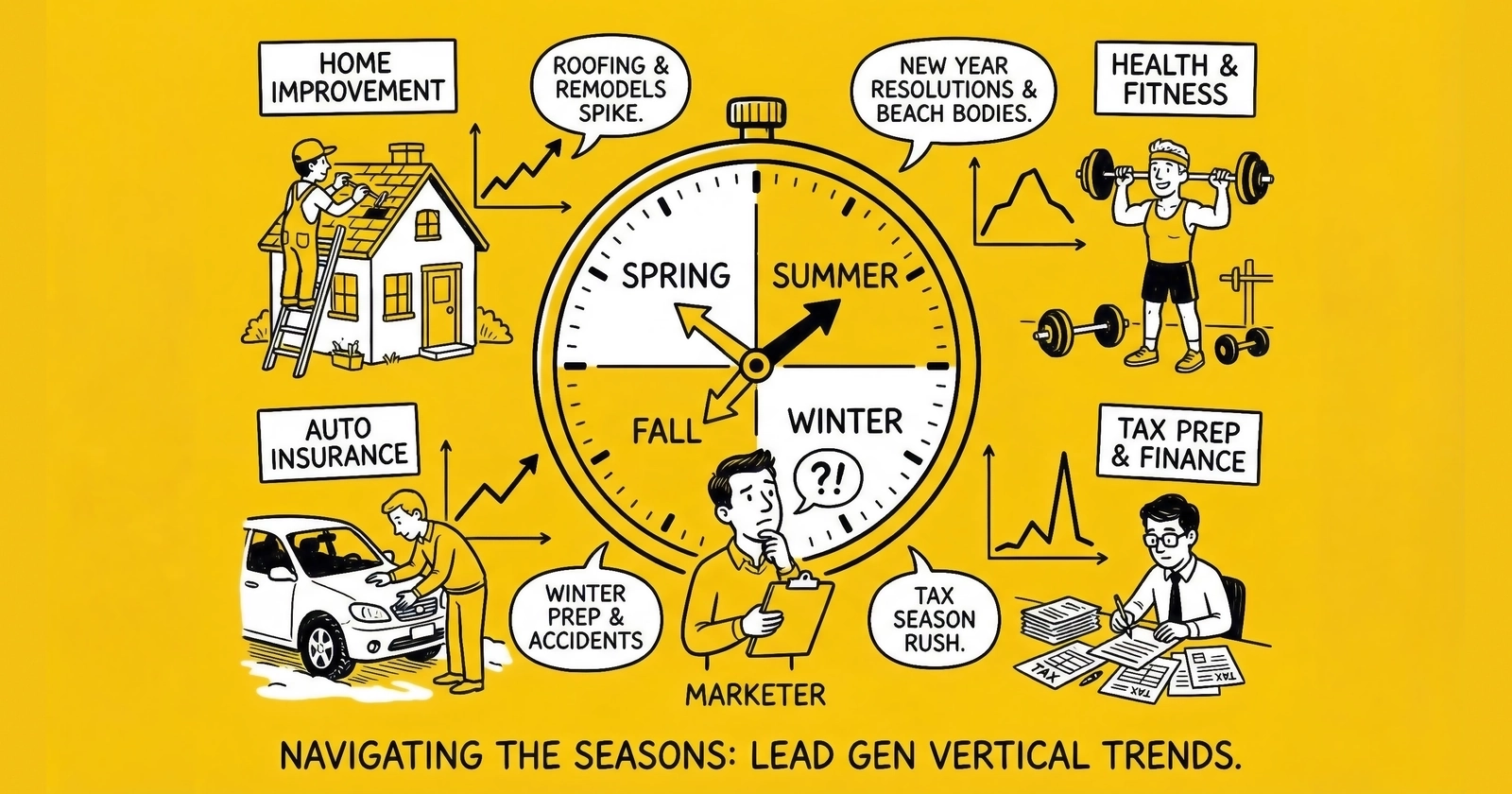

Timing determines profitability. This guide maps the annual rhythms of insurance, solar, mortgage, legal, and home services leads so you can allocate budget, staff, and resources when they matter most.

Lead generation operates on rhythms that most practitioners learn the hard way. The Medicare lead that costs $40 in July commands $150 in November. The solar lead worth $200 in April drops to $100 in December. The mortgage refinance lead that dominated your revenue in 2020 disappeared entirely by 2023.

Understanding these seasonal patterns separates profitable operations from those constantly scrambling to explain revenue shortfalls. This guide maps the annual cycles across the five major lead verticals, providing the calendar intelligence you need to plan budgets, staff appropriately, and capture counter-cyclical opportunities your competitors miss.

The patterns are not suggestions. They are market realities backed by decades of industry data. Ignore them and you will overspend during low-demand periods, understaff during peak seasons, and watch margins compress while wondering what went wrong.

Insurance Seasonality: The Most Predictable Vertical

Insurance leads follow the most structured seasonal patterns in lead generation. Different sub-verticals operate on entirely different calendars, and understanding each is essential for profitability.

