conversions wherever they exist, and “wherever” often means audiences you would never have chosen manually.

The second mechanism is placement dilution. Platforms start by showing ads in premium placements. As budget increases, they fill volume by accessing cheaper inventory – lower-quality sites, less engaged audiences, placements with accidental clicks. A $100/day search campaign runs exclusively on high-intent keywords. A $400/day campaign often expands to display network placements you did not request.

The third mechanism is time-of-day optimization breakdown. Your highest-quality leads likely convert during specific hours – typically weekday business hours when motivated buyers research actively. As budget increases, platforms spread spend across 24 hours to hit volume targets, purchasing leads at 2 AM when intent patterns differ dramatically. A mortgage lead captured at 11 AM on Tuesday converts differently than one captured at 3 AM on Sunday. The platform treats them identically because both completed your form. Your buyer’s sales team does not.

The Data Showing Quality Decline

Industry data confirms these patterns across verticals. Average contact rates drop 15-25% when campaigns scale beyond 2x original spend without quality controls. Lead-to-sale conversion rates typically decline 20-30% during aggressive scaling phases. Buyer return rates often spike from baseline 8-12% to 18-25% during uncontrolled scaling.

These numbers compound. A 20% contact rate decline combined with a 25% conversion decline means you need 67% more leads to generate the same sales. Your effective customer acquisition cost can double while your dashboard shows “growth.”

The Quality-Volume Tradeoff: Understanding the Curve

The relationship between volume and quality is not linear. It follows a curve with three distinct phases that every operator must understand before scaling.

Phase 1: The Free Zone (0-50% Increase)

During initial scaling, quality often holds steady or even improves slightly. The platform finds more of your existing audience at similar efficiency. This phase creates dangerous confidence – operators assume quality will remain stable at any scale.

In this phase, CPL typically increases by 5-15%, contact rates remain stable or decline slightly by 1-3%, and conversion rates and return rates hold steady. Everything looks fine. This is where operators build false confidence about their ability to scale indefinitely.

Phase 2: The Friction Zone (50-150% Increase)

Quality begins degrading measurably. The platform exhausts your core audience and expands into secondary segments. CPL increases accelerate, typically rising 20-40% above baseline. Contact rates decline by 8-15%, conversion rates drop 10-20%, and return rates increase by 3-8 percentage points.

This is where most practitioners fail. They see volume increasing, accept the CPL hit as “cost of growth,” and do not track downstream metrics closely enough to catch the quality degradation before buyers notice. The numbers still look acceptable if you squint, but the trend is moving in the wrong direction.

Phase 3: The Cliff (150%+ Increase)

Quality collapses. The platform relies heavily on low-quality inventory, expanded audiences, and non-core placements. Even if CPL stabilizes (platforms often find cheap conversions at scale), the leads generate minimal value.

In this phase, CPL becomes highly variable – sometimes decreasing as quality craters. Contact rates decline 20-35%, conversion rates drop 30-50%, and return rates climb to 20-30% or higher. At this point, your buyer relationship is at serious risk.

Where Your Operation Sits on the Curve

Your position depends on multiple factors. Vertical matters significantly – insurance leads have higher tolerance for volume scaling than legal leads, and home services scale more predictably than mortgage during rate volatility.

Traffic source matters too. Google Search has a steeper quality-volume curve than Facebook because search intent is more targeted to begin with. Display and native advertising have flatter curves – quality is more variable at any spend level, so scaling produces less dramatic degradation.

Geographic concentration matters because operations targeting a single state hit audience saturation faster than national campaigns. Buyer quality thresholds also factor in – a buyer requiring 70% contact rates has less tolerance for scaling-related degradation than one operating at 50% baseline.

Scaling Incrementally: The 15-20% Weekly Protocol

Controlled scaling follows a specific protocol: increase spend by 15-20% weekly, measure quality for 5-7 days, and only proceed if thresholds hold. This pace allows algorithm learning, audience expansion monitoring, and buyer feedback loops to function.

Why 15-20% Weekly

This increment balances growth velocity against quality monitoring. Scaling too slowly at 5-10% takes 4-6 months to double spend, during which market conditions and buyer demand change before you reach your target. Scaling too fast at 30% or more means quality degradation outpaces your measurement capability – you discover problems after buyers have already been damaged.

The optimal 15-20% increment doubles spend in 6-8 weeks while providing time to catch quality degradation before it compounds. This is fast enough to matter strategically but slow enough to maintain visibility.

