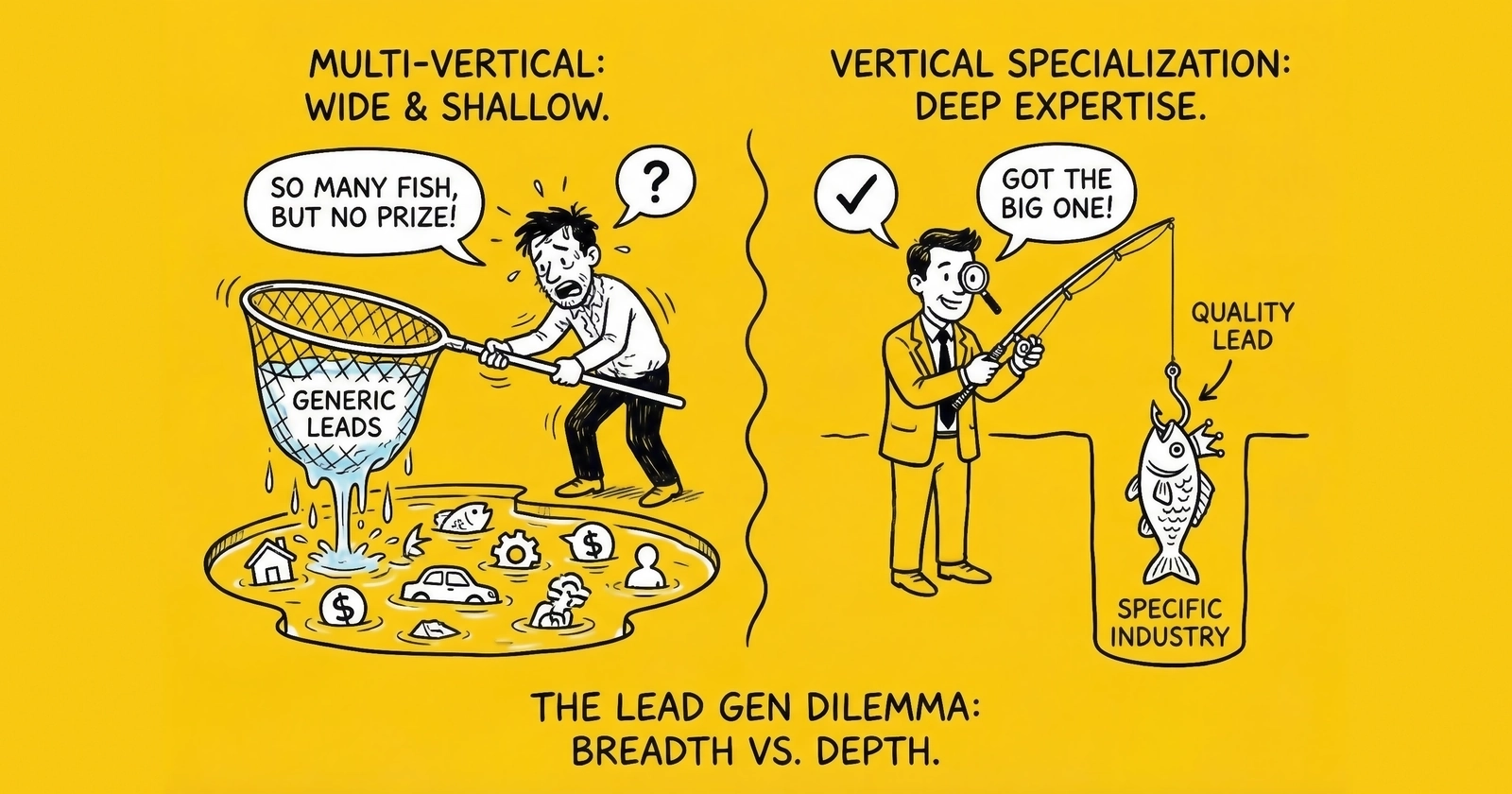

A data-driven analysis of the most critical strategic decision in lead generation: should you go deep in one vertical or diversify across multiple markets? Learn the real economics, risk factors, and decision frameworks that separate sustainable operators from those who struggle.

The strategic choice between vertical specialization and multi-vertical operations defines the trajectory of every lead generation business. Get this decision right, and you build a defensible position with sustainable margins. Get it wrong, and you either trap yourself in a declining market or spread resources so thin that you achieve mediocrity across the board.

This is not an abstract strategic debate. It is the question that keeps experienced practitioners awake at night when their primary vertical contracts, their best buyer churns, or a regulatory change reshapes their competitive landscape overnight.

