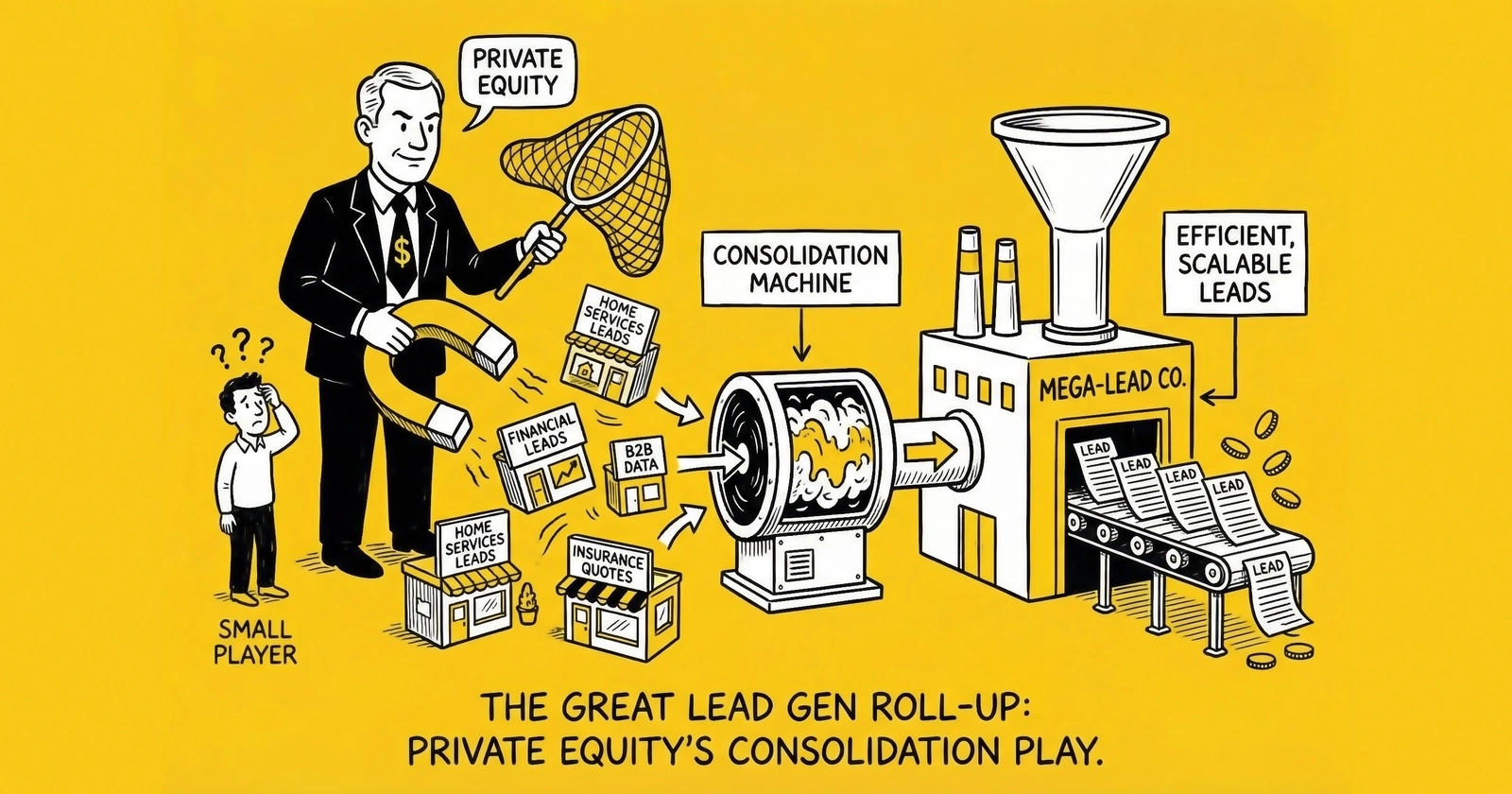

Why PE firms are aggressively acquiring lead generation companies, what this means for operators at every tier, and how to position your business in a consolidating market.

The lead generation industry has entered a transformative period. Private equity capital is reshaping the competitive landscape through aggressive acquisition, creating both existential threats and unprecedented opportunities for operators across the ecosystem. Understanding these dynamics is no longer optional for anyone building a lead generation business – it is fundamental to strategic planning.

The transformation has accelerated beyond what most observers anticipated. Over 100 M&A transactions since 2016 have fundamentally altered the industry structure. MediaAlpha and EverQuote emerged as public company winners in insurance. LendingTree consolidated mortgage comparison. ANGI Homeservices rolled up home services platforms. The pattern is unmistakable: capital concentration accelerates, scale advantages compound, and operators without strategic positioning face margin compression or acquisition at unfavorable terms.

This article provides an operator-level analysis of private equity activity in lead generation. You will understand why PE finds this industry attractive, how consolidation affects each tier of the ecosystem, what valuation multiples actually look like, and how to position your business whether you want to grow, sell, or simply survive the transformation.

