Geographic arbitrage, policy volatility, and the qualification requirements that separate profitable solar operations from money pits. Everything you need to know about generating and selling solar leads in a post-ITC environment.

The solar lead vertical operates unlike any other in lead generation. An identical lead sells for $1,929 in California and $225 in North Dakota. That 8.5x pricing spread exists because of five converging factors: electricity rates, state incentives, net metering policies, installer density, and customer sophistication. Understanding this geographic variation is the difference between building a profitable solar lead operation and bleeding money while wondering why your traffic stopped converting.

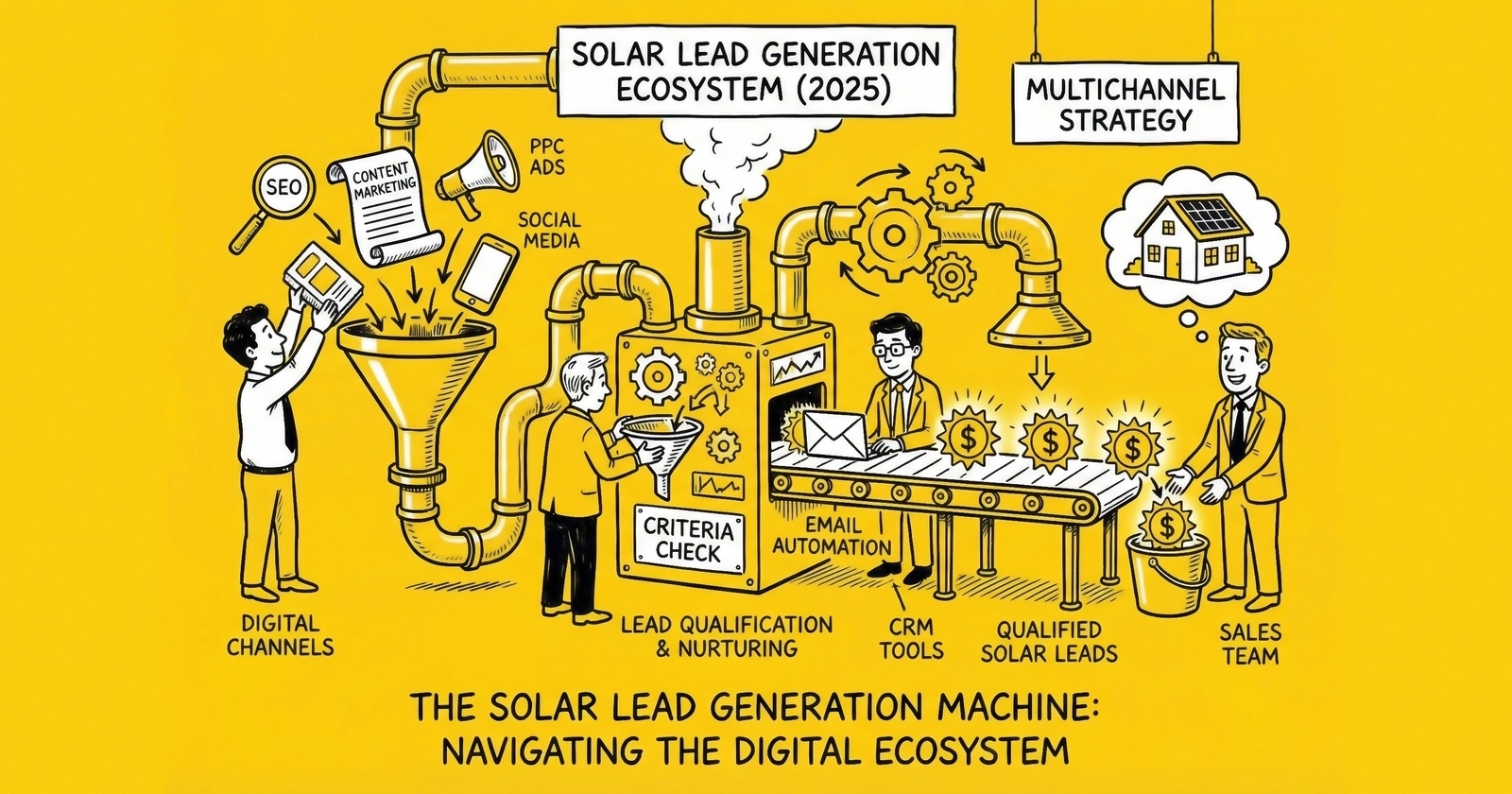

Solar lead generation in 2026 exists in a state of transition. The residential market contracted 12% in 2024. California volumes dropped 41%. Yet solar still accounted for 58% of all new electricity-generating capacity added to the U.S. grid in the first half of 2025. The opportunity remains substantial for operators who understand the nuances. The trap awaits those who treat solar as a simple high-CPL volume play.

This comprehensive guide provides the complete framework for solar lead generation: market dynamics, geographic pricing analysis, CPL benchmarks by state tier, qualification requirements, installer partnership strategies, policy impact analysis, seasonal patterns, and fraud prevention. Every number comes from current market data. Every recommendation comes from operational experience.

Market Overview: The 2024-2026 Landscape

The solar industry presents a paradox that lead generators must understand. Aggregate growth numbers look exceptional: the U.S. installed 11.7 gigawatts of solar capacity in Q3 2025, a 20% increase year-over-year and the third-largest quarter in the industry’s history. Solar and battery storage combined accounted for 85% of new generating capacity through the first three quarters of 2025. These numbers suggest a market accelerating toward dominance.

The residential sector tells a different story. Q2 2025 marked the lowest quarter for residential capacity since Q2 2021, with installations declining 9% year-over-year and falling below 1 gigawatt for the first time in four years. California volumes dropped 41% in 2024 compared to 2023. The national residential market contracted 12% in 2024, even as utility-scale projects boomed.