The Weekly Scaling Protocol

On day one, raise daily budget by 15-20% across campaigns. Document starting CPL, conversion rate, and quality metrics. Note any audience or placement changes the platform makes automatically.

During days two through four, monitor leading indicators. Track CPL in real-time, daily or more frequently. Watch form completion rates, since declining form completion often precedes quality decline. Check placement reports for new inventory being accessed and review audience expansion signals in platform dashboards.

During days five through seven, evaluate lagging indicators. This includes contact rate data from your buyer (which requires a 3-5 day delay minimum), conversion rate data (often 7-14 day delay), return rate trending, and qualitative buyer feedback.

On day eight, make your scale decision. If quality metrics hold within thresholds, increase another 15-20%. If quality metrics decline but remain acceptable, hold spend level for another week. If quality metrics breach thresholds, reduce spend and diagnose the source of degradation.

The 72-Hour Stabilization Rule

After any budget increase, allow 72 hours for platform algorithms to stabilize before drawing conclusions. Day-one performance after a budget change is not representative. Algorithms typically require 48-72 hours to optimize delivery patterns around new budget levels.

This means a Monday budget increase should not be evaluated until Thursday at earliest. Friday budget changes often show distorted results due to weekend traffic patterns – hold your judgment until Tuesday to see representative performance.

Source Diversification During Scale

Single-source scaling hits diminishing returns faster than diversified scaling. As you push more budget into one platform, that platform exhausts quality inventory faster. The solution is horizontal expansion across sources rather than vertical depth into a single source.

The Multi-Source Scaling Framework

Rather than scaling Google Ads from $10K to $50K monthly, consider spreading growth across multiple platforms. In phase one, growing from $10K to $20K, increase Google from $10K to $15K (a 50% increase) while adding Facebook as a new source at $5K.

In phase two, growing from $20K to $35K, increase Google from $15K to $20K (a 33% increase), scale Facebook from $5K to $10K (100% increase), and add Microsoft Ads as a new source at $5K.

In phase three, growing from $35K to $50K, increase Google from $20K to $25K (a 25% increase), scale Facebook from $10K to $12K (20% increase), grow Microsoft from $5K to $8K (60% increase), and add native advertising through Taboola or Outbrain as a new source at $5K.

This approach caps individual source scaling at 50-60% during any phase while achieving overall 100% growth.

Source-Specific Quality Characteristics

Each traffic source behaves differently during scaling. Google Search offers highest intent and highest CPL but has the steepest quality degradation curve – scale carefully. Facebook and Meta platforms provide moderate intent and moderate CPL, but audience quality degrades before CPL increases. Watch frequency metrics closely.

Microsoft and Bing have a lower volume ceiling but often deliver higher quality per lead than Google, making them excellent for quality-focused scaling. Native advertising through Taboola and Outbrain is highly variable by publisher. Start with premium packages before allowing programmatic expansion.

The 60/30/10 Diversification Rule

For sustainable scaling, target approximately 60% of spend on your primary, proven source, 30% on secondary sources with established quality, and 10% on testing new sources. This limits damage from any single source degradation while maintaining efficiency from proven channels. When a source degrades, you have alternatives already producing, rather than scrambling to find new traffic from scratch.

Maintaining Quality Thresholds

Quality thresholds are not suggestions. They are the hard lines that determine whether scaling produces profit or destroys buyer relationships. Define these thresholds before scaling, monitor them continuously, and treat breaches as scaling stops – not inconveniences.

Essential Quality Metrics and Thresholds

Leading indicators require daily monitoring. CPL should not exceed 30% above baseline. Form completion rate – visitors who complete forms divided by visitors who start – should maintain minimum 85% of baseline. Validation pass rate for leads passing phone and email validation should stay at minimum 90% of baseline. Duplicate rate should not exceed 15%, though this varies by vertical.

Quality indicators require weekly monitoring. Contact rate – leads reached on first attempt divided by total leads – should maintain minimum 90% of buyer baseline. Qualification rate – leads qualified for product divided by leads contacted – should stay at minimum 85% of buyer baseline. Return rate should not exceed baseline plus 5 percentage points.

Conversion indicators require monthly monitoring. Lead-to-sale rate should maintain minimum 80% of buyer baseline. Revenue per lead should stay at minimum 85% of baseline. Buyer satisfaction based on qualitative feedback should show no negative trending.

Setting Your Baseline

Before scaling, establish a 30-day baseline for each metric during stable operations. This baseline becomes your comparison point for all scaling decisions. Document the average value, standard deviation, day-of-week patterns, and traffic source breakdown for each metric.

