How to apply the Boston Consulting Group’s growth-share matrix to lead generation verticals and product portfolios, optimizing resource allocation across stars, cash cows, question marks, and dogs.

Lead generation operators typically serve multiple verticals – insurance, mortgage, home services, legal – each with different growth trajectories, competitive dynamics, and capital requirements. Without systematic portfolio analysis, operators over-invest in declining verticals, under-invest in growth opportunities, and maintain positions that drain resources without strategic value.

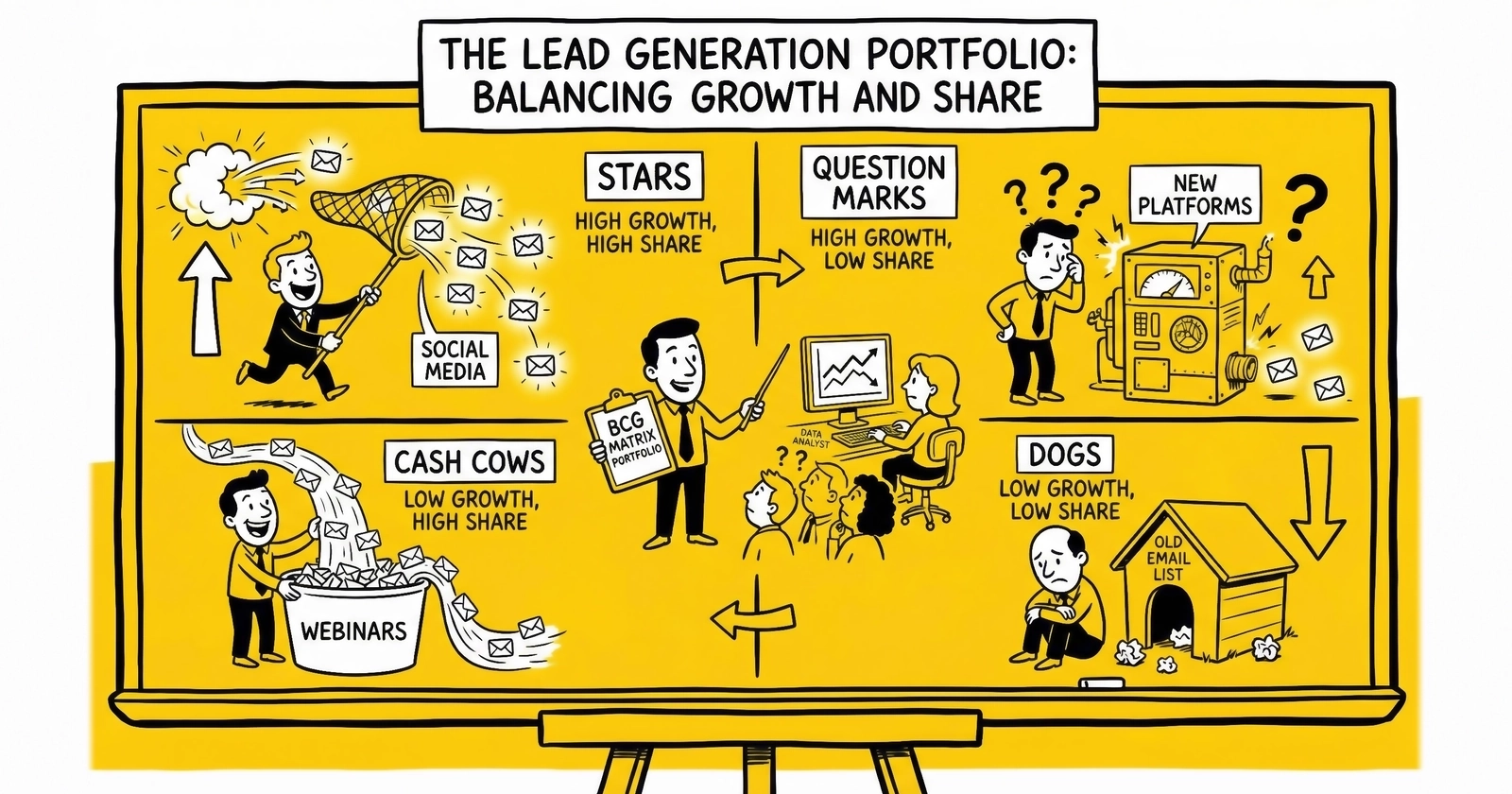

The Boston Consulting Group’s growth-share matrix, developed in 1970 by Bruce Henderson, provides a framework for portfolio analysis that applies directly to lead generation. By classifying verticals and product types according to market growth rate and relative market share, operators can make informed decisions about where to invest, where to harvest, and where to exit.

