Understanding the customer acquisition strategies of the two dominant residential solar installers reveals the economics that drive the entire industry. Their approach to first-party versus third-party leads, direct sales versus channel partnerships, and vertical integration versus specialization creates the competitive landscape every lead generator must navigate.

The residential solar industry has consolidated dramatically over the past five years. SunPower filed for bankruptcy in August 2024 despite its four-decade history. Dozens of smaller installers have exited. Two companies now dominate the landscape: Sunrun, with approximately 12% market share and over one million customers, and Tesla Energy, which has taken a notably different path to market leadership. Understanding how these giants acquire customers is essential for anyone operating in the solar lead economy.

These are not simply large installers. They are customer acquisition machines that have developed sophisticated strategies for generating, qualifying, and converting leads. Their approaches differ markedly, and those differences create distinct opportunities and challenges for independent lead generators operating in the same market.

This analysis examines the customer acquisition strategies, economics, and market dynamics of both companies, providing actionable intelligence for lead generators who either compete with, supply to, or simply need to understand the competitive environment these giants have created.

The Market Context: Consolidation and Dominance

The U.S. solar industry has reached 262 gigawatts of installed capacity, enough to power 45 million homes. Solar and storage now represent 85% of new capacity additions annually, with solar accounting for over 8% of U.S. electricity generation compared to less than 0.1% in 2010. The industry employs 280,000 Americans directly and supported over 600,000 total jobs in 2023 when including indirect positions.

Yet the residential segment tells a more nuanced story. Q2 2025 marked the lowest quarter for residential capacity since Q2 2021, with installations declining 9% year-over-year and falling below 1 gigawatt for the first time in four years. California volumes dropped 41% in 2024 compared to 2023. The national residential market contracted 12% in 2024.

This contraction has accelerated consolidation. The top five installers now control approximately 35% of the residential market, up from less than 25% five years ago. Sunrun alone accounted for 19% of new U.S. solar installations and 45% of new energy storage installations in Q4 2024. This concentration has profound implications for customer acquisition dynamics across the industry.

Market Share Distribution: Current Landscape

Understanding the competitive landscape requires examining actual market positions:

| Installer | Market Share (2024) | Primary Markets | Customer Base |

|---|---|---|---|

| Sunrun | 12%+ | National (22+ states) | 1,000,000+ |

| Tesla Energy | 5-7% (estimated) | National | 500,000+ installations |

| Freedom Forever | 7% | Southwest, expanding | 100,000+ |

| Momentum Solar | 3-4% | Northeast, Mid-Atlantic | 50,000+ |

| Blue Raven | 2-3% | Mountain West, expanding | 40,000+ |

The remaining 70%+ of the market comprises hundreds of regional and local installers, creating the fragmented buyer landscape that independent lead generators serve.

Sunrun: The Subscription Model Pioneer

Sunrun operates as the largest residential solar installer in the United States, with a market capitalization of approximately $4.75 billion and 11,058 employees. The company’s stock has demonstrated significant recovery, with year-to-date returns exceeding 121% through late 2025. Understanding Sunrun’s customer acquisition approach reveals strategies that shape the broader market.

Business Model Foundation

Sunrun’s core innovation is the subscription model. Rather than selling solar systems outright, the company offers solar leases and power purchase agreements (PPAs) that allow homeowners to adopt solar with minimal upfront cost. The homeowner pays a monthly fee for the electricity produced by Sunrun-owned equipment installed on their roof.

This model creates several customer acquisition advantages:

Lower barrier to entry. A $25,000 system purchase becomes a $100-$200 monthly payment. This removes the credit qualification and financing hurdles that block many potential solar buyers from cash or loan purchases.

Tax credit capture. Sunrun, as the system owner, claims the 30% federal Investment Tax Credit directly. This $7,500 value on a typical installation is monetized by Sunrun and passed to customers through lower monthly payments. Homeowners who cannot fully utilize the tax credit due to limited tax liability benefit from this structure.

Recurring revenue model. Twenty-year lease agreements create predictable cash flows that support aggressive customer acquisition investment. Unlike installers who recognize revenue at sale, Sunrun’s subscription model justifies higher upfront customer acquisition costs because lifetime value is calculated over two decades.