Why Private Equity Targets Lead Generation

Private equity firms evaluate investments through a specific lens: cash flow predictability, growth potential, operational improvement opportunity, and exit viability. Lead generation businesses, when structured properly, satisfy all four criteria.

Recurring Revenue Characteristics

While lead generation isn’t subscription software with 95% gross retention, the economics create revenue patterns that PE finds attractive. Buyers need leads consistently. Publishers develop traffic sources that generate volume predictably. Brokers build buyer relationships that renew month after month.

A well-run lead operation might see 70-80% of its monthly revenue come from relationships established in prior periods. This isn’t SaaS-level predictability, but it’s far more consistent than project-based businesses or one-time transaction models. PE firms applying discounted cash flow analysis can model future revenue with reasonable confidence.

High Cash Flow Margins

Lead generation businesses, particularly those operating as brokers or technology platforms, can generate substantial EBITDA margins. Distribution platforms like boberdoo and LeadsPedia charge subscription fees plus per-transaction revenue, creating operating leverage as volume scales. Brokers operating at sufficient volume typically achieve 15-18% net margins after accounting for returns, float costs, and operational overhead.

Compare this to many digital marketing agencies operating at 8-12% net margins, and the PE interest becomes clear. A $10 million revenue lead business might generate $1.5-2 million in EBITDA. Apply a 6-8x multiple, and you have a $9-16 million enterprise value from a business that required relatively modest capital to build.

Technology Leverage Potential

PE firms see technology as a primary value creation lever. Many lead generation businesses operate with manual processes, spreadsheet-based reconciliation, and limited automation. The playbook is straightforward: acquire, implement technology infrastructure, reduce operational costs, improve margins, and exit at a higher multiple.

A broker managing 50,000 leads monthly through email and manual data entry represents significant optimization opportunity. Implementing proper distribution technology might reduce labor costs by 40-60% while improving lead routing precision and reducing returns. This operational improvement directly flows to EBITDA.

Fragmented Market Structure

The lead generation industry remains highly fragmented. While MediaAlpha ($864.7 million 2024 revenue) and EverQuote ($500.2 million 2024 revenue) have achieved scale in insurance, thousands of smaller companies compete across verticals. This fragmentation creates roll-up opportunity.

A PE firm can acquire multiple complementary businesses, integrate them onto shared technology infrastructure, cross-sell buyer relationships, and create an entity worth more than the sum of its parts. The strategy has played out repeatedly:

- ANGI Homeservices (now Angi) combined Angie’s List, HomeAdvisor, and Handy into a home services lead platform

- Internet Brands rolled up Martindale-Avvo, WebMD, and numerous vertical content sites

- Constellation Software acquired CAKE and other marketing technology assets

Each acquisition adds buyer relationships, traffic sources, or technology capabilities that strengthen the platform’s competitive position.

A notable 2025 example: Ignite Visibility’s acquisition of EverConnect in October 2025, backed by Mountaingate Capital ($1.4 billion AUM). This represents Ignite’s fourth acquisition since their February 2023 PE partnership, with financing from Capital Southwest Corporation and Main Street Capital. The deal exemplifies the pattern – PE-backed platforms using acquisition to build multi-vertical capabilities while spreading compliance costs across larger revenue bases.

Compliance as a Moat

Rising regulatory complexity, particularly around TCPA and state privacy laws, creates a natural barrier to entry that PE firms recognize as valuable. Operating a compliant lead generation business requires significant infrastructure: consent verification through TrustedForm or Jornaya, real-time validation services, legal expertise, and ongoing compliance monitoring.

Smaller companies struggle to absorb these costs. TCPA litigation averaging $6.6 million in settlements creates existential risk for undercapitalized businesses. PE-backed platforms can spread compliance costs across larger revenue bases, invest in robust documentation systems, and afford the legal teams necessary to defend against litigation.

The compliance moat deepens with each new regulatory requirement. The FCC’s one-to-one consent rule proposal (though currently vacated), state mini-TCPA laws in Florida, Oklahoma, and Washington, and evolving state privacy legislation all increase the sophistication required for compliant operations. Each new requirement raises the bar that small operators must clear, creating natural consolidation pressure as compliance costs become unsustainable at subscale volumes.

This dynamic accelerates consolidation. Smaller players either sell to larger platforms that can absorb compliance costs, or they exit the industry entirely when a lawsuit materializes.

The Consolidation Wave: 2016-2025

The lead generation industry has experienced three distinct consolidation phases, each characterized by different buyer profiles and strategic rationales.

Phase 1: Strategic Acquisition (2016-2019)

The initial consolidation wave was driven primarily by strategic buyers seeking market share expansion. Insurance carriers acquired lead generation assets to control customer acquisition costs. Media companies purchased comparison sites to monetize existing traffic.

Key transactions during this period:

- Bankrate acquired by Red Ventures (2017): Created a content and lead generation powerhouse in financial services

- QuoteWizard acquired by LendingTree (2018): Consolidated insurance lead generation under the comparison platform umbrella

- Various vertical roll-ups: Multiple smaller transactions as regional players combined to achieve scale

Valuations during this phase typically ranged from 4-6x EBITDA for smaller transactions and 6-10x for strategic acquisitions with clear synergies. Buyers paid premiums for market position, technology assets, and key relationships.