This analysis adapts the BCG matrix specifically for lead generation, examining how the framework applies to vertical portfolios, product type portfolios, and buyer segment portfolios. The goal is systematic resource allocation that maximizes long-term business value rather than reactive decision-making based on short-term metrics.

The BCG Matrix Framework

The BCG matrix classifies business units – or in lead generation, verticals and product types – into four quadrants based on two dimensions:

- Market Growth Rate (Vertical Axis): How fast is the overall market growing? High-growth markets require investment to capture share; low-growth markets generate cash with minimal investment.

- Relative Market Share (Horizontal Axis): What is your position relative to competitors? High share suggests competitive advantage and economies of scale; low share suggests vulnerability and higher costs.

The four quadrants that emerge:

Stars (High Growth, High Share)

Stars operate in fast-growing markets where you hold strong competitive position. They generate significant revenue but require continuous investment to maintain share as the market expands.

Characteristics:

- High revenue growth

- Significant investment requirements

- Competitive pressure from others seeking share

- Potential to become cash cows as growth slows

Strategy: Invest to maintain or expand position. Stars represent future cash generation if share is protected during the growth phase.

Cash Cows (Low Growth, High Share)

Cash cows operate in mature markets where you hold dominant position. Growth has slowed, but strong share generates steady cash flow with minimal investment requirements.

Characteristics:

- Stable, predictable revenue

- Low investment requirements

- High profit margins

- Vulnerable to disruption if market shifts

Strategy: Harvest cash flow to fund stars and question marks. Maintain position but don’t over-invest in growth that won’t materialize.

Question Marks (High Growth, Low Share)

Question marks operate in fast-growing markets where you hold weak position. The market opportunity is attractive, but capturing share requires significant investment with uncertain outcomes.

Characteristics:

- High growth potential

- Weak competitive position

- Significant investment required to compete

- Binary outcome: become stars or exit

Strategy: Selective investment in question marks with strongest potential. Not all question marks can become stars; choosing which to fund is the critical decision.

Dogs (Low Growth, Low Share)

Dogs operate in mature markets where you hold weak position. Neither growth nor competitive advantage suggests future value creation.

Characteristics:

- Limited growth potential

- Weak competitive position

- Cash neutral or negative

- Divert management attention from valuable opportunities

Strategy: Divest or minimize investment. Dogs rarely become valuable; resources devoted to dogs come at the cost of more promising opportunities.

Applying the Matrix to Lead Generation Verticals

Lead generation operators can map their vertical portfolio onto the BCG matrix by assessing market growth and competitive position for each vertical they serve.

Assessing Market Growth Rate

Market growth rate for lead generation verticals depends on:

- Buyer Demand Trends: Is buyer demand for leads in this vertical increasing, stable, or declining? Factors include industry growth, marketing budget shifts, and competitive channel dynamics.

- Lead Supply Dynamics: How is lead supply evolving? Traffic source availability, regulatory changes, and cost trends affect overall market size.

- Technology Impact: Is technology expanding or contracting the market? AI and automation may grow some verticals while commoditizing others.

- Regulatory Environment: Are regulations expanding or constraining the market? Compliance requirements affect market accessibility.

Example Growth Assessment:

| Vertical | Growth Indicators | Growth Rate |

|---|---|---|

| Solar | Federal incentives, climate awareness, declining installation costs | High (15-20%) |

| Medicare Supplement | Aging population, AEP/OEP activity, carrier expansion | Moderate-High (8-12%) |

| Auto Insurance | Market maturation, rate stabilization | Low (2-4%) |

| Traditional Mortgage | Rate sensitivity, refinance decline | Low-Negative (-5% to 2%) |

| Mass Tort | Case-specific, highly volatile | Variable (depends on active cases) |

Assessing Relative Market Share

Relative market share in lead generation reflects competitive position:

- Volume Share: What percentage of leads in this vertical do you generate or distribute?

- Buyer Relationships: How strong are your relationships with major buyers relative to competitors? Understanding how the lead economy works helps assess competitive dynamics.

- Quality Position: How does your lead quality compare to competitive alternatives?