Service relationship. Owning the equipment creates ongoing customer relationships that generate referrals, battery storage upsells, and grid services revenue. Sunrun’s virtual power plant programs aggregate customer batteries for grid services, creating revenue streams that further subsidize acquisition costs.

Customer Acquisition Cost Economics

Sunrun’s subscription model allows customer acquisition costs (CAC) that would bankrupt cash-sale installers. Industry estimates place Sunrun’s CAC in the $3,000-$5,000 range per customer, significantly above the $1,500-$2,500 typical for regional installers selling owned systems.

The math works because of lifetime customer value. A 20-year PPA generating $150 monthly represents $36,000 in gross revenue per customer. After equipment, installation, maintenance, and financing costs, customer lifetime value supports the elevated acquisition spend.

This CAC capacity creates pricing pressure throughout the lead market. When Sunrun buys leads, they can pay premiums that regional installers cannot match. Some lead generators report that Sunrun bids 30-50% above market rates for exclusive leads in priority territories. This pulls up pricing for all buyers but creates potential dependency on a single large purchaser.

Multi-Channel Acquisition Strategy

Sunrun deploys capital across multiple customer acquisition channels:

Direct sales force. Sunrun employs thousands of sales representatives across its service territories. Door-to-door canvassing remains significant despite industry evolution toward digital channels. A Sunrun representative knocking on doors captures leads before competitors can reach them.

The direct sales approach is expensive. Sales representative compensation, training, management overhead, and vehicle costs add up to $800-$1,200 per lead generated internally. However, these leads are exclusive and high-quality because face-to-face qualification occurs during generation.

Retail partnerships. Sunrun has partnered with major retailers including Costco and Home Depot to generate leads through in-store solar displays. These partnerships provide foot traffic, brand credibility, and qualified homeowner access.

Retail leads benefit from the partner’s brand trust. A homeowner exploring solar at Costco already has membership, indicating income and homeownership qualification. The partnership structure typically involves revenue sharing rather than per-lead payments, aligning incentives between Sunrun and retail partners.

Third-party lead acquisition. Despite substantial internal generation, Sunrun remains one of the largest purchasers of third-party solar leads. The company buys from major platforms including SolarReviews, EnergySage, and numerous smaller generators.

Sunrun’s lead buying behavior provides market signals for other participants. When Sunrun increases daily caps, market demand is strong. When caps tighten, typically in Q4 when installation capacity is full, the entire lead market feels the contraction.

Referral programs. Existing customers represent Sunrun’s highest-quality lead source. Referral bonuses of $500-$1,000 for referring a friend who installs have generated significant volume. These leads convert at 2-3x the rate of cold third-party leads because trust transfers from the referring customer.

Digital marketing. Paid search, social advertising, and programmatic display support Sunrun’s acquisition mix. The company’s brand spending builds awareness that reduces cold lead conversion resistance. A homeowner who has seen Sunrun advertising is more likely to request a quote and convert when contacted.

Geographic Focus and Expansion

Sunrun operates in 22 states plus Washington D.C. and Puerto Rico. Primary markets include California (despite NEM 3.0 headwinds), Texas, Florida, New Jersey, and New York. The company has expanded into emerging markets including Nevada, Utah, and Colorado.

Geographic strategy reflects the same unit economics that drive the broader lead market. Sunrun prioritizes states with:

- High electricity rates ($0.15+ per kWh)

- Favorable net metering policies

- State-level incentives beyond the federal ITC

- Dense installer infrastructure (indicating market maturity)

- Growing populations with new housing stock

In states where Sunrun operates, their customer acquisition activity influences the entire local market. Lead generators serving these territories compete with or supply to a dominant buyer with deep pockets and long time horizons.