This divergence creates both challenge and opportunity. The residential sector faces policy headwinds, high interest rates, and regulatory uncertainty. But within that challenged market, massive geographic variation means operators can still find pockets of exceptional profitability if they know where to look.

Current Lead Pricing by Type

Solar leads command premium pricing because the underlying transaction is substantial. A typical residential solar installation costs $20,000 to $30,000, with installers earning margins that justify customer acquisition costs ranging from $1,500 to $3,000 per closed sale. This creates room for lead prices that would be absurd in other home services verticals.

| Lead Type | Price Range | Typical Close Rate | Effective CPA |

|---|---|---|---|

| Exclusive, qualified | $100-$200+ | 8-15% | $1,000-$2,000 |

| Shared (2-3 buyers) | $35-$125 | 3-5% | $1,000-$2,500 |

| Set appointments | $150-$200 | 15-25% | $750-$1,250 |

| Aged leads (30+ days) | $5-$30 | 1-3% | $500-$1,000 |

The math illustrates why installers pay these premiums. An exclusive lead at $150 converting at 10% yields an effective cost per acquisition of $1,500. On a $25,000 installation with 30% gross margin, that produces $7,500 in gross profit minus $1,500 in lead cost. The remaining $6,000 covers installation, overhead, and net profit. Compare this to a shared lead at $50 with 3% conversion: the effective CPA is $1,667, marginally higher but with faster sales cycle decay and lower close rates once multiple installers contact the same prospect.

Major Market Players

Understanding the competitive landscape helps lead generators position their operations and identify partnership opportunities.

EnergySage operates as the industry’s dominant comparison marketplace. Supported by the U.S. Department of Energy, EnergySage has processed millions of quotes from over 500 installers across all 50 states. The company publishes semi-annual marketplace reports that have become the industry’s authoritative source for pricing trends. EnergySage reports median quoted solar prices reached a record low of $2.48 per watt in H1 2025, down from peaks above $3.50 just three years earlier.

For lead generators, EnergySage represents both competitor and benchmark. Their marketplace model provides transparency that benefits sophisticated installers willing to compete on price and reviews. Their data sets pricing expectations across the industry.

SolarReviews operates the largest direct lead generation platform in residential solar. The company generated 396,505 leads in 2024 and reports responsibility for up to 40% of sales for their largest partners. Unlike EnergySage’s marketplace model, SolarReviews sells leads directly to installers with various exclusivity options.

Established in 2007, SolarReviews’ scale and longevity give it significant advantages in SEO and paid traffic acquisition. Their business model allows more flexible pricing and territory arrangements than marketplace models, making them preferred partners for regional installers who want exclusivity in specific geographic areas.

Sunrun represents a different model entirely: the vertically integrated installer that generates, consumes, and occasionally resells leads. As the largest residential solar installer in the U.S. with 12% market share in 2024 and over one million customers, Sunrun’s lead generation operations are primarily internal. However, understanding their economics matters because they set the competitive floor for what installers can afford to pay.

Sunrun’s subscription model (leases and power purchase agreements) allows them to monetize the federal tax credit directly, then pass savings to customers through lower monthly payments. This financing advantage means they can afford higher customer acquisition costs than installers selling owned systems. In Q4 2024, Sunrun accounted for 19% of new U.S. solar installations and 45% of new energy storage installations.

The installer landscape continues consolidating. SunPower, once a dominant brand, filed for bankruptcy in August 2024 despite its four-decade industry history. Smaller installers face margin pressure from rising interest rates (median loan rates climbed to 7.5% in H1 2026) and declining customer acquisition efficiency. This consolidation affects lead generators through buyer churn. Building relationships with installers that subsequently exit the market wastes partnership investment.

Smart lead generators track installer financial health, not just lead appetite. A buyer aggressively purchasing leads while simultaneously laying off staff signals potential trouble. The private equity consolidation wave affecting lead generation also impacts the installer landscape. Monitoring public filings, industry news, and payment patterns helps identify at-risk buyers before they become collection problems.

Geographic Arbitrage: The Core Solar Strategy

No other lead vertical exhibits the geographic pricing variation of solar. The 8.5x spread from California to North Dakota exists because of fundamental differences in economics, policy, and market maturity. Understanding why this spread exists and how to exploit it separates profitable solar lead operations from commodity volume plays.

The Five Drivers of Geographic Value

Electricity Rates directly determine payback periods. California’s average residential electricity rate exceeds $0.25 per kWh, among the highest in the nation. Hawaii, Massachusetts, and Connecticut have similarly high rates. North Dakota’s rate hovers around $0.10 per kWh. Higher electricity costs mean faster payback and easier sales conversations. A homeowner paying $300 monthly for electricity has a compelling reason to explore solar. One paying $75 has marginal motivation.

State and Utility Incentives layer on top of federal credits. California historically offered additional rebates, net metering at retail rates, and SREC programs. Massachusetts has SMART (Solar Massachusetts Renewable Target) incentives. New York offers a 25% state tax credit up to $5,000. North Dakota offers nothing meaningful beyond the federal Investment Tax Credit. These incentive stacks can add $3,000-$10,000 in additional value, fundamentally changing the sales conversation.

Sunshine Hours matter less than most assume. Arizona has better solar irradiance than Massachusetts, yet Massachusetts has higher installed capacity per capita. Policy and rates trump sunshine in determining market attractiveness. Solar panels produce electricity in cloudy conditions. The question is whether the financial case works, not whether the sun shines.

Installer Density affects competition and pricing dynamics. California’s mature market has hundreds of competing installers, creating downward price pressure on installation costs and upward pressure on lead prices. Less competitive markets have higher installation costs but lower lead prices because fewer buyers compete for available traffic.