- Pricing Power: Can you command premium pricing, or are you forced to compete on price?

- Operational Advantage: Do you have cost, technology, or process advantages that competitors can’t easily replicate?

Example Share Assessment:

| Operator Position | Share Indicators | Relative Share |

|---|---|---|

| Vertical leader | Major buyer relationships, quality premium, volume concentration | High (>1.5x next competitor) |

| Strong competitor | Established position, competitive quality, some buyer preference | Medium-High (0.8-1.5x) |

| Emerging player | Limited buyer relationships, competitive quality | Medium-Low (0.4-0.8x) |

| Marginal player | Few buyers, quality concerns, price competition | Low (<0.4x) |

Portfolio Mapping Example

Consider a hypothetical multi-vertical operator:

Stars (High Growth, High Share):

- Solar leads: Strong market growth, established buyer relationships, quality reputation

- Strategy: Invest in traffic expansion, buyer development, technology improvement

Cash Cows (Low Growth, High Share):

- Auto insurance: Mature market, dominant buyer relationships, efficient operations

- Strategy: Harvest cash flow, maintain operations, fund growth elsewhere

Question Marks (High Growth, Low Share):

- Medicare Supplement: Growing market, weak position relative to established competitors

- Strategy: Evaluate investment required to achieve competitive position; invest or exit

Dogs (Low Growth, Low Share):

- Traditional mortgage refinance: Declining market, weak competitive position

- Strategy: Exit or minimize; redirect resources to higher-value opportunities

Applying the Matrix to Lead Product Types

Beyond verticals, the BCG matrix applies to lead product portfolios – different lead types within verticals.

Product Type Classification

Common lead product types include:

- Exclusive vs. Shared Leads: Different economics, buyer preferences, and growth trajectories (see lead vs. prospect terminology for clarity on these distinctions)

- Form Leads vs. Call Leads vs. Live Transfers: Different delivery mechanisms with different market positions

- Real-Time vs. Aged Leads: Different pricing, buyer segments, and operational requirements

- Intent Levels: High-intent vs. low-intent leads with different conversion economics

Product Portfolio Analysis

Example Product Matrix:

Stars: Live transfers in growing verticals

- High growth as buyers seek better contact rates

- Strong position if you have call center capability

- Requires continued investment in agent quality and technology

Cash Cows: Exclusive form leads in mature verticals

- Stable demand from established buyer relationships

- Premium pricing with efficient fulfillment

- Generates cash to fund other initiatives

Question Marks: AI-qualified leads

- Emerging category with high potential

- Current position requires capability building

- Investment decision: build AI qualification capability or cede market

Dogs: Low-intent shared leads

- Commoditized, price-competitive market

- Weak differentiation from competitors

- Consider exit to focus on higher-value products

Strategic Implications by Quadrant

Each quadrant implies different strategic actions for lead generation operators.

Star Strategy: Invest to Dominate

Stars represent the most valuable opportunities – high-growth markets where competitive position provides advantage. Strategic priorities:

- Invest in Traffic: Expand traffic acquisition to capture growing demand. Stars justify higher CPL targets because market growth creates opportunity.

- Deepen Buyer Relationships: Lock in major buyers with service quality, integration depth, and favorable terms. Buyer relationships built during growth become valuable as markets mature.

- Invest in Technology: Build capabilities that reinforce competitive advantage – better scoring, faster delivery, superior compliance documentation.

- Defend Against Competition: Growing markets attract competitors. Invest in differentiation that makes competitive attack difficult.

- Accept Lower Margins: Stars may generate lower margins during investment phase. Prioritize share over profit during growth; margins improve as market matures and investments amortize. Calculating true ROI helps justify these short-term tradeoffs.

Cash Cow Strategy: Harvest and Protect

Cash cows fund the portfolio. They don’t need growth investment, but they do need protection. Strategic priorities:

- Optimize Efficiency: Maximize margin through operational efficiency. Cash cows should generate cash, not consume it.

- Maintain Quality: Don’t cut quality to improve margins. Quality degradation invites competitive attack and damages buyer relationships.

- Protect Buyer Relationships: Existing buyer relationships are the cash cow’s primary asset. Invest in relationship maintenance even if not in growth.

- Monitor Disruption: Mature markets face disruption risk. Monitor technology shifts, regulatory changes, and competitive innovations that could destabilize position.

- Resist Over-Investment: Cash cows don’t need aggressive investment. Resources beyond maintenance should flow to stars and selected question marks.