Tesla Energy: The Ecosystem Play

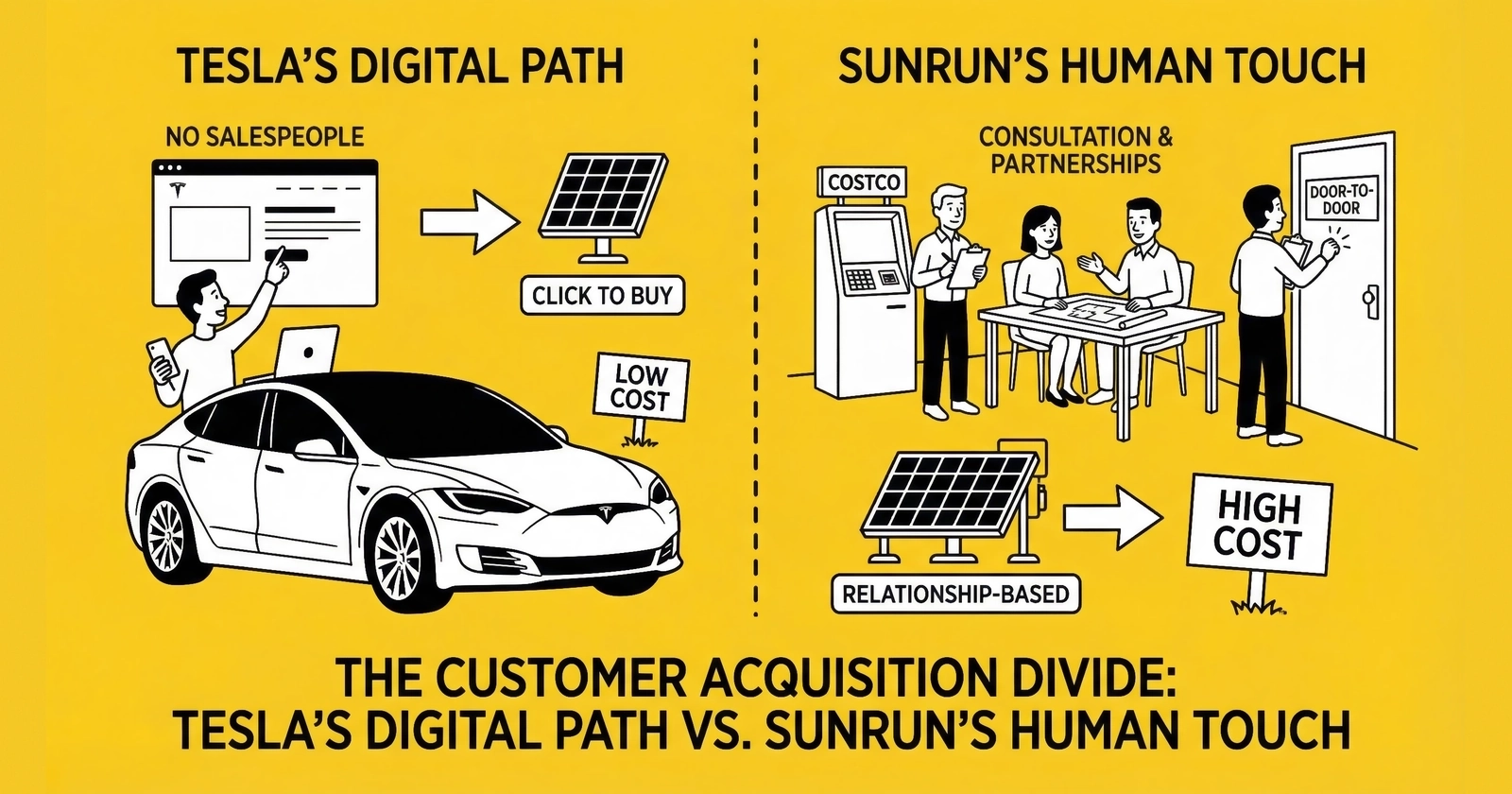

Tesla Energy operates as a division of Tesla, Inc., leveraging the parent company’s brand, retail infrastructure, and customer base to acquire solar customers. The approach differs fundamentally from Sunrun’s subscription-focused model.

The Tesla Difference

Tesla’s solar strategy centers on ecosystem integration rather than standalone solar sales. A Tesla solar customer often owns or aspires to own a Tesla vehicle. The Powerwall battery storage product creates energy independence that appeals to Tesla’s core demographic of technology-forward, environmentally conscious consumers.

This ecosystem approach creates customer acquisition efficiencies unavailable to standalone solar installers:

Brand leverage. Tesla’s brand recognition dwarfs any solar-specific company. Consumer awareness of Tesla as an energy company drives inbound interest without solar-specific advertising spend. The automotive marketing budget indirectly supports solar customer acquisition.