Auto Insurance: Policy Renewal Cycles

Auto insurance demand remains relatively stable throughout the year compared to other insurance products, but distinct patterns emerge that smart practitioners exploit.

January Peak: New Year’s resolution shopping drives a measurable uptick as consumers review their finances and seek better rates. The post-holiday period also coincides with annual policy renewals for a significant portion of the market.

Spring Surge (March-May): Pre-summer travel planning increases shopping activity. Families planning road trips and summer vacations compare rates. Young drivers graduating from college enter the market.

Fall Activity (September-October): Back-to-school routines prompt parents to reassess household expenses. Teen drivers added to policies create shopping triggers.

December Lull: Holiday distractions reduce shopping activity. Consumers focus on gift buying rather than insurance comparison.

Auto insurance CPLs typically range from $25-75 for shared leads and $50-150 for exclusive leads throughout the year. Seasonal variation runs approximately 15-25%, with January and spring commanding premium pricing and December seeing compression.

The bigger pricing driver in auto insurance is carrier advertising behavior. When Progressive or GEICO increase advertising budgets, lead demand spikes regardless of season. When carriers pull back due to underwriting losses, prices compress even during typically strong months.

Medicare: The 54-Day Window That Dominates Everything

Medicare lead generation operates on a calendar so rigid that operators build entire businesses around two enrollment windows. Missing these windows means missing 70-80% of annual opportunity.

Annual Enrollment Period (AEP): October 15 - December 7

This 54-day window accounts for 60-70% of annual Medicare lead volume. During AEP, beneficiaries can switch Medicare Advantage plans, change prescription drug coverage, or transition between Original Medicare and Medicare Advantage.

Lead pricing during AEP:

- Shared leads: $50-100

- Exclusive leads: $80-200+

- Premium exclusive with verification: $150-300

Compare these to off-season pricing of $30-60 for shared leads. The premium reflects the compressed opportunity window and intense competition for limited consumer attention.

Medicare Advantage plans pay agents approximately $600 for initial enrollments (2026 national compensation amount), with renewal commissions continuing annually. The Medicare lead generation market operates under strict regulatory guidelines that affect timing and messaging. This economics justifies premium CPLs during AEP. A $150 lead converting at 8% yields a $1,875 effective CPA against multi-year commission streams exceeding $3,000 per enrollee.

Open Enrollment Period (OEP): January 1 - March 31

OEP provides a secondary peak with different characteristics. Only Medicare Advantage enrollees can make changes during this window, limiting the addressable market but reducing competition compared to AEP.

Lead pricing during OEP typically runs 50-75% of AEP levels. Consumers switching during OEP often have higher purchase intent because they are making active changes to coverage that proved unsatisfactory, rather than routine annual comparisons.

Special Enrollment Periods (SEPs)

Year-round Medicare leads come from Special Enrollment Periods triggered by qualifying life events: moving to a new service area, losing employer coverage, qualifying for Medicaid, or experiencing plan-level changes. SEP leads maintain relatively consistent pricing at $40-70 for exclusive leads, but volume is inherently limited.

Medicare Operational Implications:

- Begin AEP preparation by July (carrier plan finalization, creative approval)

- Scale traffic acquisition capacity 3-5x for peak periods

- Build sales team flexibility that can expand and contract

- Maintain year-round presence for SEP volume, but recognize it will not replace AEP scale

Health Insurance: Open Enrollment Concentration

Under-65 health insurance through the Affordable Care Act marketplace creates concentrated demand around the November 1 - January 15 Open Enrollment Period.

November-January Peak: Approximately 50-60% of annual volume concentrates in this window. Consumers can enroll in marketplace plans, creating intense lead demand from insurance brokers and carrier partners.

Special Enrollment Throughout Year: Life events (job loss, marriage, having a child) trigger SEPs that provide year-round lead opportunity, though at significantly lower volumes than Open Enrollment.

Pre-Enrollment Season (September-October): Awareness campaigns and early shopping behavior create a ramp into the main enrollment period.

Health insurance lead pricing shows dramatic seasonal variation:

- Open Enrollment: $75-200 for exclusive leads

- Off-season SEP: $40-80 for exclusive leads

The gap reflects both demand concentration and the value of securing annual customers during enrollment windows.

Solar Seasonality: Spring Peak, Winter Trough

Solar lead generation follows predictable seasonal patterns driven by consumer psychology, installation logistics, and policy timing.

The Spring-Summer Peak (March-June)

Spring represents the optimal solar selling season for multiple reasons:

- Psychological factors: Consumers receive Q1 utility bills showing winter heating costs and look forward to summer cooling expenses. The combination creates motivation to explore alternatives. Longer daylight hours make solar feel tangible and relevant.

- Installation logistics: Roof work is easier in moderate weather. Spring installations complete before summer production peaks, maximizing first-year output.

- Tax timing: Q1 tax season reminds homeowners of available credits. Those receiving refunds have capital available for solar investments or down payments.

Spring solar lead pricing typically runs 20-40% above winter levels. A lead commanding $150 in April might drop to $100 in January.