Question Mark Strategy: Choose and Commit

Question marks require the hardest decisions: which to invest in, which to abandon. Strategic priorities:

- Assess Achievability: Can you realistically achieve competitive position? Some question marks face structural barriers – established competitors with cost advantages, buyer loyalty, or regulatory protection.

- Calculate Investment Requirements: What would it cost to become a star? Question marks with realistic paths to leadership justify investment; those requiring unrealistic resources should be exited.

- Set Decision Timelines: Question marks shouldn’t remain question marks indefinitely. Set deadlines for achieving milestones that indicate star potential.

- Concentrate Resources: Investing equally across multiple question marks dilutes resources and achieves nothing. Pick winners and commit fully.

- Accept Failure: Some question mark investments will fail. Accept this reality and exit quickly when evidence indicates the path to star status is blocked.

Dog Strategy: Exit or Minimize

Dogs consume resources without generating strategic value. Strategic priorities:

- Evaluate Exit Options: Can the vertical or product be sold? Some dogs have value to operators with different positions or capabilities.

- Minimize Investment: If exit isn’t practical, minimize resource consumption. Don’t invest in improvement; accept current position and extract whatever value remains.

- Manage Wind-Down: If exiting, manage buyer and team transitions professionally. Abrupt exits damage reputation and relationships.

- Avoid Sentiment Traps: Dogs often represent legacy businesses with emotional attachment. Make decisions based on strategic reality, not history.

- Redirect Resources: Every dollar and hour devoted to dogs is unavailable for stars and question marks. Exit dogs to fund opportunities.

Portfolio Balance Considerations

Beyond individual quadrant strategies, portfolio balance matters for sustainable operations.

Cash Flow Balance

A healthy portfolio balances cash generation and cash consumption:

- Cash cows generate cash to fund investment

- Stars consume cash during growth but become future cash cows

- Question marks require selective cash investment

- Dogs should neither consume nor generate significant cash

Portfolios dominated by stars and question marks without cash cows face funding pressure. Portfolios dominated by cash cows without stars face future revenue decline.

Risk Diversification

Portfolio composition affects business risk:

- Vertical Concentration: Heavy concentration in single verticals creates exposure to vertical-specific risks (regulatory changes, market shifts, buyer consolidation).

- Growth Stage Distribution: Portfolios weighted toward early-stage or mature-stage assets face different risk profiles.

- Product Type Balance: Diversification across product types (form, call, transfer) reduces dependence on single delivery mechanisms.

Resource Allocation Discipline

The matrix framework disciplines resource allocation:

- Stars get growth investment proportional to opportunity size and competitive position.

- Cash cows get maintenance investment sufficient to protect position without excess.

- Selected question marks get strategic investment with clear milestones and accountability.

- Dogs get minimal investment pending exit or harvest.

Violating this discipline – over-investing in dogs, under-investing in stars, spraying resources across question marks – destroys portfolio value.

Limitations and Adaptations

The BCG matrix has known limitations that lead generation operators should consider.

Market Share Limitations

Relative market share is difficult to measure precisely in lead generation. Unlike consumer products with market data, lead generation lacks reliable industry-wide volume figures. Operators must estimate competitive position based on:

- Buyer feedback about competitive alternatives

- Industry relationships and intelligence

- Observable competitor activity

- Market sizing estimates with significant uncertainty

Accept that share assessment involves judgment, not precise measurement.

Growth Rate Volatility

Lead generation verticals experience growth rate volatility that the matrix assumes is stable:

- Mortgage lead demand swings dramatically with rate changes

- Legal leads spike and collapse with mass tort cases

- Seasonal patterns create apparent growth and decline

Assess growth based on underlying trends rather than short-term fluctuations.

Competitive Dynamics Complexity

The matrix assumes competitive dynamics are captured in market share, but lead generation involves:

- Buyer relationship stickiness beyond market position

- Vertical-specific expertise that doesn’t transfer

- Regulatory knowledge as competitive advantage

- Technology capabilities that enable or constrain position

Consider factors beyond simple share measurement when assessing competitive position.

Quadrant Boundaries

The matrix implies distinct quadrants, but real positions fall along continuous dimensions. A vertical that’s neither clearly high-growth nor low-growth, neither clearly high-share nor low-share, requires judgment rather than mechanical classification.

Use the framework for strategic thinking, not rigid categorization.