Customer Sophistication influences close rates in opposing directions. California homeowners have seen decades of solar marketing. They understand financing options, know to get multiple quotes, and negotiate aggressively. This sophistication reduces margins but increases overall market volume. Emerging market consumers often close faster with higher margins because they lack comparison benchmarks, but total addressable volume is smaller.

CPL Benchmarks by State Tier

For practical lead generation, states cluster into five tiers based on lead value and market maturity. These tiers determine traffic acquisition strategy, buyer relationships, and margin expectations.

Tier 1: Premium Markets ($150-$300+ per lead)

California, Hawaii, Massachusetts, and New York command premium lead prices despite market challenges. These states combine high electricity rates, policy support, and mature installer infrastructure.

California deserves special attention. NEM 3.0 took effect for new interconnection applications on April 15, 2023, reducing export compensation by approximately 75%. Payback periods extended from 5-6 years to 14-15 years. The California Solar and Storage Association reported sales drops of 66-83% compared to 2022. Residential installations plummeted.

Yet California remains Tier 1. Battery attachment rates soared to 79% as the value proposition shifted from grid export to self-consumption. Lead generators targeting California now must qualify for storage interest, not just solar interest. A solar-only California lead has limited value. A solar-plus-storage lead with verified high electric bills remains premium.

Hawaii has the highest electricity rates in the nation, making solar economics compelling despite limited installer competition. Massachusetts combines strong state incentives, high rates, and dense population. New York offers substantial state credits and serves a large market with premium installation economics.

Tier 2: Strong Markets ($75-$150 per lead)

Texas, Florida, Arizona, New Jersey, and Colorado represent the growth frontier for solar leads.

Texas installed the most solar capacity of any state in H1 2026 (3.8 GW), though most was utility-scale. The residential market grows but faces headwinds from utility resistance to net metering. However, rising electricity prices and a freedom-oriented consumer base create strong demand for energy independence.

Florida recovered from previous policy challenges. Strong fundamentals include high electricity rates in summer, abundant sunshine, and a growing population of retirees with paid-off homes. Homeowners with no mortgage represent ideal solar customers since they own their roofs free and clear and have stable income to support installation financing.

Arizona offers strong irradiance but reduced net metering since 2016 changes. Competition among installers is intense. New Jersey combines high population density with good state incentives. Colorado benefits from environmental consciousness and moderate electricity rates.

Tier 3: Developing Markets ($40-$75 per lead)

Nevada, Utah, New Mexico, Illinois, Virginia, Georgia, North Carolina, and South Carolina represent growth opportunities with developing infrastructure.

These states offer less competition, meaning lower lead costs, but installers also have lower close rates and less sophisticated operations. Lead generators serving these markets often need to provide more education-focused content and longer nurture sequences. The sales cycle extends because consumers have less familiarity with solar economics. Understanding the 90-day solar decision journey is particularly critical for these developing markets where buyers need more time and touchpoints.

Success in Tier 3 markets requires different traffic strategies. Brand awareness campaigns may outperform direct response because consumers need education before they are ready to buy.

Tier 4: Emerging Markets ($25-$50 per lead)

Most Midwest and Mountain states fall into this tier. Low electricity rates and minimal policy support make solar economics challenging. Lead volume is limited, and buyers are price-sensitive.

Success requires extremely low traffic acquisition costs. SEO-driven organic traffic, content marketing, and referral programs work better than paid advertising. The unit economics do not support high CPL marketing spend.

Tier 5: Minimal Markets (Generally Unprofitable)

North Dakota, South Dakota, Wyoming, and parts of Appalachia present minimal opportunity for lead generation. Low electricity rates, minimal sunshine, sparse population, and no policy support make these markets generally unprofitable. Even if leads are nearly free to generate, installer appetite is minimal. Few buyers operate in these territories, and those who do have strict volume limits.

Utility-Level Targeting

Selling national leads at uniform pricing leaves money on the table. State-level pricing captures true value variation. Utility-level targeting captures even more.

A lead in San Diego (SDG&E territory) has different economics than one in Sacramento (SMUD territory) due to different rate structures and net metering rules. California alone has three major investor-owned utilities (PG&E, SCE, SDG&E) with distinct tariff structures, export adder schedules, and customer economics. Municipal utilities like LADWP and SMUD operate under entirely separate rules.

Lead generators who understand utility-level nuance can route traffic to the highest-value territories. The technical requirement is maintaining utility territory lookup by ZIP code and separate pricing matrices by utility. The complexity is justified by the margin improvement.

Dynamic pricing by ZIP code captures the most value. Some installers convert at 15% in their core territories but only 5% in adjacent areas due to brand recognition and referral density. Lead generators who can route at this granularity capture premium pricing from buyers who know exactly where they perform best.

Qualification Requirements That Separate Profitable Leads from Waste

Solar leads face endemic quality problems that exceed most other verticals. Industry estimates suggest fraud rates of 25-35% for third-party leads. The combination of high CPLs, complex qualification criteria, and commission-driven sales creates fertile ground for abuse.

Homeownership Verification

The fundamental question is whether this person owns their home and has authority to make installation decisions. Renters cannot authorize installation. Yet self-reported ownership is unreliable. Consumers frequently misrepresent their status, whether through confusion (living in a family-owned property) or intentional fraud (seeking information without intent to buy).

Property database matching using services like ATTOM or CoreLogic verifies name-to-address matches and ownership status. Cost ranges from $0.50 to $2.00 per lead but catches obvious fraud. This verification should occur before leads route to buyers.

Utility bill requirements where consumers upload or verify their electric bill create friction that reduces volume but dramatically improves quality. Legitimate prospects have bills readily available. This verification simultaneously confirms address, electricity usage, and serious purchase intent.