Phase 2: PE Platform Building (2019-2022)

Private equity firms moved aggressively into lead generation during this phase, recognizing the industry’s attractive characteristics. Multiple platform investments launched with explicit roll-up mandates.

The pattern was consistent: PE firms acquired a platform company with established operations, installed professional management, built acquisition pipelines, and executed multiple add-on transactions to build scale. Technology integration, buyer relationship consolidation, and operational improvement drove value creation.

This phase saw increased valuation competition. Platform acquisitions commanded 7-12x EBITDA multiples as PE firms competed for market position. Add-on acquisitions traded at lower multiples (4-7x) as platform buyers leveraged their existing infrastructure and buyer relationships.

Phase 3: Market Maturation (2022-2025)

The current phase reflects a maturing market where consolidation continues but with more sophisticated buyer approaches. Valuations have moderated somewhat from peak levels, though quality assets still command premium multiples.

Several trends characterize this phase:

Vertical specialization: Rather than horizontal roll-ups across multiple industries, buyers increasingly focus on deep vertical expertise. A PE-backed platform might concentrate exclusively on insurance, legal, or home services leads, building vertical-specific technology and compliance infrastructure.

Technology platform premiums: Pure technology plays (distribution platforms, validation services, consent verification) command higher multiples than asset-heavy lead generation operations. A SaaS-like lead distribution platform might trade at 10-15x EBITDA, while a broker dependent on manual operations might see 4-6x.

Compliance-driven consolidation: smaller companies increasingly sell to avoid compliance risk rather than maximize valuation. These distressed sales occur at lower multiples but represent significant volume as regulatory pressure intensifies.

Quality-over-quantity emphasis: Buyers now scrutinize lead quality metrics, return rates, and buyer relationship durability more carefully. A business with 8% return rates commands a meaningful premium over one with 15% returns, even at similar revenue levels.

Valuation Multiples: What Operators Should Know

Understanding valuation ranges helps operators make informed decisions about building, buying, or selling lead generation businesses. While every transaction is unique, clear patterns emerge.

Revenue Multiple vs. EBITDA Multiple

Buyers typically value lead generation businesses on EBITDA multiples rather than revenue multiples. This reflects the significant margin variation across business models and operational efficiency levels.

A $5 million revenue business operating at 20% EBITDA margins ($1 million EBITDA) is worth materially more than a $5 million revenue business at 10% margins ($500K EBITDA), even at identical EBITDA multiples. The first might trade at $6-8 million; the second at $3-4 million.

Revenue multiples matter primarily for high-growth businesses where current profitability understates potential. A lead generation startup growing 100%+ annually might justify a 1-2x revenue multiple despite minimal current EBITDA, based on the path to scale economics.

Typical EBITDA Multiple Ranges by Business Type

Technology Platforms (10-15x EBITDA) Lead distribution platforms with recurring subscription revenue, sticky customer relationships, and high gross margins command the highest multiples. Buyers pay for predictable cash flows and the operating leverage that comes from technology-driven delivery.

Examples: boberdoo, LeadsPedia, Phonexa, CAKE

Key valuation drivers:

- Customer retention rates above 90%

- Gross margins exceeding 70%

- Low variable cost structure

- Defensible competitive position

Lead Exchanges and Marketplaces (8-12x EBITDA) Platforms that facilitate transactions without taking inventory risk trade at premium multiples reflecting their capital-light models and network effects. MediaAlpha and EverQuote, as public companies, provide observable benchmarks.

MediaAlpha, with $864.7 million in 2024 revenue and transaction value exceeding $1.5 billion, demonstrates the scale possible in marketplace models. EverQuote’s $500.2 million in 2024 revenue, with auto insurance alone generating $446 million (96% year-over-year growth), shows vertical concentration can drive premium valuations.

Integrated Lead Generators (6-9x EBITDA) Businesses that own traffic sources and convert them to leads command middle-tier multiples. The value of owned traffic (SEO assets, content properties, established paid media operations) offsets the lower margins compared to pure technology plays.

Key valuation drivers:

- Traffic source diversification (multiple channels, not dependent on single platform)

- SEO asset quality and durability

- Conversion optimization expertise

- Compliance infrastructure

Lead Brokers and Distributors (4-7x EBITDA) Pure brokerage operations without owned traffic or proprietary technology trade at lower multiples. The business model requires significant working capital, faces margin compression from transparency, and offers limited competitive moats.

Key valuation drivers:

- Buyer relationship depth and exclusivity

- Return rate metrics (8-10% is strong; 15%+ raises concerns)

- Publisher quality and diversity

- Float management efficiency

Distressed or Compliance-Risk Businesses (2-4x EBITDA) Businesses with pending litigation, high return rates, concentrated customer relationships, or other risk factors trade at significant discounts. Buyers apply substantial risk adjustments reflecting the probability of value impairment.

Value Enhancement Levers

Operators seeking to maximize exit value should focus on specific metrics that drive multiple expansion:

Reduce buyer concentration: A business where the top three buyers represent 80% of revenue will trade at a discount to one with diversified buyer relationships. Aim for no single buyer exceeding 25% of revenue.