Implementing Portfolio Analysis

Effective portfolio analysis requires systematic process:

Annual Portfolio Review

Conduct comprehensive portfolio review annually:

- Update growth assessments for each vertical

- Reassess competitive position based on recent performance

- Reclassify verticals and products as positions change

- Evaluate resource allocation against matrix implications

- Adjust strategy and investment based on review findings

Quarterly Monitoring

Monitor portfolio health quarterly:

- Track growth rate trends in star and question mark verticals

- Monitor competitive indicators for cash cows

- Assess question mark progress against milestones

- Confirm dog minimization is proceeding

Investment Decision Framework

Apply matrix logic to investment decisions:

- New vertical entry: Is this a question mark worth pursuing?

- Expansion investment: Does star status justify the capital?

- Maintenance investment: Is cash cow position secure?

- Exit decision: Has dog status been confirmed?

Performance Metrics by Quadrant

Different metrics matter for different quadrants:

Stars: Market share growth, buyer acquisition, competitive position Cash Cows: Margin optimization, retention rates, efficiency improvement – tracking the right KPIs for each quadrant is essential Question Marks: Milestone achievement, competitive gap closure, investment efficiency Dogs: Resource minimization, exit progress, wind-down management

Transition Strategies: Managing Quadrant Movement

Verticals and products don’t remain static in their quadrants. Understanding how positions evolve – and how to manage transitions – enables proactive portfolio management.

Star to Cash Cow Transition

The ideal trajectory: stars mature into cash cows as market growth slows and dominant position generates stable cash flow.

Managing the Transition:

- Recognize growth deceleration signals early

- Shift from share acquisition to position defense

- Reduce growth investment proportionally to growth rate decline

- Optimize operations for efficiency as volume stabilizes

- Protect buyer relationships that provide stable revenue

Warning Signs of Premature Harvest:

- Cutting star investment while growth continues

- Reducing marketing while competitors still acquire share

- Focusing on margins before position is secure

- Underestimating competitor ambition in growing market

Common Timing Mistake: Treating stars like cash cows prematurely – harvesting before position is secure. The short-term margin improvement from reduced investment can cost long-term position if competitors capture share during ongoing growth.

Question Mark to Star (Success Path)

Successful question marks become stars through focused investment that establishes competitive position.

Success Requirements:

- Clear competitive strategy that creates differentiation

- Sufficient investment to overcome incumbent advantages

- Execution capability to deliver on strategic plan

- Market timing that allows position establishment

- Buyer acquisition that builds sustainable relationships

Progress Indicators:

- Market share growth outpacing market growth

- Buyer relationship quality improving

- Unit economics improving toward profitability

- Competitive responses indicating threat recognition

- Ecosystem development (integrations, partnerships)

Timeline Expectations: Question mark to star transitions typically require 12-24 months of sustained investment with measurable milestone achievement.

Question Mark to Dog (Failure Path)

Not all question marks succeed. Recognizing failure early enables resource preservation.

Failure Indicators:

- Market share stagnant despite investment

- Competitive gap not closing

- Unit economics not improving

- Investment requirements exceeding projections

- Market dynamics shifting unfavorably

Exit Decision Triggers:

- Missed milestones without clear recovery path

- Investment required for star status exceeds reasonable bounds

- Competitive position becomes structurally disadvantaged

- Market growth decelerates before share is achieved

Exit Management: Once exit decision is made, execute quickly. Prolonged exits waste resources and damage relationships. Transfer buyers to alternatives, reassign staff, and redirect resources to productive opportunities.

Cash Cow to Dog Transition

Cash cows decline when market position erodes or market dynamics shift fundamentally.

Decline Drivers:

- Disruptive technology changing market dynamics

- Regulatory changes affecting competitive position

- Buyer consolidation reducing customer base

- New competitors with structural advantages

- Market contraction from external factors

Defense Strategies:

- Invest in disruption response when viable

- Develop transition plans for gradual decline

- Harvest more aggressively if decline is inevitable

- Prepare alternative positions in adjacent markets

Managed Decline: When cash cow decline is inevitable, manage the transition to preserve value. Accelerate cash harvest, reduce costs proportionally to revenue decline, and plan buyer transitions rather than abandoning relationships abruptly.

Dog to Exit

Dogs should move toward exit, not attempt transformation into other quadrants.