The Summer Plateau (July-August)

Summer maintains strong volume but faces distinct challenges:

- Installer capacity constraints: Crews booked from spring rush create backlog. Wait times extend to 60-90 days, reducing urgency.

- Vacation distractions: Consumer attention shifts to travel and family activities rather than home improvement decisions.

- Extreme heat challenges: In peak solar markets like Arizona and Texas, extreme temperatures make site visits uncomfortable and slow installation crews.

Summer CPLs hold near spring levels but conversion rates often decline 10-15% due to extended sales cycles.

The Fall Transition (September-November)

Fall creates a secondary peak driven by different motivations:

- Post-ITC deadline urgency: Tax credit expiration concerns (when applicable) drive year-end installation pushes.

- Bill shock: Consumers receive summer cooling bills and seek alternatives before the next summer.

- Holiday prep: Some homeowners want solar installed before holiday guests arrive.

Fall lead pricing approaches spring levels, particularly in Q4 as installers push to complete annual installation targets.

The Winter Trough (December-February)

Winter represents the lowest demand period for solar leads:

- Holiday focus: Consumer attention and discretionary spending focus on gifts rather than home improvements.

- Weather concerns: Northern markets face snow, ice, and short daylight hours that make solar feel less relevant.

- Installation delays: Cold weather slows installation crews and can push projects into spring regardless of sales timing.

Winter solar leads often price 25-35% below spring peaks. However, some sophisticated practitioners use winter for lead generation precisely because lower competition reduces CPLs, then nurture those leads for spring conversion.

Geographic Variation in Solar Seasonality

Solar seasonality varies dramatically by region:

- California, Arizona, Nevada: Relatively stable year-round due to consistent sunshine. Spring still peaks, but winter troughs are shallower.

- Northeast and Midwest: Pronounced seasonality with 40-50% swings between peak and trough. Snow cover eliminates winter demand almost entirely.

- Florida and Texas: Counter-cyclical potential as fall hurricane season and summer cooling bills create year-round triggers.

Mortgage Seasonality: Spring Homebuying Season

Mortgage lead generation follows two distinct patterns: purchase seasonality (driven by real estate markets) and refinance sensitivity (driven by interest rates).

Purchase Mortgage Seasonality

Home purchase activity follows the academic calendar and weather patterns:

Spring Surge (March-June): The primary homebuying season. Families want to move during summer before school starts. Weather improves for home shopping. Inventory increases as sellers list properties.

Summer Maintenance (July-August): Activity remains strong but begins declining. Families who needed to move have already purchased. Late-summer buyers face school-year disruption.

Fall Decline (September-November): Activity decreases as school starts. Holiday planning takes priority over house hunting.

Winter Trough (December-February): The slowest period for home purchases. Holiday focus, cold weather (in most markets), and reduced inventory all contribute.

Purchase mortgage lead pricing reflects this seasonality:

- Spring peak: $75-200 for exclusive leads

- Winter trough: $50-130 for exclusive leads

The 30-40% seasonal variation makes spring budget allocation critical for purchase-focused operations.

Refinance Volatility (Rate-Driven, Not Seasonal)

Refinance demand does not follow seasonal patterns. It follows interest rates.

When rates fall meaningfully below existing mortgage rates (typically 50-75+ basis points), refinance demand explodes regardless of the calendar. When rates rise or stabilize at elevated levels, refinance demand evaporates regardless of the calendar.

Recent history demonstrates the magnitude of these swings:

- 2021 (3% rates): $4.51 trillion in mortgage originations, refinance dominant

- 2023 (7%+ rates): $1.50 trillion in originations, refinance nearly nonexistent

Refinance lead pricing:

- Rate decline periods: $15-50 (high volume, supply exceeds capacity)

- Rate peak periods: $75-200+ (scarcity, but minimal buyer demand)

Key insight: Purchase leads maintain relatively stable seasonality. Refinance leads have no seasonality, only rate sensitivity. Operations must monitor Federal Reserve policy and bond markets, not calendars.

Home Equity: Counter-Cyclical Opportunity

Home equity leads (HELOCs and second mortgages) gained prominence during the 2022-2024 period when homeowners with 3% first mortgages needed cash but could not justify refinancing at 7%+ rates.

Home equity demand correlates with:

- Rising home values (creating tappable equity)

- Stable employment (supporting debt service)

- High first mortgage rates (making full refinance unattractive)

Home equity seasonality roughly follows home improvement patterns: spring peak for renovation projects, fall secondary peak for major purchases, winter trough.

Legal Seasonality: Varies by Case Type

Legal lead generation lacks the unified seasonality of other verticals because different practice areas follow different patterns.

Personal Injury

Personal injury leads follow activity patterns that create accidents:

Summer Peak (May-September): Increased driving (vacation travel), motorcycle usage, pedestrian activity, and outdoor work all increase accident frequency. Auto accidents, motorcycle crashes, and slip-and-fall incidents peak during this period.

Winter Secondary Peak (November-February): Ice, snow, and holiday travel create automobile accidents. Falls increase on slippery surfaces. Holiday party injuries add volume.

Spring and Fall Transitions: Moderate periods with no pronounced peaks or troughs.