Credit-based verification through soft pulls confirms identity and may indicate homeownership through mortgage tradelines. Privacy concerns and compliance requirements make this approach sensitive. It works best for high-value exclusive leads where the additional verification cost is justified.

Third-party authentication through services like TrustedForm captures behavioral data and video playback of form completion. This proves consent and helps detect fraudulent form completion patterns but does not verify ownership directly.

Roof and Property Qualification

Beyond ownership, the property itself must be suitable for solar installation. Leads on unsuitable properties waste installer time and erode buyer confidence.

Roof age over 20 years typically requires replacement before installation, adding $10,000-$25,000 to project cost. Pre-qualification questions about roof age filter these prospects early.

North-facing roofs in the northern hemisphere receive insufficient sunlight. East-west orientations produce 10-15% less than optimal south-facing installations. Complex roof geometry with multiple angles and dormers increases installation cost and reduces usable space.

Heavy shading from trees or adjacent buildings reduces production 25-50%, even with partial shade. Self-reported shading information filters obvious non-fits. Satellite imagery review or consumer-uploaded photos help identify disqualifiers before routing to buyers.

Structural limitations affect some older homes that cannot support panel weight of 3-4 pounds per square foot. Mobile and manufactured homes have structural limitations, financing restrictions, and titling complications that most installers avoid.

Roof material considerations matter for installation complexity. Asphalt shingles are standard. Tile roofs require specialized mounting with higher labor costs. Flat roofs need tilt systems.

Electric Bill Qualification

Electric bill amount correlates directly with system size opportunity and customer motivation.

The sweet spot is $150+ monthly electric bills. These customers have meaningful savings potential and strong motivation to reduce their utility costs.

The ideal range spans $200-$400 monthly. High motivation combines with affordable system size. These customers see compelling economics and can finance systems that provide significant savings.

Marginal prospects have bills under $100 monthly. Limited savings potential extends payback periods and weakens the value proposition. Unless combined with strong environmental motivation or backup power interest, these leads convert poorly.

Rate plan analysis adds sophistication. Customers on tiered rates benefit more from solar than those on flat rates because solar production offsets the highest-cost tiers first. Time-of-use rate customers need battery storage to capture maximum value by shifting consumption away from peak pricing. A comprehensive utility bill qualification guide covers the specific thresholds and verification methods that maximize conversion.

Credit Qualification

Solar financing requires FICO scores typically above 650. Many fraud schemes target credit-unqualified consumers who will never convert, either through fake information or by generating leads from populations unlikely to qualify.

Pre-qualification questions should include credit self-attestation. While imperfect, asking consumers to confirm they have good or fair credit reduces obvious mismatches. Leads from consumers who self-report poor credit or recent bankruptcy waste installer resources.

For premium lead products, soft credit checks before delivery can verify qualification. The cost is justified for exclusive leads selling at $150+ where a non-qualified lead wastes significant buyer resources.

Working with EPCs and Installers: Building Profitable Partnerships

Understanding how solar installers operate helps lead generators build relationships that last and deliver value both ways. The solar industry uses “EPC” (Engineering, Procurement, and Construction) to describe the companies that design, procure, and install solar systems.

Installer Types and Their Preferences

National installers like Sunrun, Freedom Forever, and Momentum Solar have sophisticated lead intake processes. They want volume, accept higher lead costs for verified quality, and have capacity constraints that affect buying patterns throughout the year. National players typically buy across broad geographic areas and can absorb leads that regional players cannot.

Working with nationals means meeting their system requirements for lead delivery, understanding their return policies, and managing expectations around response time. They have dedicated lead intake teams but may take longer to follow up than hungry local installers.

Regional installers dominate specific territories with 5-15 states of coverage. They often want exclusivity in their service areas, have closer installer-to-customer relationships, and convert at higher rates in their core markets. Regional players typically pay premium prices for exclusive leads in territories where they have strong brand recognition.

Building exclusive arrangements with strong regional installers provides pricing power and stability. These relationships take time to develop but create competitive moats. Once an installer depends on your leads for 30-40% of their sales, switching costs make the relationship durable. For strategies on structuring these arrangements, see our guide on EPC partnerships and solar installer lead generation.

Local installers operate with smaller teams and tighter margins. They prefer fewer, higher-quality leads over volume. Response time expectations are critical since their conversion depends on being first to contact prospects. A local installer who receives a lead within 60 seconds of form submission converts dramatically better than one who waits until the next business day.

What Installers Actually Want from Lead Suppliers

Contact rate above 70% matters more than almost any other metric. Nothing frustrates buyers more than leads that do not answer the phone. The five-minute response rule applies to solar just as much as any other vertical. Phone verification at form submission, followed by immediate delivery, maximizes contact rate. Delivering leads during business hours when sales teams are staffed improves contact rates 20-30%.

Accurate utility information enables correct quoting. Installers need to know the utility territory to design systems and quote pricing correctly. Wrong utility information wastes design time, requires re-quotes, and erodes trust in lead quality.

Verified electric bill amounts differentiate serious prospects from tire-kickers. Self-reported bill amounts are often wrong, either through genuine misremembering or intentional exaggeration. Bill upload verification dramatically improves lead quality perception and close rates.

Realistic timeline expectations set up success rather than frustration. Leads expecting installation “next week” create failure because solar installation requires permitting, utility approvals, and scheduling that typically takes 4-8 weeks. Proper expectation-setting during form completion improves close rates by reducing disappointment.

Exclusivity transparency builds long-term trust. Installers who believe they are receiving exclusive leads but are actually competing with three other installers will discover the truth and stop buying. Be transparent about your model. If leads are shared, say so and price accordingly.

Understanding Installer Capacity Constraints

Solar installation is seasonal and capacity-constrained. Installers cannot accept unlimited leads year-round.