After fifteen years in the lead economy, I can tell you that there is no universally correct answer. What exists instead is a framework for matching your specific resources, risk tolerance, and market position to the strategy most likely to succeed given your circumstances. That framework is what this guide provides.

Understanding the Core Strategic Choice

Before diving into the analysis, let us establish clear definitions. These terms carry specific meaning in lead generation that differs from general business usage.

Vertical specialization means focusing your lead generation operations on a single industry category. You become the expert in auto insurance leads, or mortgage leads, or solar leads. Your traffic acquisition, landing pages, buyer relationships, and operational expertise all concentrate on understanding and serving one market better than anyone else.

Multi-vertical operations means generating leads across multiple industry categories simultaneously. You might operate in insurance, mortgage, and home services concurrently. Your infrastructure serves diverse markets, your buyer relationships span industries, and your traffic acquisition strategies adapt to different consumer intents.

The terms exist on a spectrum rather than as binary categories. A solar lead specialist operating in residential and commercial solar is more specialized than a home services company generating leads for HVAC, roofing, plumbing, and electrical. A financial services generalist spanning mortgage, personal loans, and credit cards is more diversified than an insurance specialist covering only auto and home bundled products.

The strategic question is where on this spectrum your operation should position itself, given your specific circumstances and goals.

The Economic Case for Vertical Specialization

Vertical specialists consistently achieve better unit economics than generalist competitors operating in the same markets. Research across multiple lead generation verticals suggests specialists see 20-40% margin improvement compared to generalist operations at equivalent scale.

Why Specialists Command Premium Margins

The margin advantage stems from several compounding factors.

Traffic acquisition efficiency improves with vertical expertise. A solar lead specialist understands which creative angles resonate with homeowners considering renewable energy. They know that California leads require different messaging than Texas leads due to different utility rate structures and incentive programs. They recognize that homeownership verification and roof age matter more than generic demographic targeting. This knowledge translates directly into lower cost per click and higher landing page conversion rates.

A generalist operating in solar alongside four other verticals cannot achieve the same depth of understanding. Their campaigns perform adequately but not exceptionally. The specialist’s 15% cost advantage at the traffic level compounds throughout the entire operation.

Quality optimization becomes systematic rather than reactive. The vertical specialist develops deep understanding of what makes a lead valuable to buyers in their specific market. In insurance, they understand the difference between mono-line auto shoppers and bundled home/auto prospects, segmenting leads accordingly and commanding premium pricing for high-value segments. In mortgage, they recognize how loan amount, credit profile, and property type affect buyer interest and price elasticity.

The specialist builds qualification flows, validation rules, and buyer matching logic specifically optimized for their vertical. The generalist applies generic processes across markets, missing optimization opportunities that require vertical-specific knowledge.

Buyer relationships deepen beyond transactional exchanges. When you speak knowledgeably about carrier underwriting preferences, or mortgage rate lock timing, or solar panel installation requirements, you become a partner rather than a vendor. Partners receive priority treatment, longer-term agreements, and better pricing.

Insurance carriers working with a specialist who understands their specific appetite for risk profiles and geographic preferences provide premium rates and expanded capacity. They trust the specialist to optimize for their needs rather than simply maximizing volume. That trust translates into pricing power that generalists cannot access.

Compliance expertise reduces risk and cost. Heavily regulated verticals like Medicare, legal, and mortgage require substantial compliance investment. The specialist amortizes this investment across focused volume. The generalist must either underinvest in compliance (creating liability exposure) or replicate compliance infrastructure across multiple verticals (destroying economics through overhead).

Consider Medicare lead generation, where CMS requirements include one-to-one consent rules, TPMO disclaimers, scope of appointment documentation, 48-hour waiting periods, and 10-year record retention. Building and maintaining this compliance infrastructure makes sense when Medicare represents your core business. Replicating it as one of six verticals you operate becomes prohibitively expensive.

Real Economic Analysis: Specialist vs Generalist in Insurance

Let me walk through specific numbers to illustrate the margin differential.

Generalist Insurance Operation

- Traffic cost per lead: $35

- Platform and technology costs: $3.50 per lead

- Compliance costs: $2.00 per lead (spread across multiple verticals)

- Return rate: 14%

- Average sale price: $52

- Net margin per lead: $8.45 (16.3%)

Specialist Insurance Operation

- Traffic cost per lead: $28 (20% lower through optimization)

- Platform and technology costs: $2.50 per lead (focused infrastructure)

- Compliance costs: $1.50 per lead (amortized across volume)

- Return rate: 10% (quality optimization reduces returns)

- Average sale price: $58 (premium pricing from relationships)

- Net margin per lead: $21.50 (37.1%)

The specialist achieves 2.5x the per-lead margin of the generalist. At 10,000 leads monthly, that translates to $130,500 additional profit annually. At 50,000 leads monthly, the differential exceeds $650,000 annually.