Personal injury CPLs range from $150-500 for exclusive leads, with summer commanding 15-25% premium over winter.

Workers’ Compensation

Workers’ comp leads correlate with employment activity and workplace hazards:

Construction Season (Spring-Fall): Outdoor work increases injury frequency. Roofing, concrete, landscaping, and similar industries see elevated accident rates.

Holiday Retail (November-December): Warehouse and retail workers face increased injury risk from seasonal hiring, overtime, and rushed operations.

Manufacturing Consistent: Factory-based workers’ comp remains relatively stable year-round.

Mass Tort and Class Action

Mass tort campaigns follow case development rather than seasonal patterns:

New Case Launch: When law firms identify mass tort opportunities (pharmaceutical injuries, product defects, environmental exposure), they launch aggressive lead generation campaigns that create demand spikes.

Case Maturation: As cases progress toward settlement or trial, lead generation scales back.

Settlement Windows: Successful settlements in related cases trigger new campaign launches.

Mass tort timing is case-specific rather than seasonal. Operators must monitor litigation news and law firm activity rather than calendars.

Family Law

Divorce and custody leads show distinct seasonal patterns:

January Surge: The “divorce month” phenomenon is well-documented. Couples delay separation decisions through the holidays, then act in January. Law firms report 25-35% increases in consultation requests.

September Secondary Peak: End-of-summer transitions and back-to-school stress trigger relationship decisions.

Holiday Lull (November-December): Families delay major decisions through holiday gatherings.

Family law leads can command significant premiums in January, with CPLs 20-30% above fall levels.

Home Services Seasonality: HVAC, Roofing, and Plumbing by Season

Home services lead generation follows weather patterns and homeowner urgency cycles.

HVAC: Extreme Weather Drives Demand

Summer Peak (June-August): Air conditioning failures during heat waves create urgent demand. This is the highest-volume, highest-CPL period for cooling leads.

Winter Secondary Peak (December-February): Heating failures during cold snaps create urgent demand. Furnace and boiler leads peak during sustained cold periods.

Shoulder Seasons (March-May, September-November): Maintenance and replacement sales occur as homeowners prepare for upcoming temperature extremes. CPLs moderate 20-30% below peak.

HVAC lead pricing:

- Peak (extreme weather): $80-150 for exclusive leads

- Maintenance season: $50-100 for exclusive leads

- Off-season: $30-70 for exclusive leads

Geographic variation matters: Florida HVAC peaks in summer only (minimal heating demand). Minnesota peaks twice (extreme summer and winter). Coastal California has minimal seasonality.

Roofing: Weather Windows and Storm Events

Spring-Summer (April-August): Primary roofing season. Weather permits installation. Homeowners address winter damage discovered during spring inspection.

Storm Events: Hail storms, hurricanes, and severe weather create instant demand spikes that override normal seasonality. A major hail storm can generate more leads in one week than an entire normal quarter.

Fall Transition (September-October): Pre-winter repairs create secondary peak. Homeowners want roofs sealed before snow.

Winter Trough (November-March): Installation becomes difficult or impossible in northern climates. Demand drops 50-70% compared to peak season.

Roofing lead pricing:

- Peak season: $75-200 for exclusive leads

- Post-storm surge: $100-250+ (surge pricing)

- Off-season: $40-100 for exclusive leads

Plumbing: Emergency-Driven with Winter Peak

Winter Peak (November-February): Frozen pipes, water heater failures, and heating-related plumbing issues create the highest demand period.

Year-Round Emergencies: Unlike scheduled home improvements, plumbing emergencies occur regardless of season. Base demand remains consistent.

Summer Secondary Activity: Outdoor plumbing projects (irrigation systems, pool connections) and pre-sale home improvements create summer volume.

Plumbing leads show less seasonal variation than HVAC or roofing because emergency demand maintains baseline throughout the year. Winter premiums run 10-20% above summer.

Planning Your Annual Calendar

Effective seasonal planning requires mapping lead demand cycles against your operational capacity and budget allocation.

Q1: January-March

High-demand verticals:

- Medicare (OEP through March 31)

- Family law (January divorce surge)

- Auto insurance (New Year shopping)

- HVAC (heating demand in cold markets)

Low-demand verticals:

- Solar (winter trough)

- Roofing (weather limitations)

- Mortgage purchase (pre-spring lull)

Strategic focus: Capture Medicare OEP and January surges. Use quiet periods in solar and roofing to build content, optimize systems, and prepare for spring.

Q2: April-June

High-demand verticals:

- Solar (spring peak)

- Mortgage purchase (spring homebuying season)

- Roofing (installation season begins)

- Home services (general uptick)

- Personal injury (increased activity)

Lower-demand verticals:

- Medicare (SEP only)

- Health insurance (SEP only)

Strategic focus: This is peak season for most verticals. Scale budgets, ensure staffing capacity, and maximize margin capture during high-conversion periods.