Q1 (January-March) is slower installation season due to weather in northern markets. Installers have capacity and lead prices soften. This is the time to build relationships with new buyers who have bandwidth to evaluate your leads.

Q2-Q3 (April-September) represents peak installation season. Demand for leads is high, premium pricing is achievable, and installers compete aggressively for quality traffic. Capacity constraints become apparent in July and August as installation crews fall behind.

Q4 (October-December) creates a year-end rush for tax credit deadlines. Capacity constraints intensify. Installers become selective about which leads they accept, prioritizing prospects who can close quickly. After November, installers often stop buying entirely because they cannot install before year-end deadlines.

Smart lead generators track capacity signals from their buyer partners. Delayed follow-up, increased return rates, and reduced daily caps indicate oversupply. Installers asking for more leads at current pricing indicate undersupply and pricing opportunity.

The Investment Tax Credit and Policy Impact Analysis

The solar lead market’s fundamental vulnerability is dependence on government incentives. The residential Investment Tax Credit (ITC) has been the primary demand driver since 2005.

Understanding the ITC Expiration

Under the Inflation Reduction Act of 2022, the residential ITC was extended at 30% through 2032, with gradual step-downs through 2034. This created a decade of policy stability that supported industry growth.

The One Big Beautiful Bill Act, signed in mid-2025, changed everything. The residential solar tax credit (Section 25D) now expires on December 31, 2025, eliminating the incentive entirely rather than phasing it down – no gradual step-down, immediate termination.

Critical “Placed in Service” Requirement: Systems must be placed in service by December 31, 2025 to qualify for the 30% credit. The IRS definition of “placed in service” requires:

- System fully installed

- All permits and inspections completed

- System capable of producing electricity

- Interconnection agreement activated

Important: Simply purchasing equipment, signing a contract, or beginning installation does NOT qualify. The system must be operational and producing power before midnight December 31, 2025.

SEIA Industry Impact Analysis: The Solar Energy Industries Association estimates:

- Approximately 300,000 clean energy jobs at risk from ITC termination

- $220 billion in planned solar and storage investments threatened by 2030

- California, Texas, and Florida face the largest immediate job losses

For lead generators, this creates a compressed demand window followed by fundamental market restructuring.

Impact without the ITC:

- Direct cost increase to consumer: $6,000-$9,000 on typical installation

- Payback period extension: approximately 30% longer (from 7 years to 9 years nationally)

- Expected 2026 volume impact: -30% to -50% decline

- Lead value impact: -20% to -40% as buyer margins compress

For a deeper analysis of how these policy changes affect lead generation strategy in 2026, understanding the full scope of incentive restructuring is essential.

The commercial ITC (Section 48E) follows different timelines. Projects begun by July 4, 2026 can qualify for the full credit if placed in service within four years. This creates potential opportunity for lead generators who pivot to commercial solar leads as the residential market contracts.

Inflation Reduction Act: Understanding What Remains and What’s Changed

The Inflation Reduction Act (IRA) of 2022 originally represented the most significant clean energy legislation in U.S. history, allocating $369 billion toward energy security and climate investments over ten years. While the residential solar tax credit has been eliminated under subsequent legislation, understanding the broader IRA framework matters because several provisions continue affecting solar economics and lead generation strategy.

Manufacturing Credits and Domestic Content Bonuses

The IRA’s manufacturing provisions remain partially intact, creating incentive structures that benefit installations using domestically manufactured components. For solar installations qualifying for the domestic content bonus, additional tax benefits of up to 10% may apply when systems use panels, inverters, and mounting systems manufactured in the United States.

Lead generators can differentiate their offerings by qualifying prospects for domestic content advantages. Form questions asking about domestic manufacturing preferences, or content positioning that emphasizes “Made in America” solar equipment, can identify prospects who may qualify for enhanced incentives through alternative programs.

The practical application for lead operations involves understanding which installer partners can offer domestic content qualified systems. Installers working with U.S. manufacturers (such as First Solar, Q Cells Georgia operations, or Silfab) can market enhanced value propositions to prospects, making these leads potentially more valuable than generic solar inquiries.

Commercial and Utility-Scale Provisions

The IRA’s commercial solar provisions (Section 48E) remain available through different sunset timelines than the expired residential credit. Commercial installations still qualify for the Investment Tax Credit at 30% base rate, with potential adders for projects in energy communities, low-income communities, or projects meeting prevailing wage requirements.

For lead generation operations, this creates strategic opportunity. The residential market contracts by 30-50%, but commercial solar demand remains supported by tax incentives. Lead generators who can pivot to small commercial leads (businesses with suitable rooftops, agricultural operations, non-profits) access a market segment that maintains economic drivers the residential segment has lost.

Commercial solar lead generation differs from residential in several ways. Decision cycles extend to 3-6 months rather than 30-60 days. Multiple stakeholders influence purchasing decisions. Qualification requires understanding business ownership, roof lease terms, electricity consumption at commercial rates, and creditworthiness of the business entity rather than individual consumers.

Energy Community and Low-Income Bonuses

The IRA established bonus credits for solar installations in designated energy communities (areas with significant fossil fuel employment or plant closures) and low-income communities. These provisions continue applying to qualifying installations regardless of the residential credit expiration.

For lead generators, geographic targeting that identifies prospects in energy community or low-income census tracts can identify leads qualifying for remaining incentives. The bonus provisions add 10-20% to available credits, partially offsetting the loss of the base residential ITC for qualifying locations.

Practical implementation requires mapping energy community designations (available from the Department of Energy’s Energy Communities Tax Credit Bonus dashboard) against your traffic geographic distribution. If significant traffic originates from designated areas, highlighting remaining incentive eligibility in form flows and landing page content can improve conversion rates and lead value.

