A comprehensive guide to converting solar leads through strategic nurturing sequences designed for the industry’s extended consideration cycle.

Introduction: Why Solar Leads Require Different Nurturing

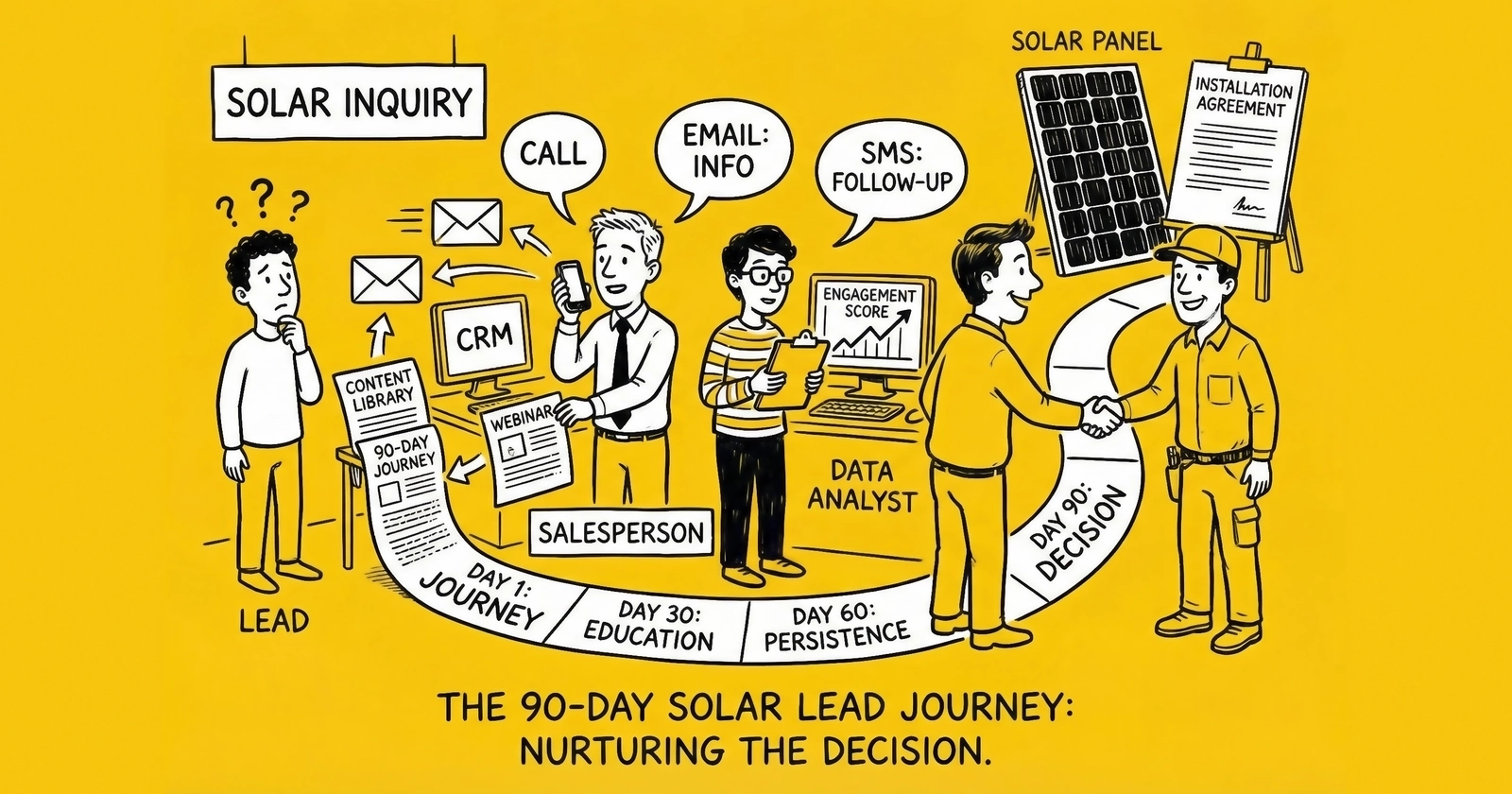

Solar lead generation operates on a fundamentally different timeline than most consumer verticals. While an auto insurance lead might convert within days and a home services lead within hours, solar decisions routinely extend 60-90 days from initial inquiry to signed contract. This extended consideration cycle is not a defect to overcome but a reality to engineer around.

The numbers tell the story. Industry research indicates that only 15-25% of solar leads convert within the first two weeks of inquiry. The remaining 75-85% either purchase later from someone who maintained the relationship, purchase from a competitor who caught them at the right moment, or abandon the process entirely. A solar installation represents a $20,000-$30,000 decision that affects the home for 25 years. Consumers do not make this decision impulsively.

Understanding why solar leads take longer to convert transforms nurturing from a nice-to-have into a competitive requirement. The typical solar buyer conducts 4-8 weeks of research before signing a contract. They compare 3-5 installer quotes. They consult with family members, verify financing options, research equipment brands, understand their utility’s net metering policies, and often coordinate with roof repairs or electrical upgrades. Each of these steps adds days or weeks to the decision timeline.