Q3: July-September

High-demand verticals:

- HVAC (cooling peak)

- Solar (maintained demand)

- Personal injury (summer accidents)

- Roofing (continued installation season)

Transitioning verticals:

- Mortgage purchase (declining from spring peak)

- Medicare (pre-AEP preparation)

Strategic focus: Maximize HVAC cooling leads during summer peaks. Begin AEP preparation by August for October launch.

Q4: October-December

High-demand verticals:

- Medicare (AEP October 15 - December 7)

- Health insurance (Open Enrollment November 1 - January 15)

- Solar (year-end ITC rush when applicable)

- HVAC (heating demand begins)

Declining verticals:

- Mortgage purchase (holiday lull)

- Roofing (weather limitations beginning)

- Personal injury (holiday travel creates accidents, but holiday distractions reduce shopping)

Strategic focus: All resources toward Medicare AEP and health insurance Open Enrollment. These compressed windows demand maximum budget and staffing allocation.

Granular Monthly Breakdowns by Vertical

The quarterly overview provides strategic context, but operational excellence requires month-by-month precision. The following breakdowns detail demand intensity, typical CPL ranges, and conversion rate patterns for each major vertical across all twelve months.

Insurance Verticals: Monthly Demand Index

Auto Insurance Monthly Patterns

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 115 | $35-85 | New Year resolution shopping drives activity. Policy renewal clusters create opportunity. |

| February | 95 | $30-70 | Post-January cooling. Valentine’s week shows slight dip. |

| March | 105 | $32-75 | Tax refund season increases shopping. Spring break travel prompts coverage review. |

| April | 110 | $35-80 | Pre-summer preparation. Teen driver additions as school year ends. |

| May | 115 | $35-85 | Memorial Day travel planning. Peak pre-summer activity. |

| June | 100 | $32-75 | Summer begins. Vacation focus slightly reduces shopping intensity. |

| July | 90 | $28-65 | Summer vacation peak. Consumer attention elsewhere. |

| August | 95 | $30-70 | Back-to-school preparation begins. Slight uptick from July. |

| September | 110 | $35-80 | Full back-to-school mode. Teen drivers added to policies. |

| October | 105 | $32-78 | Steady activity. Pre-holiday preparation. |

| November | 90 | $28-65 | Holiday distraction begins. Thanksgiving week particularly slow. |

| December | 80 | $25-60 | Holiday focus dominates. Lowest demand month. |

Demand Index represents relative volume compared to annual average (100 = average month).

Medicare Monthly Patterns

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 140 | $55-120 | OEP active. Strong demand from MA plan switches. |

| February | 120 | $45-100 | OEP continues. Volume remains improved. |

| March | 110 | $40-90 | Final OEP month (ends 3/31). Urgency drives conversions. |

| April | 40 | $25-50 | SEP only. Sharp volume decline post-OEP. |

| May | 35 | $25-50 | SEP baseline. Limited opportunity. |

| June | 35 | $25-50 | SEP baseline. Use for system optimization. |

| July | 40 | $25-55 | Slight uptick as T65 pipeline develops. |

| August | 50 | $30-60 | Pre-AEP preparation intensifies. Carrier announcements drive early interest. |

| September | 70 | $35-75 | AEP anticipation. Early shoppers research options. |

| October | 200 | $80-180 | AEP begins (10/15). Explosive demand. |

| November | 220 | $90-200 | AEP peak. Highest volume and CPL of year. |

| December | 150 | $60-140 | AEP ends (12/7). Volume concentrated in first week. |

Medicare shows the most extreme seasonality of any lead vertical. Operations must staff dramatically differently for AEP versus SEP periods.

Health Insurance (Under-65) Monthly Patterns

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 140 | $60-150 | Open Enrollment peak (ends 1/15). High urgency. |

| February | 60 | $35-80 | SEP only. Sharp post-OE decline. |

| March | 55 | $35-75 | SEP baseline. Life event triggers only. |

| April | 55 | $35-75 | SEP baseline. Maintain minimal presence. |

| May | 50 | $30-70 | Lowest demand period. |

| June | 50 | $30-70 | Lowest demand period continues. |

| July | 55 | $32-75 | Slight uptick from job changes, graduations. |

| August | 60 | $35-80 | Back-to-school life events. College-age coverage gaps. |

| September | 75 | $40-95 | Pre-OE awareness begins. Early research activity. |

| October | 90 | $50-110 | OE anticipation. Comparison shopping increases. |

| November | 180 | $80-180 | OE begins (11/1). Major volume surge. |

| December | 160 | $70-160 | OE continues. Deadline urgency builds toward 12/15 for 1/1 coverage. |

Solar Monthly Patterns

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 70 | $70-130 | Winter trough. Southern markets only viable. |

| February | 75 | $75-140 | Slight improvement. Tax refund anticipation begins. |

| March | 110 | $100-180 | Spring begins. Sharp demand increase. Tax refunds arrive. |

| April | 130 | $120-200 | Peak season begins. Optimal combination of weather and motivation. |

| May | 135 | $125-210 | Highest demand month. Pre-summer installation rush. |

| June | 120 | $110-190 | Strong demand. Installer capacity becomes constrained. |

| July | 105 | $95-170 | Summer plateau. Heat in southern markets slows activity. |

| August | 100 | $90-160 | Vacation distractions. Capacity constraints continue. |

| September | 115 | $105-185 | Fall urgency begins. Year-end installation deadlines approach. |

| October | 110 | $100-175 | Strong demand. Tax credit deadline awareness peaks. |

| November | 85 | $75-140 | Holiday distraction begins. Northern weather limits installs. |

| December | 65 | $60-120 | Lowest demand. Holiday focus. Weather limitations. |

Geographic variation is extreme in solar. California and Southwest show 20-30% less seasonal variation than Northeast and Midwest markets.