Battery Storage Standalone Credit

The IRA created a new standalone investment tax credit for battery storage that does not require pairing with solar to qualify. This provision continues regardless of solar credit status. Homeowners installing battery storage systems for backup power, time-of-use arbitrage, or grid services can claim 30% tax credit on storage costs.

For solar lead generators, this creates a pivot opportunity. Battery storage leads maintain tax credit eligibility even when solar-only installations do not. Form flows that position battery storage as the primary product (with solar as an optional addition) may access better economics than solar-primary positioning in the post-ITC environment.

Installers report that battery-first positioning resonates with consumers motivated by backup power reliability, especially in markets with grid instability (California, Texas, Florida during hurricane season). Lead forms emphasizing energy independence, outage protection, and power security rather than electricity bill savings may perform better as the value proposition shifts from pure economics to resilience benefits.

State-Level IRA Interactions

Several states have implemented complementary programs that interact with federal IRA provisions. Understanding these interactions helps lead generators identify markets where the post-federal-ITC economics remain viable.

Massachusetts: The SMART program provides production-based incentives that layer on remaining federal credits, maintaining attractive payback periods even without the residential ITC. Solar installations in Massachusetts may recover value through state incentives that partially substitute for lost federal benefits.

New York: The NY-Sun program continues offering upfront incentives of $0.20-$0.40 per watt depending on region and project type. Combined with remaining federal provisions for qualifying installations, New York maintains some of the strongest solar economics in the post-ITC environment.

California: Despite NEM 3.0 reducing export compensation, California’s Self-Generation Incentive Program (SGIP) provides substantial battery storage rebates that improve combined solar-plus-storage economics. SGIP incentives of $200-$1,000 per kWh for battery storage partially offset the loss of federal solar credits.

Illinois: The Illinois Shines program provides renewable energy credits that add $1,000-$2,000 in value to qualifying installations, maintaining economic viability in a challenging federal environment.

For lead generators, tracking state incentive program availability, funding status, and eligibility requirements becomes more important as federal support diminishes. States with strong complementary programs maintain lead values closer to historical levels. States dependent entirely on now-expired federal credits see the steepest lead value declines.

Strategic Implications for Lead Operations

The shift from federal ITC dependence requires operational adaptation across several dimensions.

Messaging must evolve from “claim your 30% tax credit” to value propositions that resonate without federal incentives: energy independence, rising utility rates, backup power reliability, and environmental benefits. Lead forms and landing pages require content updates reflecting the new value equation.

Geographic prioritization becomes more extreme. Markets with strong state incentives, high electricity rates, and storage value (California, Massachusetts, New York) maintain viable economics. Markets dependent entirely on federal incentives see sharp volume declines. Budget allocation should shift aggressively toward states where economics remain viable.

Product mix should incorporate storage as primary or co-primary alongside solar. Battery storage maintains federal credit eligibility, provides resilience benefits that justify premium pricing, and aligns with consumer concerns about grid reliability. Forms that qualify storage interest alongside solar interest identify prospects with multiple monetization paths.

Commercial pivot provides growth opportunity as residential contracts. Small commercial solar (100-500 kW systems for businesses, warehouses, agricultural operations) maintains full ITC eligibility. Developing commercial lead generation capabilities now positions operations to capture market share as residential-focused competitors struggle with volume declines.

Net Metering: The Hidden Policy Lever

California’s NEM 3.0 provides the template for net metering reductions.

NEM 3.0 took effect for new interconnection applications on April 15, 2023. Export compensation was reduced by approximately 75%. Payback periods extended from 5-6 years to 14-15 years without battery storage. The residential market contracted 38-50% within a year.

Yet the story is not purely negative. Battery attachment rates soared to 79% as the value proposition shifted from grid export to self-consumption. Solar-plus-storage became the default product.

States currently at risk for net metering changes include Arizona (already reduced in 2016), Arkansas, Hawaii, Idaho, and North Carolina. Every state with retail-rate net metering faces utility pressure to reduce compensation. Utilities argue that solar customers shift costs to non-solar ratepayers and must be compensated at avoided-cost rates rather than retail rates. Understanding how net metering policy directly impacts solar lead value helps operators anticipate market shifts before they occur.

Fixed Charges: The Emerging Threat

California approved monthly fixed charges up to $24.15 for solar customers in May 2024, even for those with $0 usage bills. This model may spread to other states, reducing solar economics regardless of net metering policy.

Fixed charges reduce the value proposition by creating a floor on utility bills that solar cannot eliminate. A customer who expected zero electric bills after installing solar now faces $24+ monthly regardless of production. Over 25 years, this represents $7,000+ in additional costs.

Building Policy Monitoring Systems

Lead generators who anticipated NEM 3.0 by pivoting traffic to Texas and Florida in late 2022 preserved profitability. Those who maintained California-heavy portfolios suffered margin compression and buyer churn.

Required monitoring activities include:

- State utility commission filings (CPUC, NYPSC, MPSC) for rate case proceedings and net metering changes

- SEIA and state solar association updates for industry intelligence and advocacy alerts

- Proposed legislation affecting net metering, renewable portfolio standards, and incentive programs

- Utility integrated resource plans that signal future rate structures

Lead value can shift 30% in 90 days based on policy changes. Building relationships with industry associations provides early warning of pending regulatory actions. The Solar Energy Industries Association (SEIA), state solar associations, and utility commission dockets are essential intelligence sources.

Seasonal Patterns and Timing Optimization

Solar leads exhibit predictable seasonal patterns driven by weather, consumer psychology, and policy deadlines. Understanding these patterns allows traffic acquisition optimization and inventory management.