Retail infrastructure. Tesla stores and service centers provide physical locations for solar customer acquisition without dedicated solar showrooms. A customer visiting for vehicle service may explore solar options. This shared infrastructure reduces customer acquisition costs per product category.

Existing customer base. Tesla vehicle owners represent a pre-qualified audience for solar sales. They have demonstrated purchasing power, technology affinity, and environmental consciousness. Marketing to this base costs less than cold prospecting.

Manufacturing integration. Tesla manufactures its own solar panels and Powerwall batteries, creating vertical integration that supports aggressive pricing. The company has claimed pricing 30% below industry average, though current pricing varies by market.

Pricing Strategy and Market Position

Tesla has pursued aggressive pricing as a customer acquisition lever. The company announced systems starting at $6,000-$8,200 in 2020, well below typical installed costs. This pricing attracted price-sensitive customers and generated viral attention.

However, Tesla’s pricing strategy has shifted over time. The company required Powerwall battery purchases with solar installations starting in 2021, effectively increasing system costs while bundling products. More recently, Tesla has introduced subscription and leasing options that compete more directly with Sunrun’s model.

The current Tesla solar subscription offers entry-level pricing with monthly payments starting around $50-$65. This competes directly with Sunrun’s PPA model while leveraging Tesla’s brand premium.

The Referral Engine

Tesla’s referral program has been central to customer acquisition across all product lines, including solar. The program structure has evolved over time:

Historical referral bonuses included significant incentives such as free Powerwall batteries, extended Supercharger credits, and cash rewards. At peak, both referrer and referred customer received substantial benefits.

Current structure provides more modest incentives but maintains the program. Referral codes generate credits toward Tesla products or accessories. The program succeeds because Tesla owners are often enthusiastic advocates who recommend the brand organically.

Referral leads convert at exceptional rates. A friend’s recommendation carries trust that no amount of advertising can purchase. Tesla’s Net Promoter Score, consistently among the highest in the automotive industry, translates to solar referral volume.

Scale and Market Position

Tesla announced 500,000+ solar installations totaling 4 GW of capacity as of December 2022. However, the company stopped reporting solar installation metrics in recent years, making current scale difficult to assess.

Industry analysts estimate Tesla Energy’s residential solar market share at 5-7%, placing it among the top five installers nationally. The company’s market position appears to have stabilized after scaling back operations in some markets during 2022.

Tesla’s approach to customer acquisition differs from Sunrun’s in key ways:

Less third-party dependence. Tesla’s brand and ecosystem generate sufficient inbound interest to rely less on purchased leads. While the company does buy leads from marketplaces like EnergySage, volume is lower relative to company size than Sunrun’s purchasing.

Online-first sales. Tesla pioneered online solar ordering with instant pricing based on satellite imagery. Customers can design systems, get pricing, and order installation through Tesla’s website without sales representative interaction. This reduces sales costs but requires customers comfortable with self-directed purchases.

Geographic concentration. Tesla’s solar operations concentrate in markets with both strong solar fundamentals and Tesla vehicle presence. California, Texas, Florida, and the Northeast receive focus. Expansion into secondary markets has been slower than Sunrun’s.

First-Party vs. Third-Party Leads: The Strategic Trade-Off

Both Sunrun and Tesla generate substantial lead volume internally (first-party) while supplementing with purchased leads (third-party). The balance between these sources reflects strategic choices that independent lead generators must understand.

First-Party Lead Advantages

Quality control. Leads generated through owned channels (direct sales, retail partnerships, website) meet quality standards that third-party leads may not. Sunrun’s door-to-door representatives pre-qualify homeowners before generating leads. Tesla’s online configurator captures only customers with genuine purchase intent.

Exclusivity. First-party leads are exclusive by definition. No competitor has the same lead. This exclusivity translates to higher close rates because the homeowner is not receiving multiple calls from competing installers.

Brand alignment. Customers who engage directly with Sunrun or Tesla have chosen to interact with that specific company. They are not comparison shopping through a marketplace. This brand affinity improves conversion.

Data ownership. First-party leads provide customer data that the installer owns without restrictions. Third-party leads may come with usage limitations, exclusivity windows, or prohibition on remarketing.