Improve return rates: Every percentage point reduction in return rates flows directly to EBITDA and signals lead quality to buyers. Invest in source-level quality monitoring and quickly eliminate underperformers.

Document compliance infrastructure: Buyers increasingly require detailed compliance audits before closing. Maintain comprehensive consent documentation, TrustedForm/Jornaya integration records, and clear policies that demonstrate defensible operations.

Build technology assets: Proprietary technology, even simple internal tools, signals operational sophistication and reduces integration risk for buyers. A custom-built distribution system or quality scoring algorithm becomes a transferable asset.

Diversify traffic sources: Single-channel dependence (all Google Ads, all Facebook, all SEO) creates platform risk that buyers discount. Demonstrate ability to acquire leads across multiple channels.

How Consolidation Affects Each Tier

The consolidation wave impacts publishers, distributors, and buyers differently. Understanding your position’s exposure helps inform strategic decisions.

Impact on Lead Generators and Publishers

For publishers generating leads through owned traffic, consolidation creates both opportunity and threat.

The opportunity: PE-backed platforms need volume. As they consolidate buyer relationships, they become attractive partners for publishers who can deliver quality at scale. A publisher with strong performance metrics might negotiate better terms, faster payments, or exclusive arrangements with consolidated platforms.

The threat: Consolidated buyers gain pricing leverage. When three or four major platforms control most buyer demand in a vertical, publishers have limited alternatives. Buyers can dictate terms, require specific compliance measures, and exert pricing pressure that independent publishers struggle to resist.

Strategic responses for publishers:

- Build direct buyer relationships alongside platform partnerships

- Develop vertical specialization that creates differentiated value

- Invest in compliance infrastructure that meets stringent requirements

- Consider vertical integration into distribution or buying

Impact on Brokers and Distributors

The distribution layer faces the most direct impact from consolidation. PE-backed platforms explicitly target this tier for margin capture.

The squeeze: As buyers consolidate, they increasingly route around middlemen to work directly with publishers. As publishers aggregate, they build their own buyer relationships. The broker’s value proposition – connecting fragmented supply with fragmented demand – erodes when both sides consolidate.

The opportunity: High-quality distributors with strong relationships on both sides become acquisition targets. A broker with 10,000+ leads daily, diversified publisher base, and loyal buyer relationships represents exactly the kind of add-on acquisition that PE platforms seek.

Strategic responses for distributors:

- Build technology infrastructure that creates switching costs

- Develop value-added services (quality filtering, compliance verification, data enhancement)

- Focus on verticals where fragmentation persists

- Consider selling to a platform before competitive pressure intensifies

Impact on Lead Buyers

Buyers face a consolidating supply base with potential pricing implications, but also benefit from improved quality infrastructure.

The challenge: Consolidated lead sources can exercise pricing power. When a few platforms control most high-quality inventory in a vertical, buyers compete on price for access. Exclusive arrangements become harder to negotiate.

The benefit: PE-backed platforms invest in quality infrastructure that improves lead performance. Better validation, consistent consent documentation, and operational sophistication can improve buyer conversion rates and reduce compliance risk.

Strategic responses for buyers:

- Diversify lead sources to avoid dependence on consolidated platforms

- Build internal lead generation capabilities as a hedge

- Invest in speed-to-contact systems that maximize conversion from every lead

- Develop data feedback loops that communicate quality requirements clearly

Strategic Positioning in a Consolidating Market

Whether you want to sell, acquire, or simply continue operating, consolidation requires strategic response.

If You Want to Sell

Timing matters. Valuation multiples fluctuate with market conditions, interest rates, and competitive dynamics. The current environment (late 2024-2025) shows moderating multiples from peak levels but continued buyer interest for quality assets.

Preparation matters more. Buyers conduct extensive diligence. Common deal-breakers include:

- Inadequate consent documentation

- Customer concentration risk

- Pending or threatened litigation

- Unclear financial records

- Technology debt that complicates integration

Start preparation 12-24 months before a planned sale. Clean up financials, document processes, address compliance gaps, and build the narrative that positions your business attractively.

Consider partial sales. Strategic partnerships or minority investments can provide liquidity while maintaining operational control. A PE firm might invest $2-3 million for 30% of a growing business, providing growth capital without requiring full exit.

If You Want to Acquire

Roll-up opportunities exist for well-capitalized operators. Smaller publishers, brokers, and vertical-specific players often sell at attractive multiples to avoid the complexity of scaling independently.

Key acquisition criteria:

- Complementary buyer or publisher relationships

- Geographic or vertical diversification

- Technology assets that reduce integration complexity

- Clean compliance history

- Reasonable seller expectations

Financing options have expanded. Traditional bank debt remains challenging for lead generation businesses due to perceived risk, but alternative lenders, SBA loans (for appropriate structures), and seller financing enable acquisitions without PE backing.

If You Want to Compete Independently

Independence requires intentional strategy. Operators choosing not to sell must build defensible positions.