This article provides the complete framework for solar lead nurturing that converts over the 90-day decision journey. We will cover the psychology of solar buying decisions, multi-channel nurturing sequences optimized for long consideration cycles, educational content strategies, compliance requirements, technology infrastructure, and measurement frameworks. Every recommendation is grounded in the operational reality of solar lead economics.

Those who master solar lead nurturing build sustainable competitive advantage. While competitors abandon leads after the first week of non-conversion, nurturing-capable operations continue extracting value from their acquisition investment. This patience compounds into cost structures that less sophisticated competitors cannot match.

The Solar Buying Psychology

Before designing nurturing systems, you must understand why solar decisions take 60-90 days and what barriers prevent faster conversion. This understanding shapes every element of your nurturing strategy.

The Extended Consideration Cycle

Solar purchases involve multiple overlapping decision processes that cannot be compressed without sacrificing conversion quality.

Financial analysis phase. The core solar value proposition is economic: reduce or eliminate electricity bills through solar production. But understanding this value requires homework. Consumers must pull their utility bills to understand current consumption, research their utility’s rate structure and net metering policies, understand time-of-use rates if applicable, and calculate payback periods based on local sunshine hours and their specific roof orientation. This analysis typically takes 2-4 weeks for engaged consumers.

Equipment research phase. Solar panels are not commodities to most consumers. They research panel manufacturers, efficiency ratings, warranty terms, and inverter technologies. The difference between tier-one panels like LG, Sunpower, or Panasonic and commodity panels matters to informed buyers. Consumers also increasingly research battery storage options, particularly in markets like California where NEM 3.0 has shifted the value proposition from grid export to self-consumption. Battery attachment rates in California reached 79% in 2024 precisely because educated consumers understand the changing economics.

Installer evaluation phase. Solar installation is a one-time decision with 25-year consequences. Consumers research installer reviews, verify licensing and insurance, check complaint histories with state contractors boards, and often request references from completed installations. The installer who built trust through nurturing often wins over the installer who simply quoted a lower price.

Household consensus building. Solar decisions rarely involve a single decision-maker. Spouses, partners, and sometimes adult children participate in the evaluation. Each additional stakeholder adds complexity and time to the decision process. Nurturing content must be shareable and must address the concerns of multiple household members with potentially different priorities.

Financing and logistics phase. Once the consumer is ready to proceed, financing approval, permit applications, utility interconnection requests, and installation scheduling add additional weeks. In markets with installation backlogs, the time from signed contract to operational system can exceed 60 days. Consumers who understand this timeline from the beginning are less likely to abandon the process due to unexpected delays.

The 90-Day Decision Timeline

Understanding the typical solar journey helps structure nurturing sequences appropriately:

| Phase | Timeline | Consumer Activities | Nurturing Focus |

|---|---|---|---|

| Initial Research | Days 1-14 | Comparing quotes, understanding solar basics | Education, credibility establishment |

| Deep Evaluation | Days 15-45 | Equipment research, installer comparison, utility analysis | Technical content, differentiation |

| Decision Preparation | Days 46-75 | Household discussions, financing research, final quotes | Urgency creation, objection handling |

| Commitment | Days 76-90+ | Contract signing, permit processing | Reassurance, process guidance |

This timeline varies by market conditions. In periods of policy uncertainty, such as the lead-up to the December 2025 ITC expiration, decision timelines may compress. In stable markets, they may extend. The 90-day framework provides a planning baseline that accommodates most consumer journeys.

Barriers to Faster Conversion

Understanding why consumers pause helps you design nurturing content that addresses specific concerns.

Complexity overwhelm. Solar involves technical concepts that most consumers have never encountered: kilowatts versus kilowatt-hours, net metering, time-of-use rates, inverter types, panel degradation, and utility interconnection. Faced with complexity, consumers delay rather than decide. Educational nurturing reduces this barrier.

Price comparison paralysis. Quote prices vary significantly between installers, sometimes by 30-40% for seemingly similar systems. Without understanding what drives these differences, consumers struggle to evaluate value. Nurturing that explains price components builds confidence to choose based on value rather than lowest price alone.

Fear of commitment. A 20-year solar loan or a 25-year lease represents a significant commitment. Consumers worry about what happens if they move, if their roof needs replacement, if the installer goes out of business, or if better technology becomes available. Addressing these concerns proactively through nurturing content reduces abandonment.

Bad timing of initial contact. The consumer requested a quote while at work, received the call during dinner, or was otherwise unavailable when your team reached out. They intended to call back but life intervened. This is not rejection but logistics that systematic nurturing overcomes.

Waiting for better conditions. Some consumers time their purchase around policy deadlines, seasonal factors, or personal circumstances. A consumer who inquires in October might intend to install in spring. Nurturing maintains the relationship until their intended purchase window.

Multi-Channel Nurturing Framework

Effective solar lead nurturing operates across multiple channels, each serving specific purposes across the 90-day journey. Single-channel approaches consistently underperform multi-channel strategies.

Email: The Educational Backbone

Email serves as the primary nurturing channel for solar due to its ability to convey detailed technical information, its low cost per touchpoint, and its persistence in consumer inboxes.