Cost predictability. While first-party lead generation has costs (sales representatives, retail partnerships, advertising), those costs are more predictable than third-party lead pricing, which fluctuates with market demand.

First-Party Lead Disadvantages

Scale constraints. Building lead generation infrastructure takes time and capital. A company cannot instantly scale first-party lead volume. Third-party leads provide on-demand scale.

Fixed costs. Sales forces and retail partnerships have fixed costs regardless of conversion. A slow month in third-party leads means lower expense. A slow month for a direct sales team means the same payroll with fewer conversions.

Geographic limitations. First-party infrastructure exists only where companies have invested. Entering new markets requires building local lead generation capability. Third-party leads provide immediate market entry.

Channel expertise. Generating high-quality leads requires expertise in media buying, content marketing, referral programs, and sales management. Not every installer excels at these disciplines. Third-party lead generators specialize in acquisition and may outperform internal efforts.

Third-Party Lead Advantages

Immediate scale. Lead generators can deliver volume tomorrow. This enables rapid market entry, seasonal flexibility, and capacity matching.

Variable costs. Lead purchases scale with business needs. Slow periods mean reduced spend. Growth periods mean increased purchasing. No fixed infrastructure is required.

Expertise access. Specialized lead generators invest in traffic acquisition, form optimization, and conversion technology. Installers benefit from this expertise without developing it internally.

Competitive pricing. Market competition among lead generators keeps pricing competitive. Installers can compare sources, negotiate pricing, and switch vendors.

Third-Party Lead Disadvantages

Quality uncertainty. Third-party leads vary widely in quality. Fraud rates of 25-35% plague the industry. Verification standards differ across sources.

Shared leads. Many third-party leads sell to multiple installers, creating competition that reduces close rates. Exclusive leads command premium pricing.

Brand disconnection. Consumers who submit forms through marketplaces or lead aggregators may not recognize the installer who contacts them. This creates friction in initial conversations.

Dependency risk. Relying on third-party sources creates vulnerability to pricing changes, quality degradation, and source exits. Diversification mitigates but does not eliminate this risk.

How Sunrun and Tesla Balance These Trade-Offs

Sunrun maintains heavy investment in first-party generation (direct sales, retail partnerships, referrals) while remaining one of the largest third-party lead buyers. This balanced approach provides scale with quality control. Internal estimates suggest 60-70% of Sunrun’s leads come from first-party sources, with third-party leads supplementing for geographic coverage and seasonal peaks.

Tesla leans more heavily toward first-party generation, leveraging brand and ecosystem advantages. Third-party leads represent a smaller percentage of total acquisition, perhaps 30-40%, with most leads coming from website inquiries, Tesla owners, and referrals. This approach sacrifices some scale for cost efficiency and quality control.

The Economics of Customer Acquisition at Scale

Understanding the customer acquisition economics that Sunrun and Tesla operate within reveals why they buy leads at certain prices and how independent generators can position offerings.

Sunrun’s Unit Economics

Sunrun’s subscription model creates customer acquisition capacity that traditional installers cannot match:

Typical 6kW installation value:

- Equipment and installation cost: $12,000-$15,000

- Federal ITC captured by Sunrun (30%): $4,500

- Monthly PPA payment: $150

- 20-year gross revenue: $36,000

- Net present value at 8% discount: $16,000-$18,000

- Allowable customer acquisition cost: $3,000-$5,000

This math explains why Sunrun can pay $150-$200 for exclusive leads that close at 10%: the effective cost per acquisition of $1,500-$2,000 fits comfortably within allowable CAC.

The subscription model also enables aggressive lead buying during growth periods. Unlike cash-sale installers who must fund acquisition from immediate revenue, Sunrun’s financed model allows investing ahead of revenue realization. This creates capacity to outbid competitors when market share expansion is prioritized.

Tesla’s Unit Economics

Tesla’s ecosystem model creates different acquisition economics:

System sale plus battery:

- 8kW solar system: $16,000

- Powerwall battery: $11,500

- Total sale: $27,500

- Gross margin: 25-30% ($6,900-$8,250)

- Allowable customer acquisition cost: $1,500-$2,500

Tesla’s direct sales and online-first model keep acquisition costs below industry average. When Tesla does buy third-party leads, the company’s price sensitivity is lower than smaller installers but higher than Sunrun’s subscription model allows.