Vertical specialization: Deep expertise in a specific niche creates differentiation that generalist platforms cannot replicate. The operator who understands Medicare lead generation nuances, CMS compliance requirements, and AEP/OEP seasonality better than anyone builds defensible value.

Quality obsession: Return rates, conversion rates, and buyer satisfaction become existential metrics. Independent operators cannot compete on scale; they must compete on performance. Track every quality metric by source, buyer, and time period. Eliminate underperformers ruthlessly.

Relationship depth: Consolidated platforms operate through systems and processes. Independent operators can offer relationships. The buyer who knows they can call you directly when an issue arises values that access. The publisher who trusts your payment reliability prioritizes your business.

Compliance leadership: Rather than treating compliance as cost, treat it as competitive advantage. Be the operator whose consent documentation is unimpeachable, whose TCPA processes are defensible, whose buyers never worry about inherited liability.

The Future of Lead Generation Consolidation

Several trends will shape consolidation dynamics over the next five years. Understanding these trajectories helps operators position strategically rather than reactively.

Continued Platform Concentration

Expect further consolidation around established platforms. The logic is compelling: compliance costs rise, technology requirements increase, and buyer expectations for quality infrastructure create barriers that smaller companies cannot efficiently surmount.

The insurance vertical provides a preview of what other verticals will experience. MediaAlpha and EverQuote have established dominant positions, with combined revenue approaching $1.4 billion. Smaller insurance lead operators face a choice: sell to platforms, carve out defensible niches, or gradually lose market share as scale advantages compound.

Other verticals – mortgage, solar, legal, home services – will follow similar patterns with vertical-specific timing. Mortgage consolidation has been delayed by interest rate volatility that reduced overall market activity, but as rates stabilize, expect renewed acquisition interest. Solar faces unique dynamics as utility rate changes and incentive structures shift the geographic distribution of opportunity. Legal lead generation, already concentrated among a few large players, will see continued platform building in personal injury and emerging consolidation in practice areas like employment law and family law.

The Rise of Vertical-Specific Platforms

Rather than horizontal roll-ups attempting to span multiple industries, the next consolidation wave will favor vertical depth over horizontal breadth. PE-backed platforms are discovering that operational complexity increases faster than synergies when combining businesses across disparate verticals.

A platform specializing exclusively in insurance leads can build deep carrier relationships, develop insurance-specific compliance infrastructure, and accumulate proprietary data about which lead characteristics predict policy issuance. These advantages compound over time and create defensible positions that generalist platforms cannot replicate.

Expect vertical specialists to emerge in segments where they do not yet exist. Medicare and health insurance leads are consolidating around AEP/OEP expertise. Solar leads are consolidating around utility territory knowledge. Legal leads are fragmenting by practice area as different case types require different qualification approaches.

Technology as Table Stakes

The technology gap between PE-backed platforms and independent operators will widen. Platforms will invest in AI-powered lead scoring, real-time fraud detection, automated compliance monitoring, and predictive analytics that independent operators cannot match.

This creates a strategic imperative: independent operators must either invest in technology, partner with technology providers, or accept that technology limitations constrain their competitive position.

Regulatory Pressure as Accelerant

Every major regulatory change accelerates consolidation. The FCC’s one-to-one consent rule (vacated but signaling direction), state mini-TCPA laws, and potential federal privacy legislation all increase compliance complexity.

Larger platforms can absorb regulatory costs across larger revenue bases. smaller companies face proportionally higher compliance burdens. Some will sell to avoid the complexity; others will exit entirely.

International Expansion

As the US market consolidates, PE-backed platforms will increasingly look internationally. The lead generation models proven in the US are being exported to European, Asian, and Latin American markets.

This creates opportunity for operators with international experience or relationships. A US platform seeking Australian expansion might acquire or partner with a local operator who understands that market’s regulatory environment and buyer landscape. Similarly, operators who develop expertise in GDPR compliance, UK data protection requirements, or Canadian anti-spam legislation (CASL) become attractive acquisition targets or partnership candidates.

International expansion brings complexity that favors experienced acquirers. Different countries have different consent requirements, different telecommunications regulations, and different buyer expectations. A US platform cannot simply export its playbook – it must adapt to local conditions. Operators who have navigated that adaptation become valuable.

The Human Capital Challenge

Consolidation creates personnel challenges that affect both acquirers and independent operators. As platforms absorb talent through acquisitions, the available pool of experienced lead generation professionals shrinks. Simultaneously, the skills required for modern lead generation – data engineering, compliance expertise, advanced media buying – command premium compensation.

This dynamic advantages well-capitalized platforms that can afford competitive compensation and creates challenges for bootstrapped operators competing for the same talent. The talent competition extends beyond technical roles to include compliance officers, legal counsel, and experienced operations managers who understand lead generation economics.

Independent operators must develop talent retention strategies or accept higher turnover as employees receive offers from better-resourced competitors. Some operators have responded by offering equity participation, flexible working arrangements, or specialized training that creates career development opportunities unavailable at larger platforms.

The Due Diligence Process: What Buyers Examine

Understanding how PE firms and strategic buyers evaluate lead generation businesses helps operators prepare for potential transactions and improve operations regardless of exit plans.