Exit Options:

- Sale: Divest to operator with different position or capabilities who may find value you can’t realize

- Partnership: Transfer operations to partner who can serve your buyers while you exit operational commitment

- Harvest and Close: Maximize remaining value extraction, then close operations cleanly

- Merger: Combine with competitor dog to create combined position with better economics

Exit Execution:

- Communicate clearly with affected buyers

- Manage staff transitions professionally

- Document lessons learned for future portfolio decisions

- Redirect resources promptly to productive opportunities

Case Patterns: Portfolio Strategy in Practice

Understanding how operators have applied portfolio analysis provides practical insight.

The Over-Invested Dog Pattern

A multi-vertical operator continued investing in traditional mortgage refinance leads despite declining market and weak competitive position.

Situation: Mortgage refinance volume collapsed as interest rates rose. The operator’s position – a mid-tier competitor with moderate buyer relationships – provided no structural advantage. Yet leadership continued investment hoping for market recovery.

Analysis Failure: The vertical was clearly a dog (low growth, low share), but emotional attachment to historical success and hope for rate cycle reversal drove continued investment. Resources devoted to mortgage came at the expense of growing solar and home services verticals.

Outcome: After 18 months of losses, the operator finally exited mortgage. The delay cost significant resources that could have funded star development elsewhere. Staff and buyer relationships were damaged by the extended decline.

Lesson: Dog classification requires honest assessment, not hopeful interpretation. Exit decisions delayed by hope rarely prove wise in retrospect.

The Unfunded Star Pattern

An operator with strong position in a growing vertical failed to invest proportionally, losing share to more aggressive competitors.

Situation: The operator held leading position in solar lead generation as the market grew rapidly. However, leadership prioritized margin over share, reducing marketing investment to improve short-term profitability.

Analysis Failure: Solar was clearly a star requiring investment. The decision to harvest star-like returns before position was secure allowed competitors to close the gap. As market growth continued, the operator’s relative share declined.

Outcome: Within two years, the operator lost market leadership to a competitor who invested aggressively during the growth phase. The margin “saved” through under-investment was dwarfed by the value lost through competitive position erosion.

Lesson: Stars require investment proportional to growth opportunity. Premature harvest sacrifices long-term position for short-term margin.

The Selective Question Mark Pattern

An operator facing multiple question mark opportunities made disciplined choices about which to fund.

Situation: The operator identified opportunities in Medicare leads, legal leads, and education leads – all high-growth markets where they lacked competitive position. Resources were insufficient to pursue all three aggressively.

Analysis Approach: Leadership evaluated each question mark against explicit criteria: path to competitive position (how could they win?), investment requirements (what would it cost?), competitive dynamics (who were they fighting?), and strategic fit (did it leverage existing capabilities?).

Decision: Medicare won based on existing insurance buyer relationships that could expand into Medicare, realistic investment requirements, and fragmented competitive landscape. Legal and education were abandoned – legal because competition was too strong, education because investment requirements exceeded available resources.

Outcome: Concentrated investment in Medicare achieved star position within 18 months. The underfunded alternatives were exited cleanly. Resources freed from abandoned question marks funded the Medicare push.

Lesson: Question mark selection requires discipline. Investing partially across multiple question marks achieves nothing; concentrated bets on the most promising opportunities create stars.

The Portfolio Rebalancing Pattern

An operator recognized portfolio imbalance and restructured over 24 months.

Initial Portfolio: Three cash cows (auto, home, and life insurance) generating stable cash but requiring no investment. Zero stars to drive future growth. Two dogs consuming management attention. Two question marks receiving inadequate investment.

Rebalancing Strategy:

- Exit both dogs immediately to free resources and attention

- Identify which question mark had better star potential

- Concentrate resources on the selected question mark

- Continue harvesting cash cows without over-investment

- Develop pipeline for next question mark opportunities

Execution:

- Dogs exited within 90 days (transferred buyers to partners)

- Question mark selection made through rigorous analysis (chose home services over legal)

- 70% of freed resources directed to home services development

- Cash cow operations maintained with efficiency focus

- Market scanning for next opportunities continued

Outcome: Within 24 months, home services reached star status. Dogs were eliminated. Cash cows continued generating funds. Portfolio health transformed from vulnerable (cash cows without stars) to sustainable (stars funded by cash cows).

Lesson: Portfolio rebalancing requires comprehensive action across all quadrants simultaneously. Partial measures – fixing dogs without funding stars, or funding question marks without exiting dogs – fail to achieve transformation.