Without a documented baseline, you cannot objectively identify when quality degrades. You will rely on buyer complaints – which arrive too late to prevent damage.

Threshold Breach Response Protocol

When one metric reaches 90-95% of threshold, you have a yellow flag. Continue monitoring but increase measurement frequency to daily. Prepare intervention options but no spend reduction is required yet.

When one metric reaches 95-100% of threshold, or two metrics reach yellow flag status, you have an orange flag. Pause scaling and hold current spend. Investigate the root cause and implement targeted correction. Require two consecutive days within threshold before resuming.

When any metric breaches its threshold, you have a red flag. Reduce spend by 20-30% immediately. Isolate the source of quality degradation and communicate proactively with affected buyers. Do not resume scaling until metrics stabilize for one full week.

When to Pause Scaling

Knowing when to stop is more valuable than knowing how to start. Certain signals require immediate scaling pause, while others warrant evaluation before action.

Hard Stop Signals

Buyer communication signals demand immediate attention. When a buyer requests volume reduction, mentions quality concerns unprompted, delays payment (which may indicate cash flow stress from conversion issues), or sees return rates exceed contractual thresholds, stop scaling immediately.

Data signals also trigger hard stops. These include contact rates dropping more than 15% week-over-week, return rates increasing more than 5 percentage points week-over-week, CPL exceeding profitability threshold at current buyer pricing, or three or more quality metrics simultaneously reaching yellow flag status.

Market signals may also require pauses. Seasonal demand decline, such as insurance Q4 slowdown or mortgage during rate spikes, should give you pause. So should major regulatory changes affecting your vertical and competitive intensity spikes during political advertising seasons or open enrollment periods.

Soft Pause Signals

Some signals warrant evaluation rather than immediate action. When CPL trends upward for three consecutive days, a single quality metric reaches yellow flag status, a platform announces significant algorithmic changes, or a buyer requests pricing renegotiation, take time to assess the situation before making major changes.

The 48-Hour Rule

When you observe concerning signals, give yourself 48 hours before making major decisions. Quality metrics are inherently noisy. What looks like degradation on Monday may resolve by Wednesday as algorithms stabilize.

One critical exception: buyer communication requesting changes requires immediate response regardless of data patterns. The relationship matters more than your analysis timeline.

Building Capacity Before Scaling

The most common scaling failure has nothing to do with traffic quality. It happens when generators scale lead volume beyond buyer capacity, forcing them to sell to secondary buyers at discounted rates or warehouse leads until they age out of value.

Understanding Buyer Capacity

Every buyer has three capacity constraints. Contact capacity determines how many leads their sales team can contact within the first five minutes or their target contact window. A 10-person sales team making 20 dials per hour has roughly 200 leads per day contact capacity – assuming no other lead sources. Speed-to-lead directly impacts conversion rates.

Absorption capacity determines how many leads per day, week, or month they can profitably convert. This depends on close rates, product margins, and operational leverage.

Financial capacity determines how much they can spend on leads while maintaining cash flow. A buyer paying net-30 on $50 leads has different capacity than one paying weekly on $30 leads.

The Capacity-First Scaling Protocol

Before increasing ad spend, verify that your primary buyer can absorb increased volume. Get confirmation in writing – email or contract amendment – specifying volume increase and timeline, and clarify any quality threshold adjustments.

Verify that secondary buyers exist for overflow. You need minimum two backup buyers under contract with tested delivery and payment processes. Understand the pricing differential, typically 20-40% lower prices for secondary buyers.

Verify your own float capacity supports the increase. Calculate your new daily spend multiplied by 45-60 days to determine required float. Verify cash reserves or credit line availability, and factor in seasonal payment timing.

Building Buyer Relationships During Stable Periods

The worst time to find new buyers is when you need them. Build buyer relationships during stable operations by testing three new buyers quarterly with 50-100 leads each. Evaluate payment reliability, return patterns, and communication quality, then elevate top performers to secondary status with contracted minimums. This continuous development ensures expansion capacity when scaling opportunities arise.

Tracking Quality Metrics During Scale

Quality tracking during scaling requires more granular measurement than stable-state operations. You need to identify degradation sources quickly enough to intervene before damage compounds.