Financial Due Diligence

Buyers analyze financial performance with particular attention to metrics that reveal business quality and sustainability.

Revenue quality analysis: Buyers segment revenue by source stability. Revenue from buyers with 24+ month relationships trades differently than revenue from buyers who started last quarter. Expect detailed analysis of customer cohorts, churn patterns, and revenue concentration.

EBITDA adjustments: Lead generation businesses often have significant add-backs and adjustments. Buyers will scrutinize owner compensation above market rates, one-time expenses, and costs that will not continue post-acquisition. Be prepared to defend every adjustment with documentation.

Working capital requirements: The 60-day float rule means lead businesses require significant working capital. Buyers analyze the cash conversion cycle carefully. A business that pays publishers in 15 days but collects from buyers in 45 days needs ongoing working capital investment. This affects purchase price negotiation, as buyers may reduce price to account for working capital needs beyond typical business requirements.

Return rate trends: Buyers track return rates over time by source and buyer. Increasing return rates signal quality degradation. Decreasing rates suggest operational improvement. The trend matters as much as the absolute level.

Operational Due Diligence

Beyond financials, buyers examine operational infrastructure and processes.

Technology assessment: Buyers evaluate technology stack maturity, integration complexity, and technical debt. A business running on outdated infrastructure requires post-acquisition investment that reduces effective purchase price. Modern, well-documented systems trade at premiums.

Compliance infrastructure review: Expect detailed examination of consent capture processes, TrustedForm or Jornaya integration, DNC list management, and TCPA compliance documentation. Buyers may require compliance representations and warranties that create seller liability for undisclosed issues.

Key person risk: Many lead businesses depend heavily on founder relationships with key buyers or publishers. Buyers assess transition risk carefully. Businesses with institutionalized relationships and documented processes trade at premiums over those dependent on individual connections.

Publisher and buyer quality: Buyers examine the quality and concentration of both supply and demand relationships. Top-tier publishers with diversified traffic sources and financially stable buyers with strong payment histories increase business value.

Legal Due Diligence

Legal examination focuses on liability exposure and contractual obligations.

Litigation history and pending claims: Any TCPA litigation history significantly impacts valuation. Pending claims may require escrow arrangements or purchase price adjustments. Even threatened claims can affect deal structure.

Contract review: Buyer and publisher agreements receive detailed scrutiny. Non-compete provisions, termination clauses, change of control provisions, and liability limitations all affect deal structure and post-close operations.

Intellectual property: Technology assets, brand trademarks, and domain portfolios are valued and verified. Any IP disputes or unclear ownership creates deal risk.

Regulatory compliance verification: Beyond TCPA, buyers verify compliance with vertical-specific regulations (CMS for Medicare, state insurance requirements, RESPA for mortgage), state privacy laws, and advertising standards.

The Economics of Lead Generation M&A: Real Numbers

Understanding actual transaction economics helps operators set realistic expectations and identify value creation opportunities.

Transaction Costs

Selling a lead generation business involves significant transaction costs that reduce net proceeds.

Investment banking fees: For transactions under $20 million, investment banking fees typically run 4-6% of enterprise value. Larger transactions may see fees of 2-4%. Success-based fees are standard, though retainers and minimum fees apply.

Legal costs: Seller legal costs for a mid-market transaction typically run $50,000-$150,000 depending on complexity. Complex deals with earnouts, escrows, or unusual structures cost more.

Accounting and due diligence costs: Quality of earnings reports, financial statement preparation, and diligence support add $25,000-$75,000 for most transactions.

Management distraction: The diligence process consumes significant management attention for 3-6 months. This often impacts current operations, potentially affecting trailing revenue metrics at the worst possible time.

Total transaction costs typically consume 6-10% of enterprise value for smaller transactions and 4-6% for larger deals. A $10 million enterprise value transaction might see $600,000-$1,000,000 in total transaction costs.

Deal Structure Considerations

Lead generation transactions rarely occur as simple cash-at-close purchases. Understanding typical structures helps sellers negotiate effectively.

Earnouts: Buyers frequently propose earnouts tied to post-close performance, often 15-30% of total consideration. Earnouts protect buyers against optimistic projections but create risk for sellers whose compensation depends on post-close performance they may not control.

Escrows and holdbacks: Expect 10-15% of purchase price held in escrow for 12-24 months to cover indemnification claims. TCPA representations often require extended escrow periods given the statute of limitations on claims.

Working capital adjustments: Purchase agreements typically include working capital true-ups that adjust final price based on closing date working capital versus a target. Sellers should negotiate targets carefully and understand the calculation methodology.

Seller financing: Smaller transactions often include seller financing, typically 10-20% of purchase price. This reduces buyer risk and can provide attractive returns for sellers comfortable with credit risk.

Post-Close Integration Realities

For practitioners selling to PE-backed platforms, understanding post-close realities helps set expectations.

Transition periods: Key personnel typically commit to 12-24 month transition periods, often with significant compensation tied to successful handoff. Plan for this commitment when evaluating timing.