These numbers are not theoretical. They represent patterns observed across multiple insurance lead generation operations at various scales. The specific percentages vary by sub-vertical and market conditions, but the directional relationship between specialization and margin holds consistently.

The Economic Case for Multi-Vertical Operations

If specialization delivers superior unit economics, why would anyone choose multi-vertical operations? Because unit economics tell only part of the story. Multi-vertical operations address risks and opportunities that specialization inherently misses.

Concentration Risk: The Specialist’s Vulnerability

Concentration risk killed more lead generation businesses in 2024 than competitive pressure. When 40% of your profit comes from one vertical and that vertical contracts, you do not have a business problem. You have an existential crisis.

Consider the mortgage lead market through recent rate cycles. When rates spiked from 3% to 7%, refinance lead volume collapsed by 70-80%. Operators concentrated in refinance leads saw their businesses nearly disappear regardless of operational excellence. Those with purchase mortgage alongside refinance maintained some revenue. Those with mortgage plus insurance plus home services continued operating profitably while their competitors scrambled.

Solar lead generation tells a similar story. California’s NEM 3.0 policy reduced export compensation by 75%, dramatically impacting the economics for installers and consequently their appetite for leads. Operators concentrated exclusively in California solar faced devastating volume and price compression. Those with geographic diversification across Texas, Florida, and the Northeast maintained profitability. Those with vertical diversification into home services or insurance avoided the impact entirely.

The pattern repeats across verticals. Insurance carriers adjust advertising spend based on underwriting profitability, creating 50% or greater swings in lead demand within quarters. Legal mass tort campaigns follow lifecycle patterns where individual litigations mature and decline. Education lead generation contracted dramatically following regulatory changes. Every vertical faces its own volatility patterns.

The rule of thumb established by experienced practitioners: no single vertical should represent more than 30-40% of your total lead volume. This ceiling protects against vertical-specific disruptions destroying your entire business.

Market Timing Advantages

Different verticals move through different cycles, often with negative correlation. When mortgage refinance contracts during rising rates, home improvement expands as homeowners invest in existing properties rather than moving. When auto insurance demand softens during carrier profitability pressures, health insurance enrollment remains steady through seasonal patterns.

Multi-vertical operators capture these timing advantages by shifting resources toward verticals in favorable phases while maintaining presence in contracted markets. The mortgage specialist watches helplessly as volume disappears. The diversified operator redirects traffic budget toward home services while maintaining mortgage infrastructure for the eventual recovery.

This counter-cyclical positioning requires genuine capability in multiple verticals. Attempting to enter a new vertical during your primary vertical’s contraction is desperate, not strategic. Building diversified operations during favorable conditions creates options you can exercise when conditions change.

Scale Economics in Infrastructure

Certain infrastructure components serve multiple verticals efficiently. Lead distribution platforms, consent verification systems, analytics frameworks, and compliance monitoring tools operate across markets with marginal additional cost. A diversified operation can amortize these investments across larger total volume than a specialist achieving the same volume in one vertical.

The diversified operator processing 50,000 leads monthly across five verticals pays essentially the same platform costs as a specialist processing 50,000 leads in one vertical. But the diversified operator has five buyer relationship networks, five traffic expertise domains, and five market positions creating optionality. The infrastructure cost per lead is equivalent; the strategic positioning is superior.

This infrastructure leverage works only when the organization genuinely operates across verticals rather than fragmenting attention. The key distinction is shared infrastructure with specialized execution, not generic execution replicating across markets.

Buyer Relationship Leverage

Large lead buyers increasingly seek consolidated vendor relationships. Insurance carriers operating across auto, home, and life products prefer working with suppliers who can serve multiple needs rather than managing separate relationships for each vertical. Mortgage lenders expanding into personal loans and credit cards value partners with diversified traffic and expertise.

Multi-vertical operators can capture larger wallet share from existing buyer relationships. The insurance specialist selling only auto leads captures one purchasing budget. The multi-line operator selling auto, home, life, and health leads from the same buyer relationship captures four. Customer acquisition cost spreads across larger revenue.

This relationship leverage requires genuine capability rather than nominal presence. Buyers quickly identify suppliers attempting to expand beyond their competence. The leverage works when you execute well across verticals, not when you simply claim presence.