Mortgage Monthly Patterns

Purchase Mortgage

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 70 | $45-100 | Winter lull. Limited inventory. |

| February | 80 | $50-110 | Slight pickup. Spring preview shopping. |

| March | 105 | $65-140 | Spring season begins. Inventory increases. |

| April | 130 | $80-170 | Peak season. Families targeting summer moves. |

| May | 140 | $85-180 | Highest demand. School-year timing drives decisions. |

| June | 135 | $80-175 | Strong demand continues. Closing deadlines for summer moves. |

| July | 115 | $70-150 | Slight cooling. Some families already relocated. |

| August | 100 | $60-130 | Transitional. School starting reduces activity. |

| September | 85 | $55-120 | Fall decline begins. |

| October | 75 | $50-110 | Continued decline. |

| November | 65 | $45-95 | Holiday preparation reduces shopping. |

| December | 55 | $40-85 | Lowest demand. Holiday focus dominates. |

Home Equity/HELOC

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 90 | $40-90 | Post-holiday debt consolidation interest. |

| February | 85 | $38-85 | Slight decline from January. |

| March | 100 | $45-100 | Home improvement season approaching. |

| April | 115 | $50-115 | Spring renovation projects drive demand. |

| May | 120 | $55-120 | Peak renovation/improvement demand. |

| June | 115 | $52-115 | Strong continued demand. |

| July | 105 | $48-105 | Moderate summer demand. |

| August | 100 | $45-100 | Back-to-school preparation. Some education financing. |

| September | 95 | $42-95 | Slight decline. |

| October | 90 | $40-90 | Pre-holiday period. |

| November | 85 | $38-85 | Holiday distraction. |

| December | 80 | $35-80 | Year-end tax planning drives some activity. |

Home Services Monthly Patterns

HVAC

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 130 | $70-140 | Heating emergency peak. Cold snaps drive urgent demand. |

| February | 125 | $65-135 | Continued heating demand. Weather dependent. |

| March | 90 | $50-100 | Transitional. Maintenance season begins. |

| April | 85 | $45-95 | Shoulder season. Preventive maintenance. |

| May | 95 | $52-105 | Pre-cooling preparation. System checkups. |

| June | 140 | $80-160 | Cooling season begins. First heat waves drive urgency. |

| July | 160 | $90-180 | Peak cooling demand. Emergency replacement highest. |

| August | 150 | $85-170 | Continued cooling peak. |

| September | 100 | $55-110 | Transitional. Post-summer maintenance. |

| October | 85 | $48-95 | Shoulder season. Pre-heating preparation. |

| November | 110 | $60-120 | Heating season begins. First cold snaps. |

| December | 120 | $65-130 | Heating emergency demand. Holiday hosting preparation. |

HVAC shows a distinctive double-peak pattern with June-August cooling and November-January heating creating two annual demand spikes.

Roofing

| Month | Demand Index | CPL Range | Conversion Notes |

|---|---|---|---|

| January | 40 | $35-70 | Winter trough. Northern markets inactive. |

| February | 45 | $38-75 | Slight improvement. Emergency repairs only. |

| March | 80 | $55-110 | Early season begins. Post-winter damage assessment. |

| April | 120 | $75-150 | Full season begins. Optimal installation weather. |

| May | 140 | $90-180 | Peak demand. Perfect weather window. |

| June | 145 | $95-185 | Highest demand. Storm season in some regions adds volume. |

| July | 130 | $85-170 | Strong demand. Heat limits workday hours in South. |

| August | 120 | $75-155 | Continued demand. Pre-fall preparation. |

| September | 110 | $70-140 | Strong demand. Pre-winter deadline awareness. |

| October | 90 | $60-120 | Declining. Weather windows closing in North. |

| November | 55 | $45-90 | Sharp decline. Weather limitations. |

| December | 35 | $30-60 | Lowest demand. Winter hiatus. |

Storm events create unpredictable demand spikes that override seasonal patterns. A major hail storm can generate more leads in one week than an entire normal quarter.

Budget Allocation by Season

Effective budget allocation requires shifting resources toward high-conversion periods rather than spreading spend evenly throughout the year.

The Even-Spend Trap

many practitioners default to monthly budgets that divide annual spend by twelve. This approach wastes money during low-demand periods (paying premium CPLs for limited opportunity) and underinvests during high-demand periods (leaving profitable volume on the table).

A $1.2 million annual budget allocated at $100,000 monthly performs worse than the same budget allocated according to seasonal opportunity.