Technology integration: Platform buyers typically migrate acquired businesses onto their technology infrastructure within 6-18 months. This integration consumes significant resources and can temporarily impact operations.

Buyer and publisher relationship transitions: Introducing new ownership to key relationships requires careful management. Buyers typically want sellers involved in these transitions, which drives transition period length requirements.

Cultural integration: PE-backed platforms often operate differently than founder-led businesses. More formal reporting, structured decision-making, and professional management practices replace entrepreneurial flexibility. Some founders thrive in this environment; others struggle.

Case Study: Anatomy of a Lead Generation Roll-Up

Understanding how successful roll-ups execute helps operators position for potential acquisition or learn from consolidated platform strategies.

The Platform Acquisition

A PE firm acquires a $15 million revenue lead distribution business at 8x EBITDA ($1.5 million EBITDA = $12 million enterprise value). The business has:

- Established technology platform requiring minimal investment

- 150+ active buyer relationships across insurance and home services

- 200+ publisher integrations

- 85% customer retention

- 12% return rates

- Clean compliance history

The PE firm installs a CEO with industry experience, CFO with PE reporting expertise, and sales leadership focused on relationship expansion.

Add-On Acquisitions

Over 24 months, the platform executes five add-on acquisitions:

Add-on 1: $3 million revenue insurance lead broker acquired at 5x EBITDA ($450K EBITDA = $2.25 million). Brings 40 exclusive buyer relationships that integrate onto the platform. Technology eliminated; staff reduced from 8 to 3.

Add-on 2: $2 million revenue SEO-focused publisher acquired at 6x EBITDA ($300K EBITDA = $1.8 million). Provides organic traffic previously purchased from third parties. Vertical integration reduces traffic acquisition costs.

Add-on 3: $4 million revenue home services lead generator acquired at 5.5x EBITDA ($500K EBITDA = $2.75 million). Expands vertical presence and adds buyer relationships in adjacent markets.

Add-on 4: $1.5 million revenue validation service acquired at 7x EBITDA ($180K EBITDA = $1.26 million). Technology integration reduces third-party validation costs and provides additional revenue stream.

Add-on 5: $2.5 million revenue mortgage lead generator acquired at 4.5x EBITDA ($400K EBITDA = $1.8 million). Rate-sensitive vertical acquired during cyclical downturn at attractive multiple.

Total add-on investment: $9.86 million for $1.83 million combined EBITDA.

Value Creation

Three years post-initial acquisition:

Revenue growth: Combined platform grows from $28 million (platform + add-ons) to $45 million through organic growth and cross-sell opportunities.

Margin improvement: EBITDA margins improve from 10% to 18% through technology consolidation, overhead reduction, and operational efficiency. EBITDA grows from $3.33 million to $8.1 million.

Multiple expansion: The consolidated platform with scale, diversification, and proven growth commands 10x EBITDA versus the 6x average paid for add-ons.

Exit value: $8.1 million EBITDA x 10x multiple = $81 million enterprise value.

Total investment: $12 million (platform) + $9.86 million (add-ons) + $3 million (growth capital) = $24.86 million.

Value created: $81 million - $24.86 million = $56.14 million value creation.

Returns: 3.3x money multiple, approximately 35% IRR over three years.

This simplified example illustrates why PE finds lead generation attractive and how the roll-up playbook creates value. Not every transaction achieves these returns, but the model explains industry consolidation dynamics.

Key Takeaways

Private equity involvement in lead generation has fundamentally altered the competitive landscape. Understanding these dynamics is essential for strategic positioning:

-

PE finds lead generation attractive for its recurring revenue characteristics, high cash flow margins, technology leverage potential, fragmented market structure, and compliance-driven consolidation opportunity

-

Valuation multiples vary significantly by business model: technology platforms command 10-15x EBITDA, while basic brokerage operations trade at 4-7x. Quality metrics, buyer diversification, and compliance infrastructure drive meaningful premium or discount

-

Consolidation affects each tier differently: publishers gain access to consolidated buyer demand but face pricing pressure; distributors face direct competitive pressure from platform growth; buyers must diversify sources to avoid platform dependence

-

Strategic positioning requires intentional choice: operators must decide whether to sell (prepare 12-24 months ahead), acquire (target complementary assets), or compete independently (specialize, obsess over quality, build relationships)

-

The trend will accelerate: continued platform concentration, technology requirements, and regulatory pressure will drive further consolidation. Operators without clear strategic positioning face margin compression or unfavorable acquisition terms

Frequently Asked Questions

What EBITDA multiple can I expect when selling my lead generation business?

Multiples vary significantly based on business model, quality metrics, and market conditions. Technology platforms with recurring subscription revenue typically command 10-15x EBITDA. Lead exchanges and marketplaces trade at 8-12x. Integrated lead generators with owned traffic sources see 6-9x. Pure brokerage operations without proprietary technology typically trade at 4-7x. Distressed businesses with compliance issues or high return rates might see 2-4x. Within each range, specific factors like buyer concentration, return rates, compliance documentation, and growth trajectory drive substantial variation. A broker with 8% return rates and diversified buyers might achieve 6-7x while an identical-revenue business with 15% returns and concentrated customers sees 4-5x.