Deliverability fundamentals. Solar email faces elevated spam filtering due to industry-wide marketing volume. Use authenticated sending domains (SPF, DKIM, DMARC), maintain clean lists by removing bounces and unengaged addresses, and warm new domains gradually. Industry benchmarks show solar email open rates averaging 18-28%, but deliverability problems can push rates below 10%.

Sequence structure for the 90-day journey. Solar nurturing sequences should span the full consideration cycle with content that matches each phase:

Week 1 (Days 1-7): Foundation Building

- Day 1: Thank you email with what to expect from evaluation process

- Day 3: “Understanding Your Quote” educational content

- Day 5: Local solar success stories or case studies

- Day 7: “Questions to Ask Any Solar Installer” comparison framework

Weeks 2-4 (Days 8-28): Deep Education

- Day 10: Equipment education (panels, inverters, optimizers)

- Day 14: Financing options comparison (loan vs. lease vs. cash)

- Day 17: Net metering and utility policy explanation

- Day 21: Battery storage overview and economics

- Day 25: Roof considerations and installation process

Weeks 5-8 (Days 29-56): Decision Support

- Day 30: “Ready to Compare Quotes?” with evaluation criteria

- Day 35: ROI calculator or payback period worksheet

- Day 42: Common concerns addressed (warranty, moving, technology changes)

- Day 49: Customer testimonial with specific numbers

- Day 56: Soft check-in asking about decision timeline

Weeks 9-12 (Days 57-84): Conversion Focus

- Day 60: Policy or rate change urgency (if applicable)

- Day 65: Final questions consultation offer

- Day 72: Limited-time incentive or promotion

- Day 77: Decision deadline reminder

- Day 84: Final opportunity before moving to maintenance

Ongoing (Day 85+): Maintenance Cadence

- Monthly newsletter with industry updates

- Quarterly check-ins asking if circumstances have changed

- Policy change alerts relevant to their market

Subject line optimization. Solar emails face consumer skepticism toward promotional messaging. Testing shows informational subject lines outperform promotional ones for nurturing sequences. “How Net Metering Affects Your Solar Savings” outperforms “Get 30% Off Your Solar Installation” in both open rates and downstream conversion. Lead with value, not discounts.

Content personalization. Effective nurturing emails reference the consumer’s specific situation: their quoted system size, their utility provider and applicable rate structure, their estimated savings based on actual bill data, and their state’s specific incentive programs. Generic national content underperforms localized messaging.

SMS and Text Messaging

Text messaging offers immediate deliverability and open rates exceeding 90%, but requires careful compliance management given TCPA requirements.

Compliance requirements. SMS marketing to solar leads requires Prior Express Written Consent (PEWC) under TCPA regulations. Your lead capture forms must include clear disclosure that the consumer agrees to receive text messages at the provided number. This consent must be documented with technologies like TrustedForm or Jornaya. Non-compliant text messaging exposes your operation to TCPA liability of $500-$1,500 per message.

SMS use cases for solar nurturing.

Appointment confirmation and reminders: “Hi [Name], confirming your solar consultation for [Date] at [Time]. Reply YES to confirm or call [Number] to reschedule.”

Quote follow-up after delivery: “[Name], your solar proposal is ready. Check your email for details, or reply here with any questions. -[Rep Name], [Company]”

Time-sensitive information: “Important: [State/Utility] announced rate changes affecting solar. Your locked quote expires [Date]. Call [Number] to discuss.”

Re-engagement for unresponsive leads: “Hi [Name], checking in on your solar interest. Still looking? Reply YES and I’ll call at your convenience. -[Rep Name]”

Frequency limits. Solar’s extended timeline means SMS frequency must be carefully managed. Sending promotional texts weekly over 90 days creates fatigue and opt-outs. Limit marketing SMS to 2-4 per month during active nurturing, reserving texts for high-value moments: quote delivery, appointment reminders, policy deadlines, and direct responses to questions.

Phone Outreach in Nurturing Sequences

While initial speed-to-contact determines first-contact success, strategic phone outreach throughout the 90-day journey significantly impacts overall conversion.

Structured call sequences. Rather than random follow-up calls, implement structured outreach patterns aligned with the decision journey:

- Days 1-7: 3-5 contact attempts at varied times

- Days 8-30: Weekly check-in calls for engaged leads

- Days 31-60: Bi-weekly calls focused on decision timeline

- Days 61-90: Conversion-focused calls with specific offers

Voicemail strategy. Each voicemail should provide distinct value, not repeat the same script. Effective solar voicemails reference:

- Specific next step: “I’m calling to walk through the financing options in your proposal”

- New information: “I wanted to share an update on the federal tax credit that affects your quote”

- Timeline context: “With installation schedules filling up, I wanted to discuss timing”

- Personal connection: “I was thinking about your roof orientation question and wanted to share something”

Disposition tracking. Document every call attempt outcome to optimize timing and messaging:

| Disposition | Count Toward Sequence | Next Action |

|---|---|---|

| No answer, no voicemail | Partial attempt | Retry different time same day |

| No answer, voicemail left | Full attempt | Wait 2-3 days before next attempt |

| Answered, not ready | Full contact | Schedule specific follow-up |

| Answered, objection raised | Full contact | Address objection, schedule follow-up |

| Answered, interested | Full contact | Advance to next stage |

| Wrong number | End sequence | Verify data, attempt alternate contact |

Direct Mail for High-Value Leads

Physical mail cuts through digital noise, particularly for high-value solar leads in premium markets.