The Concentration Risk Framework

Because concentration risk represents the central trade-off in this strategic decision, it deserves detailed examination. The framework below helps quantify and manage concentration risk across your operation.

Measuring Concentration Risk

Track concentration across four dimensions simultaneously. For detailed guidance on managing buyer relationships, see our guide on buyer concentration risk.

Vertical concentration measures what percentage of your total lead volume and revenue comes from each industry category. Calculate monthly and trailing-twelve-month figures. If any single vertical exceeds 40% of volume, you face significant vertical concentration risk.

Buyer concentration measures what percentage of your total revenue comes from individual buyers. The standard guidance is no single buyer should exceed 25% of revenue, with conservative practitioners targeting 20%. This applies regardless of vertical strategy.

Traffic source concentration measures what percentage of your leads come from individual platforms or channels. If Facebook represents 60% of your acquisition, you are one algorithm change or account suspension away from losing majority of your business. No single platform should exceed 40% of volume.

Geographic concentration measures what percentage of your leads concentrate in specific states or regions. This matters especially in verticals with strong geographic economics like solar, home services, or real estate.

The Concentration Score

Combine these dimensions into a single concentration score for regular monitoring.

For each dimension, calculate the Herfindahl-Hirschman Index (HHI): sum the squares of each component’s percentage share. An operation where four verticals each contribute 25% of revenue has vertical HHI of 2,500 (25^2 x 4). An operation where one vertical contributes 70% and another contributes 30% has vertical HHI of 5,800 (70^2 + 30^2).

Lower scores indicate better diversification. Scores below 2,000 suggest healthy diversification. Scores above 4,000 indicate significant concentration risk requiring attention.

Calculate this score monthly for each dimension. Track the trend over time. When any dimension’s concentration increases, investigate whether that increase reflects deliberate strategy or drift that should be corrected.

Responding to High Concentration

When concentration metrics exceed safe thresholds, you have three response options.

Accept the concentration if it represents deliberate specialization strategy with understood risk. A solar lead specialist accepting 100% vertical concentration makes a conscious trade-off favoring margin optimization over risk diversification. This is valid strategy provided you maintain financial reserves sufficient to survive vertical contraction.

Reduce the concentration through diversification investment. Building capability in adjacent verticals, developing alternative traffic sources, or expanding buyer relationships reduces concentration over time. This requires resource allocation and timeline commitment. Diversification cannot happen instantly when crisis strikes.

Transfer the risk through business structure or financial instruments. Some operators maintain separate entities for different verticals to isolate liability. Others maintain larger financial reserves specifically sized for concentration risk. These approaches do not reduce probability of vertical disruption but limit damage when disruption occurs.

The Strategic Decision Framework

With economic cases and risk frameworks established, let us build the decision framework that matches your specific situation to the appropriate strategy.

Factor 1: Available Capital and Resources

Vertical specialization requires less capital to achieve competitive positioning than multi-vertical operations. Becoming expert in one vertical demands deep investment in that domain. Becoming competent in five verticals demands broad investment across all five.

If your capital is constrained (under $100,000 available): Specialization is likely your only viable path. Attempting multi-vertical operations with insufficient capital produces mediocre performance across markets. Focus resources on dominating one vertical, then expand from a position of strength.

If your capital is moderate ($100,000-$500,000): Either strategy is viable, but capital allocation becomes critical. Specialization means faster path to profitability with higher risk concentration. Diversification means longer path to profitability with lower risk concentration.

If your capital is substantial (over $500,000): Diversification becomes increasingly attractive because you can invest adequately in multiple verticals simultaneously. The risk reduction benefits compound at scale.

Factor 2: Existing Expertise and Relationships

Your starting position matters enormously. Entering a vertical where you have existing expertise and relationships provides structural advantage over entering as a complete outsider.

If you have deep expertise in one vertical: Specialization lets you monetize existing knowledge immediately. Your domain expertise translates into better traffic targeting, quality optimization, and buyer relationships from day one. Building equivalent expertise in additional verticals requires years of investment.

If you have broad exposure across verticals: Multi-vertical operations let you leverage existing relationships across markets. A broker who previously worked with buyers in insurance, mortgage, and home services has relationship capital to deploy across all three.

If you are entering without industry expertise: Neither strategy provides natural advantage. Consider starting as a specialist to build deep expertise in one area, then expanding once you have a foundation.

Factor 3: Market Cycle Position

The current position in your target vertical’s cycle affects strategy.

If your vertical is in expansion phase: Specialization captures maximum upside during favorable conditions. Insurance lead demand surging following carrier profitability improvements rewards focused investment. The specialist captures more gains than the diversified operator during expansion.