Seasonal Allocation Framework

Peak Season Months: Allocate 130-150% of average monthly budget Shoulder Season Months: Allocate 90-110% of average monthly budget Trough Months: Allocate 50-70% of average monthly budget

Example: Medicare Lead Generation

Annual budget: $600,000 Even allocation: $50,000/month

Seasonal allocation:

- October-December (AEP): $120,000/month (240% of average)

- January-March (OEP): $60,000/month (120% of average)

- April-September (SEP): $20,000/month (40% of average)

Total: $360,000 + $180,000 + $120,000 = $660,000 (need to adjust)

Refined seasonal allocation:

- October-December (AEP): $100,000/month

- January-March (OEP): $50,000/month

- April-September (SEP): $16,667/month

Total: $300,000 + $150,000 + $100,000 = $550,000 (leaves $50,000 reserve)

The reserve allows opportunistic spending during unexpectedly strong periods or coverage for seasonal staffing needs. Maintaining proper working capital becomes especially critical during high-spend peak seasons.

Multi-Vertical Portfolio Balancing

Operators running leads across multiple verticals can smooth revenue through strategic diversification:

Complementary seasonality pairs:

- Medicare (Q4 peak) + Solar (Q2 peak)

- Mortgage purchase (Q2 peak) + HVAC heating (Q4 peak)

- Roofing (Q2-Q3 peak) + Personal injury (consistent with summer edge)

By allocating budget toward in-season verticals while maintaining minimal presence in off-season verticals, operators can maintain consistent monthly revenue despite individual vertical fluctuations.

Staffing for Seasonal Volume

Lead generation requires human capacity that must expand and contract with seasonal demand. Building this flexibility is essential for profitability.

Sales Team Scaling

Peak season staffing model:

- Core team: 60-70% of peak capacity, employed year-round

- Seasonal expansion: 30-40% additional capacity during peaks

- Overflow partners: Call center or BPO arrangements for extreme surges

Medicare example: An operation processing 5,000 leads monthly during off-season needs 10 sales agents at 500 leads/agent. During AEP, volume jumps to 15,000+ leads monthly, requiring 30+ agents.

Staffing options:

- Core team of 15 agents (150% of off-season need, 50% of peak need)

- Seasonal hires of 15 additional agents (October through December)

- Overflow arrangement with partner call center for surge capacity

The core team maintains institutional knowledge and performance consistency. Seasonal hires require training investment but provide flexibility. Overflow partners sacrifice margin but prevent capacity constraints during peak periods.

Training Lead Time

Seasonal hiring requires advance planning:

- 6-8 weeks before peak: Post positions, begin recruiting

- 4-6 weeks before peak: Complete hiring, begin training

- 2-4 weeks before peak: Intensive training and certification

- Peak period: Full staffing with ongoing coaching

For Medicare AEP (October 15 start), seasonal hiring should begin in early August with training throughout September.

Technology Capacity

System infrastructure must scale with seasonal demand:

Lead distribution: Peak periods may require 3-5x normal lead volume routing. Test systems under load before peak seasons.

CRM capacity: More leads mean more data. Ensure database capacity and response times remain acceptable under peak load.

Telephony: Call volume increases require adequate trunk capacity, queue management, and recording storage.

Compliance systems: Consent capture, DNC checking, and documentation systems face proportionally higher load during peak periods.

Counter-Cyclical Opportunities

While most practitioners chase peak season volume, sophisticated players find opportunity in off-seasons.

Lower CPL Acquisition

Off-season lead costs decline 20-40% in most verticals. Operators with strong nurture capabilities can acquire leads cheaply during troughs and convert them during peaks.

Solar example: Winter leads cost $80 versus spring leads at $120. An operator acquiring 1,000 winter leads at $80,000 and nurturing them into spring conversion windows can achieve effective CPL equivalent to $100 once conversion rates adjust for the longer cycle.

The strategy requires:

- Sophisticated nurture sequences (email, SMS, content)

- Patient capital (leads acquired in December may not convert until April)

- Strong lead quality (aged leads convert at lower rates; low-quality aged leads do not convert at all)

Competitive Advantage

Reduced competition during off-seasons creates opportunities:

- Lower ad costs: PPC and social advertising costs decline when fewer advertisers compete.

- Better placement: Organic content faces less competition during slow periods.

- Buyer attention: Lead buyers have more time for relationship development, system integration, and optimization during slow periods.

- Preparation time: Off-seasons allow infrastructure improvements, training, and planning that peak seasons do not permit.

Buyer Relationship Building

Off-seasons provide opportunity to strengthen buyer relationships:

- Account reviews: Schedule quarterly business reviews during slow periods when both parties have bandwidth.

- Integration improvements: Implement new technology, optimize routing rules, and refine quality filters during low-volume periods.

- Contract negotiations: Buyers are more willing to negotiate favorable terms when they are not overwhelmed with peak-season operations.

Counter-Seasonal Verticals

Some opportunities run opposite to major vertical patterns:

Tax preparation (January-April): Peaks when insurance and solar are transitioning.

Holiday retail (November-December): Peaks when mortgage is at annual low.