Tesla’s strategic advantage is cross-selling efficiency. A Tesla vehicle owner who adds solar and Powerwall represents incrementally low acquisition cost since the customer relationship already exists. Marketing to existing customers costs a fraction of cold acquisition.

What This Means for Lead Generators

Understanding these economics reveals pricing opportunities and constraints:

Premium pricing is possible for leads that fit Sunrun’s target profile: homeowners with high electricity bills ($200+/month), good credit, interest in storage, and located in priority markets. Sunrun’s subscription economics support $150-$200+ per exclusive lead.

Volume opportunities exist as both companies need lead flow beyond internal generation. Despite substantial first-party infrastructure, neither company generates sufficient volume to meet installation capacity. Third-party leads fill the gap.

Quality differentiation matters because both companies have experienced fraud and quality issues with third-party sources. Generators who can demonstrate verified homeownership, utility bill validation, and property qualification command premium pricing.

Geographic targeting is essential. Sunrun and Tesla prioritize different territories. Understanding where each company is actively buying and at what capacity levels helps generators route leads to the highest-paying buyers.

Timing affects pricing. Q1 typically sees stronger lead buying as companies build pipeline for peak installation season. Q4 buying slows as installation capacity fills. Lead generators who can bank inventory from soft periods for peak demand capture better margins.

Market Dynamics: How Giants Shape the Lead Economy

The presence of Sunrun and Tesla as dominant buyers shapes the entire solar lead marketplace. Their behaviors create ripple effects that affect every market participant.

Price-Setting Power

When Sunrun increases lead pricing in a market, other buyers must respond or accept reduced volume. This price leadership role means Sunrun’s internal economics set effective price floors in many territories.

Conversely, when Sunrun reduces caps or exits a market, lead pricing can collapse. Generators with Sunrun as their primary buyer face concentration risk. Diversification across multiple buyers, including regional installers who may pay slightly less but provide stability, mitigates this vulnerability.

Quality Standard Influence

Sunrun’s quality requirements influence industry standards. When Sunrun demands phone verification, property database matching, or utility bill upload, generators who want to sell to Sunrun must implement these features. These requirements then spread as other buyers adopt similar expectations.

This quality ratchet benefits the industry by reducing fraud and improving lead value, but it increases generator costs. Those costs must be recovered through pricing or volume efficiency.

Market Entry Barrier

New solar lead generators face a market where the largest buyers have sophisticated intake processes, detailed quality requirements, and established relationships with incumbent generators. Breaking into Sunrun as a new source requires demonstrating quality over time, often starting with small volume tests before earning meaningful capacity.

This creates barriers to entry that protect established generators but make market entry challenging. New entrants often succeed by specializing in geographies or lead types that larger buyers do not prioritize.

Consolidation Acceleration

When major installers like SunPower fail, the buyers who remain (Sunrun, Tesla, and surviving regionals) absorb displaced market share. This consolidation concentrates buying power further, increasing the importance of relationships with remaining major buyers.

Lead generators should monitor installer health beyond lead appetite. An installer aggressively buying leads while reporting layoffs or delayed payments may be approaching financial distress. Early warning signs help generators adjust exposure before becoming creditors in bankruptcy proceedings.

Strategic Implications for Independent Lead Generators

Operating in a market dominated by Sunrun and Tesla requires strategic positioning that accounts for their presence without depending entirely on their business.

Diversification Strategy

No lead generator should have more than 30% of volume dependent on a single buyer. Sunrun’s scale makes it tempting to build around their demand, but concentration risk is severe. A single buyer’s decision to reduce caps, implement quality requirements you cannot meet, or exit a geography can devastate an undiversified operation.

Build relationships with regional installers who provide stable, if smaller, volume. These buyers often appreciate the personal relationship and consistent quality that large buyers cannot prioritize.

Quality as Differentiation

The major installers have experienced every form of lead fraud. Their quality requirements reflect years of disappointment with underperforming sources. Generators who invest in verification infrastructure, maintain low return rates, and demonstrate consistent close rates earn preferred status.

Invest in property database verification, phone validation, utility bill collection, and behavioral analytics. The $3-$8 per lead cost of comprehensive verification pays for itself through premium pricing and buyer retention.