When direct mail makes sense. The cost of direct mail ($1-3 per piece including printing and postage) limits broad deployment. Target direct mail for:

- Leads in Tier 1 markets (California, Hawaii, Massachusetts, New York) where system values justify the cost

- Leads with high estimated electric bills ($250+ monthly)

- Leads who engaged with email content but have not converted

- Leads in competitive situations where differentiation matters

Content approach. Solar direct mail performs best when it provides tangible reference value:

- System comparison worksheets

- Savings calculation guides with space for their numbers

- Equipment specification sheets they can reference during decision-making

- Financing comparison cards showing monthly payment scenarios

Integration with digital. Track direct mail effectiveness through unique URLs or QR codes linking to personalized landing pages. This attribution enables ROI calculation and optimization.

Educational Content Strategy

Solar’s complexity creates opportunity for nurturing content that establishes expertise while guiding consumers toward confident decisions.

Content Pillars for Solar Nurturing

Organize your content library around the key questions consumers ask at each stage:

Pillar 1: Solar Economics

- How solar saves money (basic explanation)

- Understanding your electric bill and what solar replaces

- Net metering: selling power back to the grid

- Time-of-use rates and how solar interacts with them

- Payback period calculation methodology

- Solar ROI compared to other investments

Pillar 2: Equipment and Technology

- Solar panel types and efficiency ratings

- Inverter technologies (string vs. micro vs. optimizers)

- Battery storage basics

- System sizing for your home

- Equipment warranties and what they cover

- Technology trends and when to upgrade

Pillar 3: Financial Options

- Cash purchase economics

- Solar loans explained

- Lease and PPA structures

- Federal tax credit requirements (current as of your content date)

- State and local incentives

- Utility rebate programs

Pillar 4: Installation Process

- Site evaluation and proposal

- Permitting and approvals

- Installation timeline expectations

- Utility interconnection process

- System activation and monitoring

- Maintenance requirements

Pillar 5: Addressing Concerns

- What if I move before payback?

- What if my roof needs replacement?

- What if the installer goes out of business?

- What if technology improves after I install?

- How does solar affect home value?

- What about cloudy days and winter production?

Content Format Selection

Different formats serve different purposes in the nurturing journey:

Blog articles and guides (800-2,000 words). Primary format for email content and website resources. Enables deep explanation of complex topics. Best for middle-of-journey education when consumers are actively researching.

Short-form video (60-90 seconds). Effective for concept introduction and social proof. Site tours, customer testimonials, and quick explanations of specific concepts work well. Link from email to video content for engagement variety.

Calculators and interactive tools. Savings calculators, payback period estimators, and system size tools create engagement while gathering additional qualification data. Consumers who complete calculations demonstrate serious intent.

Comparison worksheets. Downloadable PDFs that help consumers compare quotes on equal terms establish your company as the helpful advisor rather than just another salesperson. Even if the consumer ultimately chooses a competitor, they remember who helped them understand the decision.

Case studies with specific numbers. Vague testimonials lack credibility. Case studies that specify system size, installation cost, monthly savings, and payback period provide the concrete evidence that moves consumers toward decisions. Include geographic and home-type diversity to help various consumers see themselves in the examples.

Geographic and Policy Customization

Solar economics vary dramatically by location. Content must reflect these variations to maintain credibility.

State-specific content requirements:

California: Address NEM 3.0 impact on solar economics, emphasize battery storage value proposition, explain time-of-use rate optimization, reference SMUD/LADWP/municipal utility exceptions if applicable.

Texas: Explain the lack of statewide net metering, identify which utilities offer favorable policies, address grid reliability concerns driving energy independence interest.

Florida: Cover lease and PPA availability (restricted in some periods), address hurricane and high-wind considerations, explain net metering status.

Northeast (NY, MA, NJ, CT): Emphasize strong state incentives, explain SREC programs where applicable, address winter production concerns, reference high electricity rates driving faster payback.

Arizona/Nevada: Address reduced net metering compensation, emphasize self-consumption value, explain how battery storage changes the economics post-net metering changes.

Generic national content damages credibility when consumers recognize their local situation differs from what you describe.

Technology Stack for Solar Nurturing

Effective solar lead nurturing requires technology infrastructure that handles the extended timeline while maintaining personalization and compliance.

CRM Requirements

Your CRM must support the unique requirements of 90-day nurturing cycles:

Extended lead lifecycle tracking. Unlike verticals where leads convert or expire within days, solar leads remain active for months. Your CRM must track each lead’s full journey: acquisition source, all contact attempts, engagement signals (email opens, website visits, content downloads), stage transitions, and disposition. The ability to view a lead’s complete 90-day history during any conversation is essential.

Complex workflow automation. Solar nurturing sequences branch based on lead behavior, engagement level, and stage progression. Your CRM should support conditional logic: “If lead opened the financing email but not the equipment email, send equipment content before the next financial message.” Time-based triggers must work across 90-day spans without manual intervention.

Multi-channel orchestration. Email, SMS, phone, and potentially direct mail must coordinate through a single system. Sending a phone reminder the day you also send an email and a text creates overwhelming contact. The CRM should prevent channel collision and maintain appropriate pacing.