If your vertical is in contraction phase: Diversification provides resilience. Mortgage refinance lead volumes collapsed during 2022-2024 rate increases. Operators diversified into purchase mortgage, home equity, and adjacent verticals maintained revenue. Those specialized in refinance had no options.

If cycle position is uncertain: Diversification provides optionality. You maintain presence in multiple markets positioned to capture whichever cycle turns favorable first.

Factor 4: Risk Tolerance and Time Horizon

Personal risk tolerance and business time horizon influence optimal strategy.

If you have low risk tolerance: Diversification reduces volatility even if it sacrifices some margin. The multi-vertical operator experiences smoother revenue patterns because different verticals move through different cycles. This stability comes at the cost of maximum potential margin.

If you have high risk tolerance: Specialization offers higher potential returns with greater variance. You accept that your vertical might contract, betting that your specialized expertise creates sufficient advantage during favorable conditions to justify the risk.

If your time horizon is short (under 3 years): Specialization provides faster path to significant results. Building genuinely diversified operations requires time to develop expertise and relationships across markets.

If your time horizon is long (over 5 years): Diversification becomes more attractive because you have time to build genuine capability across verticals. The short-term margin sacrifice for long-term stability makes sense.

Factor 5: Competitive Dynamics

Your target market’s competitive structure affects which strategy creates advantage.

If your vertical has dominant specialists: Competing as a generalist against well-established specialists is difficult. They have deeper expertise, stronger relationships, and better economics. Either specialize to compete directly or choose a different vertical.

If your vertical has fragmented generalist competition: Specialization creates differentiation. When competitors spread attention across markets, your focused expertise becomes competitive advantage.

If you operate across multiple verticals with different competitive structures: Match your investment to competitive opportunity. Specialize where you can compete with specialists. Maintain generalist presence where specialists do not dominate.

The Hybrid Approach: Concentrated Diversification

The most successful lead generation operators often employ a hybrid strategy that captures benefits of both approaches: concentrated diversification.

Defining Concentrated Diversification

Concentrated diversification means operating across multiple verticals while maintaining disproportionate focus on your strongest positions. Rather than equal investment across all markets, you allocate resources based on competitive advantage and opportunity.

A concentrated diversification portfolio might look like:

- Primary vertical: 40% of volume, deep specialization, premium margins

- Secondary vertical: 25% of volume, strong capability, competitive margins

- Tertiary vertical: 20% of volume, solid presence, market-rate margins

- Emerging or testing verticals: 15% of volume, building capability

This structure captures specialization benefits in your primary vertical while maintaining diversification across the portfolio. Your best market receives enough focus to achieve specialist-level performance. Your diversification provides resilience when any single vertical contracts.

Vertical Adjacency Strategy

Concentrated diversification works best with adjacent verticals that share infrastructure, expertise, or buyer relationships.

Insurance adjacencies might include auto, home, life, and health products. Traffic targeting overlaps (homeowners, vehicle owners). Buyer relationships overlap (carriers and agents sell multiple products). Compliance infrastructure overlaps (TCPA and state insurance regulations apply across products). An insurance specialist can expand across products without building entirely new capabilities.

Financial services adjacencies might include mortgage, personal loans, home equity, and credit cards. Consumer intent overlaps (people seeking financing). Buyer relationships overlap (lenders offer multiple products). The mortgage specialist has natural expansion paths within financial services.

Home services adjacencies might include HVAC, roofing, plumbing, electrical, and general contracting. Geographic targeting is identical. Buyer relationships with home service platforms overlap. The home services operator builds on existing infrastructure when adding service categories.

Dangerous non-adjacencies would include combinations like insurance and legal leads, or mortgage and solar leads. These verticals share minimal infrastructure, expertise, or relationships. Expanding across non-adjacent verticals requires building entirely new capabilities, negating the efficiency benefits of diversification.

Implementation Timeline for Hybrid Strategy

Building a concentrated diversification strategy takes time. Rushing diversification before establishing strong primary vertical position creates weakness everywhere.

Year 1: Establish primary vertical dominance. Build deep expertise, strong buyer relationships, and optimized operations in one vertical. Achieve specialist-level margins before considering expansion.

Year 2: Add first adjacent vertical. Leverage existing infrastructure and relationships to enter adjacent market. Accept that the new vertical will underperform your primary vertical while capability develops. Allocate resources to build genuine expertise rather than nominal presence.

Year 3: Optimize portfolio balance. Evaluate which verticals deserve continued investment based on performance. Increase allocation to strong performers. Reduce or exit underperformers. Consider adding third vertical if resources support genuine capability development.