The Daily Quality Dashboard

During active scaling, build a daily dashboard showing traffic source breakdown – CPL by source, lead volume by source, validation pass rate by source, and form completion rate by source. Track buyer performance including delivery acceptance rate by buyer, rolling 7-day return rate by buyer, contact rate by buyer where available, and payment status by buyer. Display threshold status for each metric with green, yellow, orange, or red indicators, week-over-week trending, and days since last threshold breach.

Attribution Requirements

You cannot manage quality without accurate attribution. Every lead must carry its traffic source, campaign, and ad group through to buyer feedback – generic “Google” attribution is insufficient. Record capture time, delivery time, and first contact time. Track geographic origin at state-level minimum and note which ad or landing page generated each lead.

Building Feedback Loops with Buyers

Quality tracking depends on buyer data. Build systematic feedback loops: daily delivery confirmations and return notifications, weekly contact and qualification rate reports, monthly conversion and revenue-per-lead analysis, and quarterly relationship reviews. Those who scale successfully receive buyer feedback in days rather than weeks. If you are waiting two weeks to learn how your leads performed, you are operating blind during the most critical phase of scaling.

Case Study: Scaling from $10K to $100K Monthly

This case study follows a real scaling trajectory in the home services vertical covering HVAC and plumbing leads. The timeline, metrics, and decision points illustrate the principles discussed throughout this guide.

Starting Position

At month zero, the operation spent $10,000 monthly on advertising, all through Google Ads. The primary buyer was a regional HVAC company. CPL ran $42, generating 238 leads monthly. Contact rate was 67%, return rate was 9%, and lead-to-sale rate was 12%.

Phase 1: Foundation Building (Months 1-2)

During these first two months, the operation established baseline documentation for all quality metrics and contracted a secondary buyer – a plumbing company – at 15% lower pricing. A $1,500 Facebook Ads test showed CPL of $38 with 58% contact rate, acceptable for the secondary buyer. The team built a daily tracking dashboard.

By end of month two, monthly spend reached $12,000 – $10,500 on Google and $1,500 on Facebook. Monthly leads increased to 295. All quality metrics remained within baseline range.

Phase 2: Controlled Scaling (Months 3-5)

Following the 15-20% weekly protocol, Google increased incrementally while the team monitored CPL and contact rates. When Google CPL spiked 22% in month three, investigation revealed Performance Max had expanded to mobile app placements. Excluding that inventory returned CPL to acceptable range.

By month five, monthly spend reached $32,000 – $24K on Google, $6K on Facebook, and $2K on Microsoft. Monthly leads hit 685 at $47 CPL, 12% above baseline. Contact rate was 63%, a 6% decline monitored closely. Return rate was 11%, a 2 point increase within threshold.

Phase 3: Diversification and Optimization (Months 6-9)

The team recognized Google was nearing its quality degradation zone at $24K monthly. Incremental spend shifted to Facebook and new sources. When Facebook contact rate declined to 51% in month seven due to audience expansion, the team tightened targeting and scaled Microsoft instead.

By month nine, monthly spend reached $62,000 – $32K on Google, $12K on Facebook, $10K on Microsoft, and $8K on native advertising. Monthly leads hit 1,180 at $53 blended CPL. Contact rate was 61%, a 9% decline approaching threshold. Return rate held at 12%, within threshold.

Phase 4: Optimization and Scale Completion (Months 10-12)

Challenges emerged. The primary buyer reached capacity at 800 leads monthly, requiring addition of a third buyer. Native advertising return rates spiked, requiring publisher pauses. Seasonal demand decline required volume adjustments.

By month twelve, monthly spend reached $98,000 across five sources – Google at 35%, Facebook at 20%, Microsoft at 18%, native at 15%, and other sources at 12%. Monthly leads reached 1,850 at $53 blended CPL. Contact rate was 59%, 12% below starting baseline, but buyers had been informed throughout. Return rate was 13% and lead-to-sale rate was 10.5%, both within acceptable ranges.

Key Lessons from This Scale

Source diversification preserved quality. No single source exceeded 35% of spend, limiting exposure to any source’s quality degradation.

Weekly monitoring caught problems early. The month three placement issue and month seven Facebook issue were identified and resolved before causing buyer complaints.

Buyer capacity required parallel development. Three buyers were necessary to absorb 1,850 monthly leads. Building this capacity required six months of relationship development during stable operations.

Quality thresholds declined but remained profitable. Contact rate dropped 12% from baseline, but the business remained profitable because thresholds were set conservatively and buyers were informed throughout the process.