Territory and assignment management. Solar often operates through geographic territories. The CRM should route leads to appropriate representatives, track assignment history, and prevent leads from falling through cracks during rep transitions.

Quote and proposal tracking. Integration with solar design and proposal software (Aurora Solar, OpenSolar, Enphase) enables tracking which leads have received proposals, what they were quoted, and how that compares to current pricing.

Email Platform Selection

Solar email requirements include:

Deliverability management. Solar emails face elevated spam filtering. Choose platforms with strong deliverability track records and proactive reputation management. Implement authentication (SPF, DKIM, DMARC) properly.

Long-sequence automation. Your platform must support sequences spanning 90+ days with complex branching logic. Basic autoresponders that run 5-10 emails are insufficient.

Dynamic content. Insert lead-specific information (quoted system size, estimated savings, state-specific incentives) into templates automatically.

Engagement tracking. Beyond opens and clicks, track content consumption patterns that indicate buying stage progression.

Dialer and Phone Integration

Solar phone outreach at scale requires:

Compliance features. DNC list scrubbing (federal and state registries), calling hour restrictions by time zone, and litigator database screening.

Local presence. Displaying local area codes improves answer rates significantly. Implement compliantly by using numbers you legitimately own in each market.

Recording and logging. Record all calls for quality assurance and compliance documentation. Integrate recordings with CRM lead records for complete contact history.

Scheduled callback management. When leads request callbacks at specific times, the system should automatically queue those calls and remind representatives.

Analytics and Reporting

Solar’s long timeline requires different reporting approaches:

Cohort analysis. Track lead cohorts by acquisition date through the full 90-day conversion window. A source that appears poor after 30 days may prove valuable at 90 days if their leads convert later in the cycle.

Sequence performance by stage. Understand where in the 90-day journey leads convert, exit, or stall. If most conversions happen between days 45-60, intensify nurturing during that window.

Channel attribution. Multi-touch attribution across 90 days is complex but essential. A lead who converts after a phone call may have been influenced by 15 preceding emails and 3 SMS messages.

Engagement correlation. Identify which engagement behaviors correlate with conversion. Leads who open specific emails, download specific content, or visit specific pages may warrant different treatment than non-engagers.

Compliance Framework for Solar Lead Nurturing

Solar lead nurturing operates under federal and state regulatory frameworks that impose specific requirements on communications.

TCPA Requirements

The Telephone Consumer Protection Act governs calls and text messages:

Prior Express Written Consent. Telemarketing calls and texts to cell phones require PEWC, which must be documented and retained. Your consent language must clearly identify the specific companies authorized to contact the consumer and describe the types of communications they will receive.

Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, many sophisticated buyers require consent specific to each installer. Consent for “solar companies” generally may not satisfy buyer requirements for transfer to multiple installers.

Calling hours. Federal TCPA restricts calls to 8 AM - 9 PM in the consumer’s time zone. Several states impose stricter requirements. Your systems must determine consumer time zones and enforce appropriate restrictions.

Do Not Call compliance. Scrub against the National DNC Registry, state DNC lists, and your internal DNC list before each contact attempt. Consumers who request removal must be suppressed within required timeframes (30 days federal, faster in some states).

Litigator scrubbing. Serial TCPA litigators target solar companies aggressively. Scrub your call lists against litigator databases before outreach.

Revocation handling. Under April 2025 FCC rules, revocation requests must be processed within 10 business days via any reasonable method the consumer uses to communicate that request. Text message opt-outs (“STOP”) must be honored immediately.

CAN-SPAM Requirements

Commercial email must comply with:

Clear sender identification. Emails must clearly identify your company and include a valid physical postal address.

Honest subject lines. Subject lines cannot be deceptive about email content.

Unsubscribe mechanism. Every email must include a clear, conspicuous unsubscribe option.

Prompt opt-out processing. Honor unsubscribe requests within 10 business days.

State Consumer Protection Laws

Solar sales face additional regulation in many states:

Cooling-off periods. Most states require 3-day cancellation rights for home solicitation sales. California extends this for senior citizens. Your nurturing and contract processes must respect these requirements.

Door-to-door sales regulations. If your operation includes canvassing, additional disclosure requirements apply. Even phone follow-up to canvassed leads may trigger these regulations.

Home improvement contractor licensing. Installers must be properly licensed. Marketing that implies installer status when you are a lead generator may create compliance issues.

Documentation and Retention

Maintain documentation that proves compliant operations:

Consent records. Retain consent certificates (TrustedForm, Jornaya) for at least five years. The TCPA four-year statute of limitations plus potential tolling means five years provides appropriate protection.

Contact records. Document every contact attempt with timestamp, method, content delivered, and outcome.

Suppression records. Maintain records of when consumers were added to suppression lists and the reason for suppression.

Training records. Document staff training on compliance requirements and regular refresher training.

Geographic and Seasonal Considerations

Solar lead nurturing must account for the significant geographic variation that defines this vertical.

Market Tier Implications for Nurturing

The 8.5x pricing spread from California to North Dakota reflects economic fundamentals that affect nurturing strategy.