Year 4 and beyond: Continuous optimization. Rebalance portfolio as market conditions change. Enter emerging opportunities when positioned to compete effectively. Exit declining markets when competitive advantage erodes.

This timeline assumes adequate capital and resources. Operations with constrained resources should extend these phases. The key is sequencing investment to build genuine capability rather than spreading thin.

Vertical-Specific Considerations

The specialization versus diversification question plays differently across major lead generation verticals. Let us examine the strategic landscape in key markets.

Insurance Leads

The insurance vertical is large enough to support specialization strategies within sub-verticals. An auto insurance specialist can achieve substantial scale without diversifying into other products. The market supports multiple large players focused exclusively on auto.

However, product adjacencies are strong in insurance. Carriers buying auto leads often buy home leads. Agents writing policies across products seek bundled lead solutions. The infrastructure and compliance requirements overlap substantially across insurance products.

Strategic recommendation: Consider concentrated diversification within insurance products rather than diversifying outside insurance. An insurance-focused operator spanning auto, home, life, and Medicare can achieve both specialization benefits (deep insurance expertise) and diversification benefits (product mix resilience) without building capabilities in unrelated verticals.

The primary risk is carrier concentration. When major carriers adjust advertising spend simultaneously (as occurred during underwriting profitability challenges), all insurance products contract together. This correlation limits the diversification benefit within insurance.

Mortgage Leads

Mortgage is the most cyclical major lead generation vertical. Rate movements create 50% or greater swings in volume within relatively short timeframes. Refinance volume collapsed 70-80% during 2022-2024 rate increases.

Pure mortgage specialization exposes operators to severe cyclical risk. Even excellent mortgage specialists suffered during high-rate environments. The operational excellence that created margin advantage during favorable conditions provided no protection against market contraction.

Strategic recommendation: Product diversification within lending (purchase, refinance, home equity, personal loans) provides some protection, as different products have different rate sensitivities. But vertical diversification outside mortgage may be necessary for operators who cannot tolerate significant revenue volatility.

The counter-argument is that mortgage specialists with adequate financial reserves can survive cycles and capture disproportionate opportunity when conditions improve. Generalists lack the expertise to compete effectively when refinance volume surges during rate declines. The specialist who survives the downturn emerges stronger.

Solar Leads

Solar lead generation has strong geographic concentration, with California historically representing disproportionate share of quality lead volume. Policy changes like NEM 3.0 demonstrated the risk of geographic concentration within a specialized vertical.

The vertical also faces policy dependency risk from federal tax credits. With residential ITC ending after 2025, the market faces structural uncertainty that specialization amplifies.

Strategic recommendation: Geographic diversification within solar is essential. Texas, Florida, and Northeast markets now command attention alongside California. Consider adjacent vertical expansion into storage, commercial solar, or EV charging to diversify within the clean energy ecosystem.

Pure solar specialization carries substantial policy risk that operators should acknowledge explicitly. Financial reserves and contingency planning become critical for specialists choosing to accept this concentration.

Legal Leads

Legal lead generation commands the highest CPLs in the industry, with personal injury leads ranging from $100-500 or more. The high prices reflect high lifetime case values that justify substantial acquisition cost.

Mass tort campaigns create additional opportunity and risk. Individual litigations follow predictable lifecycles where volume and pricing evolve from emergence through maturity to decline. Operators concentrated in single mass tort campaigns face cliff risks when campaigns conclude.

Strategic recommendation: Diversification within legal across case types (personal injury, mass tort, family law, estate planning) reduces campaign concentration risk. The vertical expertise and compliance requirements are similar across legal categories, supporting concentrated diversification within legal rather than expansion outside the vertical.

The key risk is buyer concentration. Legal lead buyers are often sophisticated law firms with substantial purchasing power. Concentration in a few large buyers creates vulnerability even for operators diversified across case types.

Home Services

Home services represents a naturally diversified vertical encompassing HVAC, roofing, plumbing, electrical, pest control, and general contracting. Operators can achieve diversification benefits within the vertical by spanning service categories while maintaining home services focus.

Seasonality creates opportunity for portfolio management. HVAC peaks during summer heat waves. Roofing peaks following storm events. Pest control peaks during seasonal infestations. A diversified home services operator can shift resources across categories based on seasonal demand.

Strategic recommendation: Home services supports concentrated diversification within the vertical effectively. The geographic targeting overlaps completely. Buyer relationships with platforms like Angi and HomeAdvisor span service categories. Build genuine capability in multiple service categories while maintaining home services focus.