Geographic Specialization

Rather than competing nationally against well-funded major generators, consider geographic specialization. Deep knowledge of specific markets, including utility territories, local incentives, installer relationships, and consumer behaviors, creates competitive advantage that scale cannot match.

A generator who dominates Arizona solar leads may earn better margins than one with thin national coverage. Geographic expertise enables utility-level routing, seasonal optimization, and buyer relationships that generalists cannot develop.

Exclusive Value Creation

Major installers pay premium prices for leads they cannot get elsewhere. Exclusive relationships with specific traffic sources, content platforms, or referral networks create value that commodity lead generation cannot match.

Consider building owned media properties (content sites, comparison tools, calculators) that generate leads only you can sell. This first-party lead generation mirrors the major installers’ approach at smaller scale.

Channel Partnership

For generators who cannot compete directly with major installers on volume or pricing, partnership models provide alternative paths:

White-label generation for regional installers who want lead generation without building internal capability

Overflow handling for major installers who need surge capacity during peak periods

Quality verification services that improve other generators’ leads before sale to major buyers

Geographic expansion support for installers entering new markets who need immediate lead flow

Frequently Asked Questions

How does Sunrun acquire most of its customers?

Sunrun uses a multi-channel approach combining direct sales force (door-to-door canvassing), retail partnerships (Costco, Home Depot), third-party lead purchases from platforms like SolarReviews and EnergySage, referral programs offering $500-$1,000 bonuses, and digital marketing including paid search and social advertising. Approximately 60-70% of leads come from first-party sources, with third-party leads supplementing for geographic coverage and seasonal peaks. The subscription model (leases and PPAs) allows customer acquisition costs of $3,000-$5,000, higher than most competitors can sustain.

What is Tesla’s solar customer acquisition strategy?

Tesla leverages its automotive brand, retail infrastructure, and existing customer base to acquire solar customers at lower cost than competitors. The company pioneered online solar ordering with instant satellite-based pricing, reducing sales costs. Tesla vehicle owners represent a pre-qualified audience who convert at high rates. The referral program generates significant volume through enthusiastic owner recommendations. Tesla buys fewer third-party leads than Sunrun, relying more heavily on inbound interest generated by brand awareness.

Why can Sunrun pay more for solar leads than other installers?

Sunrun’s subscription model (leases and power purchase agreements) creates different economics than cash-sale installers. By owning the equipment and monetizing the 30% federal tax credit directly, Sunrun generates 20-year recurring revenue averaging $36,000 per customer. This lifetime value supports customer acquisition costs of $3,000-$5,000 compared to $1,500-$2,500 for regional installers. When Sunrun bids $150-$200 for exclusive leads that close at 10%, the effective $1,500-$2,000 cost per acquisition fits their model while being uneconomical for competitors.

Do Tesla and Sunrun buy third-party leads?

Yes, both companies purchase third-party leads to supplement internal generation. Sunrun is one of the largest third-party lead buyers in the solar industry, purchasing from SolarReviews, EnergySage, and numerous smaller generators. Tesla also buys from marketplaces but relies more heavily on first-party sources. For lead generators, understanding when and where these companies are buying, at what volume caps, and with what quality requirements is essential for pricing strategy.

What quality standards do major installers require from lead suppliers?

Major installers have implemented increasingly stringent quality requirements after years of fraud exposure. Standard requirements include phone verification via SMS or voice, email confirmation, property database matching to verify homeownership, and address standardization. Premium requirements include utility bill upload or verification, credit self-attestation, TrustedForm or Jornaya certification for consent documentation, and property imagery review. Generators who meet these requirements earn premium pricing; those who cannot are relegated to lower tiers or rejected entirely.

How has the SunPower bankruptcy affected the solar lead market?

SunPower’s August 2024 bankruptcy removed a major installer from the market, concentrating buying power among remaining players. Sunrun and Freedom Forever absorbed displaced market share. For lead generators, this reduced buyer diversity and increased concentration risk. Generators previously dependent on SunPower had to rapidly shift volume to other buyers, often at reduced pricing. The lesson: maintain relationships with multiple buyers across company size categories.

What percentage of customer acquisition costs do solar leads represent?