Tier 1 markets (CA, HI, MA, NY): Consumers are generally more educated about solar, having seen decades of marketing. For detailed CPL benchmarks by state tier, see our pricing guide. Nurturing can assume baseline knowledge and focus on differentiation, quality, and trust-building. Premium markets justify more intensive nurturing investment including direct mail, personalized video, and white-glove consultation offers.

Tier 2 markets (TX, FL, AZ, NJ, CO): Growing awareness but more education needed. Nurturing sequences should include more foundational content while still moving toward conversion. These markets often respond well to energy independence messaging beyond pure economics.

Tier 3 markets (NV, UT, IL, VA, GA, NC, SC): Education-heavy nurturing is essential. Consumers have less familiarity with solar economics and need more touchpoints to build confidence. Expect longer sales cycles averaging 90-120 days rather than 60-90.

Tier 4-5 markets (Midwest, Plains, Appalachia): Limited economic case for solar reduces conversion potential regardless of nurturing quality. Focus resources on identifying and qualifying the small segment of genuinely motivated buyers rather than attempting mass nurturing.

Utility-Level Customization

Solar economics vary at the utility level within states. Effective nurturing references the specific utility:

California examples:

- PG&E, SCE, SDG&E: Standard NEM 3.0 rules with time-of-use rates

- SMUD, LADWP: Different rules than investor-owned utilities

- Each has different rate structures affecting the solar value proposition

Texas examples:

- Retail electricity competition means highly variable rates

- Some utilities offer net metering; many do not

- Generic “Texas solar” content fails to address this variation

Your nurturing content library should include utility-specific modules that can be dynamically inserted into sequences based on the lead’s location.

Seasonal Nurturing Adjustments

Solar lead generation exhibits seasonal patterns that affect nurturing strategy:

Spring (March-May): Peak demand season. Consumers are planning for summer and installation weather windows are opening. Nurturing can be more conversion-focused with shorter timelines. Capacity constraints mean leads should understand installation scheduling realities.

Summer (June-August): High electricity bills reinforce the value proposition. However, vacation season interrupts decision-making. Extend nurturing sequences to accommodate summer scheduling. Installer capacity constraints become apparent.

Fall (September-November): Year-end tax credit deadlines create urgency. In the lead-up to the December 2025 ITC expiration, fall 2025 saw exceptional demand compression. Post-ITC, fall urgency will decrease but still exists for state incentive deadlines and installation timing.

Winter (December-February): Slower season in northern markets where weather prevents installation. Nurturing focuses on pipeline building for spring. Southern markets (FL, TX, AZ) continue year-round, creating opportunity for leads who convert faster.

The Post-ITC Environment

The residential solar tax credit (Section 25D) expires for new installations after December 31, 2025. This fundamentally changes solar economics and nurturing strategy.

Changed Value Proposition

Without the 30% federal tax credit:

- Consumer cost increases $6,000-$9,000 on typical installations

- Payback periods extend approximately 30%

- The pure economic case weakens significantly

Nurturing content must evolve to emphasize value propositions beyond pure savings:

- Rising electricity rates (up 15-20% in many markets over 2023-2025)

- Grid reliability and energy independence

- Home value enhancement

- Environmental benefits

- Protection against future rate increases

Adjusted Timeline Expectations

With weaker economics, consideration cycles may extend further. Consumers have less urgency when the savings case is less compelling. Nurturing sequences may need to extend to 120+ days for significant conversion volume.

State Incentive Focus

Post-ITC, state and local incentives become more important. Nurturing content should emphasize:

- State tax credits (NY, MA, others)

- Utility rebate programs

- Property tax exemptions

- Local incentives

This requires more geographic customization than when the federal credit dominated the conversation.

Measurement Framework

Effective measurement enables continuous optimization across the 90-day journey.

Key Performance Indicators

Track these metrics across your nurturing programs:

Sequence conversion rate. Percentage of leads entering nurturing who eventually convert. Segment by acquisition source, market tier, and entry point to identify high-performing segments.

Time to conversion. Days from lead acquisition to signed contract. Understanding the distribution (not just average) reveals whether your nurturing aligns with actual buyer timelines.

Engagement rates by channel.

- Email: Open rates, click rates, content consumption depth

- SMS: Response rates, opt-out rates

- Phone: Answer rates, conversation rates, scheduled callback rates

Engagement-to-conversion correlation. Which engagement behaviors predict conversion? Leads who open 8+ emails may convert at 3x the rate of leads who open 1-2. This insight informs lead scoring and resource allocation.

Stage progression rates. What percentage of leads progress from initial research to deep evaluation, from evaluation to decision preparation, from preparation to commitment? Identifying stage-specific bottlenecks enables targeted improvement.

Cost per nurture-converted lead. Total nurturing program costs (technology, labor, content creation, communication costs) divided by conversions. Compare to fresh lead acquisition costs for ROI context.

Sequence exit analysis. Why do leads exit sequences? Categories include: converted, unsubscribed, marked unqualified, completed sequence without converting, became unreachable. High unsubscribe rates may indicate overly aggressive messaging.

Cohort Analysis for Long Cycles

Solar’s 90-day timeline requires cohort-based analysis:

Track cohorts by acquisition week. A source that appears poor after 30 days may prove valuable when measured at 90 days. Do not cut sources based on premature data.