Practical Implementation Guidance

Strategic frameworks require practical implementation. The following guidance addresses common implementation challenges.

Building a New Vertical: Realistic Expectations

Expanding into a new vertical takes 12-18 months to reach competitive performance, regardless of your expertise in existing verticals. This timeline reflects the learning required for traffic optimization, quality calibration, and relationship development.

Month 1-3: Infrastructure development and initial testing. Build landing pages, configure routing, establish initial buyer relationships. Launch small-scale traffic to validate basic economics.

Month 4-6: Optimization and learning. Identify which traffic sources and creative approaches work in this vertical. Develop quality signals that predict buyer acceptance and conversion. Expect unit economics to be unfavorable during this phase.

Month 7-12: Scale and relationship development. Increase volume on validated traffic approaches. Build deeper buyer relationships based on demonstrated performance. Unit economics should approach profitability.

Month 13-18: Competitive performance. Achieve unit economics comparable to established players. Buyer relationships mature to provide stable demand. The vertical becomes a genuine contributor rather than an investment.

Budget for this timeline explicitly. Allocate resources knowing the new vertical will consume capital during the development phase. Attempting to shortcut the timeline by rushing scale before optimization typically destroys economics permanently.

Managing Resource Allocation Across Verticals

Diversified operations require explicit resource allocation frameworks. Without clear allocation, resources drift toward squeaky wheels rather than strategic priorities.

Budget allocation by vertical: Set explicit budgets for traffic acquisition, platform costs, and personnel time by vertical. Review allocations quarterly based on performance and strategic priority.

Personnel specialization: Even in diversified operations, individual team members should specialize. A traffic buyer responsible for insurance should focus on insurance, not split attention across five verticals. Diversification happens at the organizational level, not the individual level.

Capacity allocation during contraction: When one vertical contracts, explicitly decide whether to redirect resources to other verticals or reduce total capacity. Defaulting to equal cuts across verticals may preserve an underperforming market at the expense of strong performers.

Exit Criteria for Underperforming Verticals

Not every vertical expansion succeeds. Establish explicit exit criteria before entering new markets.

Timeline gates: If a vertical has not achieved break-even unit economics within 18 months, evaluate whether continued investment is warranted. Some verticals require longer development timelines, but most do not.

Competitive position assessment: If after significant investment you remain unable to achieve competitive cost per lead or quality metrics, the vertical may not be viable for your operation. Competitor advantages in expertise or relationships may not be surmountable.

Strategic fit review: Even profitable verticals may not warrant continued investment if they do not fit strategic direction. A solar vertical that generates positive margins but requires disproportionate management attention may be worth exiting to focus on more productive markets.

Exit decisions are emotionally difficult. The time and resources invested in a struggling vertical create attachment that clouds judgment. Establish exit criteria in advance when thinking is clear, then follow those criteria when the time comes.

Frequently Asked Questions

What is vertical specialization in lead generation?

Vertical specialization means focusing your lead generation operations on a single industry category such as insurance, mortgage, solar, or legal leads. Specialists build deep expertise in their chosen vertical, developing optimized traffic acquisition, quality processes, and buyer relationships specific to that market. Research indicates specialists achieve 20-40% margin improvement compared to generalist competitors operating in the same vertical, primarily through better traffic efficiency, lower return rates, and premium pricing from stronger buyer relationships.

What are multi-vertical lead generation operations?

Multi-vertical operations generate leads across multiple industry categories simultaneously. A multi-vertical operator might generate insurance, mortgage, and home services leads concurrently, maintaining separate traffic campaigns, landing pages, and buyer relationships for each vertical. This approach provides diversification against vertical-specific risks like regulatory changes, market cycles, or buyer consolidation, but requires building and maintaining expertise across multiple domains.

Which strategy generates higher profit margins?

Vertical specialization typically generates higher unit margins due to superior traffic optimization, quality processes, and buyer relationship leverage. Specialists often achieve 35-45% net margin compared to 15-25% for generalists in the same market. However, multi-vertical operations may generate higher total profit through larger scale across combined verticals and more stable revenue through diversification. The optimal strategy depends on your risk tolerance, available capital, and competitive position.

How much should I diversify across verticals?

Industry best practice suggests no single vertical should exceed 40% of your total lead volume, with conservative practitioners targeting 30% maximum. This concentration limit provides meaningful protection against vertical-specific disruptions while allowing sufficient focus to achieve competitive performance. The balance between concentration and diversification should reflect your financial reserves, risk tolerance, and competitive position in each vertical.

What is concentration risk in lead generation?