The scaling timeline was 12 months, not 12 weeks. Patient, controlled scaling created a sustainable $100K monthly operation. Aggressive scaling would have destroyed buyer relationships by month four.

Frequently Asked Questions

How fast can I realistically scale ad spend without destroying quality?

The 15-20% weekly increment is the maximum sustainable rate. This allows algorithm stabilization, quality monitoring, and buyer feedback loops to function. At this pace, you can double spend in 6-8 weeks while maintaining quality visibility. Faster scaling at 30% weekly or more consistently produces degradation that damages buyer relationships.

Should I scale vertically on one platform or diversify across multiple platforms?

Diversify. Single-platform scaling hits diminishing returns faster because you exhaust quality inventory on that platform. A $50K monthly Google budget produces lower average quality than $25K on Google plus $15K on Facebook plus $10K on Microsoft. Target no more than 50% of spend on any single platform during scaling.

How do I know if quality degradation is temporary algorithm noise or a real problem?

Apply the 72-hour rule and the two-data-point rule. Quality fluctuations within 72 hours of a budget change are often algorithm noise – wait before acting. If quality metrics decline in consecutive measurement periods, treat it as a real problem requiring intervention.

My buyer says quality is declining but my metrics look fine. Who is right?

Your buyer is right. Always. Buyers experience quality through their sales team’s daily reality. If their experience diverges from your metrics, your metrics are measuring the wrong things. Align your tracking to buyer experience rather than defending your dashboard.

What percentage quality decline is acceptable during scaling?

Most operations can sustain a 10-15% decline in contact and conversion rates while remaining profitable. Beyond 15%, profitability erodes quickly. Set thresholds at 85-90% of baseline metrics, giving room for normal scaling friction while preventing serious degradation.

How do I handle buyer capacity constraints when I can generate more leads than they can absorb?

Build secondary and tertiary buyer relationships before hitting capacity constraints. Secondary buyers typically pay 15-30% less, which changes unit economics but maintains revenue. The worst outcome is generating leads you cannot sell – warehoused leads lose 50% or more of value within 48 hours.

Should I scale CPL or scale volume first?

Scale volume at stable CPL first. Attempting to reduce CPL while scaling volume creates compounding pressure that degrades quality. Establish your volume target at acceptable CPL, then optimize CPL once volume stabilizes.

How long should I wait between scaling increments?

Minimum five days, preferably seven. Leading indicators stabilize within 48-72 hours; lagging indicators require 5-7 days. Scaling faster than weekly means making decisions before you have data from the previous decision.

What should I do if I scaled too fast and quality has already degraded?

Reduce spend by 30-40% immediately – not incrementally. Return to a spend level where quality was previously stable, then restart the 15-20% weekly protocol. The audience available at $40K/month is fundamentally different from the audience at $20K/month.

How do I communicate scaling-related quality changes to buyers?

Proactively and specifically. When you begin scaling, inform buyers: “We are increasing volume over the next 8 weeks. We anticipate slight quality normalization as we expand sources. Our target is to maintain contact rates above X%. We will check in weekly with updates.” This transparency builds trust even when numbers fluctuate.

Key Takeaways

Quality degradation during scaling is predictable, not surprising. Advertising platforms expand to lower-quality inventory as budgets increase. The 15-20% weekly scaling protocol gives you visibility into this degradation before it damages buyer relationships.

Diversification beats depth. Four traffic sources at $20K each produce higher average quality than one source at $80K. No single platform should exceed 50% of total spend during active scaling.

Buyer capacity must scale before lead volume. The constraint on most operations is not traffic availability – it is buyer absorption capacity. Build buyer relationships during stable periods so capacity exists when you need it.

Thresholds are not guidelines – they are hard stops. Define quality thresholds before scaling begins. When metrics breach thresholds, reduce spend immediately. Continuing to scale through quality problems compounds damage exponentially.

Twelve months beats twelve weeks. Sustainable scaling from $10K to $100K monthly typically requires 9-12 months of disciplined execution. Attempts to compress this timeline consistently produce quality collapses that force partial or complete pullbacks.

Your buyer’s experience is the only metric that matters. Dashboards can show green while buyers experience red. When buyer feedback diverges from your data, your data is wrong. Align tracking to buyer reality, not the other way around.

The lead economy rewards operators who scale patiently and punishes those who chase volume at the expense of quality. The buyers who pay premium prices for your leads have options. The moment your leads stop converting, those buyers move to competitors who prioritized sustainable quality over impressive growth charts. Scale like your buyer relationships depend on it – because they do.