Maturity-adjusted comparison. Compare Week 12 cohort at 60 days to Week 8 cohort at 60 days, not to Week 8 at 90 days. Consistent measurement windows prevent misleading conclusions.

Conversion curve analysis. Plot cumulative conversion percentage over time for each cohort. Identify when the conversion curve flattens (indicating diminishing returns from continued nurturing) to optimize sequence length.

A/B Testing Framework

Systematic testing improves performance over time:

Test one variable at a time. Changing multiple elements simultaneously makes it impossible to determine what caused observed differences.

Run tests to statistical significance. Solar’s lower volume and longer cycles mean tests need extended run times. A test that achieves significance in 2 weeks for auto insurance may require 8 weeks for solar.

Test high-impact elements first. Subject lines, send timing, content topics, and offer structure typically have larger impacts than formatting details.

Document and implement winners. When tests identify improvements, update standard sequences promptly. Many organizations run tests but fail to implement learnings consistently.

Advanced Nurturing Tactics

Beyond fundamental sequences, advanced tactics can significantly improve nurturing performance.

Behavioral Triggers

Move beyond time-based sequences to behavior-triggered communications:

Website revisit triggers. When a nurtured lead returns to your website, trigger immediate outreach. This return visit indicates renewed interest that may not persist. Integration between your analytics and CRM enables this automation.

Email engagement escalation. Leads who click multiple links in emails signal high engagement. Trigger more aggressive follow-up (phone calls, consultation offers) for engaged leads while maintaining lighter touch for non-engagers.

Quote interaction tracking. If your proposal system tracks when leads view their quotes, use this signal. A lead who reviews their proposal three times in a week is ready for conversion-focused outreach.

Competitive research signals. Through intent data providers or pixel tracking, you may identify when leads are actively researching competitors. Accelerate outreach with differentiation-focused messaging.

Personalization at Scale

Technology enables personalization that was previously possible only through individual sales attention:

Dynamic content insertion. Insert lead-specific information into templates: quoted system size, estimated production, projected savings, applicable incentives based on their utility and state.

Behavioral personalization. Reference past interactions: “I noticed you downloaded our battery storage guide. Here’s additional information about how storage economics have changed under NEM 3.0.”

Rep consistency. When leads are assigned to specific sales representatives, ensure all automated communications come from that representative to build relationship continuity.

Engagement-based segmentation. Leads who consume educational content receive different nurturing than leads who ignore it. Engaged leads may receive more conversion-focused messaging; unengaged leads need re-engagement tactics.

Re-engagement Campaigns

Leads who become unresponsive should not be abandoned permanently:

Timed re-engagement. After 30-45 days of no engagement, run re-engagement campaigns that acknowledge the gap: “It’s been a while since we connected. Has anything changed in your solar plans?”

Policy change outreach. Major events (utility rate changes, new incentive programs, tax law changes) provide legitimate reasons to reconnect with previously unresponsive leads.

Seasonal reactivation. Leads who went cold in winter may reactivate in spring. Leads acquired in fall may be waiting for spring installation windows. Seasonal campaigns aligned with natural buying rhythms capture this deferred demand.

New product announcements. When you add battery storage options, new financing programs, or new equipment partnerships, notify previously unconverted leads who might benefit.

Frequently Asked Questions

What is the typical solar lead conversion timeline?

Solar leads typically require 60-90 days from initial inquiry to signed contract. Only 15-25% of leads convert within the first two weeks. The remaining 75-85% either convert later in the journey, purchase from a competitor, or abandon the process. This extended timeline reflects the complexity of solar decisions: financial analysis, equipment research, installer evaluation, household consensus building, and financing arrangement. Nurturing systems must accommodate this reality rather than treating solar like a transactional purchase.

How many nurturing touchpoints should a solar lead receive?

Effective solar nurturing includes 15-25 touchpoints across the 90-day journey, distributed across channels. A typical distribution might include 12-15 emails, 3-5 SMS messages, 6-10 phone contact attempts, and potentially 1-2 direct mail pieces for high-value leads. The key is pacing these touchpoints appropriately, with more frequent contact in the first two weeks and during the decision phase, and reduced frequency during the extended evaluation period. Over-communication creates opt-outs; under-communication allows competitors to capture the relationship.

What content is most effective for solar lead nurturing?

Educational content that addresses the specific questions consumers ask at each decision stage performs best. Early-stage content focuses on solar basics, quote understanding, and comparison frameworks. Mid-stage content covers equipment technology, financing options, and net metering policies. Late-stage content addresses common objections (moving, roof replacement, technology changes) and provides urgency drivers. Case studies with specific numbers (system size, cost, savings, payback period) outperform generic testimonials. Geographically customized content reflecting local utility policies and incentives outperforms national generic content.

How should nurturing differ between states?

Solar economics vary dramatically by location, creating an 8.5x pricing spread from premium to minimal markets. Tier 1 markets (California, Hawaii, Massachusetts, New York) can assume baseline consumer awareness and focus on differentiation and trust. Tier 3 markets require more foundational education and longer nurturing sequences. Utility-specific content is essential; a lead in PG&E territory faces different economics than one in SMUD territory, even within California. State incentives, net metering policies, and electricity rate structures all require geographic customization.

How does the federal tax credit expiration affect solar nurturing?