How do I prepare my lead generation business for sale?

Start preparation 12-24 months before a planned exit. Key preparation steps include: cleaning up financial records with clear EBITDA adjustments; documenting all processes and SOPs; ensuring comprehensive consent documentation with TrustedForm or Jornaya integration; reducing customer concentration below 25% for any single buyer; building technology infrastructure that creates transferable value; addressing any pending compliance issues or litigation; creating a compelling growth narrative with realistic projections. Buyers conduct extensive diligence, and common deal-breakers include inadequate consent documentation, customer concentration, pending litigation, unclear financials, and technology debt.

What attracts private equity firms to lead generation businesses?

PE firms evaluate lead generation businesses on four primary criteria: recurring revenue characteristics (70-80% of monthly revenue often comes from established relationships); high cash flow margins (15-18% net margins are achievable at scale); technology leverage potential (many operations have significant automation opportunity); and fragmented market structure (thousands of smaller companies create roll-up opportunity). Additionally, rising compliance costs create natural barriers to entry that PE firms recognize as valuable, as larger platforms can spread regulatory burden across larger revenue bases.

How does consolidation affect independent lead generators?

For publishers generating leads through owned traffic, consolidation creates both opportunity and threat. The opportunity: PE-backed platforms need volume and become attractive partners for publishers with strong performance metrics. The threat: consolidated buyers gain pricing leverage, and when a few platforms control most buyer demand, publishers have limited alternatives. Strategic responses include building direct buyer relationships alongside platform partnerships, developing vertical specialization, investing in compliance infrastructure, and considering vertical integration into distribution or buying functions.

Should I sell my lead generation business now or wait for higher multiples?

The decision depends on multiple factors beyond current multiples. Consider: Is your business positioned to benefit from consolidation trends, or does increased competition threaten your margins? Do you have the capital and appetite to invest in technology infrastructure that will increasingly be required? Are regulatory pressures increasing compliance costs faster than you can absorb them? Is your owner-dependence creating risk that buyers discount? Current multiples (late 2024-2025) have moderated from peak levels but quality assets still command premiums. If your business faces structural pressures that will worsen, selling now at slightly lower multiples may be preferable to selling later under distress.

What compliance infrastructure do acquirers require?

Buyers increasingly require detailed compliance audits before closing. Minimum requirements include: TrustedForm or Jornaya integration with certificate retention for at least five years; documented TCPA consent language reviewed by legal counsel; clear policies for PEWC (Prior Express Written Consent) capture; DNC list scrubbing procedures; caller ID and SMS compliance protocols; state-specific calling hour adherence; regular compliance training documentation; and incident response procedures. Businesses without robust compliance infrastructure either fail to close or receive significant valuation discounts reflecting the risk buyers inherit.

How can small lead generators compete against PE-backed platforms?

Independent operators cannot compete on scale or technology investment. Competitive strategies include: vertical specialization (deep expertise in a specific niche creates differentiation); quality obsession (tracking every metric by source and eliminating underperformers ruthlessly); relationship depth (the buyer who can call you directly when issues arise values that access); compliance leadership (treating compliance as competitive advantage rather than cost); speed and flexibility (implementing changes faster than enterprise platforms); and service customization (addressing specific buyer needs that platforms serve generically).

What does a typical PE roll-up strategy look like in lead generation?

PE firms typically acquire a platform company with established operations (the “platform investment”), install professional management, build acquisition pipelines, and execute multiple add-on transactions to build scale. Platform acquisitions often command 7-12x EBITDA as PE firms compete for market position. Add-on acquisitions trade at lower multiples (4-7x) as platform buyers leverage existing infrastructure. Value creation comes from technology integration, buyer relationship consolidation, operational improvement, and eventually either IPO or sale to a strategic buyer at an exit multiple higher than the blended acquisition multiple.

How has the FCC one-to-one consent rule affected valuations?

The FCC’s December 2023 one-to-one consent rule, though vacated by the 11th Circuit Court in January 2025, signaled regulatory direction that affects valuations. Businesses with robust consent infrastructure that could comply with one-to-one consent requirements command premiums as buyers anticipate future regulatory tightening. Businesses dependent on shared consent across multiple buyers face valuation pressure regardless of the rule’s current status. Smart buyers apply consent compliance requirements regardless of regulatory status, treating one-to-one consent capability as table stakes for defensible operations.

What role does customer concentration play in lead generation valuations?

Customer concentration significantly impacts valuations. A business where the top three buyers represent 80% of revenue trades at meaningful discount to one with diversified buyer relationships. Buyers discount concentrated revenue because: a single buyer departure can devastate the business; concentrated buyers have pricing leverage; and key relationship risk often transfers poorly to acquirers. Target metrics: no single buyer should exceed 25% of revenue; top five buyers should represent less than 60% of revenue. Building diversification often requires accepting slightly lower per-lead pricing from secondary buyers to reduce concentration risk.

This article provides strategic analysis of private equity activity in lead generation. Statistics and market conditions are current as of late 2025. Consult qualified M&A advisors, legal counsel, and financial professionals before making acquisition or divestiture decisions.