Spring Peak (March-May)

Spring represents peak demand for solar leads. Multiple factors converge:

- Increasing daylight triggers consumer awareness of solar potential

- Tax refund season provides down payment capital for cash-conscious buyers

- Installation weather windows open in northern markets after winter

- Summer electricity bill previews (from prior year) motivate action

Lead prices typically peak in April and May. Traffic acquisition costs also increase as advertisers compete for limited conversion intent. The trade-off is between higher revenue per lead and higher cost per click.

Summer Plateau (June-August)

Summer maintains strong demand with slight softening:

- Peak electricity bills reinforce the value proposition

- Vacation season reduces consumer decision-making availability

- Installer capacity constraints become apparent

- Heat in southern markets slows installation pace

Experienced lead generators build inventory during spring for summer demand. Leads generated in April can sell at premium prices through June as buyer demand exceeds immediate generation capacity.

Fall Urgency (September-November)

Fall creates a secondary demand spike driven by deadlines:

- End-of-year tax credit deadlines create urgency

- Q4 installation capacity fills quickly

- Premium pricing emerges for guaranteed year-end installation

- Lead quality requirements tighten because there is no time for marginal prospects

With the ITC expiration at end of 2026, fall 2026 will represent exceptional demand as installers race to fill pipelines. This pattern will moderate in 2027 without a year-end deadline.

Winter Trough (December-February)

Winter presents challenges in most markets:

- Holiday season reduces consumer attention and decision-making

- Cold weather in northern markets prevents installation

- Installer workforce reductions in some regions

- Lower electricity bills reduce immediate motivation

However, winter offers opportunities in southern markets. Florida, Texas, and Arizona continue installations year-round. Competition for leads decreases in winter, creating buying opportunities for generators with southern traffic.

Geographic Seasonal Variations

- California: Relatively stable year-round with Q1-Q2 peak

- Northeast: Strong seasonal swing, April-October primary season

- Florida/Texas: Inverted pattern, strong winter demand as northern installers redirect

- Mountain West: Compressed season, June-September primary window

Lead Quality Challenges: Fraud Prevention and Verification

Solar leads face fraud rates of 25-35% for third-party leads. The combination of high CPLs, complex qualification criteria, and commission-driven sales creates fertile ground for abuse. A comprehensive quality verification stack is essential for credibility with buyers.

Common Fraud Patterns

Incentive fraud occurs when fraudsters fill forms to collect affiliate commissions without generating legitimate prospects. Indicators include high-velocity submissions from single IP addresses, impossible geographic patterns (forms from multiple states in minutes), phone numbers that do not match consumer identity databases, and email addresses created immediately before submission.

Recycled leads involve selling the same consumer information to multiple buyers as “exclusive.” TrustedForm certificates with timestamps help detect this pattern. Buyer feedback loops that flag duplicate contacts provide additional protection.

Double-selling extends beyond recycled leads to outright fraud. Some vendors sell leads marked as “exclusive” to multiple buyers, hoping neither complains. Sophisticated buyers compare notes and share intelligence on bad actors.

Consumer fraud occurs when individuals submit forms seeking information without intent to buy. These are not fraudulent in the traditional sense but waste buyer resources. Longer forms with qualification questions filter casual browsers and information seekers.

Downstream sales fraud happens at the installer level but affects lead generators through reputation damage. NPR reported in August 2024 that “rooftop solar has a fraud problem,” documenting forged contracts, loan stacking, and misleading tax credit claims. Florida’s Attorney General reported 700% more complaints in 2024. The FTC and CFPB have issued warnings about deceptive solar sales practices.

Lead generators should vet their buyers carefully. Association with fraudulent installers damages reputation and invites regulatory scrutiny.

Comprehensive Quality Verification Stack

- Form-level validation: Phone verification via SMS, email confirmation, address standardization, and format validation

- Identity verification: Name-to-phone matching, property database lookup, utility account verification

- Property qualification: Satellite imagery review, Google Sunroof or Aurora Solar pre-assessment, utility bill verification

- Behavioral analysis: TrustedForm or Jornaya session recording, velocity scoring, form completion pattern analysis

- Post-delivery feedback: Buyer contact rate reporting, disposition tracking, return rate monitoring by source

Implementing this stack adds $3-$8 per lead in direct costs but can improve effective conversion rates by 2-3x. The ROI is clear: a $150 exclusive lead with 15% return rate costs $176 effective. With quality verification reducing returns to 5%, the same lead costs $158 effective while converting better.

Return Rate Management

Industry average return rates for solar leads range from 15-25% depending on verification level. Returns destroy margins and erode buyer relationships.

- High return rate (25%+): Indicates qualification problems or fraud exposure. Immediate investigation required.

- Average return rate (15-20%): Typical for standard verification. Acceptable but improvable.

- Low return rate (under 10%): Achievable with premium verification stack. Enables premium pricing.

Track returns by source, geography, time of day, and verification level to identify root causes. Systematic improvement requires data. Industry lead return rate benchmarks provide context for evaluating your performance.

Frequently Asked Questions

What is the average cost per lead for solar in 2026?

Solar CPL varies dramatically by geography and lead type. Exclusive, qualified leads range from $100-$200+ in premium markets (California, Hawaii, Massachusetts, New York) to $40-$75 in developing markets. Shared leads typically run $35-$125 depending on exclusivity count. National averages obscure the geographic variation that determines profitability. A lead generator quoting “average solar CPL” without geographic specificity is providing meaningless information.

Why is there such a large price difference between states?

Five factors create the 8.5x spread from California ($1,929 customer value) to North Dakota ($225): electricity rates, state incentives, net metering policies, installer density, and customer sophistication. High electricity costs in California create faster payback periods and justify premium lead prices. Low rates in North Dakota make solar economics marginal regardless of lead cost. Policy support adds $3,000-$10,000 in value through state credits and incentives. Installer competition affects both installation pricing and lead demand.

How does the federal tax credit expiration affect solar leads?