For installers purchasing third-party leads, lead costs represent 30-50% of total customer acquisition cost. A $150 exclusive lead that closes at 10% creates effective lead cost of $1,500 per customer. Additional acquisition costs include sales representative time ($200-$400), design and proposal preparation ($100-$200), and administrative overhead ($100-$200), bringing total CAC to $1,900-$2,300. For companies with direct sales forces, the lead cost percentage is lower but total CAC may be higher due to fixed sales infrastructure costs.

How do major installers evaluate lead quality?

Major installers track metrics that predict conversion and revenue. Contact rate (percentage of leads reached by phone) is primary because unreachable leads have zero value. Appointment rate measures how many contacted leads agree to in-home consultations. Close rate from appointment measures sales effectiveness. Return rate indicates lead defects. Average system size correlates with revenue per sale. Installers compare these metrics across lead sources, rewarding high performers with volume increases and premium pricing while reducing caps from underperforming sources.

What geographic markets do Sunrun and Tesla prioritize?

Both companies focus on states with strong solar economics: high electricity rates, favorable net metering, and state incentives. Sunrun operates in 22 states plus Washington D.C. and Puerto Rico, with priority markets including California (despite NEM 3.0), Texas, Florida, New Jersey, and New York. Tesla concentrates in markets with both solar fundamentals and Tesla vehicle presence, including California, Texas, Florida, and the Northeast. Understanding which company is actively buying in specific markets helps generators route leads to buyers with capacity.

How should lead generators position against major installer in-house generation?

Lead generators cannot compete with major installers on brand leverage or ecosystem integration. Instead, focus on value propositions internal teams cannot match: geographic specialization in markets where major installers lack first-party infrastructure, quality verification that exceeds internal standards, speed of delivery that internal lead generation cannot match, and flexibility to provide exactly the lead types and volumes buyers need at specific times. Build relationships based on reliability and quality rather than competing purely on price.

Key Takeaways

-

Sunrun’s subscription model enables customer acquisition costs of $3,000-$5,000, significantly above the $1,500-$2,500 typical for regional installers. This pricing power makes Sunrun one of the largest third-party lead buyers while also creating competitive pressure throughout the market. Understanding their economics reveals why they can pay premium prices for high-quality leads.

-

Tesla leverages ecosystem advantages that standalone solar companies cannot match. Brand recognition, retail infrastructure, and the existing customer base of Tesla vehicle owners create customer acquisition efficiencies that allow Tesla to rely less on third-party leads than competitors. This creates a smaller addressable market for lead generators but also less pricing competition.

-

First-party lead generation provides quality and exclusivity advantages that major installers prioritize. Both Sunrun and Tesla invest heavily in direct sales, retail partnerships, and referral programs because these sources outperform purchased leads on conversion metrics. Third-party leads supplement rather than replace internal generation.

-

Buyer concentration creates risk that lead generators must actively manage. With Sunrun and a handful of other major buyers dominating the market, excessive dependence on any single buyer is dangerous. Diversification across buyer size categories and geographies protects against cap reductions, quality requirement changes, or buyer exits.

-

Quality verification has become table stakes for selling to major installers. Phone verification, property database matching, utility bill validation, and consent certification are now baseline requirements. Generators who invest in comprehensive verification infrastructure earn premium pricing and volume stability.

-

Geographic and quality specialization creates sustainable competitive advantage. Competing nationally against well-funded major generators is difficult. Deep expertise in specific markets, lead types, or buyer relationships creates defensible positions that commodity lead generation cannot match.

-

The consolidation trend is accelerating. SunPower’s bankruptcy and ongoing margin pressure on smaller installers will continue concentrating the market among fewer, larger buyers. Building relationships with surviving players while maintaining diversification prepares generators for an increasingly consolidated market.

-

Referral programs represent the highest-quality lead source for both major installers. Sunrun’s $500-$1,000 referral bonuses and Tesla’s referral credit system generate leads that convert at 2-3x the rate of third-party leads because trust transfers from the referring customer. Lead generators competing with these programs must deliver comparable quality or accept lower pricing.

Industry data reflects conditions through late 2025. Sunrun and Tesla strategies continue evolving as market conditions change. Lead generators should maintain current intelligence on buyer requirements, pricing, and capacity to optimize their market position.