Advanced Portfolio Considerations

Beyond basic quadrant analysis, sophisticated portfolio management considers additional factors.

Vertical Correlation

Portfolio risk depends on correlation between verticals:

- Positively Correlated Verticals: Real estate-related verticals (mortgage, home services, real estate leads) tend to move together with housing market cycles. Portfolio concentrated in correlated verticals faces amplified cycle risk.

- Negatively Correlated Verticals: Some verticals move opposite to others. Legal leads (especially personal injury) may perform well during economic stress when insurance and mortgage leads decline.

- Uncorrelated Verticals: Verticals with independent drivers (solar responding to energy policy, Medicare responding to demographics) provide diversification benefits.

Portfolio Implication: Balance portfolio across correlation profiles to reduce aggregate risk. Don’t interpret current quadrant position without considering how positions might shift together under changing conditions.

Buyer Relationship Leverage

Some verticals provide strategic value beyond their individual economics:

- Cross-Vertical Relationships: Position in one vertical may enable entry into related verticals through existing buyer relationships. An insurance lead operator with strong carrier relationships can leverage those relationships into Medicare, even if Medicare is otherwise a question mark.

- Platform Effects: Buyers who consolidate purchasing across verticals prefer vendors who can serve multiple needs. Position in one vertical may strengthen position in others through buyer convenience.

Portfolio Implication: Quadrant analysis should consider relationship leverage. A dog that provides access to a star may have strategic value beyond its individual economics.

Competitive Dynamics Across Portfolio

Portfolio composition affects competitive dynamics:

- Market Signaling: Aggressive investment in question marks signals competitive intent. Competitors may respond defensively, raising investment requirements.

- Resource Competition: Resources committed to one quadrant are unavailable for others. Competitors may exploit your concentration by attacking positions where you’ve reduced investment.

- Talent Allocation: Staff assigned to dogs or declining cash cows may be better deployed in stars or question marks. Portfolio rebalancing requires talent reallocation.

Portfolio Implication: Consider competitive response to portfolio moves. Strategic actions rarely go unnoticed; anticipate competitor reactions when planning portfolio shifts.

Key Takeaways

-

The BCG growth-share matrix classifies verticals and products into four quadrants – stars, cash cows, question marks, and dogs – based on market growth rate and relative competitive position, enabling systematic portfolio analysis.

-

Stars (high growth, high share) represent the most valuable opportunities and justify aggressive investment in traffic expansion, buyer relationships, technology, and competitive defense – even at the cost of short-term margins.

-

Cash cows (low growth, high share) fund the portfolio and should be optimized for efficiency and protected against disruption, but should not receive growth investment that mature markets won’t reward.

-

Question marks (high growth, low share) require the hardest decisions: assess achievability of competitive position, calculate investment requirements, set decision timelines, concentrate resources on chosen opportunities, and accept that some investments will fail.

-

Dogs (low growth, low share) should be exited or minimized because resources devoted to dogs come at the cost of more promising opportunities – avoid sentiment traps that perpetuate investment in strategically worthless positions.

-

Portfolio balance matters for sustainable operations: cash cows must generate funds to invest in stars and question marks; portfolios dominated by either consumption or generation face distinct strategic challenges.

-

Market share in lead generation is difficult to measure precisely, requiring estimation based on buyer feedback, industry intelligence, and observable competitor activity rather than reliable industry-wide data.

-

Growth rate volatility – mortgage with rate changes, legal with mass tort cycles – requires trend-based assessment rather than short-term fluctuation analysis when classifying verticals.

-

Annual portfolio review should update growth assessments, reassess competitive positions, reclassify verticals, evaluate resource allocation, and adjust strategy based on matrix implications.

-

Different metrics matter for different quadrants: stars measure share growth, cash cows measure margin efficiency, question marks measure milestone achievement, and dogs measure resource minimization.

Frequently Asked Questions

How do I measure relative market share in lead generation without industry data?

Precise share measurement is impossible in lead generation’s fragmented market. Use proxies: buyer conversations about competitive alternatives (how often are you evaluated against specific competitors?), buyer volume distribution (what percentage of a major buyer’s leads do you supply?), industry relationships (how do you rank in platform provider or network reports?), and competitive intelligence (observable indicators of competitor scale and activity). Accept that share assessment involves informed judgment rather than precise measurement. The framework remains valuable even with imprecise inputs – the strategic thinking matters more than mathematical precision.