Education/tutoring (September-May): School year creates demand when summer verticals decline.

Operators with capacity to pivot across verticals can maintain consistent utilization by shifting focus to counter-seasonal opportunities.

Frequently Asked Questions

Q: What is the most seasonal vertical in lead generation?

A: Medicare leads exhibit the most extreme seasonality, with 60-70% of annual volume concentrating in the 54-day Annual Enrollment Period (October 15 - December 7). Lead prices during AEP routinely double or triple compared to off-season periods. Solar leads show the second-most pronounced seasonality, with spring peaks running 30-40% above winter troughs.

Q: How much budget should I allocate to peak season versus off-season?

A: Allocate 130-150% of average monthly budget to peak season months and 50-70% of average monthly budget to trough months. The exact ratio depends on vertical-specific seasonality and your operational capacity. Medicare operations might allocate 200%+ of average budget to AEP months while reducing summer spend to 30% of average.

Q: Should I shut down lead generation during off-seasons?

A: Rarely. Maintaining minimal presence during off-seasons preserves buyer relationships, captures Special Enrollment or emergency leads, and positions you for faster scaling when peak seasons return. However, dramatically reducing off-season spend is appropriate. The exception is verticals with near-zero off-season demand, such as Medicare outside enrollment periods in markets without SEP volume.

Q: How far in advance should I plan for seasonal peaks?

A: Begin planning 3-4 months before peak seasons. Seasonal hiring needs 6-8 weeks lead time for recruiting and training. Technology capacity testing should occur 4-6 weeks before anticipated load. Budget allocation and buyer agreements should finalize 2-3 months before peak periods to ensure smooth operations when volume increases.

Q: How does weather affect lead generation seasonality?

A: Weather creates both predictable patterns and unpredictable events. Predictable: HVAC cooling demand peaks during summer heat; roofing installation seasons follow regional weather windows. Unpredictable: Hail storms, hurricanes, and extreme weather events create instant lead demand spikes that override normal seasonality. Build operational flexibility to capture storm-driven demand.

Q: Do seasonal patterns apply to all geographic markets?

A: No. Regional variation significantly affects seasonality. Florida HVAC has different patterns than Minnesota HVAC. California solar shows less seasonality than Northeast solar. National lead generators must segment by region rather than assuming uniform seasonal patterns across markets.

Q: How should I staff for seasonal variation?

A: Build a core team sized at 60-70% of peak capacity who work year-round. Supplement with seasonal hires (30-40% of peak capacity) trained and deployed for specific peak periods. Maintain overflow relationships with call center partners for surge capacity. This model balances institutional knowledge with operational flexibility.

Q: What counter-cyclical opportunities exist in lead generation?

A: Lower off-season CPLs allow lead acquisition for nurture campaigns. Reduced competition improves ad placement and organic visibility. Buyer relationships strengthen during slower periods when both parties have bandwidth for optimization. Some verticals (tax preparation, education) peak opposite major lead gen verticals, allowing portfolio diversification.

Q: How do interest rates affect mortgage lead seasonality?

A: Interest rate movements override normal mortgage seasonality entirely. When rates fall, refinance demand explodes regardless of calendar. When rates rise, refinance demand evaporates regardless of calendar. Purchase mortgages maintain more traditional seasonality (spring peak, winter trough), but even purchase demand is suppressed during elevated rate environments.

Q: How can I predict seasonal patterns for my specific vertical?

A: Analyze your historical data across 2-3 years minimum. Plot monthly lead volume, CPL, conversion rates, and revenue. Identify consistent patterns that repeat across years. Supplement with industry research, competitor activity monitoring, and buyer feedback about their seasonal demand expectations. Patterns that repeat consistently across multiple years likely represent structural seasonality you can plan around.

Key Takeaways

-

Medicare AEP (October 15 - December 7) and OEP (January 1 - March 31) create the most extreme seasonal concentration in lead generation, with 70-80% of annual opportunity in these windows.

-

Solar leads peak in spring (March-June) and trough in winter, with 30-40% pricing variation that rewards seasonal budget allocation.

-

Mortgage purchase leads follow spring homebuying patterns, but refinance leads have zero seasonality and respond only to interest rate movements.

-

Home services leads follow weather patterns: HVAC peaks with temperature extremes, roofing follows installation-weather windows, and storm events create instant demand spikes.

-

Allocate 130-150% of average budget to peak months and 50-70% to trough months rather than spreading spend evenly throughout the year.

-

Build staffing flexibility with a 60-70% core team supplemented by seasonal hires and overflow partnerships for peak capacity.

-

Off-seasons offer lower CPLs, reduced competition, and relationship-building opportunities that sophisticated practitioners exploit while competitors sit idle.

-

Multi-vertical portfolios can balance complementary seasonality patterns (Medicare Q4 + Solar Q2) to maintain consistent annual revenue despite individual vertical fluctuations.

Understanding seasonal patterns is the difference between operators who constantly fight their business and those who flow with natural demand rhythms. Plan your calendar, allocate your budget, staff appropriately, and capture the peaks while competitors scramble.