The residential ITC (30% federal tax credit) expires for new installations after December 31, 2025. This increases consumer cost by $6,000-$9,000 on typical installations, extends payback periods by approximately 30%, and is expected to reduce 2026 lead volume by 30-50%. Lead values will compress 20-40% as installer margins tighten. The commercial ITC follows a different timeline, creating potential pivot opportunity for generators who build commercial lead capability.

What qualification data should solar lead forms capture?

Essential fields include homeownership status, property address, monthly electric bill amount, electric utility provider, roof age and condition, shading assessment, credit qualification (self-attested), installation timeline, and contact preference. Highly valuable additional fields include roof type and orientation, recent repairs, battery storage interest, and financing preference (loan vs. lease vs. cash). Bill upload verification dramatically improves quality perception.

How do I verify that solar leads are homeowners?

Three verification methods work effectively. Property database matching through services like ATTOM or CoreLogic costs $0.50-$2.00 per lead and catches obvious fraud. Utility bill upload verification offers highest friction but highest accuracy. Identity verification services check name-to-address matches using credit header data. Self-reported ownership alone has significant error rates and should not be trusted for premium lead products.

What makes California solar leads different from other states?

California implemented NEM 3.0 in April 2023, reducing export compensation by 75%. This changed the value proposition from grid export to self-consumption, making battery storage essential for economic viability. California leads now require storage interest qualification to maintain value. Battery attachment rates reached 79% in 2024. A solar-only California lead has limited value compared to solar-plus-storage leads. Additionally, California approved fixed charges up to $24.15 monthly for solar customers, further changing the economics.

How do seasonal patterns affect solar lead generation?

Spring (March-May) represents peak demand with highest lead prices and stiffest competition. Summer maintains strong demand with some installer capacity constraints. Fall creates deadline-driven urgency for year-end tax credits, though this pattern will moderate post-ITC expiration. Winter is the trough in northern markets but offers opportunity in southern states where installations continue year-round and competition decreases.

What are the most common solar lead fraud types?

Incentive fraud generates fake submissions for affiliate payouts. Recycled leads sell the same consumer to multiple buyers as exclusive. Double-selling shares leads secretly despite exclusivity claims. Consumer fraud involves information seekers without purchase intent. Verification stacks including phone validation, property database matching, behavioral analysis, and session recording reduce fraud exposure from 25-35% to under 10%.

Should I sell solar leads as exclusive or shared?

Exclusive leads command $100-$200+ but require higher traffic quality, thorough verification, and faster delivery. Shared leads (2-3 buyers) typically run $35-$125 per buyer, generating more total revenue per lead but with lower close rates for each buyer. Most successful operations offer both: premium exclusive inventory from verified traffic and shared leads from broader sources. Start with one model based on your traffic quality and buyer relationships, then expand.

How do I build relationships with solar installers?

Focus on metrics that matter to them: contact rate above 70%, accurate utility information, verified electric bill data, and honest exclusivity representation. Start with regional installers in your strongest geographic markets rather than national players. Deliver leads during business hours for maximum contact rate. Track and share performance data including contact rate, appointment rate, and close rate when available. Installers who see consistent quality and transparency become long-term partners willing to pay premium prices.

What happens to the solar lead market after the ITC expires?

The market will contract 30-50% in 2026 as the fundamental economics shift. Payback periods extend approximately 30%. Lead values will compress 20-40%. The market will not disappear. Electricity rates continue rising. Energy independence has mainstream appeal. Battery storage provides backup power value beyond bill savings. The post-subsidy market will be smaller but potentially more stable, with buyers making genuine economic decisions rather than chasing subsidies. Practitioners who prepare by diversifying geographically, building commercial capability, and focusing on high-rate markets will survive the transition.

Key Takeaways

-

Geographic arbitrage is the core solar strategy. The 8.5x pricing spread from California to North Dakota exists because of electricity rates, policy incentives, and installer density. State-level pricing captures true value variation. Utility-level targeting captures even more. Never sell national leads at uniform pricing.

-

The ITC expiration fundamentally changes unit economics. After December 31, 2025, the 30% federal tax credit disappears for residential solar. Payback periods extend by 30%. Lead volume will decline 30-50% in 2026. Lead generators must prepare for a smaller, post-subsidy market by diversifying geographically and building commercial capability.

-

Qualification verification pays for itself. Adding $3-$8 per lead for ownership verification, utility bill validation, and property qualification can improve buyer close rates by 2-3x. In a high-CPL vertical, quality differentiation determines profitability. Return rate is the key metric.

-

California leads require storage qualification. NEM 3.0 reduced export compensation 75%, making battery storage essential for economic viability. California leads without storage interest have limited value. Battery attachment rates of 79% demonstrate the market shift.

-

Policy monitoring provides competitive advantage. Lead value can shift 30% in 90 days based on regulatory changes. Practitioners who anticipated NEM 3.0 preserved profitability by pivoting traffic early. Those who waited took losses. Subscribe to utility commission filings and industry association updates.

-

Installer relationships create moats. Building exclusive arrangements with strong regional installers provides pricing power and stability that transactional relationships cannot match. Focus on contact rate, data accuracy, and transparency.

-

Seasonality creates opportunity. Spring peak, winter trough, and geographic variation allow smart practitioners to optimize traffic acquisition timing and capture seasonal pricing premiums. Build spring inventory for summer demand. Target southern markets in winter.

-

Fraud prevention is essential for credibility. Industry fraud rates of 25-35% require comprehensive verification stacks. The extra cost enables premium pricing and buyer retention. Track returns by source to identify and eliminate fraud exposure systematically.

Market data current as of December 2025. Policy information reflects the post-One Big Beautiful Bill environment. All regulatory claims regarding tax credits and net metering should be verified before acting, as policy continues to evolve.