What growth rate threshold separates high-growth from low-growth markets?

Traditional BCG guidance suggests using industry average growth as the threshold – verticals growing faster than average are high-growth; those growing slower are low-growth. For lead generation, consider both absolute and relative perspectives. In current market conditions, verticals growing above 8-10% annually typically qualify as high-growth; those below 3-5% qualify as low-growth. Verticals in the middle require judgment about trajectory and competitive dynamics. Don’t agonize over precise classification; the framework informs strategic thinking even when boundaries are fuzzy.

Should I ever invest in a dog?

Generally no. Investment in dogs diverts resources from more promising opportunities. However, limited exceptions exist: if a dog is strategically connected to a star (buyer relationships that span verticals, operational synergies), minimal investment to maintain connection may be justified. If a dog faces temporary conditions that will reverse (regulatory change being reversed, market cycle recovering), holding position may make sense. If exit costs exceed continued operation costs, minimized operation may be preferable to active exit. These exceptions should be rare and specifically justified; the default dog strategy is exit or minimize.

How often should I reconsider question mark investments?

Question marks should have explicit milestones and timelines – typically 12-18 month evaluation cycles. At each milestone, assess: Are we progressing toward star status? Is the path to competitive position becoming clearer or murkier? Have investment requirements exceeded expectations? Has the market opportunity changed? Continue investment only if evidence supports eventual star status; exit if evidence suggests the path is blocked. Avoid indefinite question mark status – the whole point is forcing decisions rather than perpetual marginal investment.

How does the matrix apply to single-vertical operators?

Single-vertical operators can apply the matrix to product types within their vertical (exclusive vs. shared leads, form vs. call vs. transfer, real-time vs. aged) or buyer segments (enterprise vs. SMB, direct vs. marketplace). The same logic applies: classify products or segments by growth and competitive position, then allocate resources accordingly. Single-vertical focus limits portfolio diversification benefits but simplifies analysis and enables deeper vertical specialization that supports competitive position.

How do I balance short-term margin pressure with star investment requirements?

The tension between short-term margin and star investment is real but manageable. First, ensure cash cows are efficiently harvested – maximum margin extraction funds star investment without sacrificing overall profitability. Second, set explicit investment budgets for stars that treat growth investment as strategic rather than discretionary. Third, communicate the strategy to stakeholders – investors and management who understand the portfolio logic will accept temporary margin compression for long-term position building. Fourth, track star investment against competitive results – if investment isn’t producing share gains, reconsider the approach rather than simply increasing spend. The goal is disciplined investment that builds position, not unlimited spending that destroys margin without competitive effect.

What if my star vertical faces regulatory threat?

Regulatory risk doesn’t eliminate star status but does affect strategy. If regulations create uncertainty, hedge by: maintaining capability in adjacent verticals that could absorb resources if the star is disrupted, building compliance infrastructure that positions you well regardless of regulatory outcome, and avoiding investments that assume regulatory status quo. Don’t abandon star investment based on potential threats; do prepare contingency options. Monitor regulatory developments closely and be prepared to reclassify if regulations materially change market growth or competitive dynamics.

How do I convince stakeholders to exit a dog vertical?

Present evidence systematically: market growth data (or decline), competitive position assessment, margin analysis, resource consumption relative to returns, and opportunity cost of maintaining the dog. Compare dog investment to potential returns from redirecting resources to stars or question marks. Address emotional attachments by acknowledging historical value while emphasizing current strategic reality. Propose managed wind-down rather than abrupt exit to reduce disruption. If stakeholders resist evidence-based analysis, the issue may be governance rather than strategy – decisions about resource allocation require clear decision rights.

Sources

- Bruce Henderson. “The Product Portfolio.” Boston Consulting Group Perspectives, 1970.

- Boston Consulting Group. “The Growth Share Matrix.” https://www.bcg.com/about/overview/our-history/growth-share-matrix

- Michael Porter. “Competitive Strategy: Techniques for Analyzing Industries and Competitors.” Free Press.

- Philip Kotler. “Marketing Management.” Pearson Education.

- Boston Consulting Group. “BCG Classics Revisited: The Growth Share Matrix.” https://www.bcg.com/publications/2014/growth-share-matrix-bcg-classics-revisited

- McKinsey & Company. “Strategy & Corporate Finance Practice.” https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/how-we-help-clients