Concentration risk measures your vulnerability to disruptions in specific areas of your business. In lead generation, concentration risk includes vertical concentration (dependence on one industry), buyer concentration (dependence on a few large customers), traffic source concentration (dependence on specific platforms), and geographic concentration (dependence on specific regions). High concentration in any dimension creates vulnerability when that concentrated element experiences problems. Track concentration metrics monthly and maintain explicit limits on maximum concentration levels.

Should I start with one vertical or multiple?

Start with one vertical regardless of your long-term strategy. Building genuine capability in a single vertical before expanding provides essential learning about traffic economics, buyer relationships, and operational requirements. Attempting multi-vertical operations without first establishing a profitable foundation spreads resources too thin and typically produces mediocre performance across all markets. Once you achieve strong performance in your first vertical, consider expansion based on your strategic analysis of risk tolerance, capital availability, and market opportunities.

How do I choose which vertical to specialize in?

Evaluate verticals across five criteria: market size (larger markets accommodate more participants), regulatory complexity (higher complexity creates barriers that protect established operators), competition intensity (crowded markets have lower margins), margin potential (some verticals support structurally higher margins), and buyer accessibility (how easily you can establish purchasing relationships). Weight these factors against your existing expertise and relationships. Prior experience in an industry provides significant advantage over entering as a complete outsider.

When should a specialist consider diversifying?

Consider diversification when your primary vertical faces significant structural risk from regulatory changes, market cycle position, or competitive dynamics. Also consider diversification when you have achieved strong competitive position in your primary vertical and have capital available for expansion. Do not diversify in response to temporary challenges that specialization can address, and do not diversify before achieving strong performance in your primary market. The best time to diversify is during favorable conditions in your primary vertical, not during crisis.

What is concentrated diversification?

Concentrated diversification is a hybrid strategy that maintains deep specialization in your strongest vertical while building presence in adjacent markets for risk mitigation. A concentrated diversification portfolio might allocate 40% of volume to your primary vertical with specialist-level expertise, 25% to a strong secondary vertical, 20% to a solid tertiary vertical, and 15% to emerging opportunities. This approach captures specialization benefits in your core market while providing diversification protection against vertical-specific disruptions.

How long does it take to enter a new vertical successfully?

Expect 12-18 months to achieve competitive performance in a new vertical, regardless of your expertise in existing markets. The first 3 months involve infrastructure development and initial testing. Months 4-6 focus on optimization and learning what works. Months 7-12 involve scaling validated approaches and building buyer relationships. Months 13-18 bring performance to competitive levels. Budget for this timeline explicitly, understanding that the new vertical will consume capital during development before contributing profit.

Key Takeaways

-

Vertical specialization typically delivers 20-40% higher margins than generalist operations in the same market through better traffic efficiency, quality optimization, and buyer relationship leverage. Specialists achieve premium pricing and lower costs by developing deep domain expertise.

-

Multi-vertical operations provide essential protection against concentration risk that has killed more lead generation businesses than competitive pressure. When your primary vertical contracts due to regulatory changes, market cycles, or buyer consolidation, diversification provides revenue continuity.

-

The 30-40% rule establishes safe concentration limits. No single vertical should exceed 40% of your total lead volume for risk-tolerant operators, or 30% for conservative practitioners. This applies alongside buyer concentration limits (25% maximum per buyer) and traffic source concentration limits (40% maximum per platform).

-

Concentrated diversification offers the best of both strategies by maintaining specialist-level performance in your primary vertical while building adjacent vertical presence for risk mitigation. Allocate resources disproportionately to your strongest positions rather than spreading evenly.

-

Adjacent verticals with overlapping infrastructure, expertise, and buyer relationships enable efficient diversification. Insurance products share compliance infrastructure. Financial services products share buyer relationships. Home services categories share geographic targeting. Non-adjacent diversification requires building entirely new capabilities.

-

New vertical expansion requires 12-18 months to reach competitive performance regardless of existing expertise. Budget for this timeline explicitly and establish exit criteria before entering new markets. Not every expansion succeeds, and prompt exit from underperforming verticals preserves resources for better opportunities.

-

Your optimal strategy depends on capital, expertise, risk tolerance, and market position. Constrained capital favors specialization. Existing expertise favors building from strength. Low risk tolerance favors diversification. Strong competitive position supports expansion. Match your strategy to your specific circumstances rather than following generic best practices.

This analysis provides strategic framework for evaluating vertical specialization versus multi-vertical operations. Market conditions, regulations, and competitive dynamics change continuously. Verify current data and adapt frameworks to your specific circumstances before making strategic decisions.