With the residential ITC ending after December 2025, the solar value proposition shifts from pure economics to a broader set of benefits: rising electricity rates, grid reliability, energy independence, home value enhancement, and environmental impact. Nurturing content must evolve accordingly. State incentives become more important relative to federal benefits. Consideration cycles may extend as the economic case weakens. Operations that prepared for this shift by developing content around non-economic benefits maintain conversion rates; those dependent on tax credit urgency face challenging adjustments.

What compliance requirements apply to solar lead nurturing?

TCPA regulations require Prior Express Written Consent for calls and texts to cell phones. Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, many sophisticated buyers require consent specific to each company that will contact the lead. Calling hours are restricted to 8 AM - 9 PM (stricter in some states). DNC list scrubbing is required before each contact attempt. CAN-SPAM governs email with requirements for sender identification, honest subject lines, unsubscribe mechanisms, and prompt opt-out processing. Documentation of consent (TrustedForm, Jornaya certificates) should be retained for five years. Revocation requests must be processed within 10 business days.

How should aged solar leads be approached differently?

Leads that did not convert within 90 days require different tactics than fresh leads. Acknowledge the time gap honestly: “I’m following up on the solar information you requested some time ago.” Lead with value rather than urgency, as these consumers have demonstrated they are not impulsive buyers. Expect changed circumstances and qualify early. Verify data quality (phone and email validity) before investing significant resources, as contact information degrades 3-5% monthly. Aged leads may still convert, particularly when triggered by rate increases, policy changes, or life events.

What technology is required for effective solar lead nurturing?

At minimum, solar operations need: a CRM capable of tracking 90-day lead lifecycles with complex workflow automation; an email platform supporting long sequences with dynamic content and branching logic; phone systems with compliance features (DNC scrubbing, calling hour enforcement, recording); and SMS capability with proper consent management. Integration between these systems is essential to prevent channel collision and maintain unified lead records. Analytics capabilities supporting cohort analysis and multi-touch attribution across 90-day windows enable ongoing optimization.

How do you measure ROI on solar lead nurturing?

Calculate the incremental conversion value by estimating how many leads convert through nurturing who would not have converted otherwise. This requires comparing nurtured lead conversion rates to baseline conversion rates for leads that receive minimal follow-up. Subtract total program costs (technology, labor, content creation, communication expenses). Divide by program costs to get ROI percentage. Additionally track leading indicators: sequence conversion rates, cost per nurture-converted lead, engagement-to-conversion correlation, and stage progression rates. Allow 90-120 days of data before drawing conclusions, given the extended timeline.

What separates effective solar nurturing from ineffective programs?

Effective programs understand and respect the 90-day timeline rather than treating solar like a transactional vertical. They provide genuine educational value rather than pure sales pressure. They customize content for geographic and utility-specific economics. They use behavioral triggers alongside time-based sequences. They maintain multi-channel coordination without overwhelming leads. They invest in compliance infrastructure proportional to risk. Most importantly, they measure cohort performance across full conversion cycles rather than judging sources and sequences prematurely.

Key Takeaways

-

Solar decisions take 60-90 days. Only 15-25% of leads convert within two weeks. The remaining 75-85% require sustained nurturing through financial analysis, equipment research, installer evaluation, household consensus, and financing arrangement. Nurturing systems must accommodate this reality.

-

Multi-channel coordination outperforms single-channel approaches. Effective programs integrate 12-15 emails, 3-5 SMS messages, 6-10 phone attempts, and potentially direct mail across the 90-day journey. Pacing matters: avoid channel collision while maintaining consistent presence.

-

Educational content drives conversion. Solar complexity creates opportunity for content that establishes expertise. Case studies with specific numbers, equipment guides, financing comparisons, and policy explanations build trust that converts into sales.

-

Geographic customization is essential. The 8.5x pricing spread from California to North Dakota reflects fundamental economic differences. Generic national content fails. Utility-specific, state-specific content reflecting actual economics maintains credibility.

-

Post-ITC economics require new value propositions. With the federal tax credit ending after 2025, nurturing must emphasize rising rates, grid reliability, energy independence, and home value, not just savings calculations.

-

Compliance infrastructure is non-negotiable. TCPA liability of $500-$1,500 per violation makes non-compliant nurturing financially catastrophic. Though the FCC’s one-to-one consent rule was vacated in January 2025, many sophisticated buyers require consent specific to each company contacting the lead.

-

Cohort analysis across 90-day windows enables accurate measurement. Judging sources or sequences at 30 days produces misleading conclusions. Allow full conversion cycles before optimization decisions.

-

Behavioral triggers complement time-based sequences. Website revisits, quote interactions, email engagement, and competitive research signals indicate renewed interest warranting accelerated outreach.

-

Patience separates winners from the competition. Competitors who abandon leads after two weeks leave value on the table. Operations with infrastructure and discipline to nurture for 90 days capture conversions others forfeit.

This article is part of The Lead Economy book series on professional lead generation. For additional resources on solar lead acquisition, geographic arbitrage strategies, and installer partnership development, explore the complete guide at The Lead Economy.

Statistics and regulatory information current as of late 2025. Policy information reflects the post-ITC environment. Verify current regulations before implementing compliance procedures.